9a886fb9-8f4a-11f0-a771-0bf262267889

The information presented is not intended to be making value judgments on the preferred outcome of any government decision or political election.

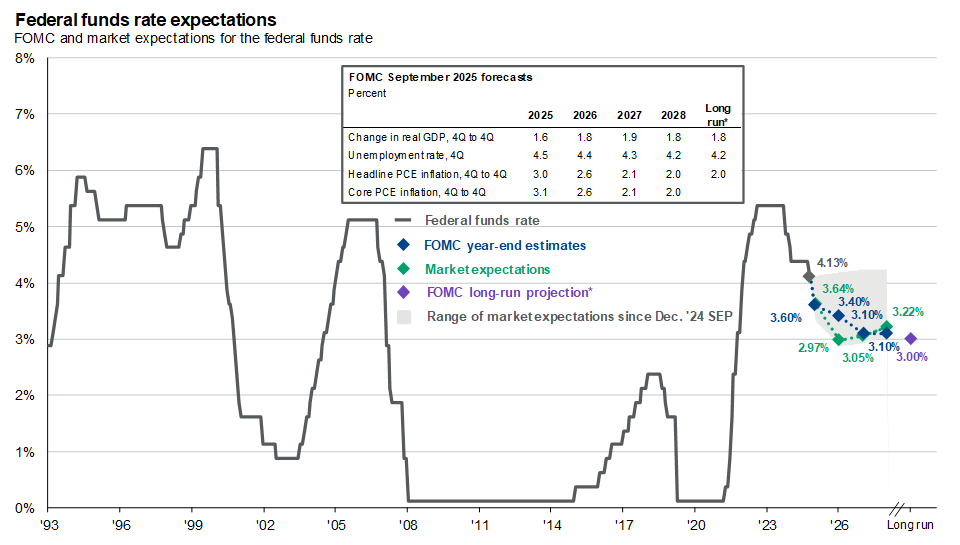

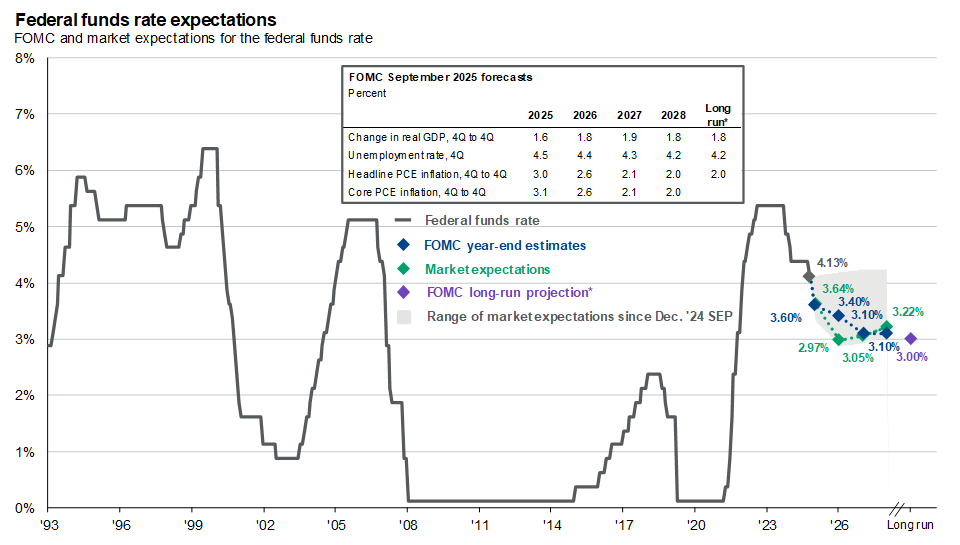

Source: Bloomberg, FactSet, Federal Reserve, J.P. Morgan Asset Management.

Market expectations are based off of USD Overnight Index Swaps. *Long-run projections are the rates of growth, unemployment and inflation to which a policymaker expects the economy to converge over the next five to six years in absence of further shocks and under appropriate monetary policy. Forecasts, projections and other forward-looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecasts, projections or other forward-looking statements, actual events, results or performance may differ materially from those reflected or contemplated.

