Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Key takeaways:

How smart can a pen be2 ?

Pens are no longer used only for writing in the healthcare sector. And some pens have become smarter.

Innovative medical devices such as a smart, reusable insulin pen2 is improving the quality of life for patients with diabetes. It’s a pen that offers quick and relatively painless injections, can calculate and track doses as well as provide reminders, alerts and reports. When connected to a smartphone app, the pen could also help diabetics better monitor their blood sugar levels, diet and exercise. The data on the pen could also help doctors and patients make optimial treatment decisions.

Additionally, some healthcare companies are using data science and artificial intelligence for new medicines and timely diagnosis. Such breakthrough in treatments and innovative technologies are presenting long-term growth opportunities in the healthcare sector.

Investing in healthcare - same, same but different1

What to keep in mind

A digital transformation of healthcare is taking place across all members of the Organization for Economic Co-operation and Development (OECD) grouping, accelerated by the public health crisis and driven up by digitisation of IT infrastructure as well as growing demand from patients3. Additionally, a rapid rise in demand among emerging markets could help accelerate the sector’s long-term growth.

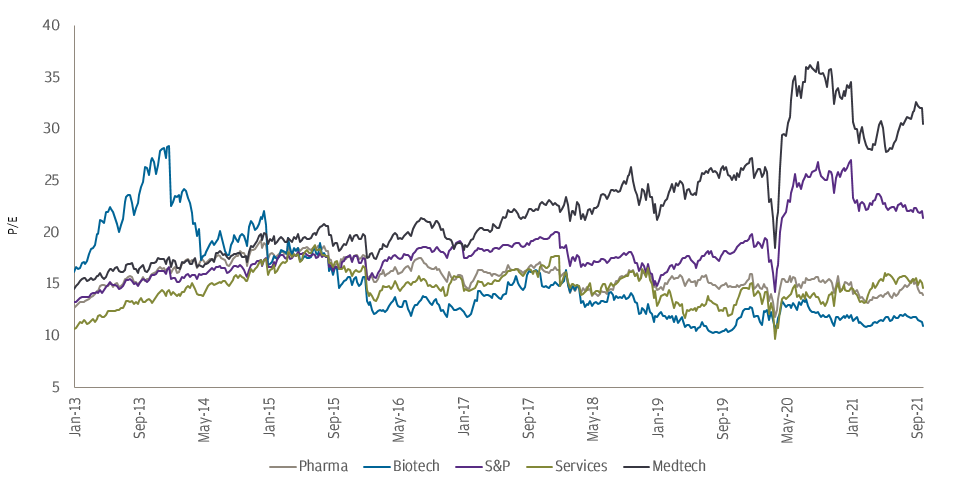

Forward P/E of US healthcare sectors and the S&P 5004

Governments and companies have accelerated investments in healthcare, including sub-sectors such as innovative medical technologies, biotechnology, pharmaceuticals and new medical devices and services. As illustrated in the chart4, these various healthcare sub-sectors, where valuation remains relatively attractive, are presenting long-term growth opportunities.

Conclusion

The global public health crisis has brought healthcare to the forefront, presenting long-term growth opportunities in sub-sectors such as innovative medical technologies, biotechnology, pharmaceuticals as well as new medical devices and services. Additionally, the growing middle class in emerging markets and an ageing population could help accelerate demand and the sector’s long-term growth.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

2. Source: “What is a smart insulin pen?”, American Diabetes Association. As of November 2021.

3. Source: “Health at a Glance 2021: OECD Indicators”, Organisation for Economic Co-operation and Development, 09.11.2021

4. Source: J.P. Morgan Asset Management’s chart based on data from Bloomberg between 04.01.2013 and 30.09.2021. Forward price-to-earnings (P/E) is next 12 months. Forecasts and estimates are indicative of macro trends, may or may not come to pass.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.