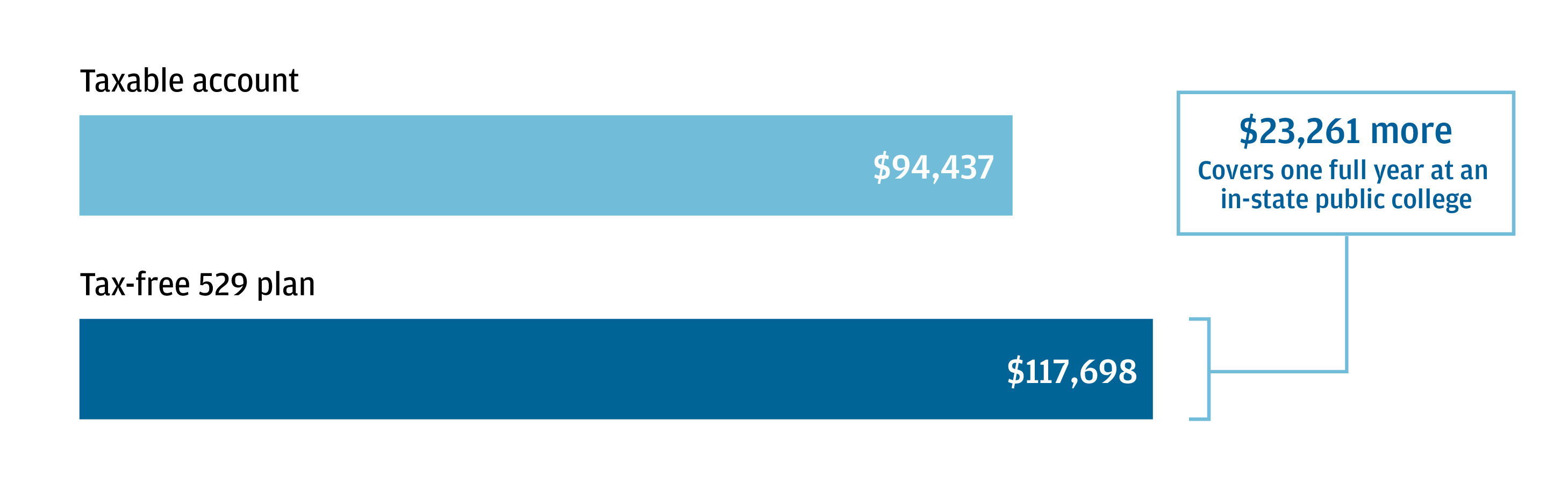

529 Plan Tax Benefits

The power of tax-free growth

With the Advisor-Guided Plan, investment earnings compound on a tax-deferred basis, and qualified withdrawals are entirely free from federal and state income taxes.1 And because your account is tax-deferred, it has the potential to grow more quickly than taxable investments earning the exact same returns.

Accumulate $23,000 more with a tax-free 529 plan

Investment growth over 18 years

Source: J.P. Morgan Asset Management. Illustration assumes an initial $1,000 investment and monthly investments of $300 for 18 years. Chart also assumes an annual investment return of 6%, compounded monthly, and federal tax rate of 35%. Investment losses could affect the relative tax-deferred investing advantage. This hypothetical illustration is not indicative of any specific investment and does not reflect the impact of fees or expenses. Each investor should consider his or her current and anticipated investment horizon and income tax bracket when making an investment decision, as the illustration may not reflect these factors. These figures do not reflect any management fees or expenses that would be paid by a 529 plan participant. Such costs would lower performance.

This chart is shown for illustrative purposes only. Past performance is no guarantee of future results.

Additional tax benefits for New York state taxpayers

New York taxpayers who open an account in New York's 529 Advisor-Guided College Savings Program can enjoy additional tax benefits. Account owners can deduct up to $5,000 ($10,000 if married filing jointly) in contributions from New York state income taxes each year.2

Potential tax savings for residents of other states

In some states, contributions to any 529 plan are eligible for the state's income tax deduction, and residents are not required to choose the in-state plan to get the benefit. Before investing, you should consider whether your home state offers any state tax or other benefits that are only available to residents. Your financial professional or tax professional can provide additional details.

