Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Nicolas Weindling

Portfolio Manager, Japan

Miyako Urabe

Portfolio Manager, Japan

Shoichi Mizusawa

Portfolio Manager, Japan

J.P. Morgan Japanese Equity Strategy aims to provide long-term capital growth by investing primarily in Japanese companies. With a fundamental, bottom-up stock selection process, the Strategy focuses on high-conviction investment ideas, leveraging the expertise of J.P. Morgan Asset Management’s Tokyo-based equity team. Click here to learn more1,2,3.

Japanese equities have stood out compared with global equities in the first half of 2023, due largely to multiple structural and cyclical tailwinds. It appears that Japan’s economic recovery and structural transformation present quality growth opportunities. This Q&A presents insights on the outlook of Japanese equities.

Q: What are the macro drivers that support the resurgence in Japanese equities?

Fuelled by consumer spending and manufacturing, Japan’s gross domestic product (GDP) growth in 1Q 2023 was better than market expected, and the economy grew at the fastest pace in three quarters4. The Japanese government also upgraded its economic assessment and forecast a moderate recovery. It is believed that Japan's economic growth appears to be more resilient than other developed markets and the risk of recession is comparatively lower as the economy is supported by domestic demand after a relatively lagged reopening.

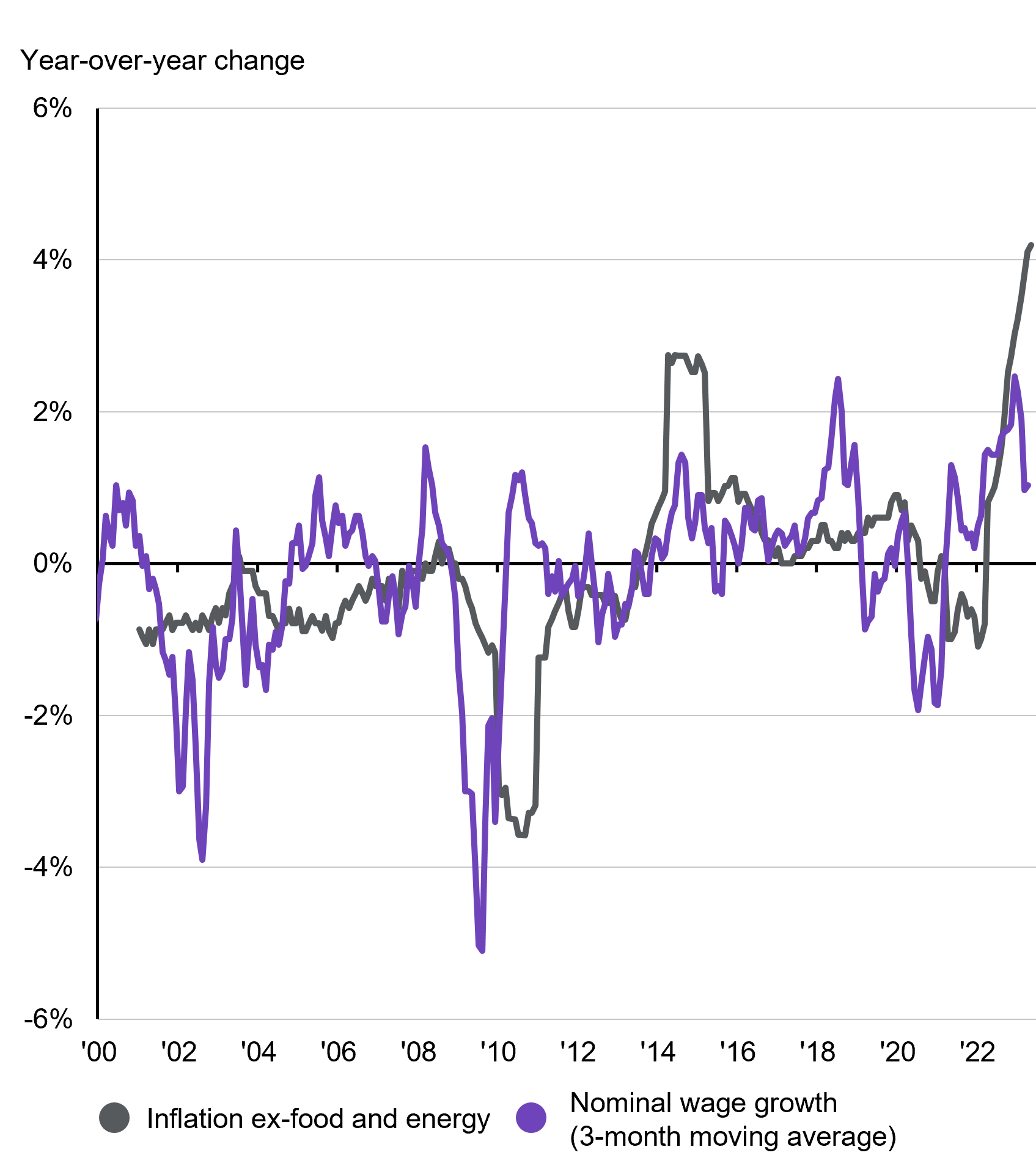

Historically, wage growth and inflation in Japan have been very low and below the Bank of Japan's (BoJ's) target, as illustrated5. Even in 2015, when there was a momentary spike up in inflation, wage growth remained anchored. However, that dynamic has started to change.

