Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

#yield #income

Key takeaways:

Income investing remains relevant in the current market environment as a way to reduce the volatility of a portfolio.

The availability of yield opportunities, particularly in fixed income sectors, has starkly improved following a challenging 2022. But market volatility remains elevated amid rising global interest rates and rising recession fears.

These factors highlight the importance of an active, well-diversified and quality-focused approach to investing in income.

Role of income investing: a cash flow buffer for volatile times

The total return of an investment typically consists of two components: price appreciation and income. The latter is usually paid in the form of coupons from bonds or dividends from stocks1.

Dividends and coupons are important sources of cash flow that could help mitigate price fluctuations or reduce the volatility of a portfolio. This is especially useful during periods of high market turbulence and elevated uncertainty. While these payments do not imply or guarantee a return, they can also boost the total return1.

Income in the context of a well-diversified portfolio, is akin to a cash flow buffer that can help partially offset volatile or stagnant asset prices.

Income in action2

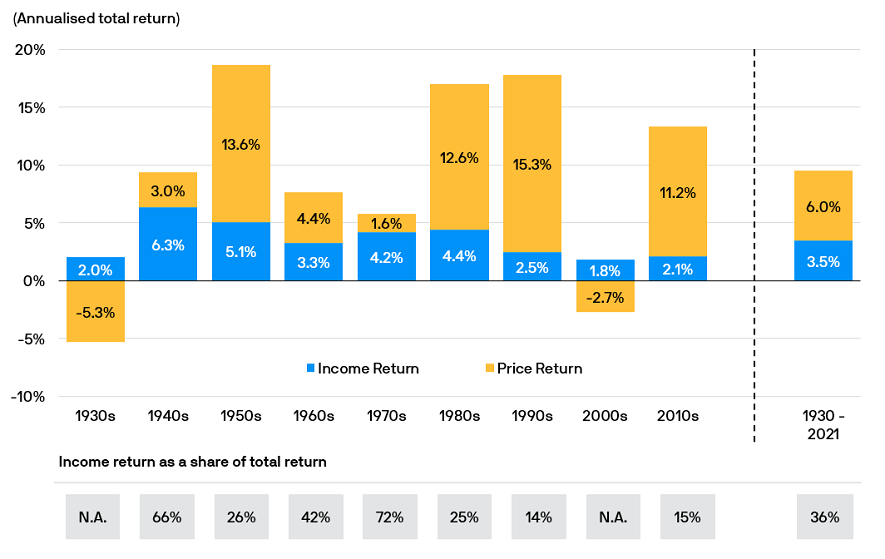

Although it is not indicative of current or future trends, the historical total return composition of the S&P 500 index can better illustrate this point. Returns generated from the distribution and reinvestment of dividends over the last nine decades have provided a buffer to the total return of the S&P 500 during periods of modest or weak price gains.

This was especially so in the 2000s, when equity returns were significantly marred by the burst of the Dot-com bubble in 2000 and the impact of the Global Financial Crisis in 2007-2008. The S&P 500’s total annualised return over the 10 year period ending December 2009 was -0.9%. But this was only because the annualised income return of 1.8% had partially offset the annualised capital loss of 2.7% over the same decade.

Looking back, we found that returns from income formed a sizeable share of the index’s total return in decades when capital or price gains were relatively muted, such as the 1940s, 1960s and 1970s. While income is still a critical component of total return over the long run, its characteristic as a potential downside buffer will likely remain relevant against the current volatile backdrop.

Chart 1: S&P 500 historical total return composition through the decades2

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.12.2021.

Provided for information only to illustrate macro trends, not to be construed as research or investment advice. Investments involve risks. Not all investments are suitable for all investors. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not indicative of current or future results.

While income opportunities abound, volatility remains elevated

Likewise, from a multi-asset portfolio perspective, income generated from a variety of instruments including stocks and bonds can act as a buffer during periods of elevated asset price volatility.

