2025 College Planning Essentials

Review our annual guide to tuition costs, financial aid, investing strategies, 529 plans and more.

Tax-advantaged investing

Special gift and estate tax benefits

New York state tax deductions

Control and flexibility

Investment choices

Meet a broad range of investor needs and preferences, with portfolios made up of mutual

funds and ETFs from J.P. Morgan Asset Management and State Street Global Advisors.

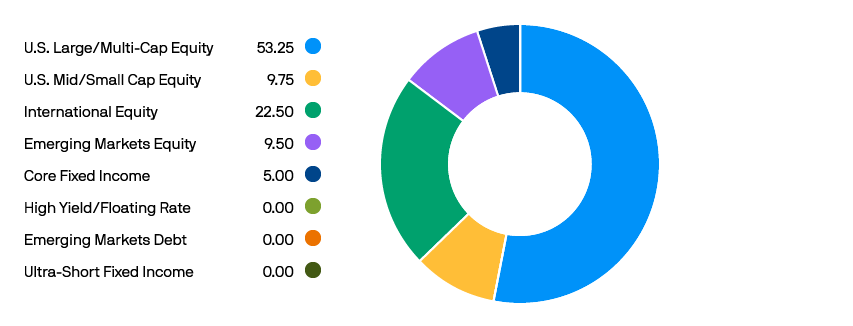

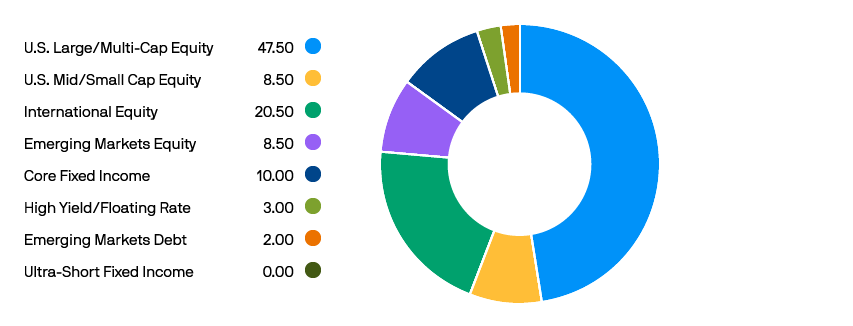

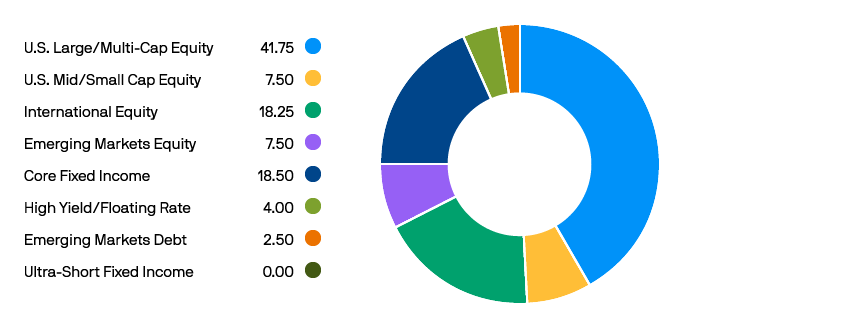

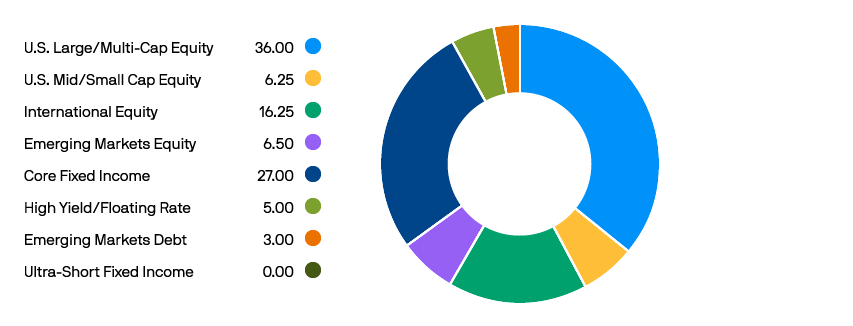

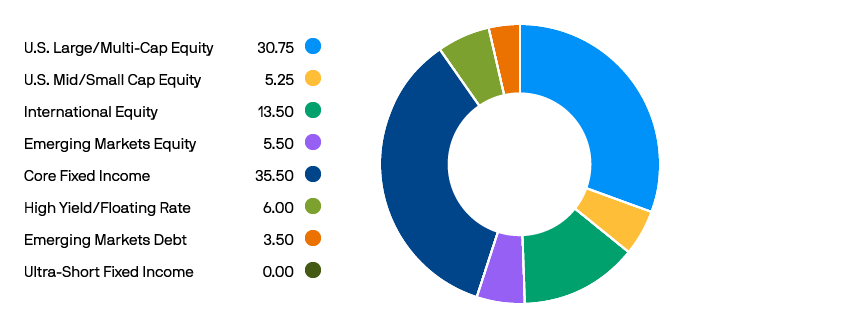

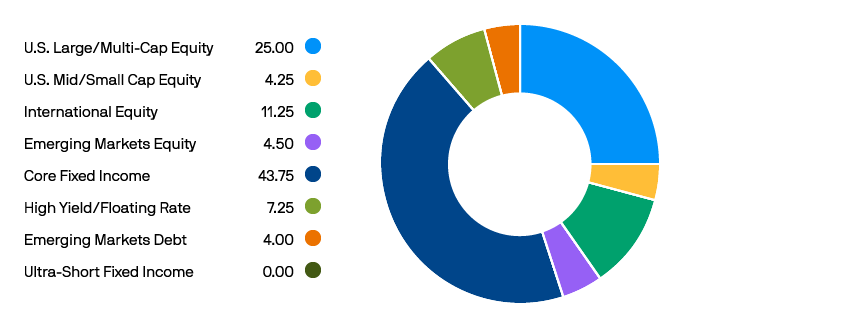

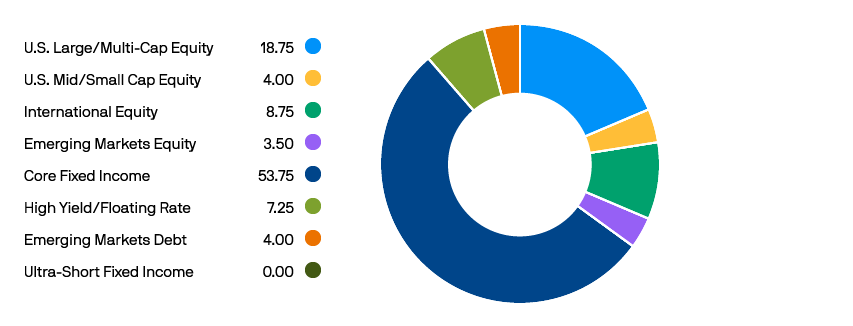

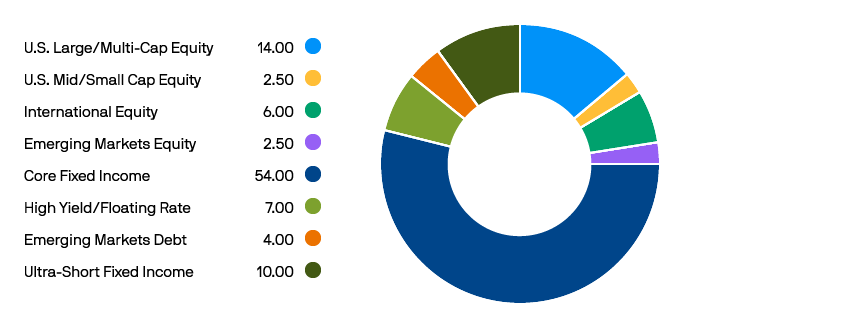

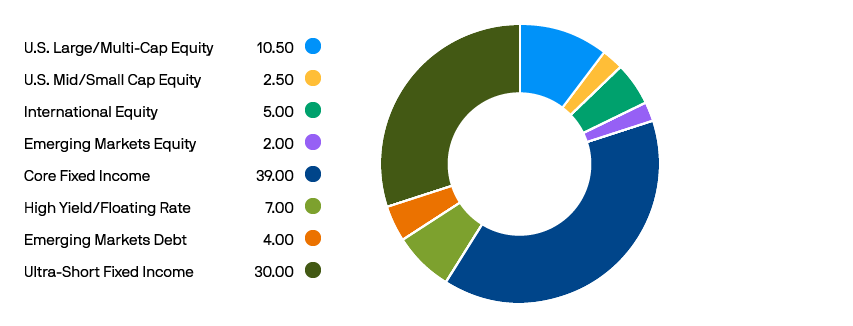

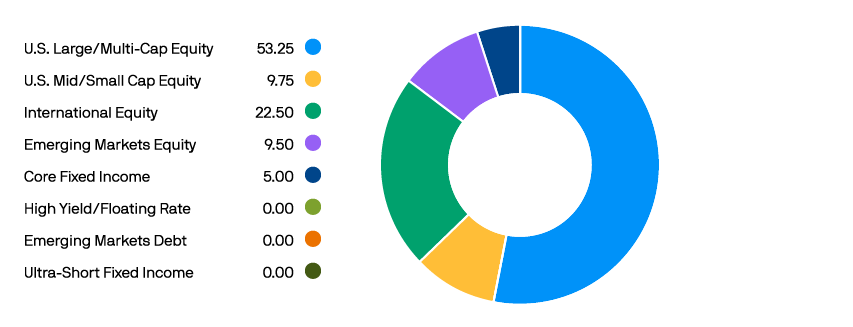

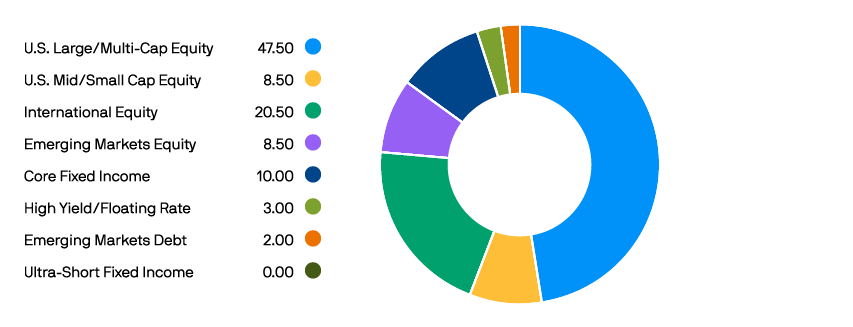

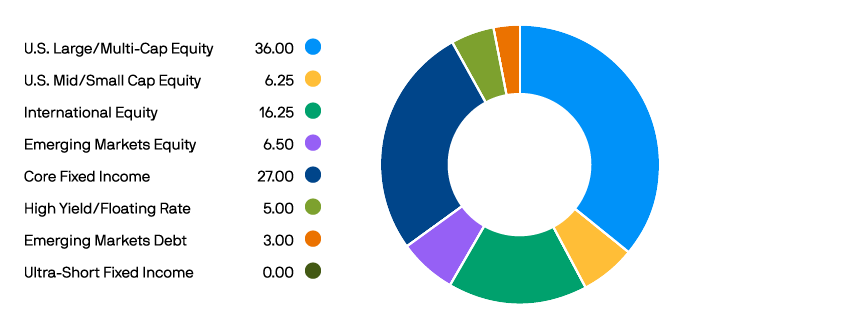

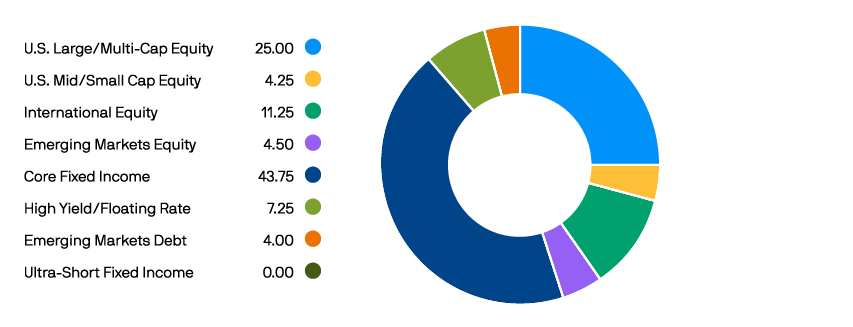

