Securitisation 101: What are ABS and MBS?

Fixed income isn’t just government or corporate bonds, it also includes non-traditional debt securities.

1. What is securitisation1?

You may have come across the acronyms, ‘ABS’ and ‘MBS’, and wonder if they are describing alphabet soup. They are not. They are part of the securitised debt universe, which includes certain assets such as mortgages or other types of loans which are pooled together and repackaged into interest-bearing securities.

Click here for more fund information

2. What are the roles of securitised assets1,2 within the overall fixed income portfolio?

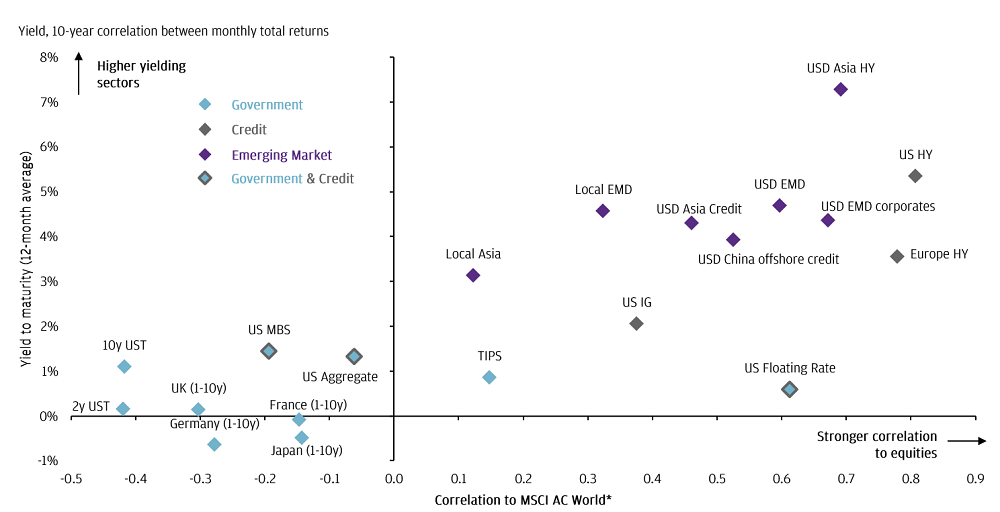

Yield3 seeking and volatility management are among the top priorities for investors as market conditions change. Employing a flexible fixed income strategy that invests in a range of uncorrelated assets could help investors manage volatility as the individual type of fixed income asset can react differently to market changes.

Securitised debt1, for example, could act as a diversifier within the overall portfolio because it tends to be less correlated to equities and high-yield (HY) bonds4. Unlike equities and HY bonds4 which are more closely tied to corporate balance sheets, the underlying assets of securitised debt are mostly loans extended to individuals. This means tapping into the balance sheets of consumers.

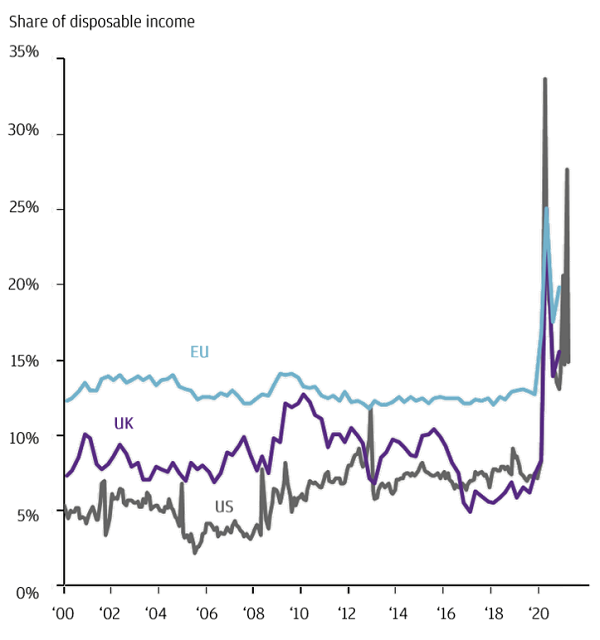

As shown in the chart5, household savings have been on the rise, which could generate pent-up consumption demand. Consumption strength and declining household debt are positive for ABS2.

Household savings and consumption5

5. Source: US Bureau of Economic Analysis, J.P. Morgan Asset Management, Eurostat, Office of National Statistics UK. Data reflect most recently available as of 30.06.2021.

Moreover, extraordinary fiscal support for US consumers because of the global public health crisis could bode well for securitised assets such as consumer ABS, auto and personal loans2. The reopening of economies, and return-to-the-office and related activities are supportive of CMBS2.

Long-term demographic trends are leading to household formations, driving demand for housing and benefiting non-agency MBS, multifamily credit and single-family rentals2.

Unlike corporate bonds, most ABS are secured by some type of collateral. They are also backed by different types of loans extended to many individual borrowers.

MBS also exhibited relatively lower volatility than individual fixed income sectors such as global investment-grade corporate and HY bonds4, as shown in the chart6. The securitisation market has also regained ground over the past decade.

Yields and correlations of fixed income returns to equities6

6. Source: Barclays, Bloomberg Finance L.P., FactSet, ICE BofA Merrill Lynch, J.P. Morgan Economics Research, MSCI, J.P. Morgan Asset Management. Based on Bloomberg Barclays US Treasury (UST) Bellwether 2y & 10y (2y & 10y UST), Bloomberg Barclays Treasury Inflation-Protected Securities (TIPS), ICE BofAML Country Government (1-10y) (France, Germany, Japan & UK (1-10y)), Bloomberg Barclays US Aggregate, Credit – Investment Grade & High Yield (US Aggregate, IG & HY), Bloomberg Barclays US Floating Rate (US Floating Rate), Bloomberg Barclays US Aggregate Securitized – Mortgage-Backed Securities (US MBS), Bloomberg Barclays Pan-European High Yield (Europe HY), J.P. Morgan GBI-EM Global (Local EMD), J.P. Morgan EMBI Global (USD EMD), J.P.Morgan Asia Credit (JACI) (USD Asia Credit), J.P. Morgan Asia Credit (JACI) – High Yield (USD Asia HY), J.P. Morgan Asia Credit China Index (USD China offshore credit), J.P. Morgan CEMBI (USD EMD corporates), J.P. Morgan Asia Diversified (JADE) (Local Asia). *Correlations are based on 10-years of monthly returns. Yield is not guaranteed. Positive yield does not imply positive return. Indices may not include fees or operating expenses and are not available for actual investment. Data reflect most recently available as of 30.06.2021.

Explore income opportunities

Conclusion

Investing across multiple fixed income sectors2 could help investors, based on their objectives and risk appetite, better tap into potential income opportunities as market conditions change. Hence our strategies go beyond the traditional sectors to explore the opportunities securitised assets1 can present as a part of the overall investment portfolio.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. Securitisation is the process in which certain type of assets, such as mortgages or other types of loans, are pooled so that they can be repackaged into interest-bearing securities. Examples of securitised debt include asset-backed securities (ABS) and mortgage-backed securities (MBS).

2. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

3. Yield is not guaranteed. Positive yield does not imply positive return.

4. High-yield credit refers to corporate bonds which are given ratings below investment grade and are deemed to have a higher risk of default. Yield is not guaranteed. Positive yield does not imply positive return.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.