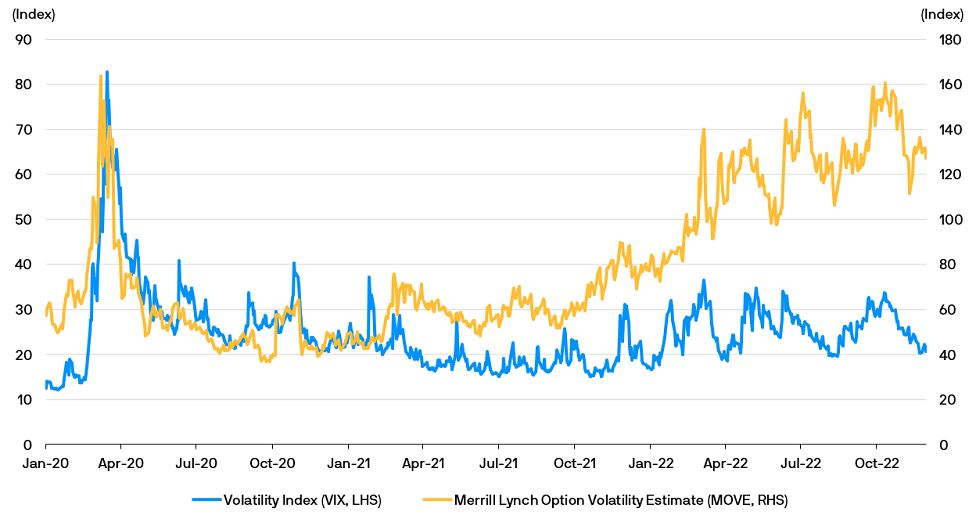

This may prove critical as market volatility remains high, as evidenced by the elevated Merrill Lynch Option Volatility Estimate (MOVE) index – a gauge of bond market volatility – and the Volatility Index – a gauge of the underlying volatility of the S&P 500. Even for a traditionally defensive asset class like fixed income, volatility has surged faster than equities. Volatility is still poised to stay elevated as markets work through a challenging macro setting, marked by stickier inflation, rising global interest rates, elevated geopolitical risks and rising recession fears.

Chart 2: Volatility remains elevated across both equity and bond markets

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 30.11.2022.

Provided for information only to illustrate macro trends, not to be construed as research or investment advice. Investments involve risks. Not all investments are suitable for all investors. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not indicative of current or future results.

Yet through the trials and tribulations of a volatile 2022, there is a silver lining – the availability of income opportunities has meaningfully improved. A revaluation of both equity and bond markets has led to opportunities for higher dividend and bond yields.

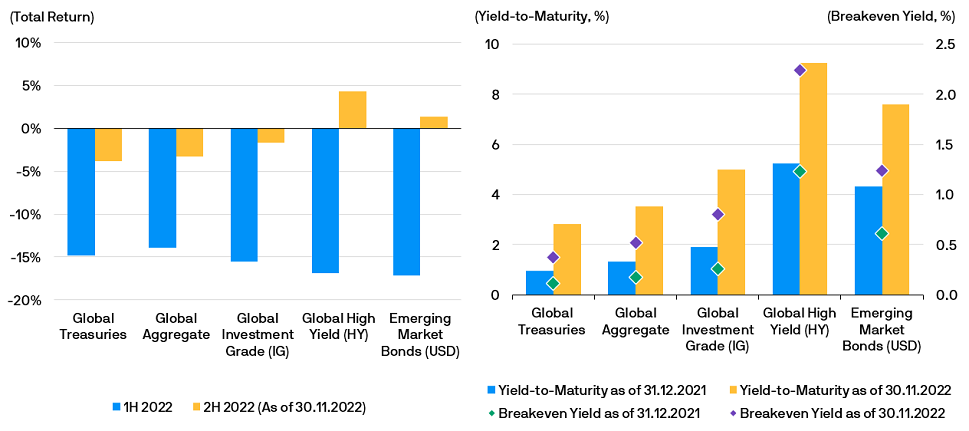

Notably, the repricing in fixed income markets has been rather aggressive, leading to a rise in yields across a wide array of fixed income sectors year-to-date (as of 30 November 2022).

Chart 3: Yields have increased meaningfully across most fixed income sectors

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 30.11.2022. 1H 2022 time frame: 31.12.2021 – 30.06.2022. 2H 2022 time frame: 30.06.2022 - 30.11.2022.

Global Treasuries: Bloomberg Global Treasury Total Return Index; Global Investment Grade (IG): Bloomberg Global Aggregate – Corporate Total Return Index; Global Aggregate: Bloomberg Global Aggregate Total Return Index; Global High Yield: Bloomberg Global High Yield Total Return Index; Emerging Market (USD): Bloomberg Emerging Market USD Aggregate Total Return Index.

High-yield refers to corporate bonds which are given ratings below investment grade and are deemed to have a higher risk of default. Yields are not guaranteed. Positive yield does not imply positive return.

Breakeven yield is the magnitude of further rate rises required to produce a negative total return. Breakeven yield is calculated by dividing the Yield-to-Maturity by the duration; this does not take into account expected default. Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years.

Provided for information only to illustrate macro trends, not to be construed as research or investment advice. Investments involve risks. Not all investments are suitable for all investors. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not indicative of current or future results.

Nevertheless, these opportunities come with risks. Dividends are not guaranteed while higher yielding bonds tend to carry higher credit risks. With economic momentum slowing and financial conditions tightening, managing these risks will become increasingly important. Investors are once again faced with the perennial challenge of having to balance the potential rewards of significantly higher yielding assets with the risks of an uncertain macro environment.

Seeking opportunities for yield

This market environment underscores three key points.

1.

Robust bottom-up security selection remains critical to pick higher quality assets with good yield potential on a risk-adjusted basis, both across equity and fixed income asset classes.

2.

Diversification across and within asset classes as well as regional markets is critical to smooth out market volatility and take advantage of yield opportunities from a variety of sources.

3.

The flexibility to adjust allocations and nimbly respond to changing market conditions is essential to navigate a more uncertain market environment.

The above considerations suggest that active management has a key role to play in navigating the risks and opportunities ahead.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, research or investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

1. Source: J.P. Morgan Asset Management, "Solving for income", January 2022.

2. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.

Which is why JPMorgan Funds – Income Fund invests opportunistically across debt sectors globally for optimal income potential while actively managing duration and other risks over time as interest rates and markets change.

Which is why JPMorgan Multi Income Fund invests flexibly across different asset classes and markets globally to seek out a diverse range of compelling income opportunities in a changing world.