-

What is an ETF?

-

How does an ETF work?

-

What are the different types of ETFs?

-

Why are ETFs tax efficient?

-

How do ETFs trade?

-

Why do ETFs trade at Premiums and Discounts?

-

How do ETFs trade at time of stress?

-

How to buy ETFs?

What is an ETF?

An exchange-traded fund (ETF) is an investment wrapper which combines the benefits of a fund and a stock.

A fund offers:

- Diversified exposure

- Economies of scale

- Professional management

A stock offers:

- Liquidity

- Transparency

- Trading flexibility

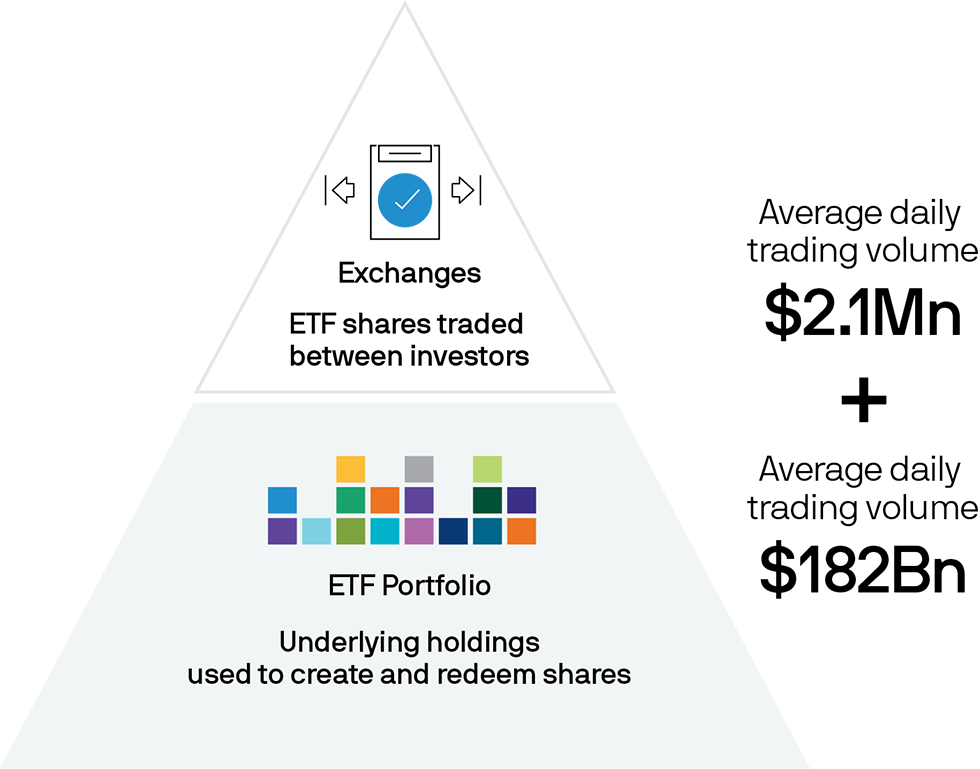

How does an ETF work?

