Is China improving?

This paper discusses the investment implications of the latest economic data release from China and the policy rate cut by the PBoC.

![]()

Volatility in perspective

Global market swings and elevated uncertainty can be unsettling. Still, there are ways to help investors achieve their long-term investment objectives.

These principles can help investors stay calm and rational in a volatile environment.

In challenging times, it is always useful to keep a few things in perspective.

Stay focused.

First, volatility is normal, and market declines are part and parcel of investing.

The urge to exit can be overwhelming when markets are falling, but doing so may mean selling at the most inopportune time and missing potential market rebounds. This can be costly for portfolios in the long run.

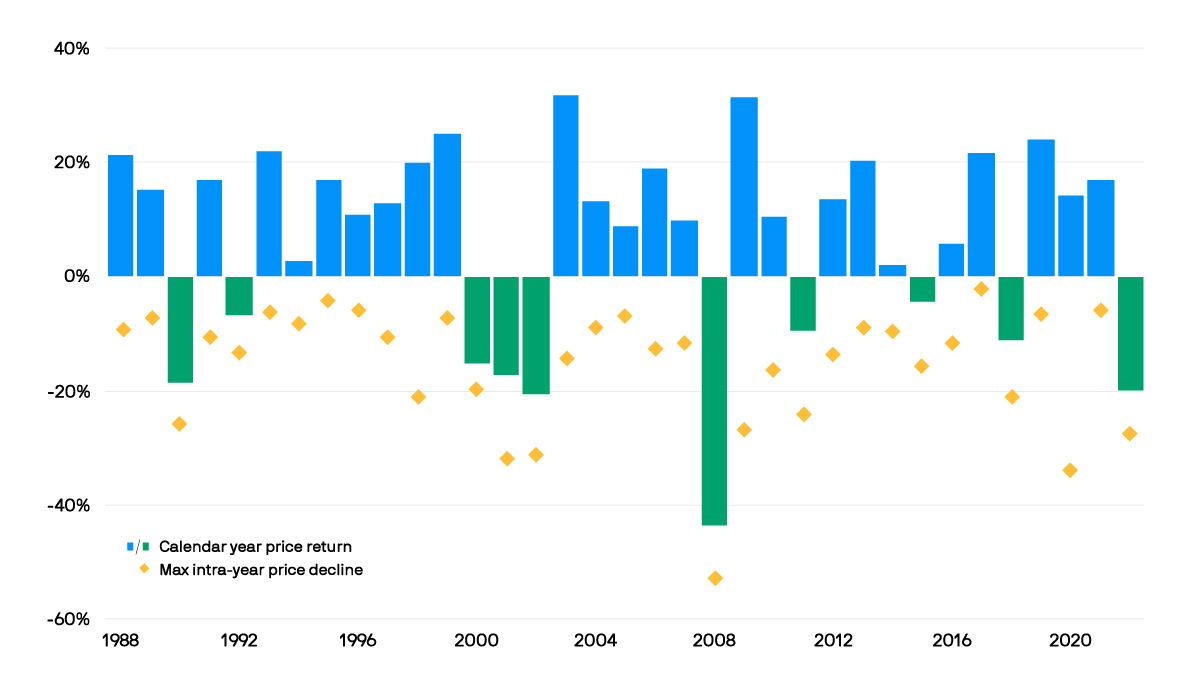

While periodic pull-backs are not uncommon, 25 of the last 35 years have ended with positive returns for the MSCI All Country World Index.

This underscores the importance of patience and perseverance to ride out choppy markets. Investors should not let short-term volatility derail their long-term investment plans and stay focused on their end goal.

Volatility is normal. As a general macro trend, annual returns of the MSCI All Country World Index were positive in 25 of the last 35 years despite average intra-year drops of 15.4%.

MSCI All Country World Index annual price return and intra-year declines (1988 – 2022)

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 30.12.2022. Max intra-year price declines refer to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Past performance is not a reliable indicator of current and future results. Average annual return between 1988 to 2022 was 6.9%.

Stay invested.

Second, investing is about time in the market, not timing the market.

For one, the range of return outcomes narrows considerably and skews positive over longer time horizons.