Guide to the Markets – U.S. Data are as of September 15. 2025.

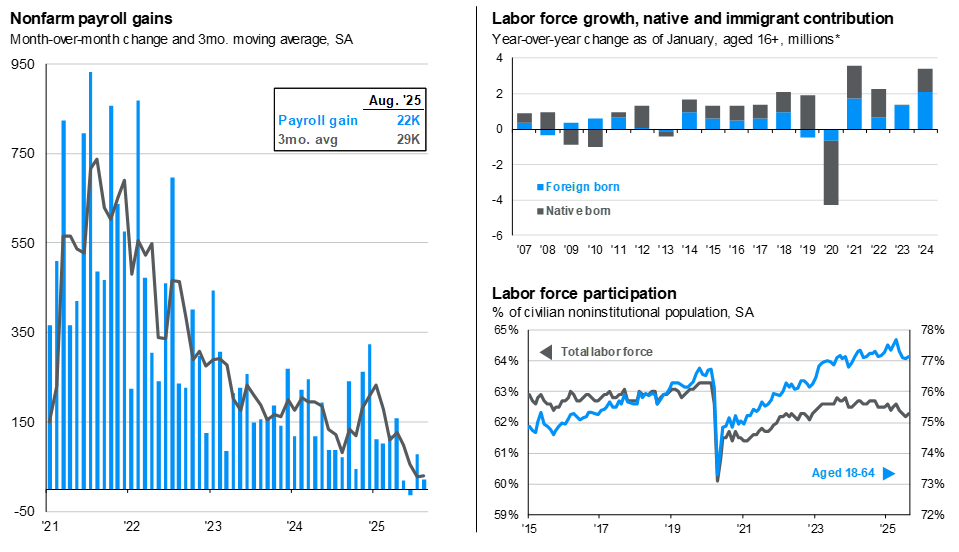

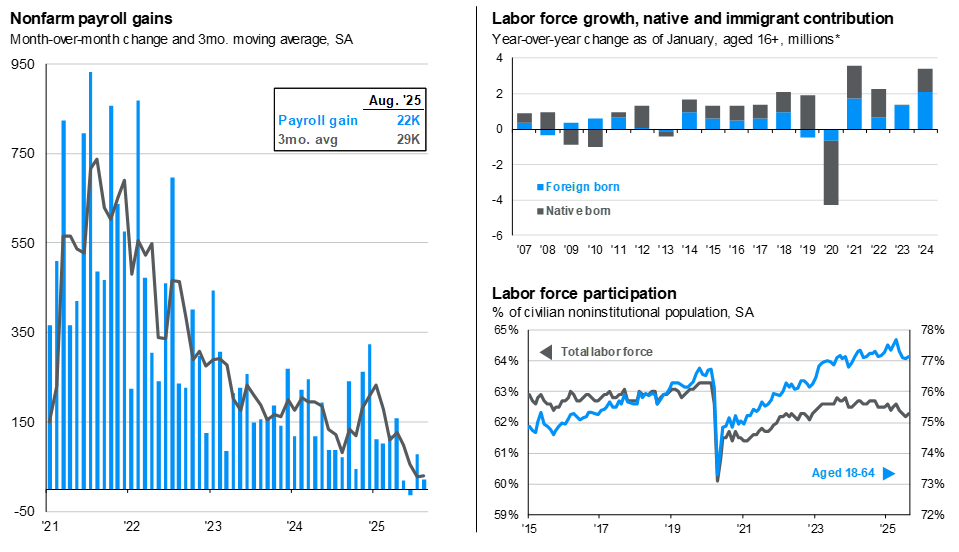

Source: BLS, FactSet, J.P. Morgan Asset Management.

Labor force data are sourced from the Current Population Survey, also known as the household survey, conducted by the BLS. *Year-over-year change in the labor force calculated from January of each year. For example, the 2024 figures are calculated by subtracting the size of the labor force as of 1/31/2024 from the size of the labor force as of 1/31/2025.

Guide to the Markets – U.S. Data are as of September 15. 2025.