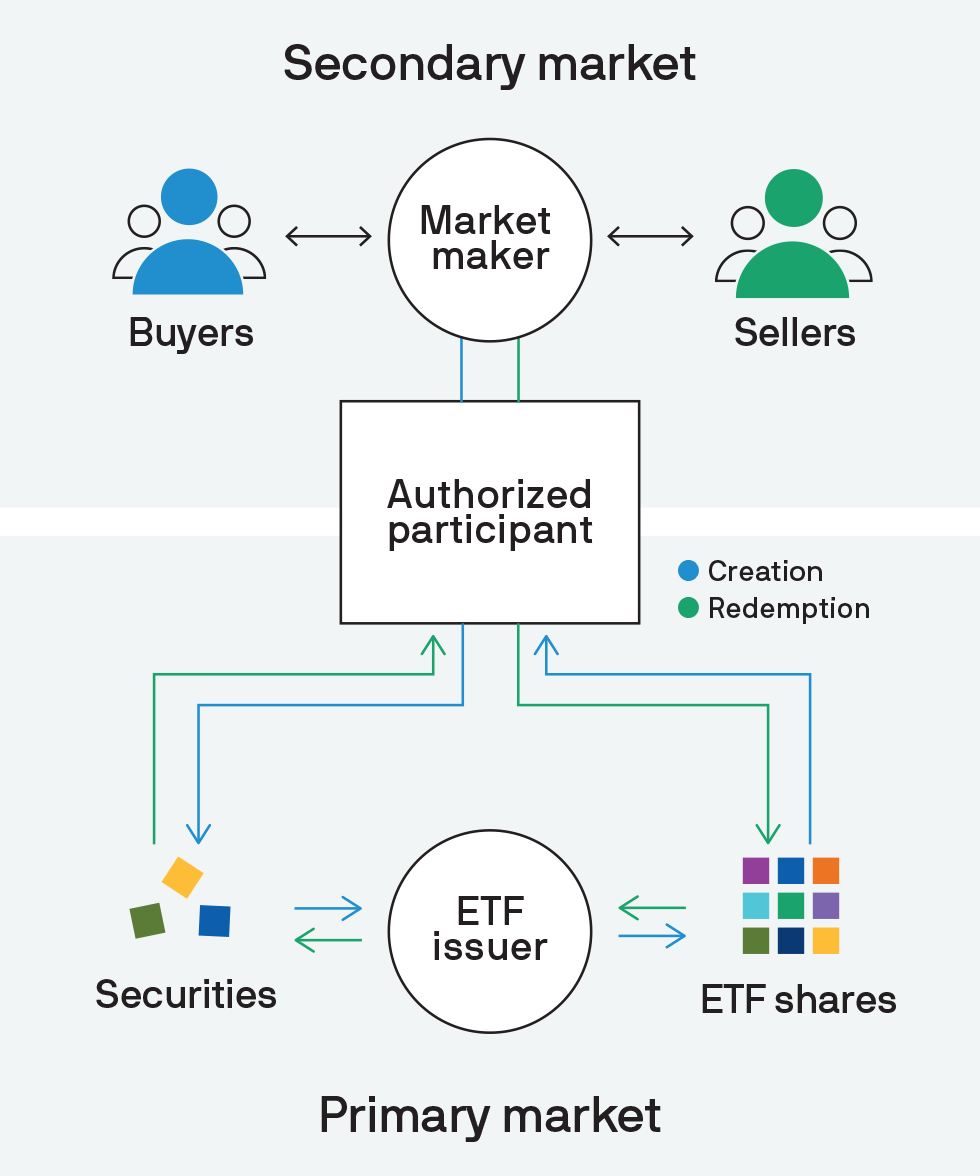

The structure of the ETF wrapper provides greater opportunity for improved economics.

- Generally, ETFs do not charge 12b-1 fees

- In-kind creations/redemptions, where securities are exchanged for ETF shares, contribute to the cost-effectiveness of ETFs

- Market-makers help mitigate outsized premiums/discounts of the ETF market-price to the ETF net asset value

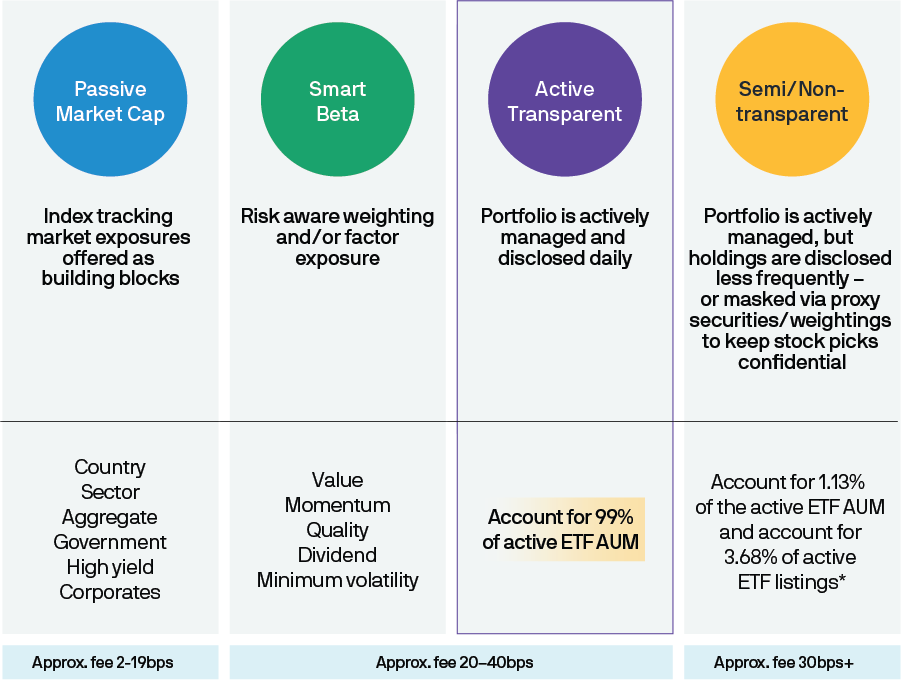

Type of ETFs

Why are ETFs tax efficient?

