In brief:

- 1Q24 earnings have been better than expected.

- Companies are expanding margins, and success moving forward will depend on their ability to keep doing so.

- Broadening profit growth should present opportunities outside of the Magnificent 7.

- Earnings growth is set to accelerate through the rest of the year.

Slowing, but still growing

During the first quarter, U.S. equities shrugged off ever-changing expectations for monetary policy with relative ease, climbing 10.6% despite a sharp hawkish repricing in policy expectations. However, an unexpected jump in inflation in March sparked the resurgence of the “higher for longer” narrative, leaving equity valuations elevated, and vulnerable, at the onset of the 1Q24 earnings season.

While the U.S. economy slowed in 1Q24, a 2.5% q/q annualized increase in consumer spending pointed to healthy underlying momentum. This, along with solid inflation, have supported profit growth on an annual basis this earnings season. Revenues have benefitted from higher prices while companies have had success expanding margins despite recent geopolitical headwinds. Thus far, 52% of companies have delivered upside surprises on revenues and 72% have beaten earnings forecasts, both of which are in-line with their long-run averages, and surprises for both measures have been positive on average.

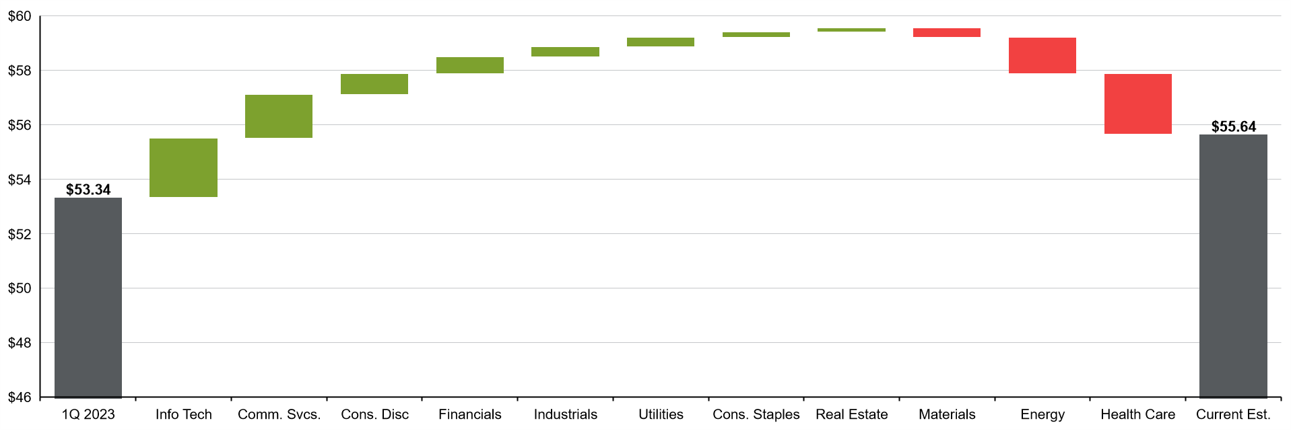

With 82% of market cap having reported earnings, results thus far have been solid. Analysts estimates for pro-forma earnings per share (EPS) are currently tracking at $55.64, which would represent an increase of 4.3% y/y and 0.2% q/q, if realized. While revenues are on track to contribute 1.5% points, margins are expected to do the bulk of the heavy lifting, contributing 3.2% points; margins are on pace to bounce to 12.2%, up from 11.3% last quarter and 11.8% a year ago. Share buybacks are set to detract 0.4% points from growth.