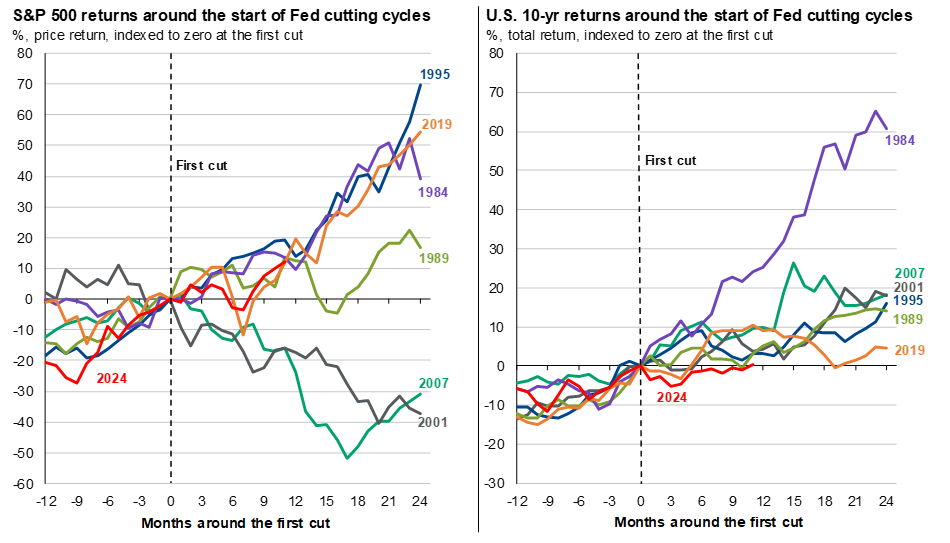

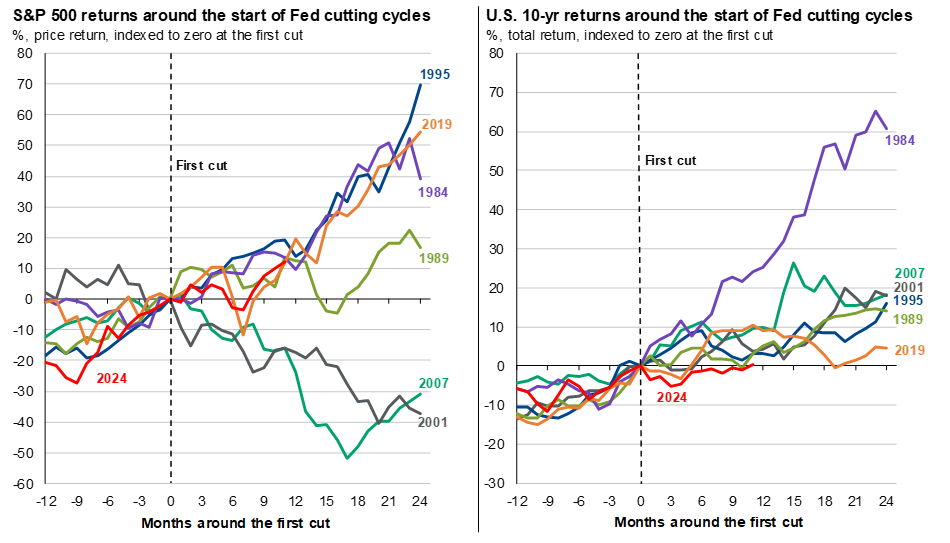

Source: FactSet, Federal Reserve, LSEG Datastream, S&P Global, J.P. Morgan Asset Management. Past performance is not a reliable indicator of current and future results. Excludes 1998 episode due to the short length of the cutting cycle and economic context for the cuts.

Guide to the Markets – U.S. Data are as of September 16, 2025.