After decades of deflation, Japan is now experiencing inflation, primarily due to a tight labour market and employers' willingness to raise wages5. The inflationary trend is expected to boost GDP levels further and accelerate earnings growth for Japanese companies. The improving economic backdrop presents both value and growth opportunities.

Japan core inflation and wage growth

5. Source: FactSet, Japan Ministry of Health, Labour and Welfare, Japan Ministry of Internal Affairs and Communications. Data as of 09.06.2023.

Still, the uncertain global economic outlook and evolving monetary stance of global central banks could change the pace of Japan’s economic recovery and inflationary trend. Fortunately, the structural change in Japanese market and secular growth opportunities across sectors could potentially offset some of the external shocks.

Q: What are the structural boosters and why do they matter?

Japan has made significant improvement in corporate governance practices in recent years. Starting from 2014 when the Japanese government introduced the Stewardship Code, multiple reform measures have been introduced to encourage companies to focus on shareholder value, transparency and accountability. In 2022, the Tokyo Stock Exchange requested companies with a price-to-book ratios that are consistently below 1 to disclose their policies and specific initiatives to improve their enterprise value. In response, companies are using their abundant cash to buyback stocks to improve their return on equity (ROE). The pace of buybacks has thus been accelerated and hit record high in 20226.

These structural changes poised for a bottom-up recovery of Japanese equities as improvements in corporate governance could unleash more potential, drive future earnings and help close the “Japan discount” that has been struggling for Japanese companies for years due to poor corporate governance. This is the main reason to be excited about Japanese equities, judging by the development so far.

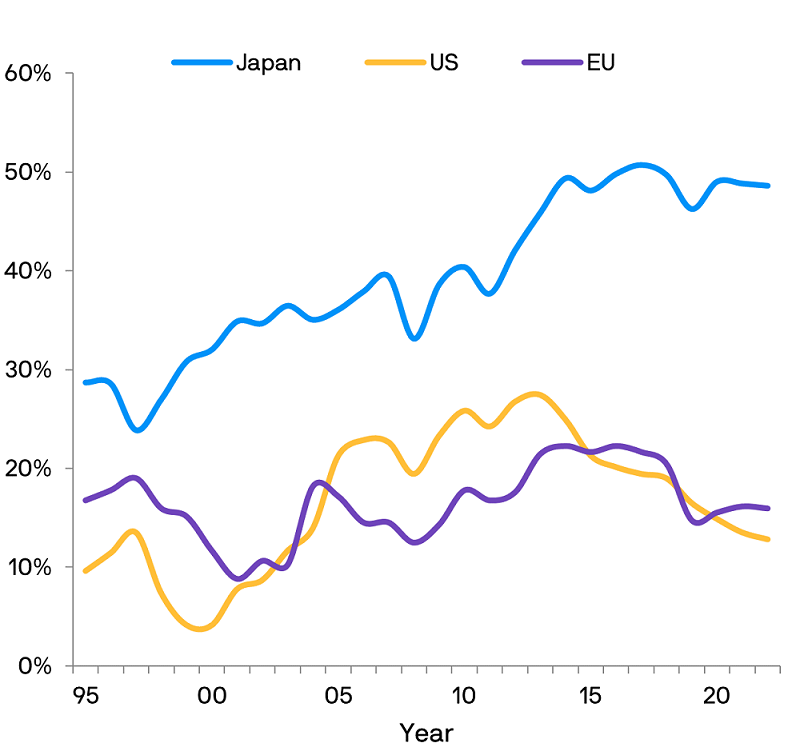

There is room for companies to take further actions given Japanese companies are holding a large percentage of net cash7 and there are more than half of the constituents of the Tokyo Stock Price Index (TOPIX) that price-to-book ratio is still below 1 8.

Percentage of net-cash listed companies7

7. Source: FactSet, Data compiled by Goldman Sachs Global Investment Research. As of 30.09.2022.

The Japanese equity story is still evolving. With a bottom-up story of improving corporate fundamentals and corporate governance, Japanese equities present opportunities for the long term, supported by a top-down environment of reopening, inflation and improved wages.

Q: What are the differentiating features of J.P. Morgan’s Japanese equity strategy?

The Japanese equity strategy is centred on investing in quality companies that exhibit strong growth potential within Japan's diverse and innovative economy. The local market presents investors with access to a diverse range of quality growth opportunities, spanning multiple themes and sectors:

Japan remains an under-researched market which creates opportunities for informed investors and active investment managers. The strategy is able to add value by focusing on quality businesses with strong future growth prospects.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. Please refer to the fund’s offering documents for further details on its objectives. The manager seeks to achieve its stated objectives and there is no guarantee they will be met. Actual account allocations and characteristics may differ..

2. There can be no assurance that professionals currently employed by J.P. Morgan Asset Management will continue to be employed by J.P. Morgan Asset Management or that past performance or success of such professionals serve as an indicator of the professionals’ future performance or success.

3. The strategy is exposed to risks related to equity, concentration, smaller companies, currency, derivative, liquidity, hedging and class currency.

4. Source: FactSet, J.P. Morgan Asset Management, Japanese Cabinet Office. As of 30.04.2023.

6. Source: J.P. Morgan Asset Management; BofA Global Research, QUICK. As of 09.06.2023.

8. Source: J.P. Morgan Asset Management, Bloomberg. As of 31.03.2023.

9. Source: International Federation of Robotics, J.P. Morgan Asset Management. As of 31.01. 2021. The companies above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.