Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Key takeaways:

As China’s economy reopens, undemanding valuations and a growth-friendly policy path could present equity opportunities1.

Active management is crucial when seeking out long-term, secular growth opportunities in China’s markets. We believe technology, consumer and renewables are key themes as China lives with COVID-191.

And just like that …

… China has begun to reopen, capping more than three years of COVID-19 isolation.

This landmark shift could present some positive tailwinds after a year that saw asset prices swooning in the face of aggressive monetary policy tightening and slowdown in economic activity.

![]()

A fresh catalyst for China equities

Following a period of adjustment towards living with COVID-19, China’s domestic economic activity could accelerate, owing to meaningful pent-up demand and excess savings to the tune of trillions of RMB in deposit accounts2. Unlocking these resources could potentially support the outlook for domestic consumption, corporate earnings and profitability2.

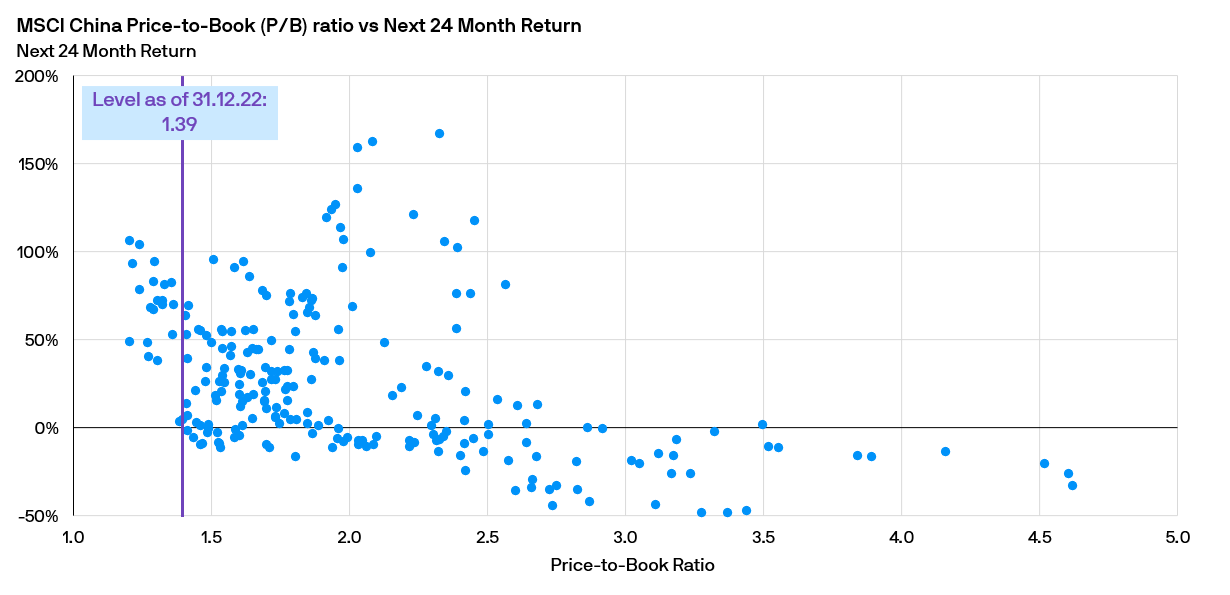

Currently, valuations of China equities look relatively undemanding, as illustrated below. This, coupled with the shift to a growth-friendly policy stance and subsequent economic recovery, may have meaningful implications to the outlook of China’s equity markets.

Valuations look undemanding and China’s economic reopening could present a fresh catalyst for recovery

Source: Bloomberg, FactSet, MSCI, J.P. MorganAsset Management. Data as of 31.12.2022. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the dateof the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met. Past Performance is not indicative of current or future results. Indices do not include fees or operating expenses and are not available for actual investment.

.

![]()

Capturing long term growth opportunities in China

Tapping enduring investment opportunities in China requires robust fundamental research and rigorous bottom-up stock selection. Being on-the-ground is crucial to truly understanding the business and dynamics of China’s equity markets which, while broad and liquid, remains inefficient with a high level of pricing anomalies. Ultimately, active management is key to navigate a year of major policy shifts and macro changes in China’s economy.

Diversification from the US & Europe

Chinese equities can bring potential diversification benefits for portfolios as well. For one, investors globally remain underinvested in the onshore Chinese equity markets relative to the size and importance of the Chinese economy.

Historically, China’s onshore equity markets have exhibited low correlation with developed markets given China’s relatively distinct economic and policy cycles. For example, while developed market central banks remain mired in a tightening posture due to persistently high inflation, relatively elevated policy rates and manageable inflation in China suggest meaningful room for further policy stimulus. As a result, onshore Chinese equities may present potential diversification opportunities against the looming downturn in the US and Europe4.