It is also worth noting that over the last 72 years ending December 2022, a 50/50 portfolio of US equities and fixed income has not posted negative returns over a rolling 5-year, 10-year or 20-year investment horizon1.

While there is no guarantee of future returns, the data demonstrates the importance of staying invested and focusing on the long-term.

The longer the holding period, the higher the chances of opportunities for positive returns as the range of potential outcomes narrows.

Range of equity, fixed income and 50/50 portfolio annualised total returns, 1950-2022

Source: Bloomberg, FactSet, Federal Reserve, Robert Shiller, Strategas/Ibbotson, J.P. Morgan Asset Management. Data as of 30.12.2022. Returns shown are based on calendar year returns from 1950 to 2022. Equity represented by the S&P 500 Shiller Composite. Fixed income represented by the Strategas/Ibbotson index for periods from 1950 to 2010 and Bloomberg Aggregate index thereafter. Past performance is not a reliable indicator of current and future results.

Stay diversified.

Third, diversification can be useful to ease the journey through choppy markets.

Diversifying portfolios across a variety of negatively correlated and/or uncorrelated asset classes can help manage the risks during a market downturn.

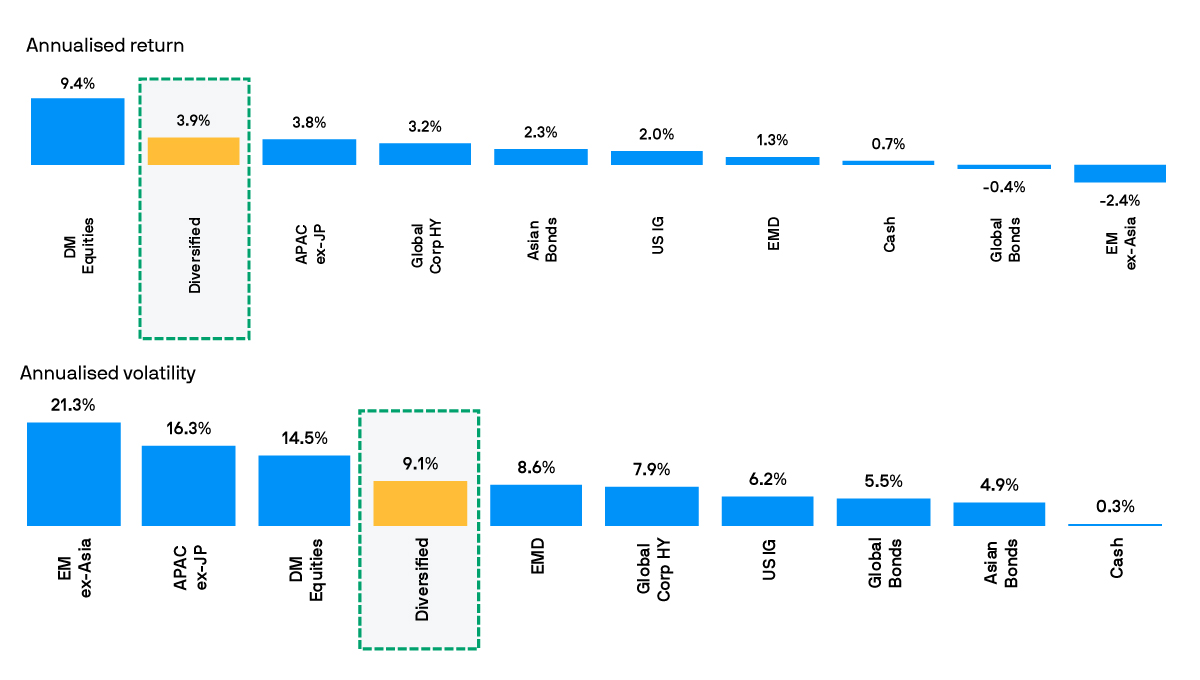

As an illustration of the macro trend, a well-diversified portfolio2 has recorded average returns of around 3.9% annually over the last decade, comparing favourably with other individual asset classes.

Such a portfolio also experienced just two-thirds of the volatility of developed market equities and less than half of the volatility of emerging market equities.

As such, diversification helps not only to mitigate volatility, but to harness opportunities across various asset classes.