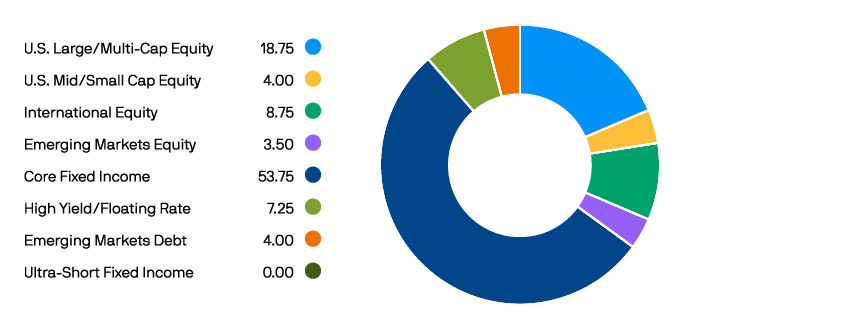

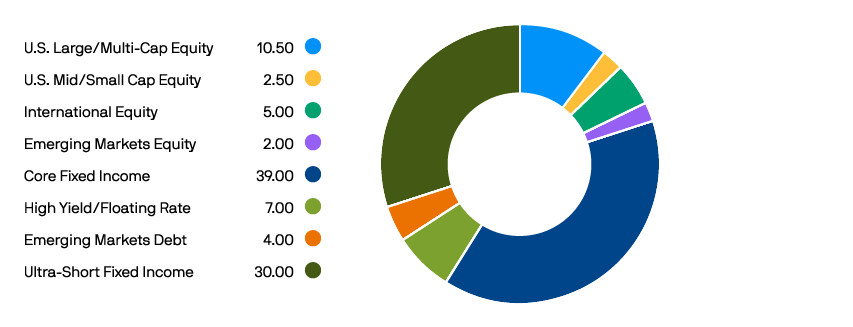

Age-based portfolio

Select a target age to view portfolio details.

This approach simplifies investing to one easy decision. Assets start in a globally diversified portfolio appropriate for the account beneficiary’s age and then automatically become more conservative as enrollment gets closer. The goal is to maximize return potential in early years and reduce risks when investors need to protect capital and generate income for education expenses.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Asset allocation portfolios

Select a portfolio to view details

Like the age-based option, asset allocation portfolios are broadly diversified across markets and managers. The difference here is that the asset mix stays roughly the same unless investors decide to switch to a different portfolio pursuing a different objective.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments, and discuss ways to maximize the Plan's benefits.