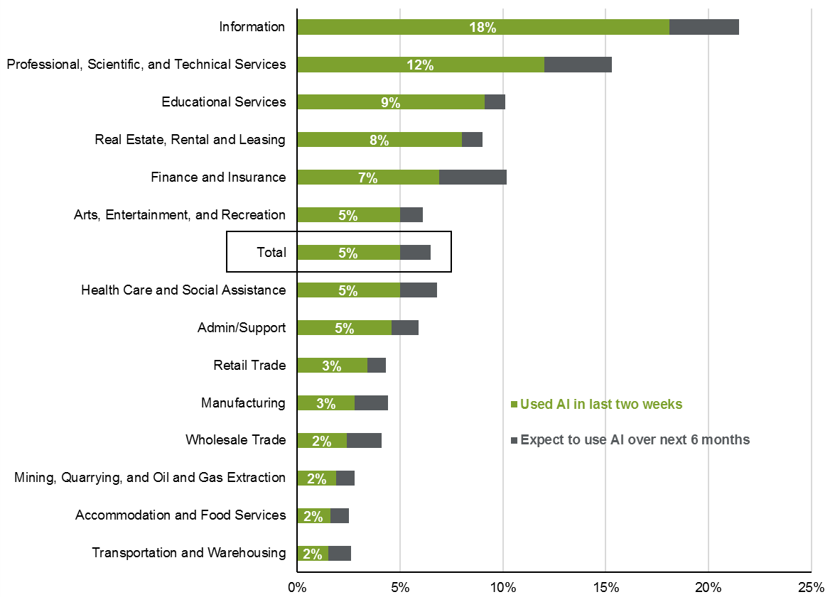

As inflation and consumer demand moderate in the coming quarters, more onus will fall on margins to maintain profit growth, although monitoring revenues will be increasingly important as pricing power diverges across companies. While slowing wage inflation and moderating input costs suggest the worst of margin pressure is behind us, there are risks that could keep costs elevated. As companies focus on maintaining margins despite this, increased utilization of AI within business processes should support the cause.

Continued adoption of AI in business processes should help margins

% of firms reporting use of AI applications

Source: Census Bureau, J.P. Morgan Asset Management. Chart based on data from the Business Trends and Outlook Survey conducted by the BLS and is derived using data for respondents who answered "Yes" to the following questions: In the last two weeks, did this business use Artificial Intelligence (AI) in producing goods or services? (Examples of AI: machine learning, natural language processing, virtual agents, voice recognition, etc.), During the next six months, do you think this business will be using Artificial Intelligence (AI) in producing goods or services? (Examples of AI: machine learning, natural language processing, virtual agents, voice recognition, etc.). Survey last conducted in February 2024.

Data are as of May 2, 2024.

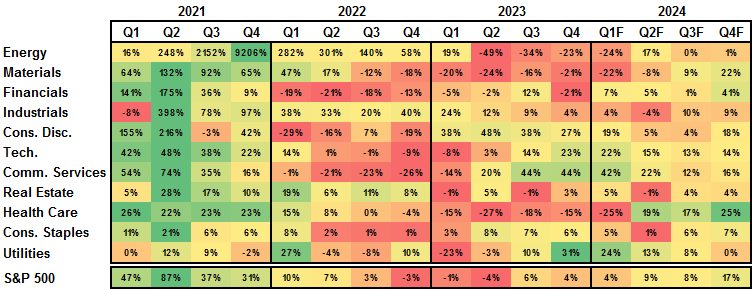

Growth sectors continue to lead the charge

Similar to last quarter, growth sectors will likely drive the bulk of pro-forma profit growth, while cyclicals look more mixed. Information technology and communication services should continue to reap the benefits of prudent expense management and demand for AI capabilities, while resilient consumer demand has supported the consumer discretionary sector. Elsewhere, financials and industrials on track to improve, while materials and health care are anticipated to see earnings contract by over 20% y/y. Moreover, lower natural gas prices in 1Q will likely hamper results in the energy sector.

Pro-forma EPS contribution by sector

Source: FactSet, Standard & Poor's, J.P. Morgan Asset Management.

Data are as of May 2, 2024.

