Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Important Information JPMorgan Multi Income Fund |

About the JPMorgan Multi Income Fund

35 years in the industry

7 years with J.P. Morgan

26 years in the industry

26 years with J.P. Morgan

15 years in the industry

15 years with J.P. Morgan

31 years in the industry

3 years with J.P. Morgan

JPMorgan Multi Income Fund seeks to maximise income return primarily through investing in a diversified portfolio of income producing equities, bonds and other securities. In addition, the Fund aims to provide medium to long term moderate capital growth. The Manager will seek to achieve these objectives by active asset allocation to, and within, different asset classes and geographies.

Click here to learn more1,2.

Signs of stress in some segments of the US banking sector, rising geopolitical risks and evidence of waning economic momentum have prompted concerns about the macro risks on the horizon. Yet decelerating inflation and the potential end to the Federal Reserve’s (Fed) rate hike cyle have stoked cautious optimism about the potential opportunities that may emerge in global financial markets.

This Q&A provides insights on how the JPMorgan Multi Income Fund is navigating the path ahead.

Q1: How do the recent concerns in some segments of the US banking sector affect the Fund’s outlook?

The strain in some segments of the US banking sector could lead to tighter bank lending standards and potentially affect access to credit for many small businesses. This would invariably tighten financial conditions and present headwinds to growth in developed economies. As a result, the odds of a moderate recession over the course of the year has increased.

Nevertheless, our base case remains for growth to stay resilient but distinctly subtrend with inflation staying relatively sticky. These views reflect the fact that there is still considerable uncertainty over the extent to which the recent banking turmoil will affect sentiment and economic activity, although the risks appear skewed to the downside. Against this uncertain backdrop, the Fund remains cautious and seeks to avoid extreme positioning between or within asset classes3.

From a global perspective, divergence in growth prospects are quite apparent. Growth risks appear greatest in the US, where the strain in regional banks and weakness in the real estate sector are clear headwinds. In Europe, lower energy prices and fiscal policy tailwinds suggest some resilience, while in China, pent-up demand and excess savings accumulated during the zero-COVID years could continue to support the uneven economic recovery as borders reopen. Absent a deep US recession, other economies could stay resilient despite growth concerns in developed markets.

Q2: How is the Fund positioned in fixed income following the significant repricing in bond markets?

Yields across a broad range of bond sectors have increased significantly since the repricing of fixed income markets last year. This has created more opportunities and sources of yield for income-oriented investors. The Fund has been able to harness these opportunities to increase its portfolio yield while effectively managing risks4.

