What to look for when evaluating 529 plan investment portfolios

08/31/2021

Douglas Polak

Navdeep Saini

Not all 529 college savings plans are created equal. Besides differences in state tax benefits, fees and contribution limits, each plan takes a unique approach to the age-based and asset allocation portfolios typically favored by participants.

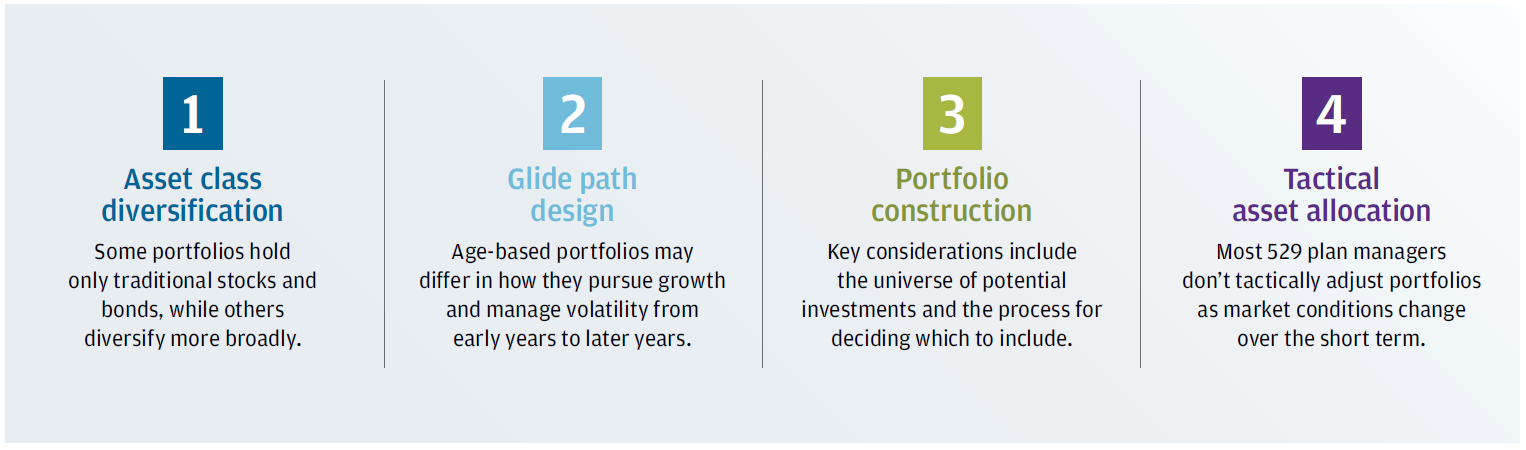

All 529 plans offer professionally managed portfolios that either remain the same over time (asset allocation) or automatically become more conservative as college approaches (age based). However, there can be vast differences in how those portfolios are allocated, assembled and adjusted. Which is right for each family? This paper examines four factors to consider when investing in 529 plans.

FOUR KEY CONSIDERATIONS IN EVALUATING 529 PORTFOLIOS

For more information

To learn more about college planning and 529 college savings plans:

- Consult your financial professional

- Visit www.ny529advisor.com

- Call 1-800-774-2108

Before you invest, consider whether your or the beneficiary's home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state's qualified tuition program.

Market Risk. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. The value of Investments may be negatively affected by the occurrence of global events such as war, terrorism, environmental disasters, natural disasters or events, country instability, and infectious disease epidemics or pandemics. For example, the outbreak of COVID-19, a novel coronavirus disease, has negatively affected economies, markets and individual companies throughout the world. The effects of this pandemic to public health and business and market conditions, including exchange trading suspensions and closures may continue to have a significant negative impact on investments.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

JPMorgan Distribution Services, Inc. is a member of FINRA.

J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co., and its affiliates worldwide.