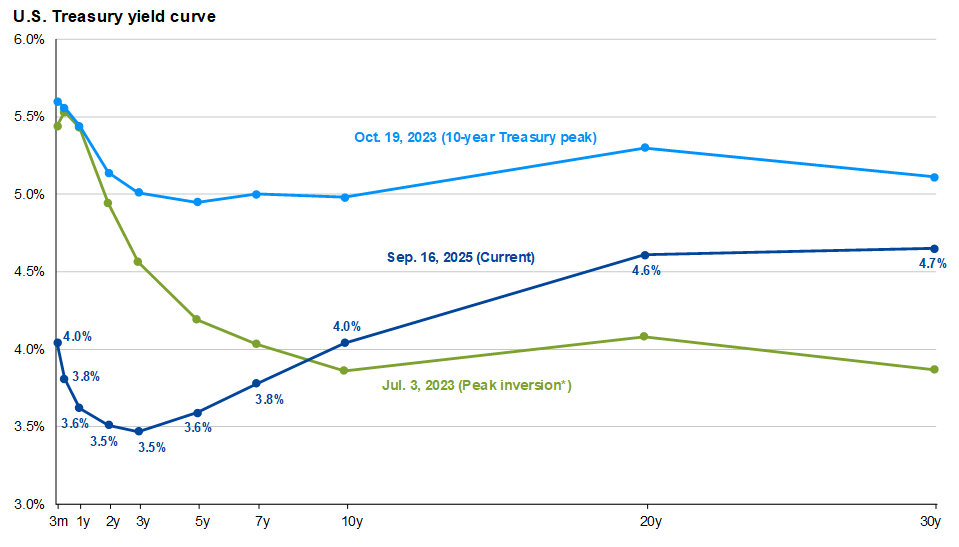

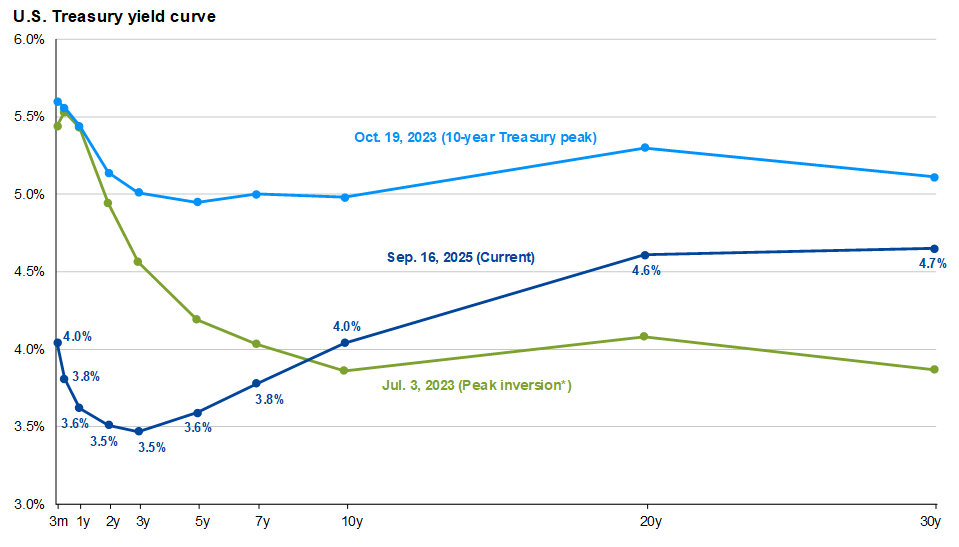

Source: FactSet, Federal Reserve, J.P. Morgan Asset Management. Analysis references data back to 2020. *Peak inversion is measured by the spread between the yield on a 10-year Treasury and 2-year Treasury.

Guide to the Markets – U.S. Data are as of September 15. 2025.