Continuing their dominant run, information technology and communication services are expected to see earnings grow by 22% and 42% y/y, respectively, despite a modest average increase in the dollar during the quarter. Across technology, the semiconductor and software segments remain strong, while a modest 1.5% y/y increase in global PC shipments off suppressed levels point to better times for hardware. Moreover, as PC shipments continue to recover, increased consumer-led demand for chips, in addition to already robust AI-related demand, should bolster semiconductor manufacturers. In terms of themes, cloud computing and AI remain key growth engines for these sectors, and many “hyperscalers” expressed their intention to continue increasing AI-related expenditures moving forward.

Consumer discretionary and consumer staples are on track to see earnings grow y/y as resilient consumer demand continues to support revenues, although management commentary alluded to some signs of weakness. Nonetheless, aggregate domestic demand remains stable, but a firm U.S. dollar and sluggish activity abroad have weighed on results. Resilient consumption has benefitted financials as well, with the sector tracking y/y growth and a large q/q recovery after FDIC charges weighed on results last quarter. Stable consumer spending habits have supported payment processing firms, while the insurance segment is tracking impressive growth on the back of elevated premiums. Bank results have surpassed expectations, with improved investment banking and capital market activity offsetting weaker net interest margins. Moving forward, a prolonged period of higher interest rates could continue to pressure net interest margins.

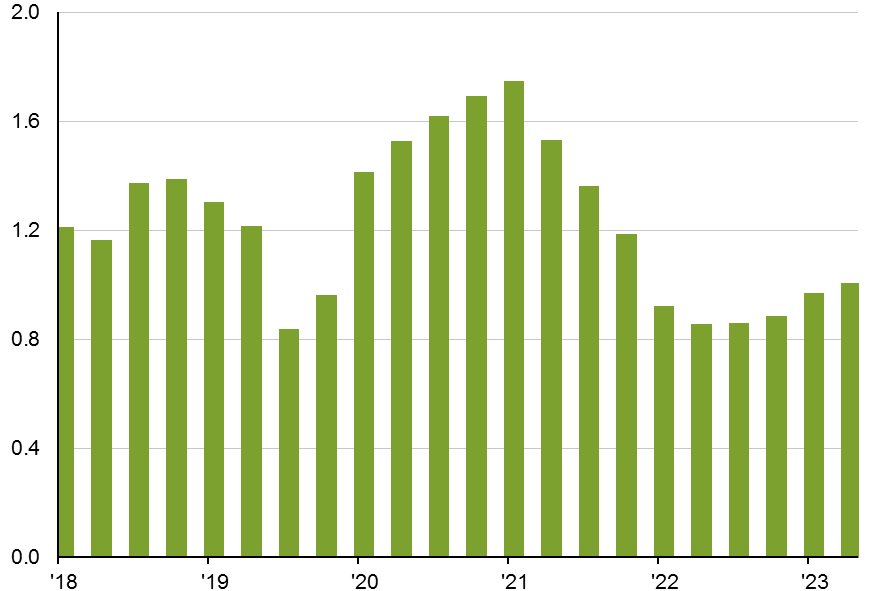

Capital market activity is improving after a challenging 2023

M&A volumes by quarter, 2-quarter moving average, USD trillions

Source: Bloomberg, J.P. Morgan Asset Management.

Data are as of May 2, 2024.