When redemptions occur, ETFs remove purchases with the lowest cost basis, reducing tax liability.

- When redemptions occur, purchases of securities with the lowest cost basis are moved out of the portfolio without being taxed. What’s left in the ETF are higher-priced securities, reducing the future tax liability when the ETF is sold.

- Portfolio gains are not distributed annually, so investors do not pay capital gains taxes until the ETF is sold.

- When investors sell ETFs on an exchange, share are usually transferred to a buyer. No money comes out of the ETF, which means no capital gains taxes because managers aren’t forced to sell securities to raise cash.

How do ETFs trade:

ETFs offer more liquidity than meets the eye.

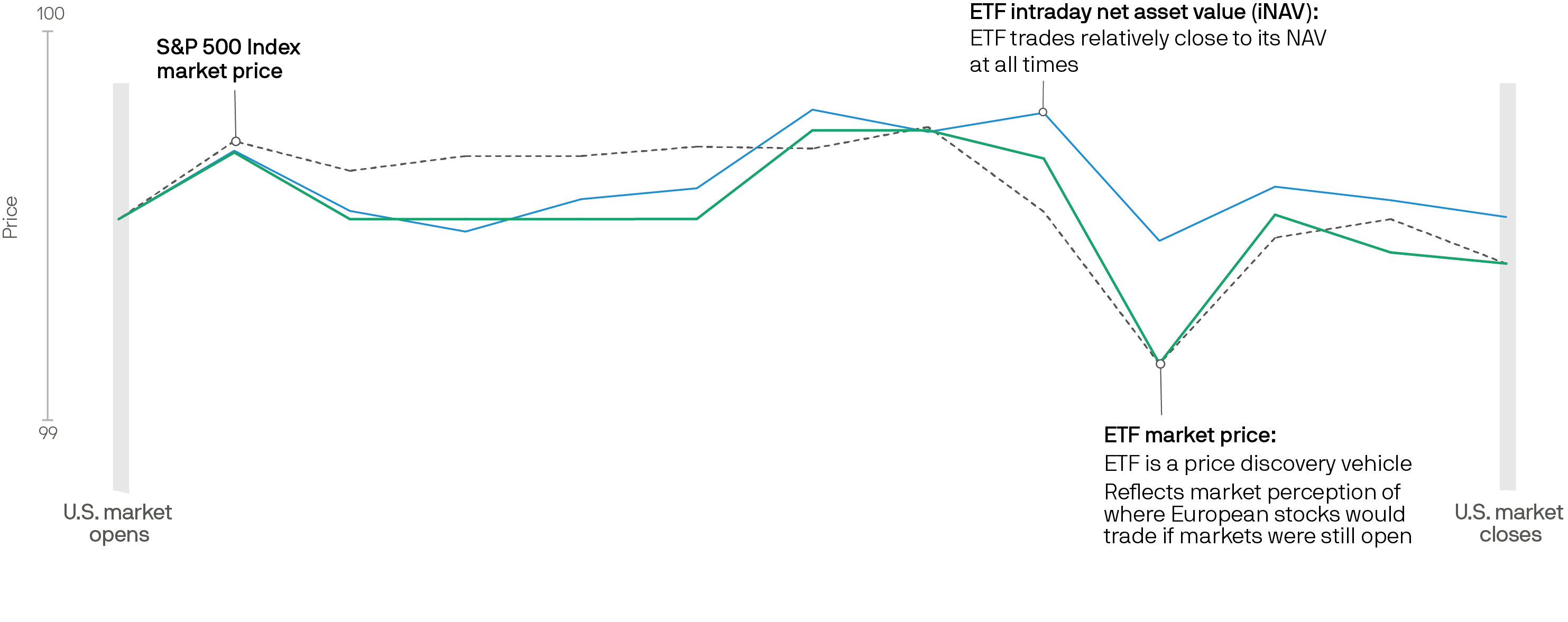

Why do ETFs trade at premiums and discounts?

