When I first arrived in America, America seemed to be all about cars.

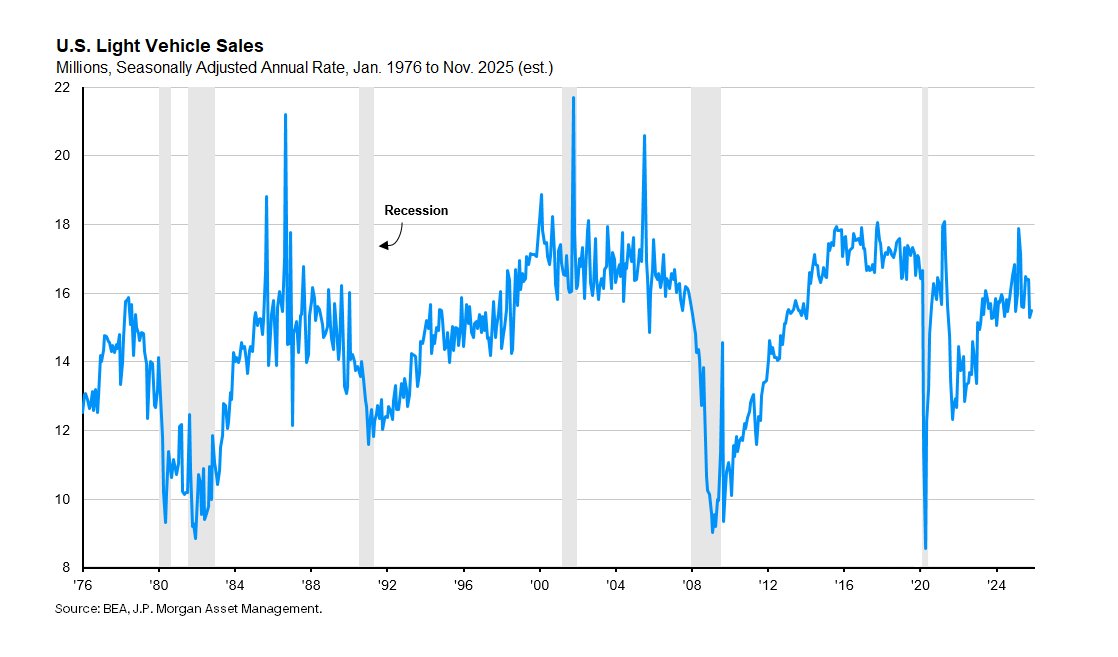

It was the early 1980s, and I had come over from Ireland to do a Ph.D. in economics at Michigan State University. The campus was strewn with the hand-me-down vehicles of the student body – great gas-guzzling behemoths rendered hopelessly uncompetitive by the soaring gas prices of the 1970s and fighting a losing battle against Japanese imports. Still, the domestic auto industry was crucial to the U.S. and particularly Michigan, and rising sales numbers, released every 10-days, were monitored as the hopeful early shoots of recovery from the brutal double-barreled recessions of 1980 and 1981-82.

Auto sales have always been the most cyclical sector of consumer spending – heralding and contributing to both recessions and recoveries. This year, slumping consumer confidence, newly imposed tariffs and falling job growth could all have been expected to clobber auto sales. Despite this, when automakers report their November numbers early this week, they will likely show continued resilience. This is testament to the unusual drivers of consumer spending in 2025 but also to long-term changes in the auto market that may be reducing its cyclical impact. For investors and policy makers, the important message is that stability in auto sales increases the odds that 2026 will be a year of continued economic expansion.

The Cyclical Importance of Autos

The auto sector has always played an outsized role in the U.S. business cycle. Indeed, while auto output has fallen from over 4% of GDP in the 1970s to less than 3% this decade, it accounted for, on average, 24% of the decline in real GDP in the six recessions from 1973 to 2009. The reasons are straight-forward. First, while a new vehicle can be used for many years, the consumption of that vehicle is counted in the month in which it is bought, so any change in sales, and consequently production, can dramatically impact GDP. Second, in most cases, a new vehicle purchase can be postponed – so sales normally plummet when the economy falls into recession or even when recession worries surge.

There certainly are recession worries today. In the November Conference Board consumer confidence survey, roughly 36% of respondents said they thought the economy was either already in recession or would very likely be in one within the next 12 months. Nevertheless, industry reports suggest that light-vehicle sales in November may have topped 15.5 million units – not particularly strong but up from October and quite close to last year’s annual average of 15.8 million units. So why are vehicle sales so resilient?

Auto Sales in 2025 – Challenges and Supports

To understand vehicle sales in 2025, it is important to consider the challenges the industry is facing but even more important to focus on what really drives sales.

One new challenge this year has been tariffs. From Inauguration Day on, the new administration has announced, implemented and modified multiple tariffs on imported vehicles, vehicle parts, steel and aluminum, as well as on the exports of individual countries. These tariff hikes have been particularly important for the highly-integrated supply chains over the Canadian and Mexican borders although they have been removed for USMCA-compliant component imports.

