Capturing fixed income opportunities in a changing rate environment

A more dynamic and flexible approach in managing fixed income portfolios can capitalise on numerous factors that impact bond prices and move markets.

Important Information

JPMorgan Global Bond Fund

1. The Fund invests primarily (at least 80%) in global investment grade debt securities. The Fund will have limited RMB denominated underlying investments.

2. The Fund is exposed to risks related to debt securities (including credit risk, interest rate risk, below investment grade/ unrated investment risk, investment grade bond risk, sovereign debt risk and valuation risk), emerging markets, currency, derivatives, liquidity, hedging, class currency, currency hedged classes and Eurozone sovereign debt crisis. For RMB hedged class, risks associated with the RMB currency and currency hedged classes risks. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point. The Manager may, under extreme market conditions when there is not sufficient RMB for currency conversion and with the approval of the Trustee, pay redemption monies and/or distributions in USD.

Read More

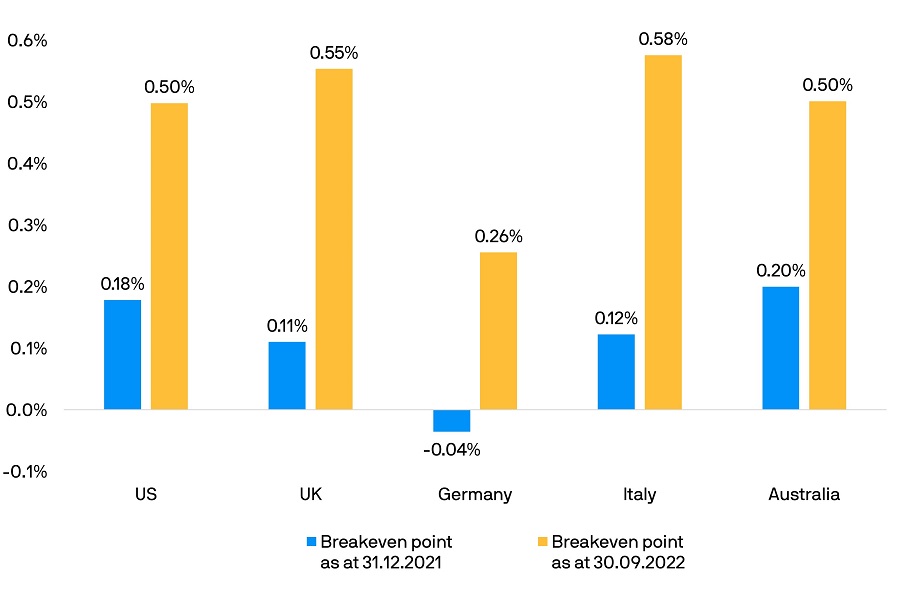

Government bond yields have been on the rise since early this year. This has presented more room to manage the impact of rate hikes. To show how big this leeway could be, the breakeven point of a bond could be an indicator to look at.

A bond fund’s total return is generally determined by bond yields and the change in bond prices. Generally, when interest rates rise, bond prices would fall. Bond yields can therefore act as a buffer when bond prices decline. Different bonds react differently to changes in interest rates and the yields would also vary. A breakeven point can then be the indicator to help investors assess the magnitude of the yield level that could offset the impact of interest rate hikes. With a higher breakeven point, a bond would have more room to manage the impact of rising rates.

More room in global government bonds to help offset rate hikes

Some major central banks have been aggressively hiking interest rates this year, prompting government bond yields to rise in tandem with their breakeven points.

Take the UK 7-10 year gilt1 as an example, its breakeven point stood at 0.11% at the start of 2022 – which meant that it had 11 basis points to help buffer the impact of falling bond prices, as illustrated in the chart. This figure rose to 0.55%2, which indicated that prices would have to drop further to fully erode income from the bond’s coupon.

As such, government bonds currently present a bigger buffer, compared with early 2022, even with the continuous rise in interest rates.

Changing breakeven points across global government bonds

2. Source: J.P. Morgan Asset Management and Bloomberg, as of 30.09.2022. US refers to the ICE BofAML 7-10 Year US Treasury Index; UK refers to the 7-10 year UK Government Bond Index; Germany refers to the 7-10 year German Government Bond Index; Italy refers to the 7-10 year Italian Government Bond Index and Australia refers to the 7-10 year Australian Government Bond Index. Take the US as an example, its breakeven point was calculated by dividing the yield-to-maturity of the ICE BofAML 7-10 year US Treasury Index with its duration. Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years. Indexes do not include fees or operating expenses and are not available for actual investment. They do not represent the fund portfolio. Yield is not guaranteed. Positive yield does not imply positive return.

Using global government bonds to help manage volatility

Market volatility will likely persist in the short term amid continuing rate adjustments to tackle inflation.

We believe that government bonds could do more, in addition to acting as a buffer against rate hikes. Historically, government bonds are relatively less volatile, and they are generally granted the higher credit quality rating. As such, they can be a tool to help manage volatility within an overall portfolio to cope with slowing economic growth economy.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss. Yield is not guaranteed. Positive yield does not imply positive return.

1. A gilt is a UK Government liability in sterling, issued by HM Treasury and listed on the London Stock Exchange. Source: United Kingdom Debt Management Office.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.