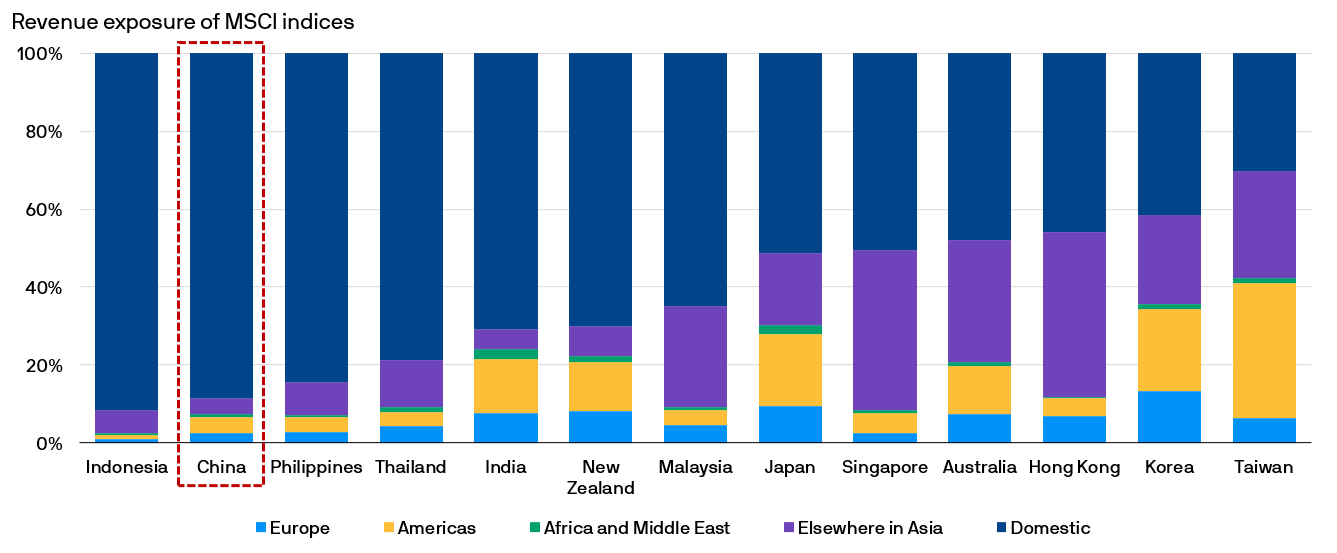

Furthermore, in line with China’s decreasing dependence on the US and Europe as key export markets, the bulk of revenue exposure for the MSCI China Index is domestically driven, which suggests less vulnerability to the economic headwinds facing the developed world, as illustrated below.

Domestically driven, Chinese equities can offer diversification from the US and Europe

Source: FactSet, MSCI, J.P. Morgan Asset Management. Data reflect most recently available as of 31.12.2022. Past Performance is not indicative of current or future results. Indices do not include fees or operating expenses and are not available for actual investment.

Key secular themes present opportunities

The economic reopening could provide a cyclical boost to long-term structural growth opportunities in China, spanning technology, consumption and carbon neutrality1. Companies with lean cost structures and strong pricing power are well-suited to ride the reopening trend, in our view.

![]()

1. Consumption

China’s reopening rebound is likely to be driven by consumption rather than investment4. This recovery will likely be centred on consumer-sensitive sectors such as tourism and retail markets. Growing affluence and an expanding middle class will continue to support the ‘premiumisation’ trend while industry consolidation in some areas can help compound growth.

Robust healthcare spending and investments will continue to drive opportunities in areas such as medical equipment and structural outsourcing, including both contract research organisations (CROs) and contract manufacturing organisations (CMOs).

![]()

2. Technology

Software companies continue to ride the digitalisation trend, aided in part by the government’s support for the creation of domestic champions.

Automation and other productivity enablers in the industrial and technology sectors are also key beneficiaries in the drive to boost growth through productivity improvements, in the face of a ‘greying’ workforce and rising wages. The continued focus on import substitution, self-sufficiency and national security will also help to buoy the growth of strategic sectors such as semiconductors.

![]()

3. Carbon neutrality

Sectors supporting the development of a “Green Economy” such as electric vehicles (EV), solar and advanced manufacturing are likely to play a key role in generating sustainable growth over time3.

Rising EV penetration, stricter emission controls and standards, and faster adoption of renewable energy could continue to support revenue and earnings growth of related segments. Additionally, the EV supply chain and renewables such as solar power supply chains, installation, and storage present other interesting opportunities. This is particularly important considering that China continues to take global market share in solar production.

Conclusion

Seeking out these high quality opportunities require specialist knowledge to navigate the unique features of China’s broad markets. To that end, J.P. Morgan Asset Management is a leading specialist in the Greater China markets, with a dedicated Greater China team of 25 investment professionals, with an average 17 years of industry experience alongside an exceptional track record of seeking quality growth opportunities in China’s equity markets5.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, research or investment advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

2. Source: "2023: The rainbow after the storm", J.P. Morgan Asset Management, December 2022.

3. Source:, "China market: buoyant market sentiment along a bumpy road to recovery ", J.P. Morgan Asset Management, 13.12.2022.

4. Source: “The spillover effects of China’s reopening”, J.P. Morgan Asset Management, 10.01.2023.

5. Source: J.P. Morgan Asset Management, data as of 31.11.2022. There can be no assurance that professionals currently employed by J.P. Morgan Asset Management will continue to be employed by J.P. Morgan Asset Management or that past performance or success of such professionals serve as an indicator of the professionals’ future performance or success.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.