Technology is transforming the face of real estate. Government stimulus, including the CHIPS Act and Inflation Reduction Act, is incentivizing the buildout of critical infrastructure in innovations hubs, which is driving demand for advanced manufacturing, residential and retail assets in these areas.

One in 12 American businesses is actively using artificial intelligence (AI) to add productivity to their process.1 While overall penetration is still low, it is growing quickly. Just five years ago, AI adoption was confined to AI innovators since there were little to no AI-enabled products offered to businesses. However, that is changing quickly, as more solutions come to market.

This rapid AI adoption is spawning the development of digital infrastructure to support AI applications. Data centers are at the heart of this infrastructure buildout, as is cheaper and cleaner energy. This transition is having a global impact. While the United States is the largest market for data centers, accounting for roughly 40% of the global share, the market is growing around the world. In Europe, Latin America and Asia Pacific regions, data center inventory grew between 15% and 22% year-over-year in 1Q 2024.2

Fundamentally, we are AI believers. J.P. Morgan (JPM) was an early adopter, and it’s already adding productivity benefits to our overall business, from chatbots to enhanced modeling. However, in our real estate portfolio we don’t own data centers and prefer to own real estate that is adjacent to this digital infrastructure. Here’s why:

1) Data centers are not “real estate” in a classic sense; rather they more closely resemble infrastructure investments. While traditional real estate is leased on a per square foot (PSF) basis, data centers are generally leased based on energy capacity (more akin to a utility). This pricing methodology intrinsically ties a data center’s value to the availability and need for power. Over 40% of U.S. data centers are in Northern Virginia where nuclear power is prevalent, and regulations have traditionally allowed data centers to connect to the power grid relatively quickly.3

Further, most of the value of a data center is the hardware inside, rather than the real estate it sits on. According to Green Street Advisors, in the two years ending March 2025, the average industrial asset traded for $180 PSF, while the average data center traded at $514 PSF. That puts traditional industrial assets at roughly one-third of the cost of a data center, implying that approximately two-thirds of the value is in the hardware (power, cooling systems, etc.) as opposed to the real estate. This makes data centers more of a tech/infrastructure investment as opposed to pure play real estate.

2) Technical obsolescence risk is high. With most of a data center’s value tied up in the power and hardware, owning one is more of a tech play than a real estate play.

In January 2025, DeepSeek, a two-year-old AI startup based in China, unveiled a new AI model that reportedly performed on par with leading U.S. models. What was most interesting is that DeepSeek is 10 times more power efficient than one of the more popular U.S. models, Meta’s Llama 3.1. This breakthrough creates both opportunities as well as obstacles. On the one hand, we believe DeepSeek will help ease one of the obstacles to broad AI adoption: constraints on power generation. More power-efficient AI will be less costly to use, and we expect this will help speed up AI adoption and its productivity gains throughout the global economy.

On the other hand, this also exposes the risk of owning data centers, as it calls into question the energy demands of AI in the future. In December 2024, the Department of Energy projected that U.S. data center electricity demand could increase by 16% to 26% annually by 2028. The efficiency of DeepSeek makes it unlikely that demand will reach the bull case, and calls into question if even the bear case will be reached.

