Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

#yield #quality #income

As the global economy loses momentum and market volatility persists, some income investors face a tough choice. They may be thinking of positioning towards traditional government bonds which could help manage volatility but present relatively low yield for the overall portfolio. Others may be considering non-traditional sectors that could offer higher income opportunities but with more risk.

What are our considerations when it comes to quality, income and risk in an overall bond portfolio?

Quality and yield both matter to us

We believe we can tap into relatively attractive income and risk-adjusted return potential by investing flexibly across different sectors in the bond markets. Non-traditional income sources such as securitised debt1 is one of the asset classes in our search for quality and yield opportunities in an overall bond portfolio2.

Agency mortgage-backed securities (MBS) are guaranteed by US government-related bodies, such as Ginnie Mae, Fannie Mae and Freddie Mac, and they are generally AAA-rated. MBS pooled from commercial mortgage loans are called commercial mortgage-backed securities (CMBS).

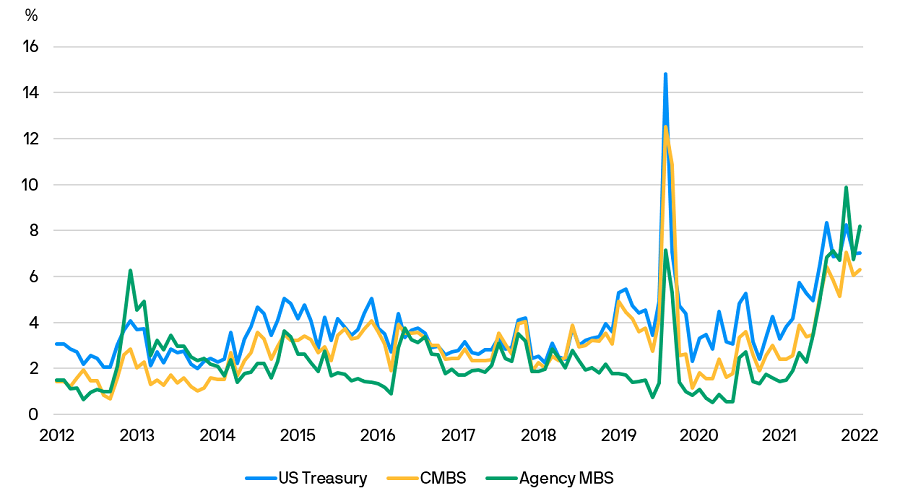

As illustrated below, agency MBS and CMBS have exhibited relatively similar trends of volatility as US Treasuries over the 10-year period between 1 September 2012 and 31 August 2022.

Volatility trends of US Treasuries, agency MBS and CMBS over the past 10 years

Source: Bloomberg, J.P. Morgan Asset Management. Data as at 31.08.2022. MBS refers to mortgage-backed securities, CMBS refers to commercial mortgage-backed securities. Indexes used are: Bloomberg US Treasury Index (US Treasury), Bloomberg US CMBS Index (CMBS), Bloomberg US MBS Index (Agency MBS). The Bloomberg US MBS Index tracks fixed-rate mortgage-backed pass-through securities issued by Ginnie Mae, Fannie Mae and Freddie Mac. Volatility refers to 30-day moving average data covering the period from 01.09.2012 to 31.08.2022. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not a reliable indicator of current and future results.

Since the beginning of 2022, we see compelling opportunities in these securitised assets. While positioning our overall fixed income portfolio currently, agency MBS and CMBS play a defensive role as they present income opportunities that are relatively higher than US Treasuries. Currently, we prefer higher coupon agency MBS because of the advantage of elevated yields, while also improving the overall quality of our securitised asset allocation. We also favour multi-family CMBS because of supportive long-term demographic trends while short-term leases can also allow these properties to increase rents and cash-flows as inflation stays elevated.

Conclusion

Active management, which integrates macro views and the bottom-up, yield-focused insights of asset class specialists, is crucial when considering quality, yield and risk in an income portfolio. We employ a flexible approach to differentiate and invest where opportunities can be found as market conditions evolve, alongside robust credit selection and a focus on quality.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss. Yield is not guaranteed. Positive yield does not imply positive return.

1. Securitisation is the process in which certain type of assets, such as mortgages or other types of loans, are pooled so that they can be repackaged into interest-bearing securities. Examples of securitised debt include asset-backed securities and mortgage-backed securities.

2. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.