Special estate and gift tax benefits

Contributions to 529 plans are considered completed gifts, which means current assets and future earnings are excluded from your taxable estate for federal estate tax purposes – even though you retain control of the assets for the life of the account.3 529 plans also allow you to contribute five years' worth of gifts in one year, up to $90,000 per beneficiary (or $180,000 if married and filing jointly) without incurring a federal gift tax, making it a valuable way to reduce the size of your taxable estate or make up for lost time as beneficiaries approach college age.4

1 Earnings on non-qualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes. New York State tax deductions may be subject to recapture in certain additional circumstances such as rollovers to another state's 529 plan and withdrawals used to pay elementary or secondary school tuition as described in the Disclosure Booklet and Tuition Savings Agreement. State tax benefits for non-resident New York taxpayers may vary. Tax and other benefits are contingent on meeting other requirements. Please consult your tax professional about your particular situation.

2 New York State tax deductions may be subject to recapture in certain circumstances such as rollovers to another state's 529 plan, federal nonqualified withdrawals, or withdrawals used to pay elementary or secondary school tuition as described in the Disclosure Booklet and Tuition Savings Agreement. State tax benefits for non-resident New York taxpayers may vary. Please consult your tax advisor about your particular situation.

3 Limitations may apply. Please review the Advisor-Guided Plan Disclosure Booklet for details.

4 No additional gifts can be made to the same beneficiary over a five-year period. If the donor does not survive the five years, a prorated portion of the gift is returned to the taxable estate.

| INVESTMENTS ARE NOT FDIC INSURED, MAY LOSE VALUE AND ARE NOT BANK GUARANTEED. |

Before you invest, consider whether your or the Beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program.

The Comptroller of the State of New York and the New York State Higher Education Services Corporation are the Program Administrators and are responsible for implementing and administering New York’s 529 Advisor-Guided College Savings Program (the “Advisor-Guided Plan”). Ascensus Broker Dealer Services, LLC serves as Program Manager for the Advisor-Guided Plan. Ascensus Broker Dealer Services, LLC and its affiliates have overall responsibility for the day-to-day operations of the Advisor-Guided Plan, including recordkeeping and administrative services. J.P. Morgan Investment Management Inc. serves as the Investment Manager. J.P. Morgan Asset Management is the marketing name for the asset management business of JPMorgan Chase & Co. JPMorgan Distribution Services, Inc. markets and distributes the Advisor-Guided Plan. JPMorgan Distribution Services, Inc. is a member of FINRA.

No guarantee: None of the State of New York, its agencies, the Federal Deposit Insurance Corporation, J.P. Morgan Investment Management Inc., Ascensus Broker Dealer Services, LLC, JPMorgan Distribution Services, Inc., nor any of their applicable affiliates insures accounts or guarantees the principal deposited therein or any investment returns on any account or investment portfolio.

New York’s 529 College Savings Program currently includes two separate 529 plans. The Advisor-Guided Plan is sold exclusively through financial advisory firms who have entered into Advisor-Guided Plan selling agreements with JPMorgan Distribution Services, Inc. You may also participate in the Direct Plan, which is sold directly by the Program and offers lower fees. However, the investment options available under the Advisor-Guided Plan are not available under the Direct Plan. The fees and expenses of the Advisor-Guided Plan include compensation to the financial advisory firm. Be sure to understand the options available before making an investment decision.

For more information about New York’s 529 Advisor-Guided College Savings Program, you may contact your financial professional or obtain an Advisor-Guided Plan Disclosure Booklet and Tuition Savings Agreement at www.ny529advisor.com or by calling 1-800-774-2108. This document includes investment objectives, risks, charges, expenses, and other information. You should read and consider it carefully before investing.

The Program Administrators, the Program Manager and JPMorgan Distribution Services, Inc., and their respective affiliates do not provide legal or tax advice. This information is provided for general educational purposes only. This is not to be considered legal or tax advice. Investors should consult with their legal or tax professionals for personalized assistance, including information regarding any specific state law requirements.

Ugift is a registered service mark of Ascensus Broker Dealer Service, Inc.