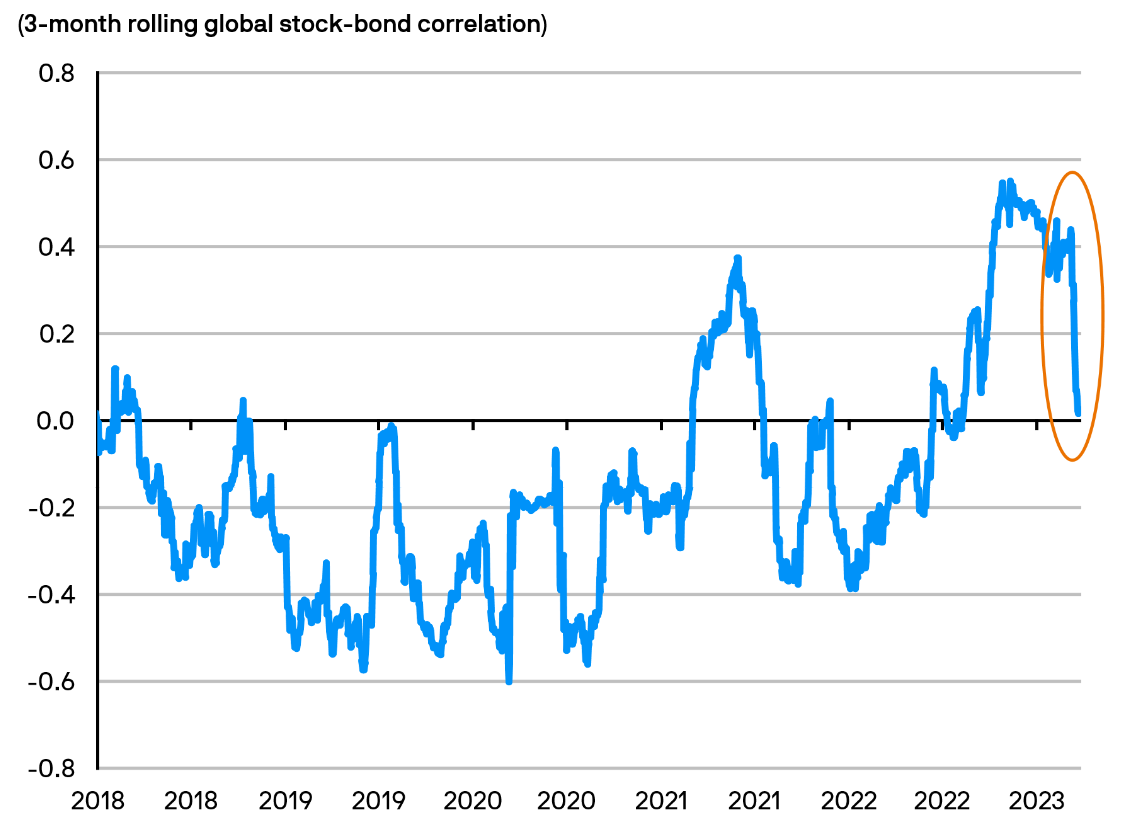

Furthermore, as illustrated below (LHS), stock-bond correlations have started to decline as focus shifts away from runaway inflation and policy tightening to slowing growth and recession risks5. Higher yields and normalising correlations suggest that bonds can, once again, help to cushion portfolio performance in the event of a market correction or an economic downturn.