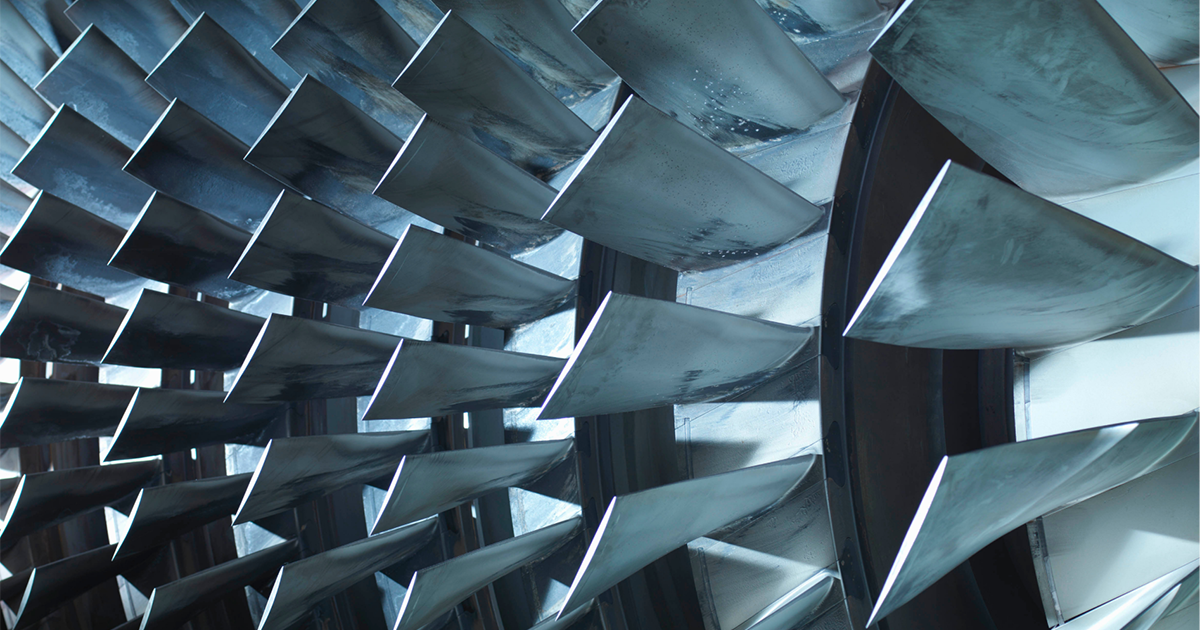

Further, data centers require more capital investment than most other commercial real estate (CRE) sectors, especially for hyperscale and colocation facilities, which are the most common implementation. The elevated CapEx is indicative of technological obsolescence risk, as it is often the case that the additional capital is necessary to keep up with technological change. In just seven years, Google has reportedly revamped its cooling systems multiple times—shifting from air to liquid—to keep pace with the demands of next-gen chips. It’s a clear signal: Data center infrastructure is evolving fast.

3) Data centers are illiquid. Conceptually, real estate liquidity is based on a) how often the asset trades, b) the size of the investor base and c) the ease of valuation. With this framework, data centers are less liquid than all traditional CRE sectors. Despite data centers being the most illiquid, they no longer offer a valuation discount to the broader CRE market.

Investing alongside the digital infrastructure buildout

Despite our skepticism on data centers, we are AI believers and expect the CRE landscape to change as AI adoption increases. However, we prefer to invest in CRE that stands to benefit beyond data centers.

The CHIPS Act and the Inflation Reduction Act are fiscal stimulus measures aimed at further incentivizing the buildout of critical tech infrastructure. As of year-end 2024, these fiscal measures were the catalyst for >$1 trillion in private sector capital investment across semiconductor, renewables and biomanufacturing.4 Interestingly, through year-end 2024, nearly half of those private investments have been made in just three states: Texas, New York and Arizona.

We believe the Trump administration is unlikely to roll back these incentives. These programs are helping red and blue states alike, and they support the reshoring and growth of U.S. manufacturing. Additionally, the recently floated Stargate fiscal stimulus initiative (while lacking details) seems to have a similar objective as the CHIPS and Inflation Reduction Acts, indicating broad support of this type of program from the current administration.

Fiscal stimulus via CapEx is the most effective form of stimulus, with academic literature suggesting fiscal multipliers can be as high as approximately six times.5 Stimulus creates jobs, knock-on business formation and retail spending in areas where the CapEx is spent. By following this money and focusing on the demand created by the changing trends in real estate, knowledgeable investors can capitalize on this growth.

As an example, in Phoenix we developed a 200,000 square foot industrial asset in the Price Road Corridor, a location proximate to Intel’s $50 billion Ocotillo campus. Since Intel is one of the largest beneficiaries of funding from the CHIPS Act, the investment thesis was to draft off the additional demand created by the capital infusion into the area. While still under construction, the building was entirely preleased to one of Intel’s vendors at a rent above underwriting. Despite being a new building, designed and constructed to the latest spec, the tenant came out of pocket to upgrade the power to 10,000 amps. This is roughly three to five times what was previously considered the standard for a building of this size and was due to the elevated power requirements of the tenant’s advanced manufacturing techniques. It’s a clear indication that the definition of “modern industrial” is shifting—driven not just by square footage or clear heights, but also by power capacity, manufacturing capabilities and proximity to innovation hubs. For investors, the takeaway is simple: The next generation of industrial demand will increasingly be shaped by technological innovation, and the assets that can keep up will be the ones that outperform.