Currently, auto manufacturers (and U.S. importers in general) are awaiting a Supreme Court decision on the legality of so-called “reciprocal tariffs”. Judging from their quarterly earnings reports, U.S. automakers have been reluctant to pass on the full impact of tariffs to consumers so far. However, if the Supreme Court rules in the administration’s favor, they may go ahead and do so. Buying ahead of tariff price increases has been a major selling point for auto-dealers in 2025, although this will go away in 2026 if tariff rates look like they are settled and fully reflected in higher prices.

A similar narrative has played out with electric vehicles. Between 2021 and 2024, electric vehicle sales surged from 3.2% of sales to 8.1% of sales and surged again to over 10% of sales in the third quarter of 2025 as buyers sought to take advantage of expiring federal EV tax credits. EV demand appears to have fallen sharply in the fourth quarter, now that these credits are no longer available.

All of this has made it a very complicated year for the auto industry and both sales and production have faced the further challenge of a shortage of qualified workers across manufacturing, sales and automobile repair and servicing. Still, there have been sources of support.

One positive has been a new federal income tax deduction of up to $10,000 on auto loan interest on new vehicle purchases, introduced as part of OBBBA. Assuming a 7% interest rate, a married couple earning less than $200,000 could save $840 on a $50,000 auto loan. However, this tax break phases out completely if the couple earns more than $250,000 and would obviously be less valuable for those buying cheaper vehicles or who are in a lower tax bracket.

Another positive has been low gas prices. Retail gasoline prices have been remarkably low and stable all year long, mostly hovering between $3.00 and $3.25 per gallon of regular unleaded fuel. In addition, average 5-year auto loan interest rates fell from 8.40% in the third quarter of 2024 to 7.64% a year later. Finally, auto insurance rates have, at last, begun to stabilize, rising just 3.1% in the 12 months ending in September 2025 compared to a huge 16.3% increase over the previous year.

However, all of these positives should be seen in the context of new vehicle prices. In August, the average price of a new light vehicle was $47,759, up 35% from the $34,354 of six years earlier. Under reasonable assumptions about fuel efficiency, mileage and insurance costs and assuming no money down at purchase, the buyer of an average new vehicle could save $300 per year from a 50 cent reduction in gas prices, $275 per year from a 1% reduction in auto-loan interest rates and $266 from a 10% reduction in auto insurance1. These should be relatively minor considerations relative to the decision to commit to an almost $50,000 purchase.

So what is important to that decision?

In short, the income and wealth of the most affluent households in America.

In 2023, according to the Consumer Expenditure Survey, the top 10% of households in terms of pre-tax income accounted for 34% of spending on new vehicles while the top 20% accounted for 53%. If higher income households continue to see good income gains and feel secure that these gains will continue, they should continue to be willing to buy new vehicles.

Moreover, according to the Survey of Consumer Finances, while the top 20% of households received 65% of the pretax income of all households in 2022, they owned 74% of the assets. The huge runup in stock market wealth over the past three years has surely been a powerful driver of new vehicle sales and could continue to be so, in 2026, via lagged effects. Conversely, a severe bear market in stocks, should it transpire, would very likely be a major negative for vehicle sales.

Longer-Term Trends and Investment Implications

Given all of this, light-vehicle sales could well maintain a steady pace of between 15.0 and 16.5 million units annualized between now and the end of 2026. The full impact of tariffs on auto prices and the expiration of electric vehicle credits will be negatives. A continuation of low gasoline prices, stable auto insurance rates, some decline in auto loan interest rates and a full year of the auto-loan tax credit should all be small positives.

However, longer term, there will be challenges to demand. A sharp reversal of U.S. immigration policies could mean a declining working-age, and driving-age, population into the next decade and, while this will initially mostly hurt the demand for used vehicles, this should, over time, also reduce the demand for new vehicles. Meanwhile, vehicle durability continues to increase. According to S&P global, the average age of vehicles on U.S. roads rose to a record 12.6 years in 2024 – up from 11.1 years in 2012.

Other longer-term issues include the types of vehicles used. In the years and decades ahead, as new electricity generation technology is developed, in part to power the AI boom, the price of electricity should fall relative to the price of the world’s dwindling stock of fossil fuels. This, combined with better and cheaper technology in electric vehicles themselves, should mean a long term switch to EVs. Autonomous vehicles will also present challenges and opportunities – embedding ever more sophisticated and expensive technologies in vehicles themselves – but also, over time, introducing profound design changes to increase passenger comfort and reduce the inefficiencies caused by accidents and the need to align the use of vehicles to the working, or at least waking, hours of their drivers.

In the short run, the auto industry will likely be less pivotal for investors. Auto stocks themselves, with the exception of Tesla, represent a miniscule part of the U.S. equity market and vehicle sales will likely take a backseat to the conflicting forces of economic nationalism and technology investment in determining the economic and market fortunes of 2026.

However, in the long run, technological changes will engulf the U.S. vehicle market. This will present opportunities for companies at the vanguard of these changes and for those who invest in them – with the usual risks in technology investment of over-paying for promises or not identifying the likely winners in an industry undergoing radical transformation.