European Union (EU) governments and business leaders believe that one of the best ways to achieve their sustainability goals is to encourage capital to flow towards efforts that promote and enable a more sustainable economy. Many investors also support this objective, but often lack enough information to assess and compare sustainable investment options on the basis of how they are aligned to their investment goals.

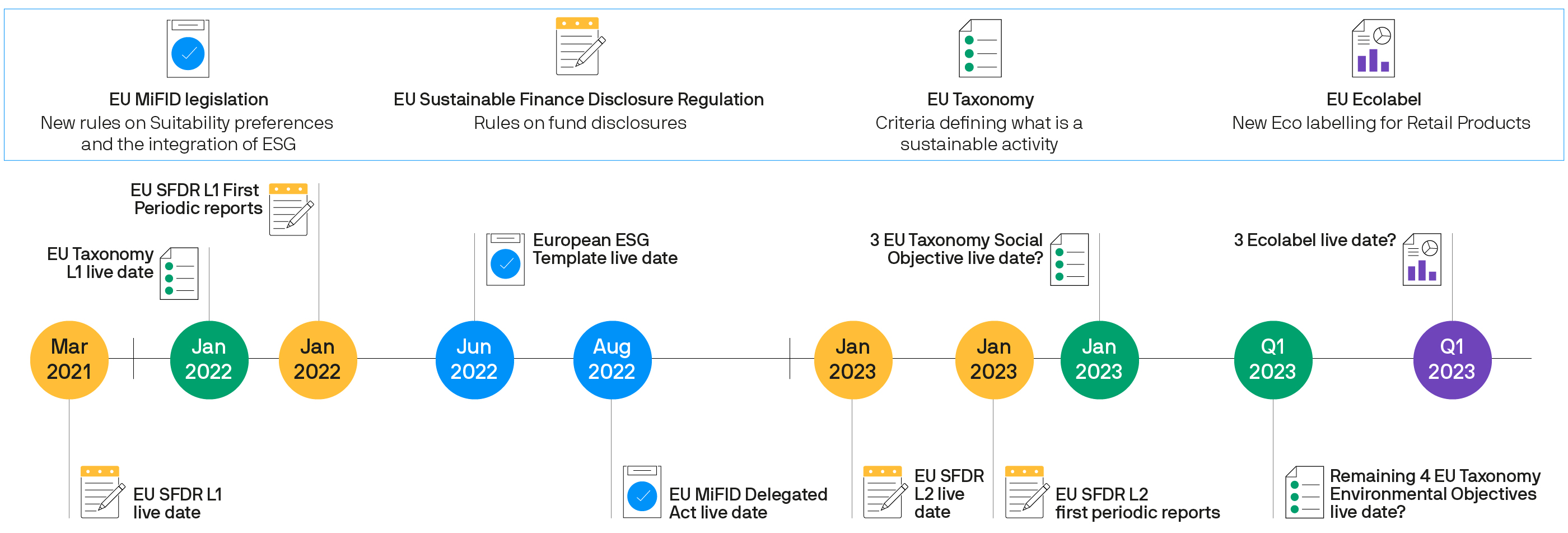

The EU Action Plan on Sustainable Finance, which features a series of interlinking regulations designed to encourage sustainable investing, represents a major step towards redirecting capital to the sustainable economy. A key part of the plan is the EU Sustainable Finance Disclosure Regulation (EU SFDR), which came into effect on 10 March 2021. Further regulations have followed, including the EU Taxonomy Regulation1, which established specific environmental criteria related to economic activities for investment purposes, and which will form part of the enhanced disclosure obligations required by the EU SFDR and became effective from January 20222. An extended environmental taxonomy and a social taxonomy are expected to follow.

In this Q&A, we look specifically at the EU SFDR, seeking to explain the importance of this wide-reaching regulation and to show how it will impact asset managers, advisers and investors alike.

What is the EU SFDR?

The EU SFDR is a regulation that is designed to make it easier for investors to distinguish and compare between the many sustainable investment strategies that are now available within the European Union. The EU SFDR aims to help investors by providing more transparency on the degree to which financial products consider environmental and/or social characteristics, invest in sustainable investments or have sustainable objectives. This information is now being presented in a more standardised way.

The EU SFDR requires specific firm-level disclosures from asset managers and investment advisers regarding how they address two key considerations: Sustainability Risks and Principal Adverse Impacts. With regards to asset managers, the EU SFDR also mandates transparency of remuneration policies in relation to the integration of sustainability risks. In addition, the EU SFDR aims to help investors to choose between products by mandating increasing levels of disclosures, depending on the degree to which sustainability is a consideration.