A diversified portfolio has posted reasonable returns with meaningfully lower volatility versus equities over the last decade.

Annualised performance and annualised volatility (2013-2022)

Source: Bloomberg L.P., Dow Jones, FactSet, J.P. Morgan Economic Research, MSCI, J.P. Morgan Asset Management. Data as of 30.12.2022. The “Diversified” portfolio assumes the following weights: 20% in the MSCI World Index (DM Equities), 20% in the MSCI AC Asia Pacific ex-Japan (APAC ex-JP), 5% in the MSCI EM ex-Asia (EM ex-Asia), 10% in the J.P. Morgan EMBIG Index (EMD), 10% in the Bloomberg Aggregate (Global Bonds), 10% in the Bloomberg Global Corporate High Yield Index (Global Corporate High Yield), 15% in J.P. Morgan Asia Credit Index (Asian Bonds), 5% in Bloomberg US Aggregate Credit–Corporate Investment Grade Index (US IG) and 5% in Bloomberg US Treasury –Bills (1-3 months) (Cash). Diversified portfolio assumes annual rebalancing. All data represent total return in US dollar terms for the stated period. Past performance is not a reliable indicator of current and future results. Diversification does not guarantee investment returns and does not eliminate the risk of loss.

This paper discusses the investment implications of the latest economic data release from China and the policy rate cut by the PBoC.

This paper discusses how improving economic data can convince the BoJ to normalize monetary policy, and help Japan's earnings growth to outpace the U.S. and Europe in 2024-25.

This paper discusses how corporate governance reforms in Asian markets can enhance earnings outlook, and the investment implications.

This paper addresses the concerns over market concentration in the S&P 500, and the investment implications.

This paper discusses trade tensions and the recent tariff impositions on China, and the investment implications.

This paper, written by Tai Hui, addresses why policy easing amid a soft landing backdrop should be positive for both equities and fixed income.

This paper, written by Kerry Craig, highlights the growing significance and potential risks of private credit markets in enhancing returns and diversification.

This paper, written by Marcella Chow, highlights the divergence in central bank monetary policies and its investment implications.

This paper discusses the election results in India, and the investment implications of short-term valuation challenges and long-term positive prospects.

This paper, written by Raisah Rasid and Jennifer Qiu, discusses the approach investors should take towards Asian equities to mitigate currency risks.

This paper, written by Dr. David Kelly and Jennifer Qiu, discusses investment implications of rising U.S. federal debt and widening deficits.

This paper discusses why U.S. 1Q24 earnings have been better than expected, and broadening profit growth should present opportunities outside of the Magnificent 7.

This paper discusses the broader outlook for inflation and the labor market, following the April jobs report in the U.S.

This paper, written by Marcella Chow, discusses the recent surges in gold and copper, and why commodity strategies can help protect portfolios when both stocks and bonds are correcting.

This paper discusses the expected delay in the Federal Reserve's rate cut cycle, and when the current wave of volatility could eventually subside.

This paper addresses the latest Chinese economic data and the factors that may contribute to China markets trending higher.

This paper discusses the relative valuation of European equities, and the factors that could suggest a more constructive outlook for the region's equity market.

This paper, written by Kerry Craig, addresses the current performance and outlook of private equity market with subdued exit activity.

This paper addresses why strong and consistent earnings growth, structural reforms and the likelihood of political continuity further enhances India's appeal in spite of rich valuations.

This paper, written by Tai Hui and Adrian Tong, discusses the key highlights of the Bank of Japan's March monetary policy meeting and what it means for the economy.

This paper discusses the macro factors in emerging markets that can drive a potential market rally once the Fed starts to cut and the U.S. dollar turns.

This paper summarizes the key objectives set out in the government work report at China’s National People’s Congress, which were broadly in line with expectations.

With monetary policy still at the forefront of the macro landscape in 2024, investors are left wondering how the election might influence Fed policymakers.

Continued demand for AI technologies from mega-cap companies should benefit Asian exporters that are involved in the regional tech supply chains.

This paper, written by Tai Hui, discusses why Japanese equities should remain strong despite potential tightening in monetary policy. (5-minute read)

This paper, written by Meera Pandit and Jennifer Qiu, discusses how quality balance sheets and margins continue to support U.S. large caps in spite of favorable small cap valuations.