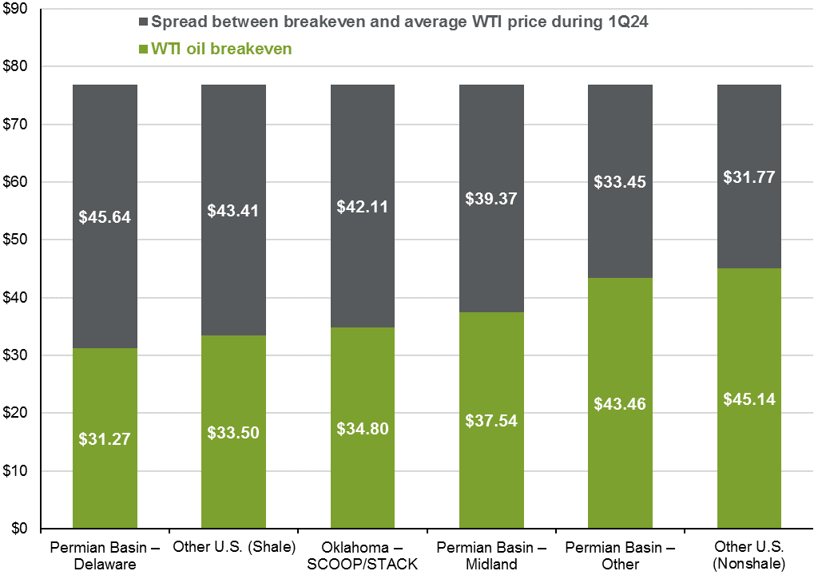

Elsewhere, industrials are forecast to see earnings improve modestly relative to last year, with poor performance from transportation weighing on results. Passenger airlines, however, have been a bright spot. By focusing on more profitable hubs and adjusting their fleet plans, these companies have been able to mitigate the impacts of supplier production issues, while strong demand for business and leisure travel has also supported results. Success moving forward will be dependent on their ability to weather continued supplier delays. While crude oil prices rose 2.2% y/y on average during the first quarter, an average decline in natural gas prices of 24.8% should weigh on the energy sector, which is on pace to see earnings fall by 24%. Even though earnings are declining, energy companies are still generating profits given underlying oil breakevens remain well below current prices.

Crude prices remain well above underlying breakevens

Average breakeven WTI oil price, by basin, USD per barrel

A bar chart showing average breakeven WTI oil prices

Source: Bloomberg, Federal Reserve Bank of Dallas, J.P. Morgan Asset Management. The breakeven WTI price is the price of WTI oil needed for a firm to cover operating expenses for existing wells.

Data are as of May 2, 2024.

The materials sector, burdened by lower crude and intermediate good prices as well as muted manufacturing activity, could see earnings contract by as much as 22% y/y. Health care is on pace to see earnings fall by 25% y/y, the worst decline across all 11 sectors. That said, one-time expenses related to acquisitions from a select few companies have had an outsized negative impact on results.

Better days ahead

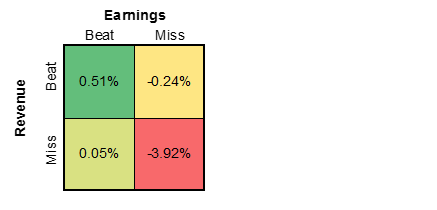

Within finance, there is a foundational theory that a stock’s intrinsic value is tied to its fundamentals, and we would expect to see stocks doing well so far given solid results. However, that has not necessarily been the case. With valuations elevated, investors have been on the lookout for weakness, and have dished an outsized punishment to companies that missed expectations relative to the reward that companies beating estimates have received.

1-day performance following announcement

Source: FactSet, J.P. Morgan Asset Management.

Data are as of May 2, 2024.