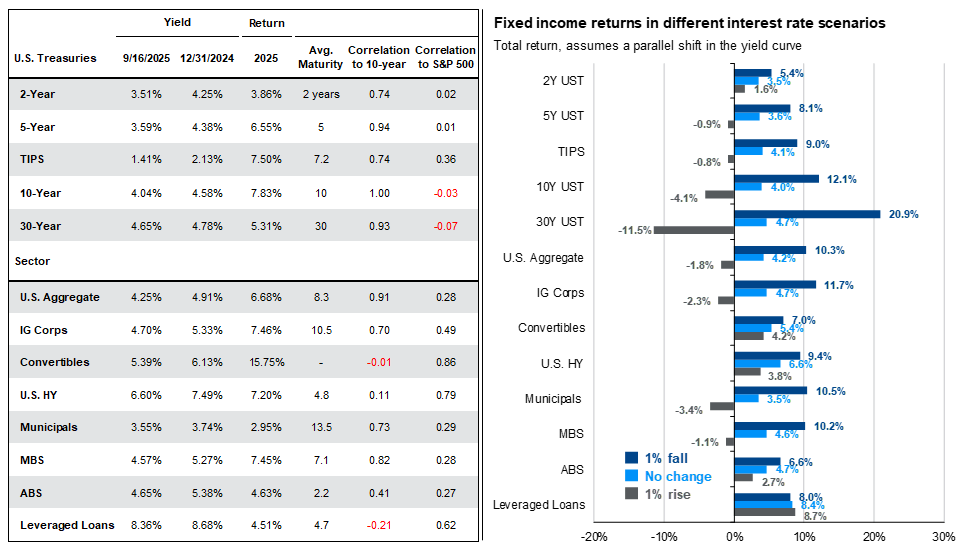

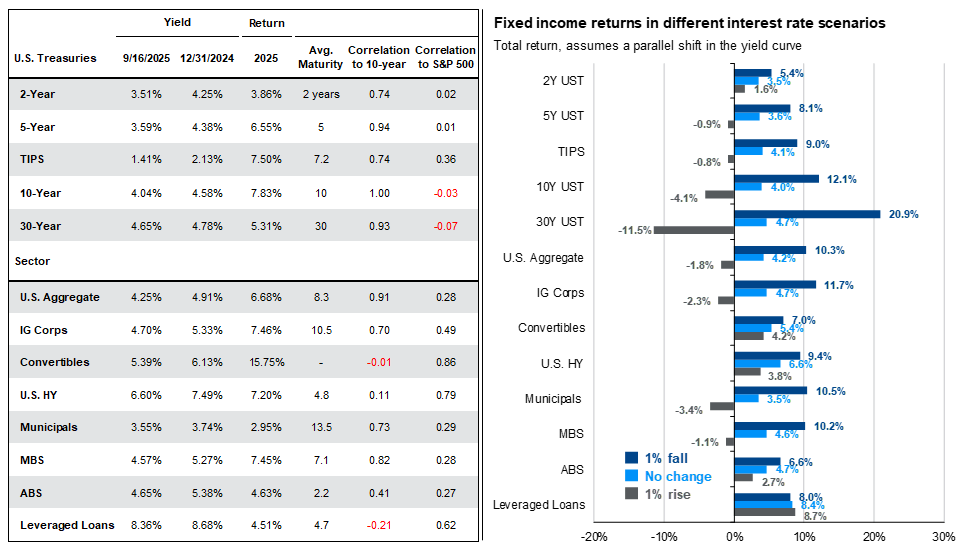

Source: Bloomberg, FactSet, Federal Reserve Bank of Cleveland, Standard & Poor’s, U.S. Treasury, J.P. Morgan Asset Management. Sectors shown above are provided by Bloomberg unless otherwise noted and are represented by – U.S. Aggregate; MBS: U.S. Aggregate Securitized - MBS; ABS: J.P. Morgan ABS Index; IG Corporates: U.S. Corporates; Municipals: Muni Bond; High Yield: Corporate High Yield; Leveraged Loans: J.P. Morgan Leveraged Loan Index; TIPS: Treasury Inflation-Protected Securities; Convertibles: U.S. Convertibles Composite. Convertibles yield is as of most recent month-end and is based on U.S. portion of Bloomberg Global Convertibles Index. Yield and return information based on bellwethers for Treasury securities. Yields shown for TIPS are real yields. TIPS returns consider the impact that inflation could have on returns by assuming the Cleveland Fed's 1-year inflation expectation forecasts are realized. Sector yields reflect yield-to-worst. Leveraged loan yields reflect the yield to 3Y takeout. Correlations are based on 15-years of monthly returns for all sectors. ABS returns prior to June 2012 are sourced from Bloomberg. Past performance is not indicative of future results.

Guide to the Markets – U.S. Data are as of September 15. 2025.