While recession risks in the US have receded, geopolitical risk, election risk and restrictive monetary policy all threaten the current rally.

This paper, written by Meera Pandit, Nimish Vyas and Stephanie Aliaga, discusses the 4Q23 U.S. earnings and what it means for the Magnificent 7 and the broader markets.

This paper, written by Tai Hui and Jennifer Qiu, addresses the history of monetary easing and our expectations of Fed policy in 2024. (6-minute read)

This paper, written by Raisah Rasid, discusses the expected weakening of the U.S. dollar and the inflation deceleration in Asia, which presents an opportunity in Asia fixed income

International equities are likely to benefit this year from positive structural changes, a weaker dollar, and exciting governance changes.

This paper, written by Chaoping Zhu, discusses the recent Chinese economic data releases and the investment implications.

Although investors may be tempted to invest based on who they think will win the election and how certain policies may be implemented, macro forces often dwarf policy agendas when it comes to sector performance.

This paper, written by Marcella Chow and Adrian Tong, discusses the outlook for Asia high dividend equities in 2024.

Many investors wonder if they can tweak their existing exposures to be either more defensive against volatility or more opportunistic if certain sectors face future policy tailwinds.

This paper, written by Tai Hui, summarizes the factors that could trigger rate cuts and policy outlook with its investment implications. (3-minute read)

This paper, written by Tilmann Galler and Natasha May, discusses the outlook of small cap stocks and the investment implications.

This paper, written by Chaoping Zhu and Marcella Chow, discusses the outlook of China and policy implications.

This paper, written by Raisah Rasid and Adrian Tong, discusses the outlook of Asia tech and the investment implications.

This paper, written by Tai Hui and Meera Pandit, summarizes the potential underlying market and policy implications of 2024 U.S. elections. (3-minute read)

Coming into 2023, the rallying cry from the asset management community was “Bonds are Back! ”. There were several reasonable assumptions behind this call.

This paper, written by Adrian Tong and Jennifer Qiu, summarizes the recent key central banks' decisions and their implication on asset allocation. (3-minute read)

This paper, written by Marcella Chow and Adrian Tong, highlights the recent performance of Asia high dividend equities and the factors influencing its outlook with investment implications. (3-minute read)

This paper, written by Raisah Rasid and Adrian Tong, discusses the outlook for Asian assets in the current global yield environment. (3-minute read)

This paper, written by Meera Pandit and Nimish Vyas, discusses our projections for the 3Q23 U.S. earnings season and the investment implications.

This paper, written by Tai Hui, discusses the factors driving oil prices and the Fed policy outlook.

After well over a year of anxiously anticipating an economic recession, the U.S. economy continues to look sound. However, as we enter the “fall of worry” there are several risks on the horizon this autumn: impacts from the UAW strike, rising oil prices, the resumption of student loan payments, and the potential for a government shutdown.

This paper, written by Tai Hui, summarizes the latest round of central bank meetings and discusses outlook for U.S., UK and European economy with its investment implications. (3-minute read)

This paper, written by Adrian Tong, highlights the driving forces and outlook of oil, food and metal prices, with their implications on policy and growth. (3-minute read)

This paper, written by Marcella Chow and Adrian Tong, addresses the key drivers and outlook of Asian domestic demand with its investment implications.

We expect a slower growth and cooling inflation environment will allow the Fed to gradually reduce rates next year, thus stabilizing real yields and potentially biasing them lower.

This paper, written by Jennifer Qiu and Adrian Tong, discusses the risks of corporate caution in the U.S. and the impact on the Asia tech sector.

This paper, written by Tai Hui, discusses China's property market, deflation risk and the investment implications.

While the probability of a soft landing has risen given the generally strong incoming data, the concern is that most leading indicators continue to point to recession.

This paper, written by Chaoping Zhu, Marcella Chow and Jennifer Qiu, discusses the recent China activity data and the investment implications.

This paper, written by Tai Hui, discusses the state of the U.S. economy and the investment implications on fixed income.

This paper, written by Kerry Craig, summarizes the previous highlights and upcoming outlook for central banks' meetings with investment implications.

