Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Important Information 1. The Fund invests primarily (at least 70%) in Asian bonds and other debt securities. The Fund will have limited RMB denominated underlying investments. |

_Aug2023.png)

Shaw Yann Ho

Portfolio Manager

_Aug2023.png)

Julio Callegari

Portfolio Manager

_Aug2023.png)

Jason Pang

Portfolio Manager

JPMorgan Asian Total Return Bond Fund aims to achieve a competitive total return, consisting of capital growth and regular interest income, through an actively managed portfolio, investing at least 70% of its total net asset value in Asian bonds and other debt securities. Click here to learn more1,2.

Q: What supported Asian bonds in 1H 2023 and what’s next for the rest of the year?

Asian bonds have outshone global aggregate bonds3 in 1H 2023, mainly driven by a stronger economic recovery in Asia and the less aggressive monetary policy amid moderate inflation. Technically, a weaker US dollar (USD) and a tighter Asian bond market also supported performance.

Asia credit would remain relatively resilient as the region’s economies continue to expand. Still, current global macro headwinds could pose some challenges to growth while concerns over the sustainability of China’s recovery has also hurt market sentiment in Asia.

That said, monetary policy in China will likely remain accommodative to better support fiscal spending as policymakers have signaled more stimulus steps. While a “bazooka” policy support package is not expected, stimulus to shore up fiscal and housing is likely, presenting “stimulus play” opportunities.

Among Asian debt, Indonesian bonds could continue to shine. Increasing demand for nickel, a key component of electric vehicles, is boosting Indonesia’s trade position as the largest producer of the metal, alongside investments from international carmakers. Together with signals of peak rates from its central bank, the attractive carry that could deliver and a rally in the local currency also present compelling opportunities for Indonesian bonds.

Q: How would portfolio risk be managed in a global economic downturn?

Given the global and China economic growth concerns, the Fund remains focused on quality names, and is tilted towards investment-grade corporate and government-related bonds. Such bonds comprise almost 70% of the Fund as of end-June 2023, reaching almost the highest level since inception on 18 January 20054.

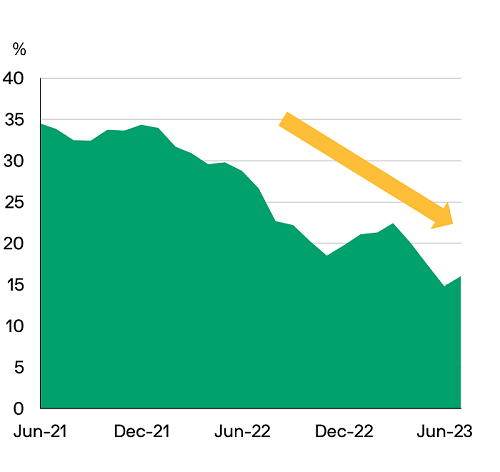

The exposure on high-yield (HY) bonds, especially those from China’s real estate sector has been significantly trimmed over the years4. This defensive stance helps manage credit risk and add resiliency to the portfolio. Click here to check the latest portfolio mix.

Historical corporate high yield exposure

4. Source: J.P. Morgan Asset Management. Data as of end-June 2023. JPMorgan Asian Total Return Bond (mth) – USD share class was incepted on 18.01.2005. The Fund is an actively managed portfolio; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. High-yield credit refers to corporate bonds which are given ratings below investment grade and are deemed to have a higher risk of default. Investments in below investment grade or unrated debt securities, may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment.

No default since inception

Since its launch in 2005, the portfolio has steered clear of default names5 by adhering to a rigorous and disciplined risk management process6, alongside the strong credit research with local presence in the region. By looking across a broad range of risk factors, the qualitative and quantitative fundamental research could stamp out the ‘bad apples’ and identify potential quality names. This repeatable, time-tested process has proved to be effective in managing volatility and seeking resilient risk-adjusted return over the long term.

For local rates and currency, the Fund gives consideration to factors such as China’s economic slowdown and the widening rate difference between the US and Asian markets, and dynamically adjusts its Asian local currency bond and non-USD currency exposure to manage risks while seeking alpha.

