A transformative approach to tax savings

Two steps to easily manage taxes

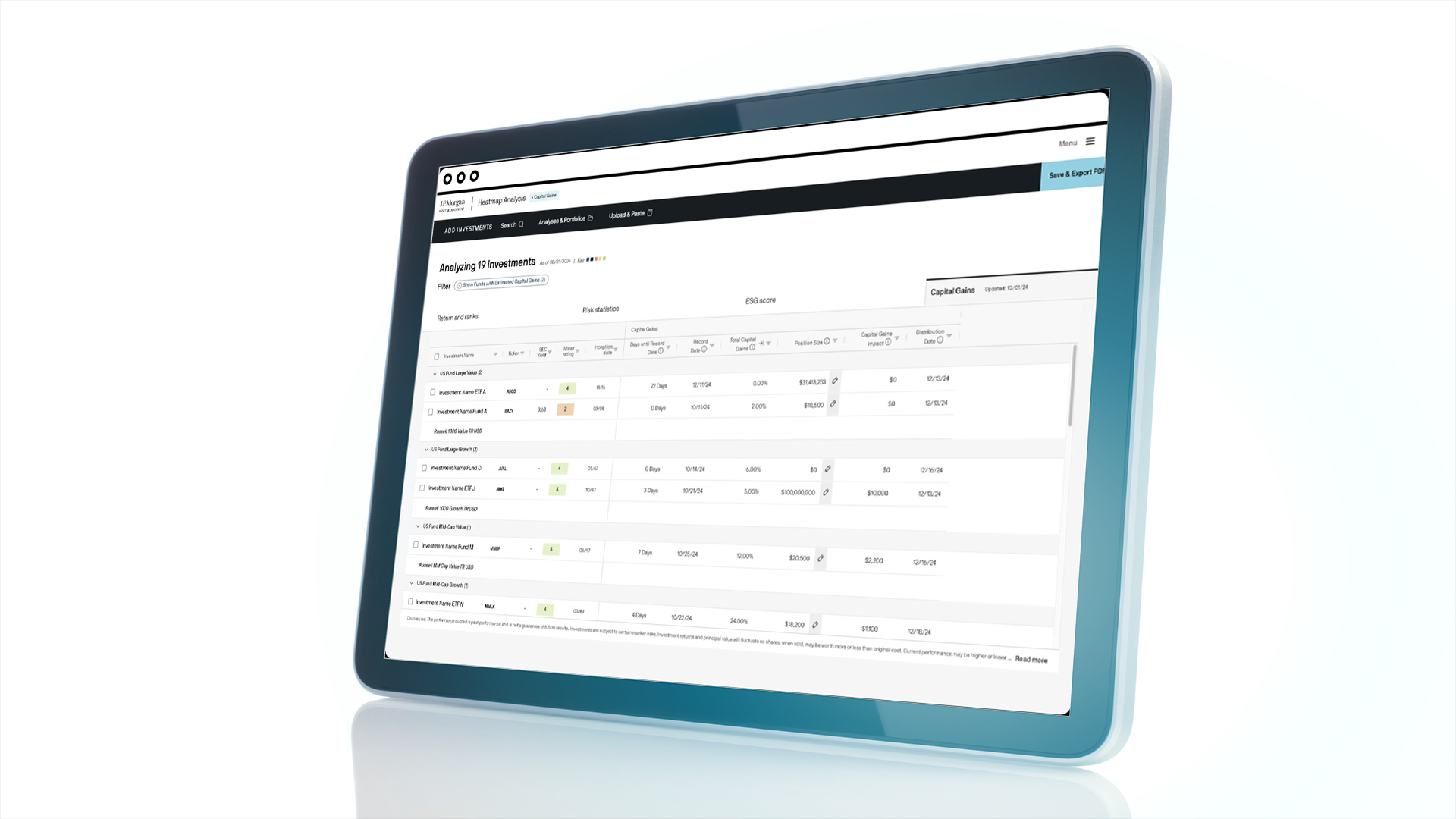

Step 1: Track estimated capital gain distributions for 5,000+ funds in the Heatmap Analysis Tool

- Easily identify funds expected to distribute large taxable gains and consider replacement opportunities.

- Monitor key dates and review data as it is updated each week to determine when actions are needed.

Step 2: Complement or replace existing holdings with tax-efficient ETFs

- Access some of J.P. Morgan’s best equity and fixed income managers through tax-efficient ETFs, that typically pay little or no capital gains distributions.

- When selling investments with substantial capital gains, consider our diverse lineup of active ETFs to help maintain comparable market exposure.

Our Tax-Smart Platform offers a range of investment solutions that effortlessly provide continual tax analysis and finds tax-loss harvesting opportunities as soon as they arise.

Imagine what clients could do with the taxes they save

Even small tax bites can have a big impact over time, as shown in this chart.

- The cost of a college education: Losing 1% of a portfolio’s value to taxes each year costs $297,000

- The cost of a new home: Losing 2% of a portfolio’s value to taxes each year costs $816,000

It’s not surprising that tax management is ranked as the #1 financial need for households with $5 million or more in investable assets.1

Potential impact of taxes

10-year growth of $1 million invested in U.S. large cap equities, with and without taxes²

¹Cerulli Associates, The Case for Direct Indexing: Differentiation in a Competitive Marketplace, December 2022.

2J.P. Morgan Asset Management, Factset, as of December 2024; US large cap equities represented by the S&P 500 index. For illustrative purposes only. You cannot invest directly in an index.

Featured insights