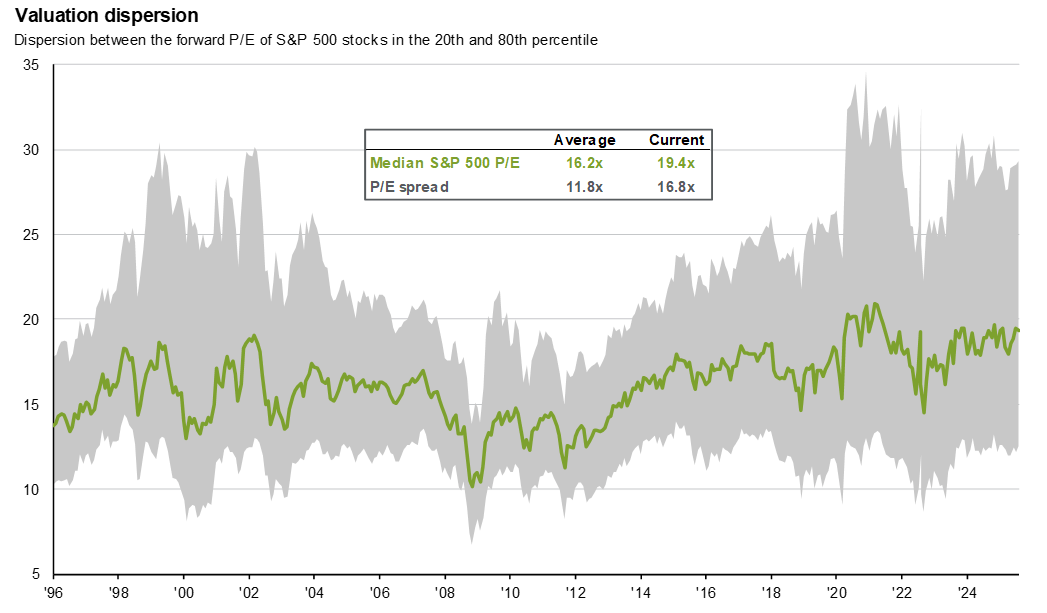

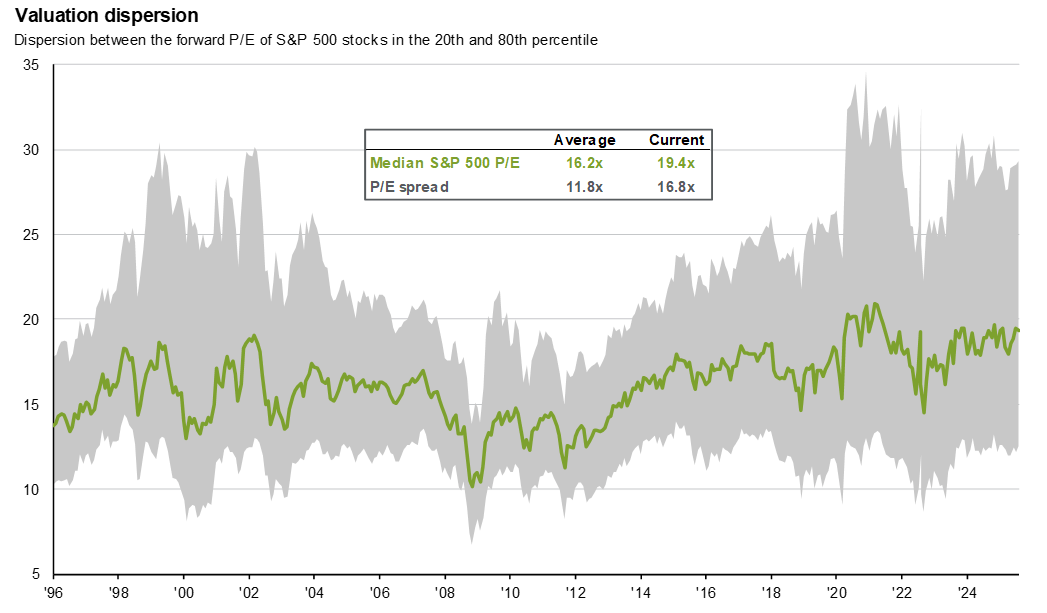

Source: Compustat, FactSet, Standard & Poor's, J.P. Morgan Asset Management.