Premiums and discounts are common with international ETFs.

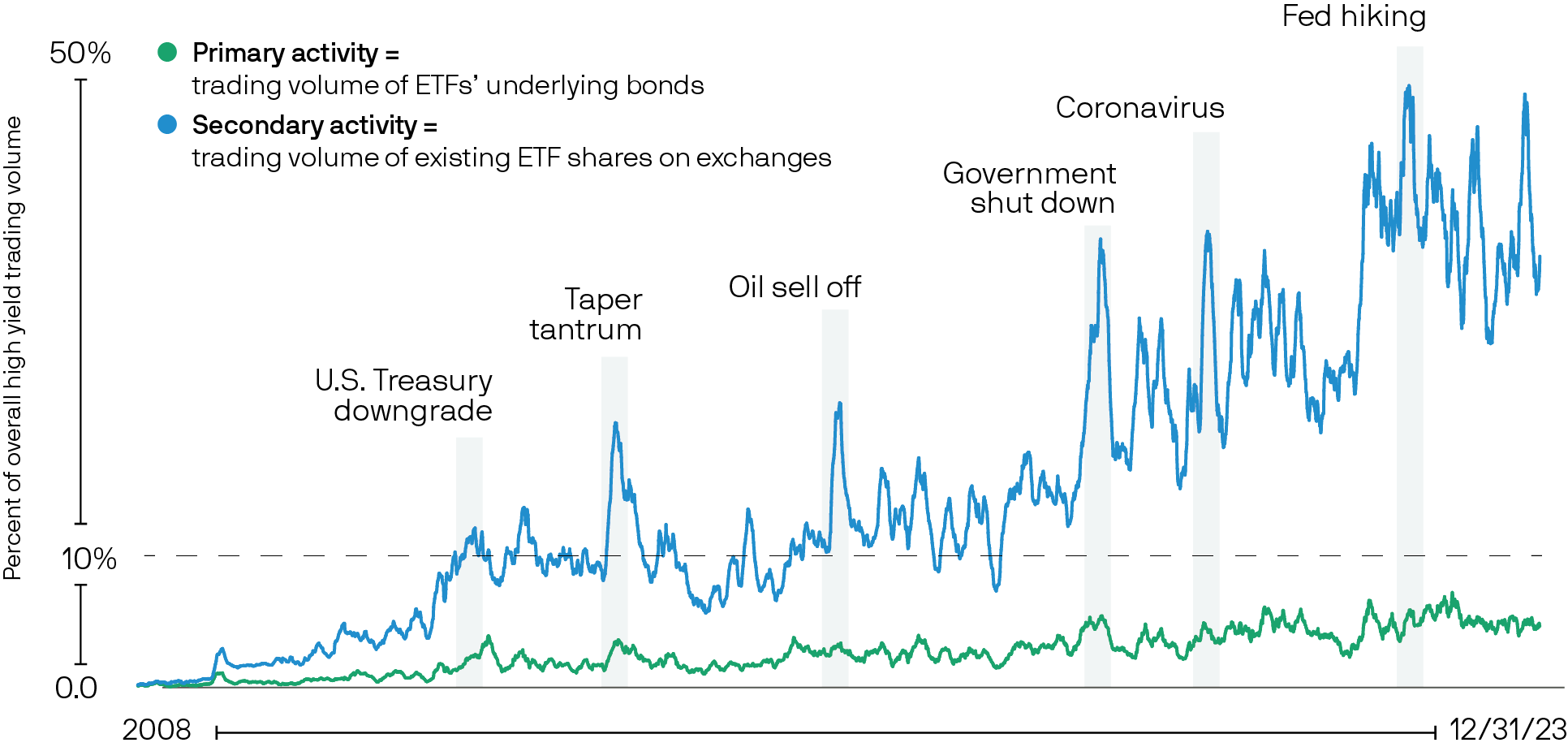

How do ETFs trade at time of stress?

