Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Important Information

1. The Fund invests primarily (at least 70%) in Asian bonds and other debt securities. The Fund will have limited RMB denominated underlying investments.

2. The Fund is exposed to risks related to debt securities (including interest rate risk, below investment grade/ unrated investment risk, investment grade bond risk, sovereign debt risk, valuation risk and credit risk) emerging markets, concentration, currency, derivatives, liquidity, hedging, class currency and currency hedged classes. Pertaining to investments in below investment grade or unrated debt securities, these securities may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment. For RMB hedged class, risks associated with the RMB currency and currency hedged classes risks. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point. The Manager may, under extreme market conditions when there is not sufficient RMB for currency conversion and with the approval of the Trustee, pay redemption monies and/or distributions in USD.

Why Asian bonds?

Asian credit & local government bonds generally have higher yields than global peers and could bring diversification benefits.

Source: Bloomberg, data as of end-August 2023. Asia local government bond represented by J.P. Morgan Asian Diversified Broad Index; Global Aggregate bond represented by Bloomberg Global Aggregate Total Return Index.; Asian Credit represented by J.P. Morgan Asian Credit Index; Global Credit represented by Bloomberg Global Credit Total Return Index. Correlation is calculated by weekly return in local currency terms over the past 10 years. Diversification does not guarantee positive returns or eliminate risk of loss. Indices do not include fees or operating expenses and are not available for actual investment. Positive yield does not imply positive return.

How does the Fund seek out opportunities in Asian bonds?

The Fund is a quality portfolio (no default since inception) with an unconstrained approach, seeking to capture income opportunities from a wide range of fixed income sectors in Asia.

Source: J.P. Morgan Asset Management, data as of end-August 2023. Inception date: 18.01.2005. The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. Investments in below investment grade or unrated debt securities, may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment.

Flexible allocation and dynamic duration management

Lowered headline credit risk and maintained a defensive stance to navigate against global economic headwinds.

The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. Investments in below investment grade or unrated debt securities, may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment.

Increased the overall duration since late 2022 as the Fund continues to dynamically adjust its duration and yield curve positioning.

Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years.

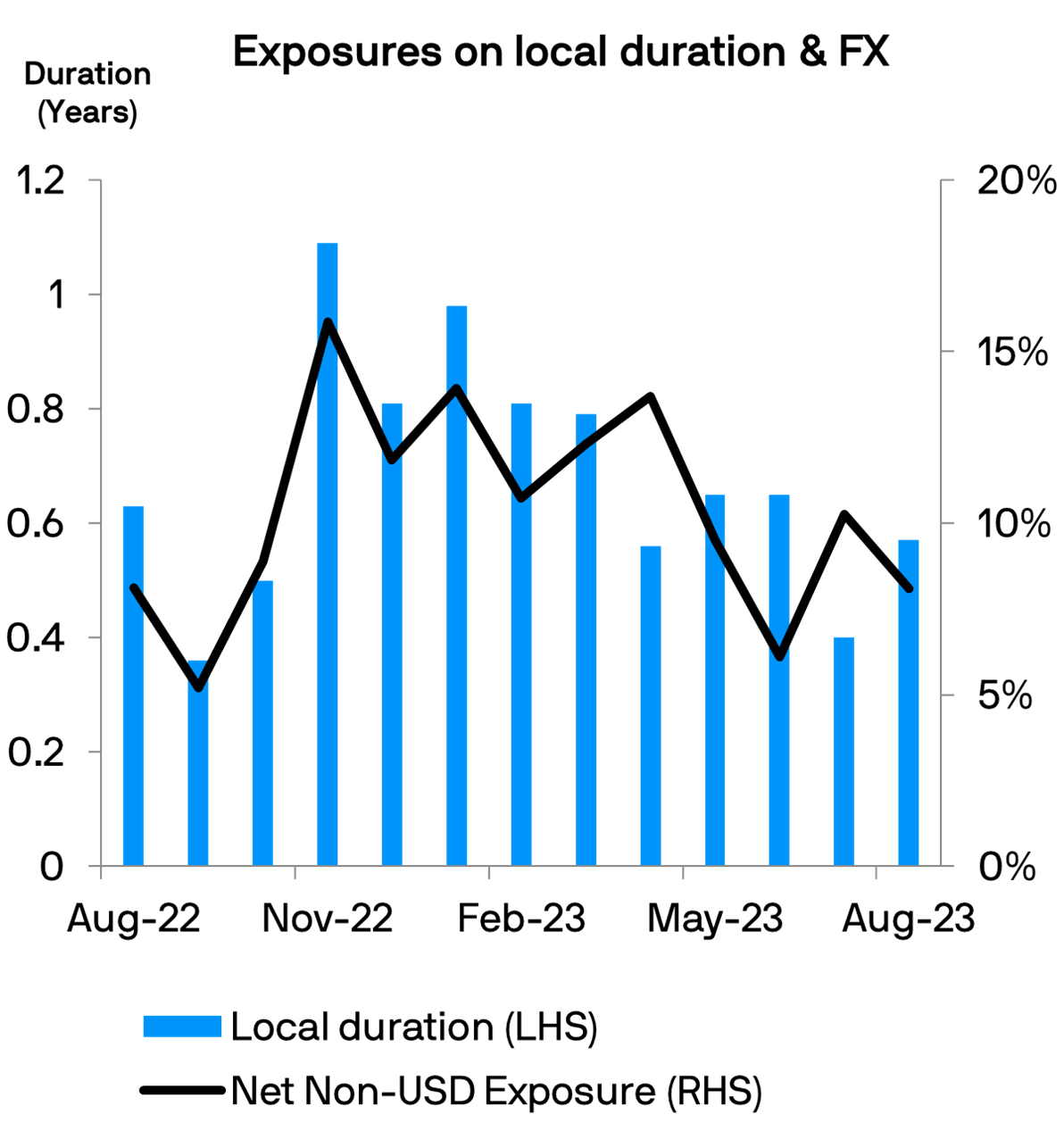

Actively managing both Asian local government duration and non-USD currency exposure to seek alpha.

Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years.

^ Source: J.P. Morgan Asset Management, Moody’s, S&P, Fitch, as of end-August 2023. To calculate portfolio credit quality, issuer or guarantor credit rating may be considered. The credit rating is based on the highest of different rating agencies. Average rating is the weighted average of the credit ratings of bond holdings (including non-rated bonds), excluding convertibles and net liquidity.

*Annualised yield = [(1+distribution per unit/ex-dividend NAV)^distribution frequency]-1. The annualised dividend yield is calculated based on the monthly dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield. Yield is not guaranteed. Positive distribution yield does not imply positive return.

The opinions and views expressed here are those held by the author as at the date of this document, which are subject to change and are not to be taken as or construed as investment advice. The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstances and market conditions.

Unless stated otherwise, all information is sourced from J.P. Morgan Asset Management, as of end-August 2023. The information contained in this document does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investment product or service. Informational sources are considered reliable but you should conduct your own verification of information contained herein.

Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document(s) for details, including the risk factors. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.