Individual portfolios

Select a portfolio to view details

For maximum customization potential, Plan participants can choose individual portfolios, each investing in a single underlying asset class. Select one to round out existing holdings or combine several to create and control an asset mix customized to specific investor needs.

Consult with your financial professional

Work with your financial professional to develop your college savings plan. Together, you can determine your college goals, open an account, choose investments and discuss ways to maximize the Plan's benefits.

Plan materials

Plan investments

Employer group 529 plans

Opening and funding accounts

Managing and updating accounts

Employer group 529 plans

Withdrawing account assets

News in education savings

Get our latest insights and explore resources to keep your clients informed and invested

2025 College Planning Essentials

Review our annual guide to tuition costs, financial aid, investing strategies, 529 plans and more.

Consider the Advisor-Guided Plan for families living in:

New York

Tax deductible contributions for New York residents3

Tax parity states

Tax-deductible contributions to any 529 plan, including ours

All other states

Weigh any state tax benefits against features, services and investments unique to our Plan

Important documents

Non-New Yorkers working in New York

Tax-deductible contributions if subject to New York taxes3

Tax-neutral states

No tax incentive to invest in the in-state 529 plan

Phone

Call 1-800-774-2108

(8am–6pm ET, Monday–Friday)

Regular mail:

New York’s 529 Advisor-Guided College Savings Program

P.O. Box 55498

Boston, MA 02205-5498

Overnight mail:

New York’s 529 Advisor-Guided College Savings Program

95 Wells Avenue, Suite 155

Newton, MA 02459-3204

Need sales-related assistance? Contact your J.P. Morgan Asset Management representative for guidance and support.