Three different product categorisations result from EU SFDR:

“Article 6” products either integrate environmental, social and governance (ESG) risk considerations into the investment decision-making process, or explain why sustainability risk is not relevant, but do not meet the additional criteria of Article 8 or Article 9 strategies.

“Article 8” products promote social and/or environmental characteristics, and may invest in sustainable investments, but do not have sustainable investing as a core objective.

“Article 9” products have a sustainable investment objective.

The disclosures, which went into effect on 10 March 2021, apply to several financial products, including UCITS, AIFs and segregated mandates.

L1 and L2 denotes the corresponding regulatory text ‘Level’

Why is the EU SFDR important?

The EU SFDR is designed to re-orient capital towards sustainable growth and help clients make better sustainable investing choices.

The primary goals are to provide greater transparency on environmental and social characteristics, and sustainability within the financial markets, and to create common standards for reporting and disclosing information related to these considerations.

Increasing transparency and introducing standards supports two important additional considerations. First, it makes it harder for asset managers to “greenwash” their products – in other words, they cannot simply brand a product with an ESG or sustainable label, without being transparent with regards to how this is achieved.

Second, it provides investors with a significantly improved ability to compare investment options in terms of the degree to which ESG factors are a consideration within the investment decision-making process, which helps them make informed decisions that align with their investing goals.

Who does the EU SFDR apply to and which types of products and services are affected?

The scope of the EU SFDR is relatively broad, applying to all financial market participants and financial advisers based in the EU, as well as investment managers or advisers based outside of the EU, who market (or intend to market) their products to clients in the EU under Article 42 of the Alternative Investment Fund Managers Directive (EU AIFMD).

In terms of products, the disclosures regime applies to UCITS, AIFs, separately-managed portfolios and sub-advisory mandates, as well as to financial advice (provided within the EU or by an EU investment firm).

While the UK is out of the scope of the EU SFDR, the UK Financial Conduct Authority (FCA) issued in November 2021 a Discussion Paper on Sustainability Disclosure Requirements and investment labels (UK SDR)3, which in part parallels the EU SFDR. In December 2021, the FCA published a Policy Statement titled “Enhancing climate-related disclosures by asset managers, life insurers and FCA-regulated pension providers”4. This final publication is aligned to the Financial Stability Board (FSB) Task Force on Climate-Related Financial Disclosures (TCFD).

What are Sustainability Risks and Principal Adverse Impacts, and how do they impact asset managers and advisers?