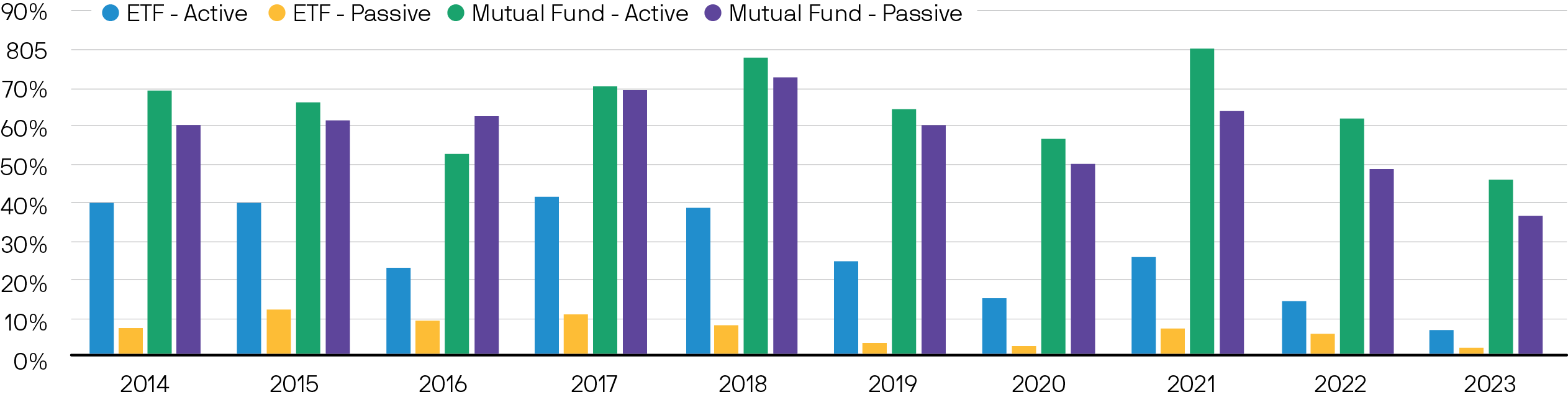

High yield ETF trading volume in periods of market stress.

Share (%) of 20-day rolling average trading volume of overall high yield bond market

- During periods of market stress, investors can trade ETF shares instead of buying or selling the underlying securities at unfavorable prices.

- In April 2025, trading volume in high yield ETF shares represented 41% of the trading volume of the high yield bond market.

- During that same period, trading volume of the underlying bonds within high yield ETFs was just 4% of the overall high yield bond market volume.

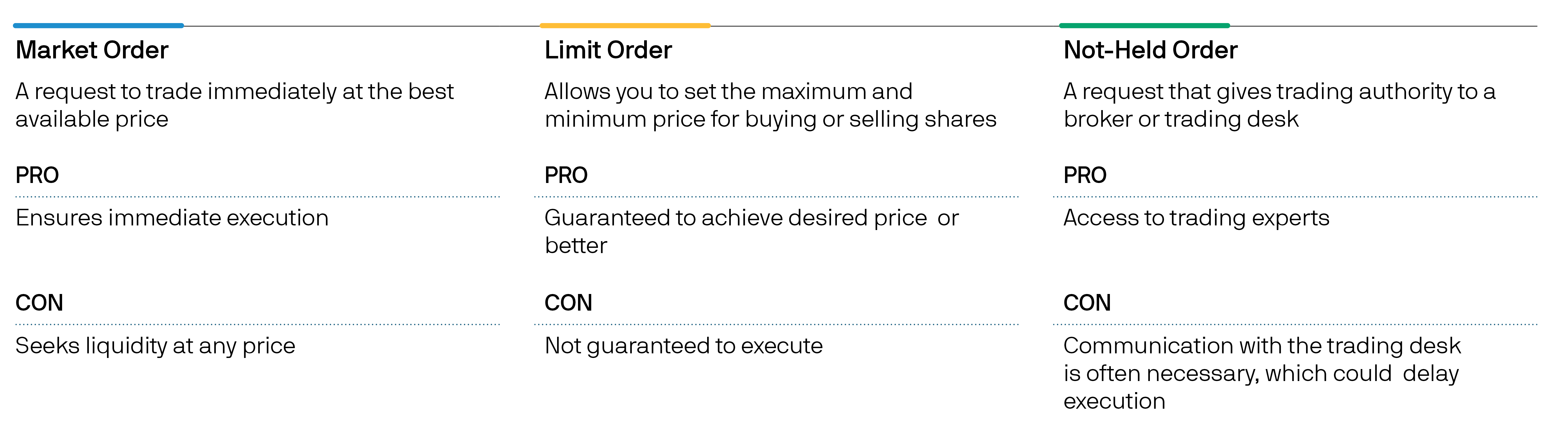

How to buy ETFs?

ETF Resources