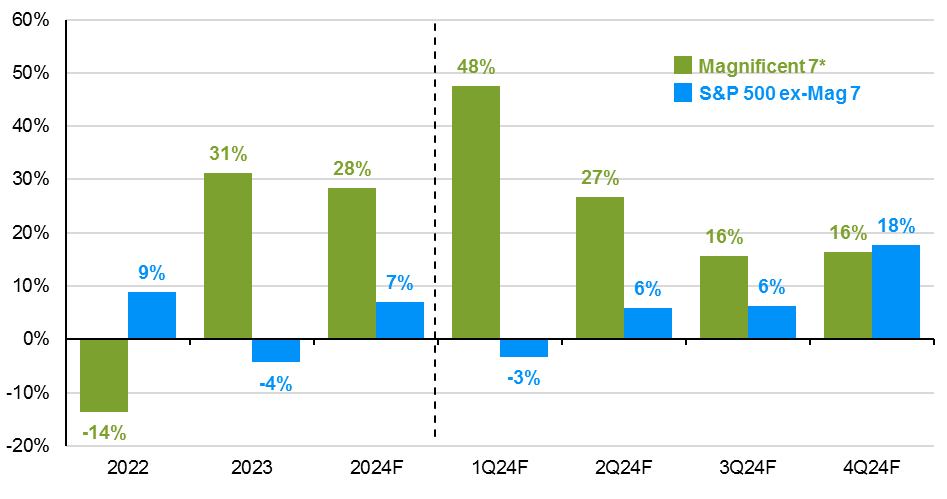

Moreover, the market’s response to the Magnificent 7, which are projected to dominate earnings growth once again this quarter (+48% y/y vs. -3% y/y for the rest of the index), has been increasingly driven by sentiment. On average, companies delivering beats within this cohort are down in the trading day after earnings, while the one company that missed expectations jumped by more than 4%. In our opinion, the divergence between price movement and fundamentals suggests some fragility within the market, particularly within the Magnificent 7. That said, broadening profit growth this year should highlight plenty of attractive opportunities across the market.

Earnings growth should broaden beyond the Magnificent 7

Pro-forma EPS, y/y % change

Source: FactSet, Standard & Poor's, J.P. Morgan Asset Management.

*Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA and TSLA. Earnings estimates for 2024 are forecasts based on consensus analyst expectations.

Data are as of May 2, 2024.

After struggling in 2023, health care, materials and energy are poised to see results recover but by varying degrees. While diminishing COVID-19 revenues, elevated R&D expenses and labor costs weighed on health care last year, favorable comps and building momentum from increased patient volumes and GLP-1 drugs should allow the sector to emerge from its protracted slump, with analysts forecasting a 33% q/q increase in earnings next quarter and y/y growth for the remainder of 2024. Results in the materials sector are expected to trough in the second quarter and expand on a y/y basis thereafter, although higher interest rates may limit sequential growth during the back half of the year. Comps for energy also look favorable moving forward. Despite this, expected growth from the sector, both on a y/y and q/q basis, looks lackluster through the remainder of the year.

Amongst the sectors facing tougher comps, peak y/y growth for both consumer sectors is likely behind us, but momentum is set to build in the second and third quarters. That said, as higher interest rates continue to pressure consumers, earnings may fall on a sequential basis in the fourth quarter. Finally, while analysts expect a moderation in earnings growth across information technology and communication services on a y/y basis, both sectors should gather momentum on a q/q basis through the end of the year. Moreover, analysts anticipate robust AI investment will materialize into strong future results, and both sectors are tracking double digit annual growth for the balance of the year even after last year’s impressive results.

Pro-forma EPS growth

Y/y % change

Source: FactSet, J.P. Morgan Asset Mangaement.

Data are as of May 2, 2024.

Investors deterred by recent volatility and the cloudy economic outlook should not fret. Even after a solid first quarter, earnings are only expected to improve from here, with every other quarter on pace to deliver both sequential and annual growth. What is even more promising for investors, however, is that if this trend persists, all 11 S&P 500 sectors could see earnings grow on a y/y basis by the fourth quarter, a feat that has not been achieved since 2Q21.

Investment implications

While nominal growth remains supportive, it will likely trend lower through the balance of the year, putting more focus on margins as a driver of profit growth. Against a backdrop of elevated valuations and moderating economic activity, we maintain a bias toward quality. This means a preference for large caps over small caps, and an increased focus on finding companies with positive fundamentals that can back current multiples.

Moreover, as profit growth expands outside of the Magnificent 7, investors should search for opportunities across sectors, especially those that are seeing renewed earnings tailwinds after a period of weakness.