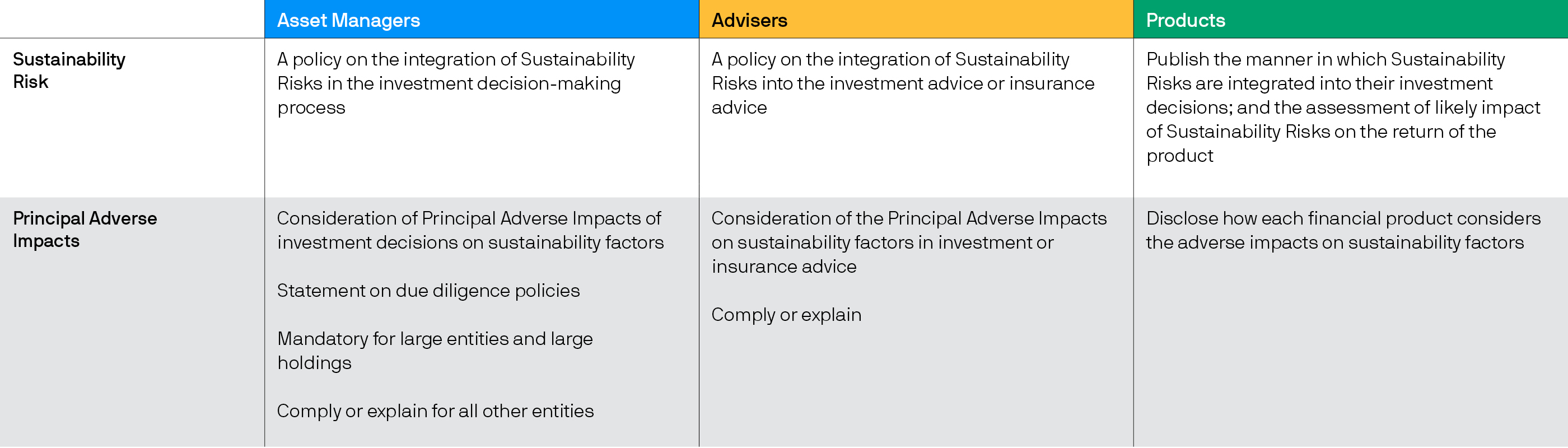

To achieve the EU SFDR’s goal of improving sustainable finance by increasing transparency and creating standards, asset managers and advisers must disclose the manner in which they consider two key factors: Sustainability Risks and Principal Adverse Impacts. Subject to specific thresholds, asset managers are required to disclose their policies at both the firm and product level, while advisers are required to explain how they consider these factors in their advice.

The EU SFDR outlines specific definitions for Sustainability Risks and Principal Adverse Impacts:

Sustainability Risks refer to environmental, social or governance events, or conditions, such as climate change, which could cause an actual or a potential material negative impact on the value of an investment.

Principal Adverse Impacts are any negative effects that investment decisions or advice could have on sustainability factors. Examples could include investing in a company with business operations that significantly contribute to carbon dioxide emissions, or that has poor water, waste or land management practices.

Asset managers and advisers need to provide specific information on Sustainability Risks and Principal Adverse Impacts

Larger firms (having more than 500 employees) are required to disclose how they consider Principal Adverse Impacts from 30 June 2021, with reporting of Principal Adverse Impacts estimated to commence mid-2023 (representing Principal Adverse Impacts data throughout 2022).

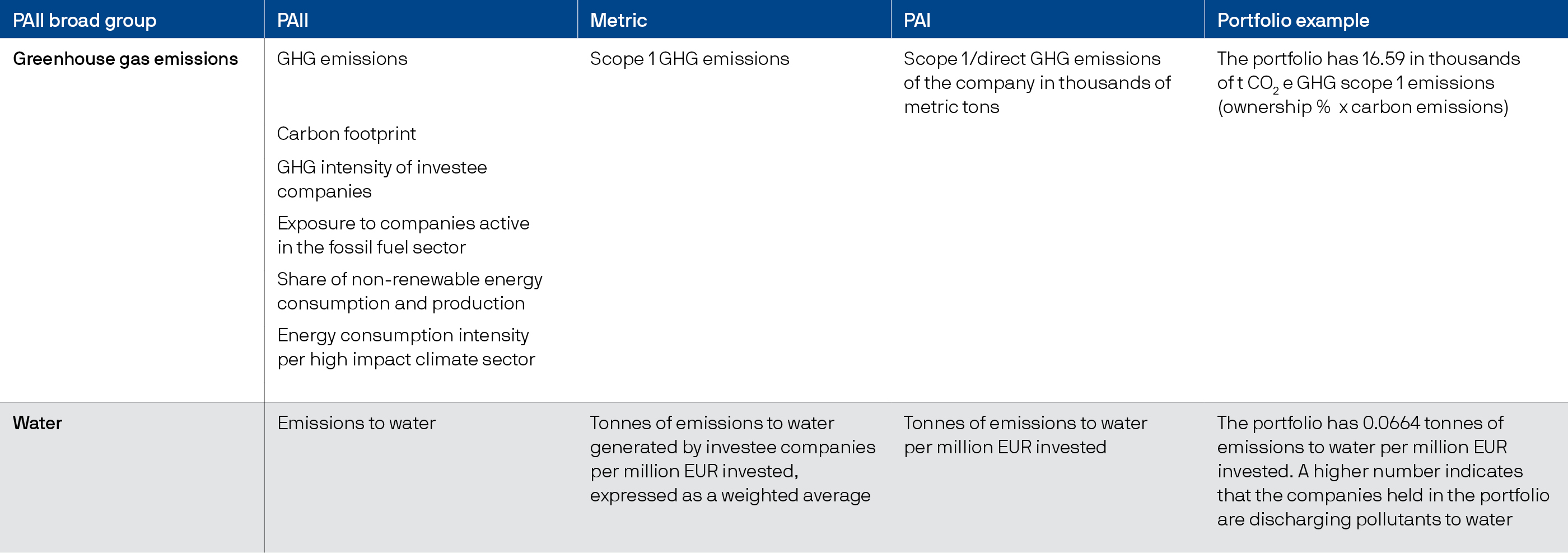

Subject to being passed into EU law, from 1 January 2023 asset managers will be required to break out how they consider Principal Adverse Impacts into more specific and quantifiable detail, with reference to indicators related to climate and the environment, and indicators related to social and employee issues, respect for human rights, and anti-corruption and anti-bribery matters. Out of the current 64 environmental and social indicators, which can be grouped into broader categories, such as greenhouse gas emissions, biodiversity or water, 18 are core, and for the other 46, investment managers have some flexibility with regards to providing detail on the impacts.