Want more account access

and more details?

1 ISS Market Intelligence, 2023 529 Industry Analysis; J.P. Morgan Asset Management, as of June 30th, 2024. Plan assets grew from $1.98B at JPMAM plan inception (5/4/12) to $9.03B as of 6/30/24.

2 Earnings on non-qualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes. New York State tax deductions may be subject to recapture in certain additional circumstances such as rollovers to another state's 529 plan and withdrawals used to pay elementary or secondary school tuition as described in the Disclosure Booklet and Tuition Savings Agreement. State tax benefits for non-resident New York taxpayers may vary. Tax and other benefits are contingent on meeting other requirements. Please consult your tax professional about your particular situation.

3 Available to account owners only. Deductions may be subject to recapture in certain circumstances, such as rollovers to another state’s plan; distributions for tuition expenses in connection with enrollment or attendance at an elementary or secondary public, private or religious school.

4 No additional gifts can be made to the same beneficiary over a five-year period. If the donor does not survive the five years, a portion of the gift is returned to the taxable estate.

INVESTMENTS ARE NOT FDIC INSURED, MAY LOSE VALUE AND ARE NOT BANK GUARANTEED.

For more information about New York's 529 Advisor-Guided College Savings Program, you may contact your financial advisor or obtain an Advisor-Guided Plan Disclosure Booklet and Tuition Savings Agreement at www.ny529advisor.comm or by calling 1-800-774-2108. This document includes investment objectives, risks, charges, expenses, and other information. You should read and consider it carefully before investing.

Before you invest, consider whether your or the Beneficiary's home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state's qualified tuition program.

The Comptroller of the State of New York and the New York State Higher Education Services Corporation are the Program Administrators and are responsible for implementing and administering New York's 529 Advisor-Guided College Savings Program (the “Advisor-Guided Plan”). Ascensus Broker Dealer Services, LLC serves as Program Manager for the Advisor-Guided Plan. Ascensus Broker Dealer Services, LLC and its affiliates have overall responsibility for the day-to-day operations of the Advisor-Guided Plan, including recordkeeping and administrative services. J.P. Morgan Investment Management Inc. serves as the Investment Manager. JPMorgan Distribution Services, Inc. markets and distributes the Advisor-Guided Plan. JPMorgan Distribution Services, Inc. is a member of FINRA.

No guarantee: None of the State of New York, its agencies, the Federal Deposit Insurance Corporation, J.P. Morgan Investment Management Inc., Ascensus Broker Dealer Services, LLC, JPMorgan Distribution Services, Inc., nor any of their applicable affiliates insures accounts or guarantees the principal deposited therein or any investment returns on any account or investment portfolio.

New York's 529 College Savings Program currently includes two separate 529 plans. The Advisor-Guided Plan is sold exclusively through financial advisory firms who have entered into Advisor-Guided Plan selling agreements with JPMorgan Distribution Services, Inc. You may also participate in the Direct Plan, which is sold directly by the Program and offers lower fees. However, the investment options available under the Advisor-Guided Plan are not available under the Direct Plan. The fees and expenses of the Advisor-Guided Plan include compensation to the financial advisory firm. Be sure to understand the options available before making an investment decision.

The Advisor-Guided Plan is offered through financial intermediaries, including broker-dealers, investment advisers and firms that are registered as both broker-dealers and investment advisers and their respective investment professionals. Broker-dealers and investment advisers are subject to different standards under federal and state law when providing investment advice and recommendations about securities. Please ask the financial professional with whom you are working about the role and capacity in which their financial intermediary acts when providing services to you or if you have any questions in this regard.

The Program Administrators, the Program Manager and JPMorgan Distribution Services, Inc., and their respective affiliates do not provide legal or tax advice. This information is provided for general educational purposes only. This is not to be considered legal or tax advice. Investors should consult with their legal or tax advisors for personalized assistance, including information regarding any specific state law requirements.

Ugift is a registered service mark of Ascensus Broker Dealer Service, Inc.