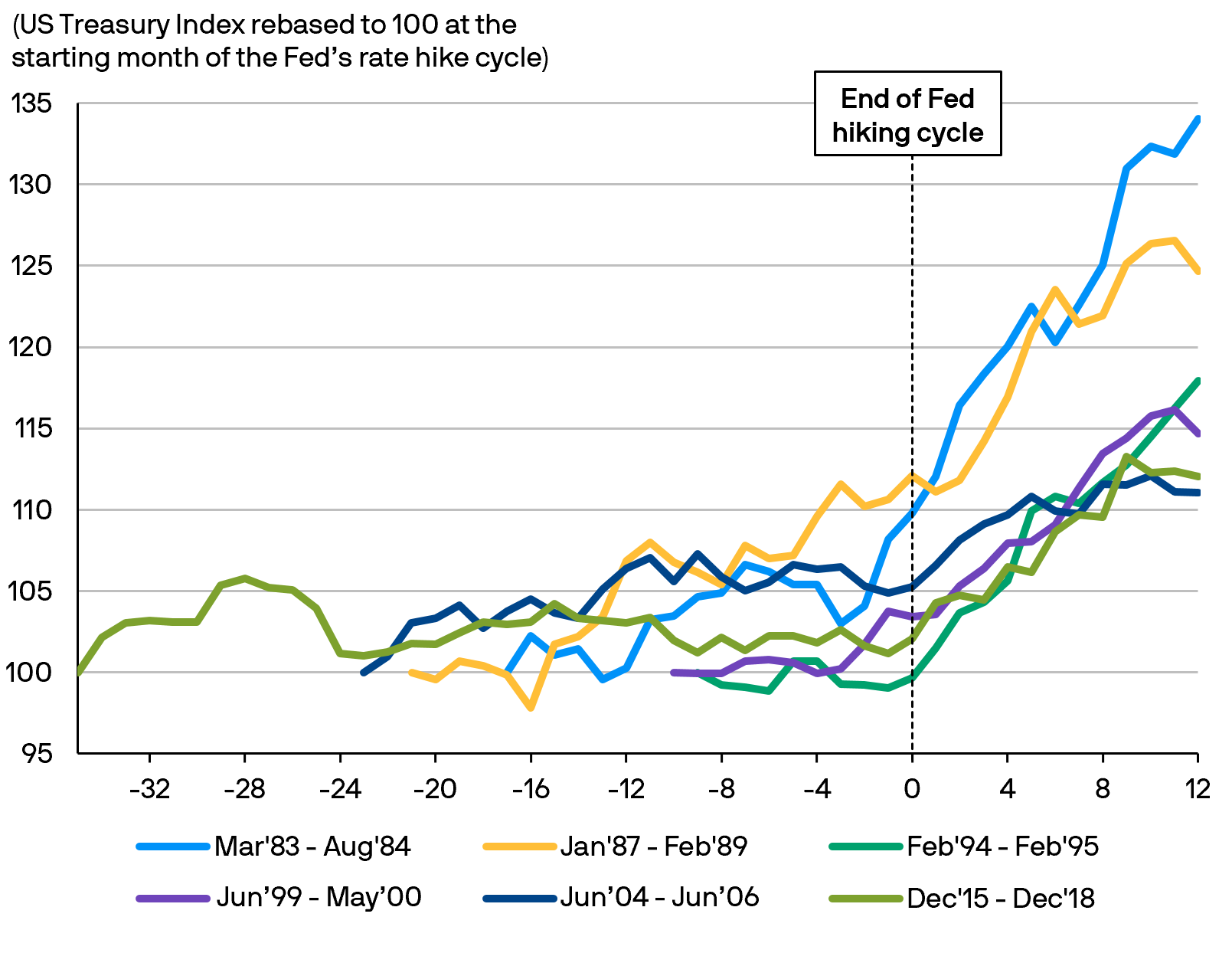

Meanwhile, the aggressive front-loading of interest rate hikes implies that we’re closer to the end of the rate hike cycle than the beginning. Decelerating inflation, tighter financial conditions and slowing growth momentum could point to a potential pause in the Fed’s interest rate hikes following May’s increase. Historically, the end of interest rate hikes has coincided with relatively decent returns for US Treasuries, as illustrated below5 (RHS). We believe this could augur well for bond returns.

Global stock-bond correlations have declined as focus shifts away from runaway inflation to growth concerns.

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 24.03.2023. This information is provided for illustrative purposes only to demonstrate general market trends. Information shown is based upon market conditions at the time of the analysis and is subject to change. Not to be construed as an offer, research or investment recommendation.

Historically, the end of the Fed’s rate hike cycle has coincided with relatively decent returns for duration.

Source: J.P. Morgan Asset Management, Bloomberg, data as of 31.01.2023. This information is provided for illustrative purposes only to demonstrate general market trends. Information shown is based upon market conditions at the time of the analysis and is subject to change. Not to be construed as an offer, research or investment recommendation.

Given these factors, alongside prevailing concerns about the growth outlook, the Fund maintains a favourable view on duration, and has marginally increased the duration profile of the portfolio by adding to credit and 10-year US Treasury futures3. More broadly, the Fund is cautiously positioned in fixed income and continues to hold higher quality global investment grade credit for diversification purposes, in view of tightening credit conditions and elevated recession risks6.

Q3: How does the Fund view equity income amid growing cyclical headwinds?

The Fund has largely maintained its equity allocation and remains well-diversified across regional equity markets6. It is also focused on high dividend stocks that are supported by strong underlying businesses that can help deliver resilient dividend growth.

Dividend equities still remain a relevant and decent source of income, bolstered by lower relative volatility, more defensive characteristics and relatively attractive valuations versus the broader stock market and growth equities. While the Fund sees growing opportunities in emerging market equities in view of the tailwinds from a softer US Dollar, prevailing concerns around slowing global growth could limit any significant allocation6.

Click here to check the latest portfolio composition of the Fund.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. As of 31.03.2023. Please refer to the fund’s offering documents for further details on its objectives. The manager seeks to achieve its stated objectives and there is no guarantee they will be met. Actual account allocations and characteristics may differ.

2. There can be no assurance that professionals currently employed by J.P. Morgan Asset Management will continue to be employed by J.P. Morgan Asset Management or that past performance or success of such professionals serve as an indicator of the professionals’ future performance or success.

3. Source: J.P. Morgan Asset Management. Data as of 31.03.2023.

4. Source: J.P. Morgan Asset Management. As of February 2023. “Five key questions for income investors for 2023”. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

5. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

6. Source: J.P. Morgan Asset Management. Data as of 31.03.2023. The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.