Interest in Principal Adverse Impacts has been increasing ahead of the inclusion of client sustainability preferences in the MiFID II update, effective 2 August 2022. Among the ways that clients may elect to express their sustainability preferences is through the consideration of Principal Adverse Impacts on sustainability factors in investments. As a result, investment managers and advisers will need to demonstrate how Principal Adverse Impacts are considered in an investment.

Example of considering Principle Adverse Impacts in an investment

PAII=Principle Adverse Impact Indicator; PAI = Principle Adverse Impact

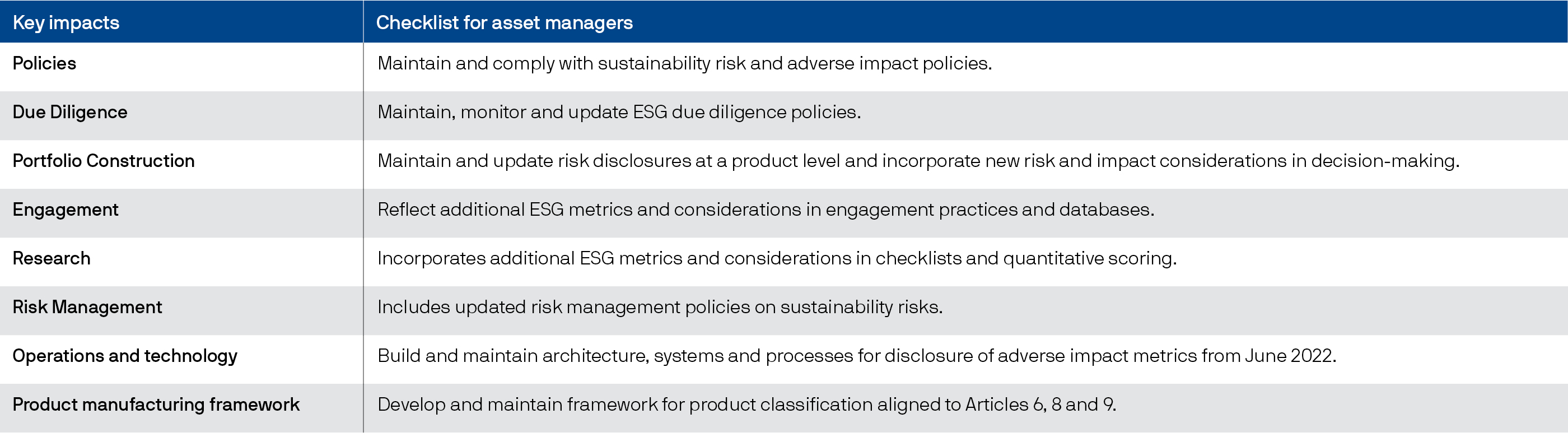

For asset managers, the incorporation of Sustainability Risks and Principal Adverse Impacts takes place at several points in the investment process.

Checklist for asset managers incorporating Sustainability Risks and Principal Adverse Impacts into the investment process

It is important to note that regulators continue to review the Principal Adverse Impacts and financial product disclosure requirements in the EU SFDR Delegated Regulation. The European Commission has invited the European Supervisory Authorities to: (1) streamline and develop further the regulatory framework; (2) consider extending the lists of universal indicators for Principal Adverse Impacts, as well as other indicators; and (3) refine the content of all the indicators for adverse impacts and their respective definitions, applicable methodologies, metrics and presentation.5

What are the different levels of disclosures introduced by the EU SFDR?

As defined in question 1, the EU SFDR currently specifies three distinct levels of disclosure for investment products with regards to sustainable investing and ESG considerations.

Article 6 financial products must disclose the manner in which sustainability risks are integrated into their investment decisions as well as an assessment of the likely impacts of sustainability risks on the returns of the financial products.

Article 8 and Article 9 financial products feature details on a variety of sustainability and ESG topics. The table below highlights a sample of the topics, though it is not a complete list.