Guide to the Markets – U.S. Data are as of September 15. 2025.

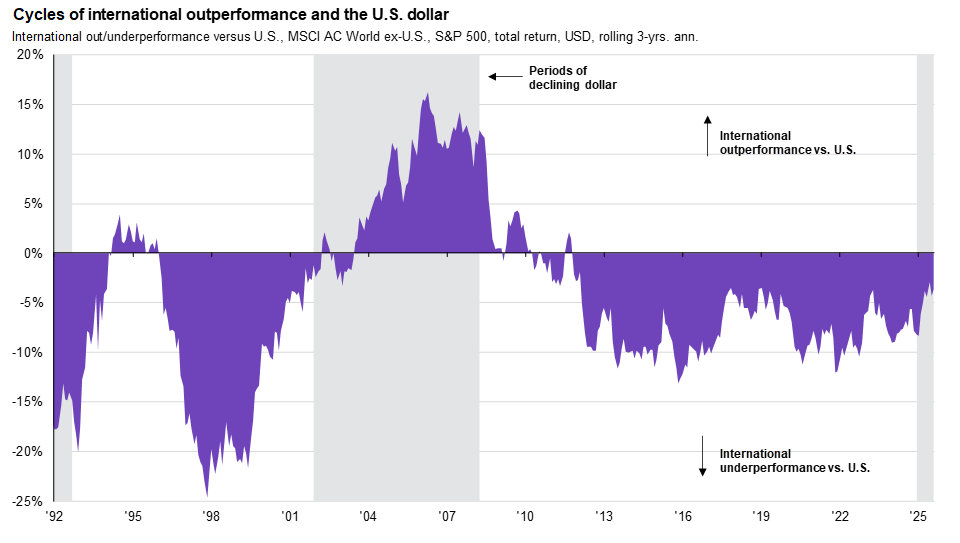

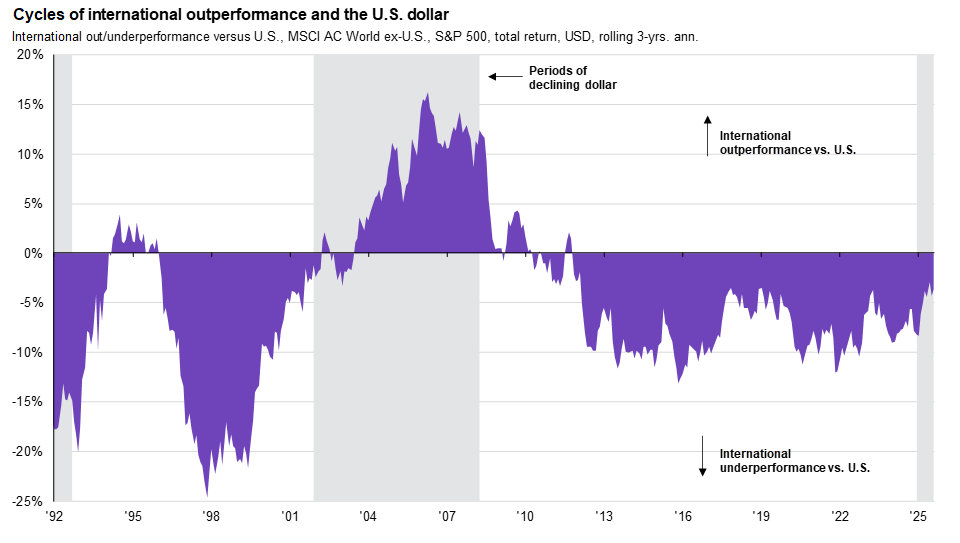

Source: FactSet, MSCI, Standard & Poor’s, J.P. Morgan Asset Management. Past performance is not a reliable indicator of current and future results.

Guide to the Markets – U.S. Data are as of September 15. 2025.