Q: How can investors optimise the income opportunity set from Asian bonds?

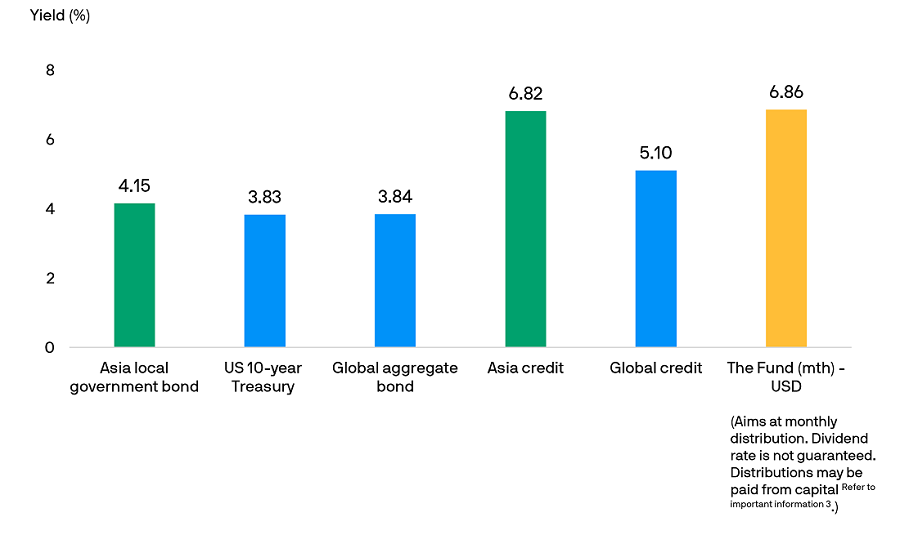

The repricing of global fixed income has not changed the relative attractiveness of Asian bonds as an income source. As illustrated below, yields of both Asia credit and local currency government bonds have remained higher than global peers. The Fund taps into yield potential across sectors as it spans the spectrum of fixed income, including corporate credit, agency and local currency bonds7.

Yield-to-maturity of bond indices & the Fund’s annualised yield

7. Source: J.P. Morgan Asset Management, Bloomberg, data as of end of June 2023. Asia local government bonds represented by J.P. Morgan Asian Diversified Broad Index; Global Aggregate bonds represented by Bloomberg Global Aggregate Total Return Index; Asian Credit represented by J.P. Morgan Asian Credit Index; Global Credit represented by Bloomberg Global Credit Total Return Index. Annualised yield = [(1+distribution per unit/ex-dividend NAV)^distribution frequency]-1. The annualised dividend yield is calculated based on the monthly dividend distribution with dividend reinvested, and may be higher or lower than the actual annual dividend yield. Yield is not guaranteed. Positive distribution yield does not imply positive return. Click here to check the latest annualised yield of the Fund.

From an aggregate perspective, coupon income is a crucial element in a bond portfolio. By employing an unconstrained approach, the Fund could go beyond sectors to seek out bonds with relatively attractive coupon opportunities on a risk-adjusted basis. It is also a high-conviction strategy to tap into the breadth of Asia’s bond opportunities, to manage risk and to optimise diversification.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. Please refer to the fund’s offering documents for further details on its objectives. The manager seeks to achieve its stated objectives and there is no guarantee they will be met. Actual account allocations and characteristics may differ.

2. There can be no assurance that professionals currently employed by J.P. Morgan Asset Management will continue to be employed by J.P. Morgan Asset Management or that past performance or success of such professionals serve as an indicator of the professionals’ future performance or success.

3. Source: Bloomberg, data as of end-June 2023. Asian bonds are represented by the J.P. Morgan Asia Credit Index (JACI) while global aggregate bonds are represented by the Bloomberg Global Aggregate Bond Index. Past performance is not a reliable indicator of current and future results.

5. Source: J.P. Morgan Asset Management. Data as of end-June 2023.

6. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.