Active ETFs: Transforming the race to invest

At J.P. Morgan Asset Management, our exchange-traded funds (ETFs) are backed by the research, trading, and technology resources of No. 1 Global Active ETF Provider*. Just like in racing, where precision and speed are crucial, our ETF solutions provide efficient and cost-effective access to equity, fixed income, and opportunities across global markets.

*By net flows in 2024. Source: Bloomberg, FactSet and J.P. Morgan Asset Management as of 31.12.2024

Discover a world of ETF opportunities with J.P. Morgan Asset Management

USD 275 bn+1

ETF assets globally

One of the world’s largest and fastest growing active ETF providers.

1402

ETFs offered globally

Active and passive ETFs across equity and fixed income strategies.

1200+3

Investment professionals

Global investment expertise and capital markets resources provided by our global investment platform.

We keep pushing the boundaries of ETF investing to deliver a wider suite of building blocks for investors’ portfolios and thought leadership.

Our active ETF platform has made noticeable achievements such as:

Our active ETF strategies

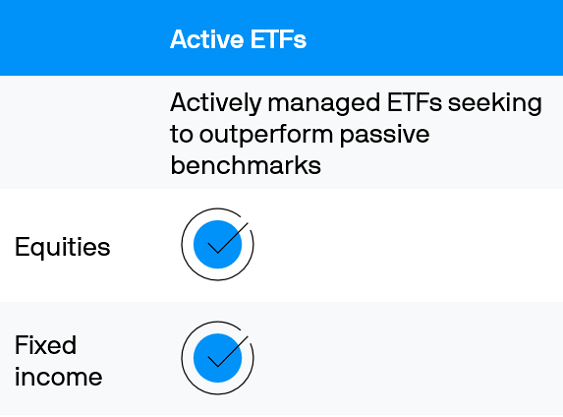

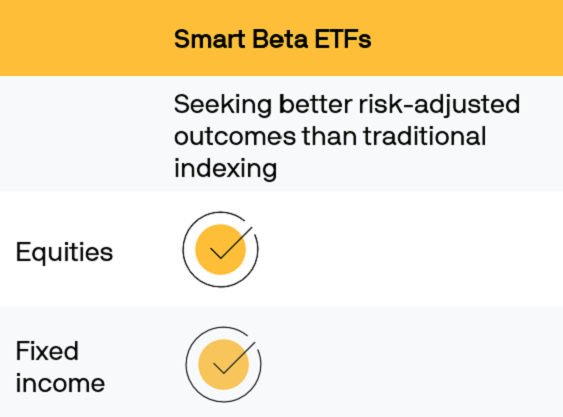

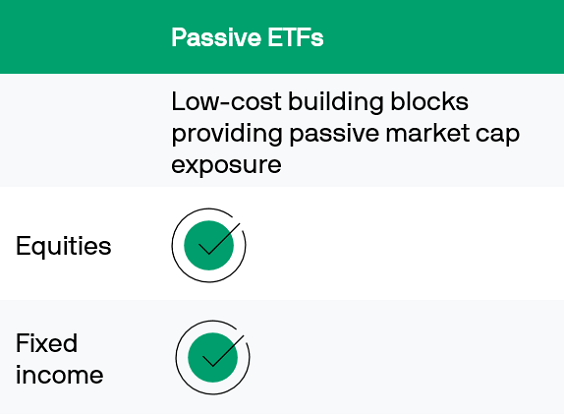

We’re constantly evolving our ETF range to provide competitive access to all major markets and the latest investment themes, helping to enable the capitalisation on timely opportunities, and adding new avenues for diversification and returns in portfolios.

Explore the full spectrum of ETF strategies

Provided to illustrate the characteristics of respective ETF strategies, Not to be construed as offer, research or investment advice. The strategies seek to achieve the stated objectives. There can be no guarantee the objectives will be met.

Our ETF insights

For more information on our ETF strategies and capabilities, please email us or contact your J.P. Morgan client advisor.

- Source: Bloomberg, FactSet and J.P. Morgan Asset Management as of 30.06.2025

- Source: J.P. Morgan Asset Management as of 30.06.2025

- Source: J.P. Morgan Asset Management as of 31.12.2024

- Source: J.P. Morgan Asset Management, Bloomberg as of 30.06.2025

- Award source: AsianInvestor Asset Management Awards 2024, 2025. The awards are issued by AsianInvestor in the year specified, reflecting performance as at the previous calendar year end.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.