![]()

On Investors' Minds - APAC Edition

Listen to the latest insights from Tai Hui to better understand what is happening in the financial markets from our Asia Pacific headquarters in Hong Kong

OUR ACTIONABLE IDEAS ON INCOME & GROWTH

You can’t be a step ahead of the market, but you can be ahead in your investing. Access our investment ideas.

A more dynamic and flexible approach in managing fixed income portfolios can capitalise on numerous factors that impact bond prices and move markets.

With starting yields across many fixed income sectors hovering near decade highs, it could be opportune to lock in elevated yields as central banks approach the end of their rate hike cycles.

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

A pulse check on our Asian bond portfolio

After a difficult year for bonds, we explain why fixed income could once again prove to be a useful diversifier for portfolios.

As the Fed’s rate hike cycle concludes, bonds can present an important source of income and diversification for portfolios.

We share our views on Asian bonds and how we position in 2H 2023.

We explain why investors should pay greater attention to quality bonds.

Here is a chart indicating IG bond opportunities as US Treasury yields stay elevated.

Flexibility is at the heart of our approach to fixed income markets.

Income investing can help tap investment opportunities while managing volatility through cash flows from a diversified portfolio of income generating assets.

Rising government bond yields have presented more room to manage the impact of rate hikes. How big is this leeway?

We share our views on the fixed income opportunities in the current tough times.

Income investing remains relevant in the current market environment, as volatility is poised to remain elevated.

We believe that quality and yield opportunities can still be found in bonds.

We share our perspectives on positioning for income as rates rise.

Going beyond the traditional fixed income sectors to tap into the potential of securitisation.

Fixed income isn’t just government or corporate bonds, it also includes non-traditional debt securities.

The securitisation market has regained much ground in the past decade.

Let’s look at what the Fund has achieved over the last 10 years.

While the US market remains an important source of alpha opportunities, there is an increasing appreciation among investors for the need to diversify return streams.

Wider valuation and performance dispersion, elevated market concentration and potentially higher-for-longer interest rates underscore the importance of an active approach when engaging opportunities in the US stock market.

A soft landing outcome coupled with the potential for monetary easing later this year, could present significant tailwinds for US stocks.

An Asian equity strategy that weilds a broader investment toolkit to generate income can help investors navigate market swings.

While traditional dividends are the core of any equity income strategy, what else can help generate additional income?

Eyes on the future with an innovative asset allocation strategy

We share insights on the Japanese equity strategy while riding on cyclical and structural tailwinds.

ASEAN, China and the broader Asia ex-Japan region present ample opportunities for long-term growth.

We highlight the impact of China’s reopening on Asia equities and the key secular trends driving long-term growth in the region.

We share the key themes driving equities as China reopens.

We share the key themes that are driving equity investment opportunities in ASEAN.

We share a 2H 2022 market outlook on the key themes in China equity investing.

Learn about how sustainable infrastructure helps drive the development of metaverse and electric vehicles.

Increasing demand for healthcare services globally is presenting growth opportunities.

Dividend equities may play an important role in portfolios as investors navigate a more challenging market environment marked by slowing growth, higher interest rates, and elevated geopolitical risks.

Approaching income investing without borders, bias and benchmarks.

Capturing dividend opportunities across Asia

A quick look at how the Fund is positioned as recession risks loom and financial conditions tighten.

A quick take on our strategy in investing Asian income assets amid global economic slowdown and China’s reopening.

Income investing remains relevant in the current market environment, as volatility is poised to remain elevated.

Explore the different possible outcomes of taking on risk as you invest for your retirement.

How technology is advancing the process of diagnosis – listening, observing, enquiring and examining – while presenting market opportunities.

Digital education helps enhance the learning experience, driving new growth opportunities.

Learn how diversification can help you stay invested in changing markets.

Long-term investing could be likened to day-to-day trainings of athletes. Learn how to stay invested in changing markets.

Consider the available investment options as you embark on your investing journey.

Start an investment journey early and map out the financial goals.

You shouldn't miss out these 3 factors when planning for retirement.

Diversification sounds easy, but how to do it effectively?

Multi-asset Solutions

Fixed Income Solutions

For more information, please call or email us. You can also contact your J.P. Morgan representative.