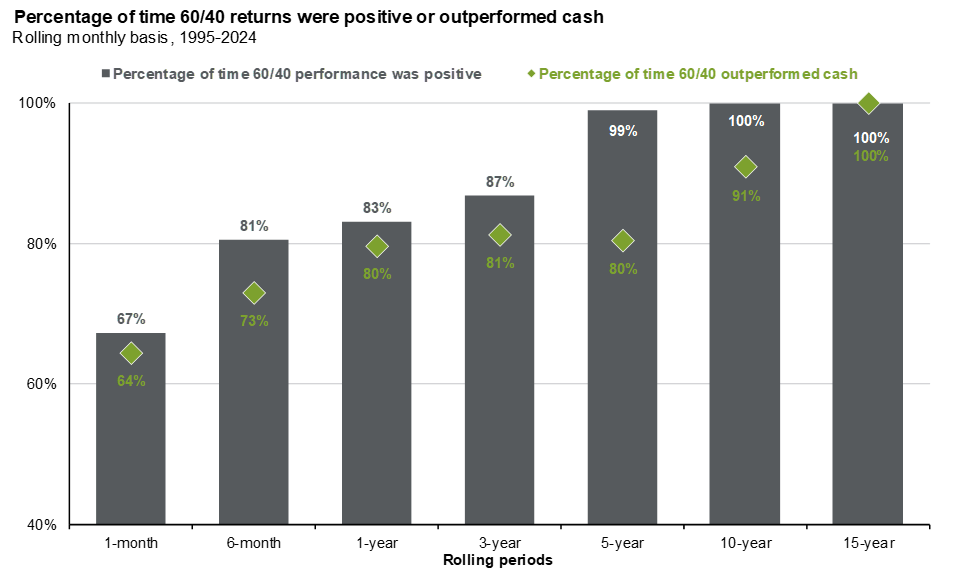

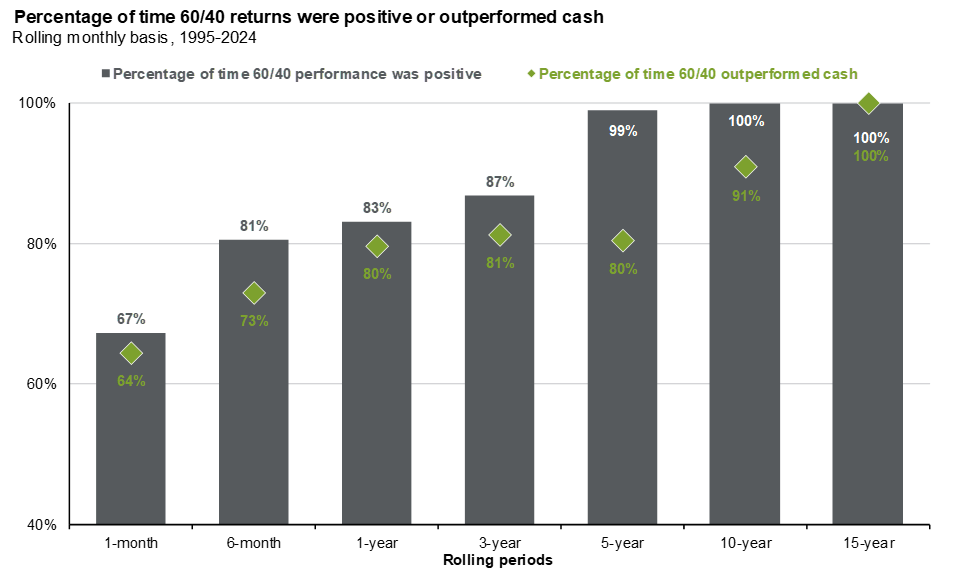

Source: Bloomberg, FactSet, Standard and Poor's, J.P. Morgan Asset Management.

A 60/40 portfolio is 60% invested in the S&P 500 Total Return Index and 40% invested in the Bloomberg U.S. Aggregate Total Return Index. Cash is the Bloomberg U.S. 30-day Treasury Bill index.

Guide to the Markets – U.S. Data are as of September 15. 2025.

9a886fb9-8f4a-11f0-a771-0bf262267889

The information presented is not intended to be making value judgments on the preferred outcome of any government decision or political election.