Sample of topics featured in the disclosures for both Article 8 and Article 9 products

What is the EU Taxonomy Regulation and how does it affect the EU SFDR?

Upcoming additional EU Taxonomy disclosures

The EU Taxonomy Regulation (EU TR), which introduces standard environmental criteria within the EU, came into effect on 1 January 2022. Subject to the corresponding EU SFDR regulatory technical standard being passed into EU law, from 1 January 2023 elements of the EU TR will be integrated into the disclosure obligations set out by the EU SFDR. This development will affect financial products that are classified as either Article 8 or Article 9. The specific EU TR elements to be disclosed under the EU SFDR are outlined below:

Article 8 products will need to state if they have any investments in sustainable investments and, if so, will need to disclose whether these investments are in activities aligned with the EU TR.

Article 9 products, which by definition have sustainable investment as an objective, will have to disclose whether their sustainable investments are in activities aligned with the EU TR.

What are the additional upcoming developments that investors should be aware of?

There remain a few additional items for investors to watch:

The “Level 2” regulatory technical standards (RTS) disclosures, which will integrate the EU Taxonomy with the Article 8 and Article 9 disclosures, remains outstanding, but approval is expected in the medium term and implementation is expected on 1 January 20236.

As noted earlier, in November 2021 the UK FCA issued a Discussion Paper on Sustainability Disclosure Requirements and investment labels (UK SDR), creating a parallel disclosure framework that goes beyond the EU SFDR.

Additional developments driven by both the European Platform on Sustainable Finance and the European Commission will need to be reviewed, particularly their focus on a potential social taxonomy7 and an extended environmental taxonomy8.

Third-party ESG-related industry standards will need to be reviewed as they get updated to align with the EU SFDR and the EU Taxonomy Regulation.

The integration of ESG considerations may have implications for the delegated acts (DAs) under the EU UCITS, EU AIFMD, EU MiFID II, EU IDD and EU Solvency II frameworks.

The effective date of the EU MiFID II Sustainable Preference obligation is 2 August 2022.

Parallel regulatory labelling requirements, such as Ecolabels, and/or related regulatory disclosure requirements from regulators in other regions, such as the Hong Kong Securities and Futures Commission, may interact with the EU SFDR and have an aggregated impact on products and disclosures.

Looking ahead

The EU SFDR represents a positive step in the growth and development of sustainable and ESG investing within the EU. As investor interest in sustainable and ESG investing continues to grow, the regulation offers investors clear comparisons and advice on ESG and sustainable investments, enabling asset managers and advisers to help capital flow towards investment products that support a sustainable economy.

J.P. Morgan Asset Management is proud to help clients achieve their ESG and sustainable investing goals. If you have questions about the SFDR or sustainable investing, please contact your local J.P. Morgan Asset Management representative.

1 The Taxonomy Regulation was published in the Official Journal of the European Union on 22 June 2020 and entered into force on 12 July 2020. The regulation sets out four overarching conditions that an economic activity has to meet in order to qualify as environmentally sustainable.

2 On 25 November 2021, the European Commission sent a letter to the European Parliament and the Council of the European Union announcing a delay to the date of application of regulatory technical standards (RTS) under EU SFDR. The Commission deferred implementation of the SFDR RTS to 1 January 2023. https://www.esma.europa.eu/sites/default/files/library/com_letter_to_ep_and_council_sfdr_rts-j.berrigan.pdf

3 https://www.fca.org.uk/publication/discussion/dp21-4.pdf

4 https://www.fca.org.uk/publication/policy/ps21-24.pdf

5 https://www.esma.europa.eu/document/mandate-esas-pai-product

6 On 6 April 2022 the European Commission adopted the Regulatory Technical Standards (RTS) under the Sustainable Finance Disclosure Regulation ( EUSFDR). In addition to the RTS itself, the Commission published the accompanying annexes:

6a Annex 1 – with the template for the principal adverse sustainability impacts statement

6b Annex 2 – with the template for pre-contractual disclosure for Article 8 products

6c Annex 3 – with the template for pre-contractual disclosure for Article 9 products

6d Annex 4 – with the presentation and content requirements for periodic reports of Article 8 products

6e Annex 5 – with the presentation and content requirements for periodic reports of Article 9 products

7 https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/280222-sustainable-finance-platform-finance-report-social-taxonomy.pdf

8 https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/220329-sustainable-finance-platform-finance-report-environmental-transition-taxonomy_en.pdf

09uw221006090317