08/14/2023

J.P. Morgan Survey Shows Plan Sponsors Increasingly Focused on Delivering Expanded Benefits and Employee Financial Wellness Programs in DC Plans

90% of plan sponsors believe it is important to offer investments that help participants generate income in retirement.

New York, NY – August 14, 2023 – J.P. Morgan Asset Management today released the findings from its fifth survey of U.S. defined contribution (DC) plan sponsors, revealing that many sponsors continue to broaden efforts to help their participants achieve retirement security across employee financial wellness, plan design, plan investments and increasingly – retirement income.

The survey and resulting white paper, titled “Continued Progress through Partnership”, draws on a decade of data tracking the evolution of DC plan sponsors’ views and actions.

“Our enhanced 2023 Plan Sponsor survey highlights the industry shift as plan sponsors begin to recognize the interconnection of overall employee financial and personal wellness. Retirement income, student loan debt assistance and emergency savings programs are all being discussed more and it’s exciting to see that companies offering these types of programs see their retirement plans as more effective,” said Alexandra Nobile, Vice President, Retirement Insights, at J.P. Morgan Asset Management. “The implications of SECURE 2.0 serve to only accelerate this trend and we expect to see more plan sponsors taking a proactive approach to evolving their retirement benefit offering through innovative DC plan design.”

Results from the 2023 Retirement Insights survey of 788 plan sponsors reveals four key themes:

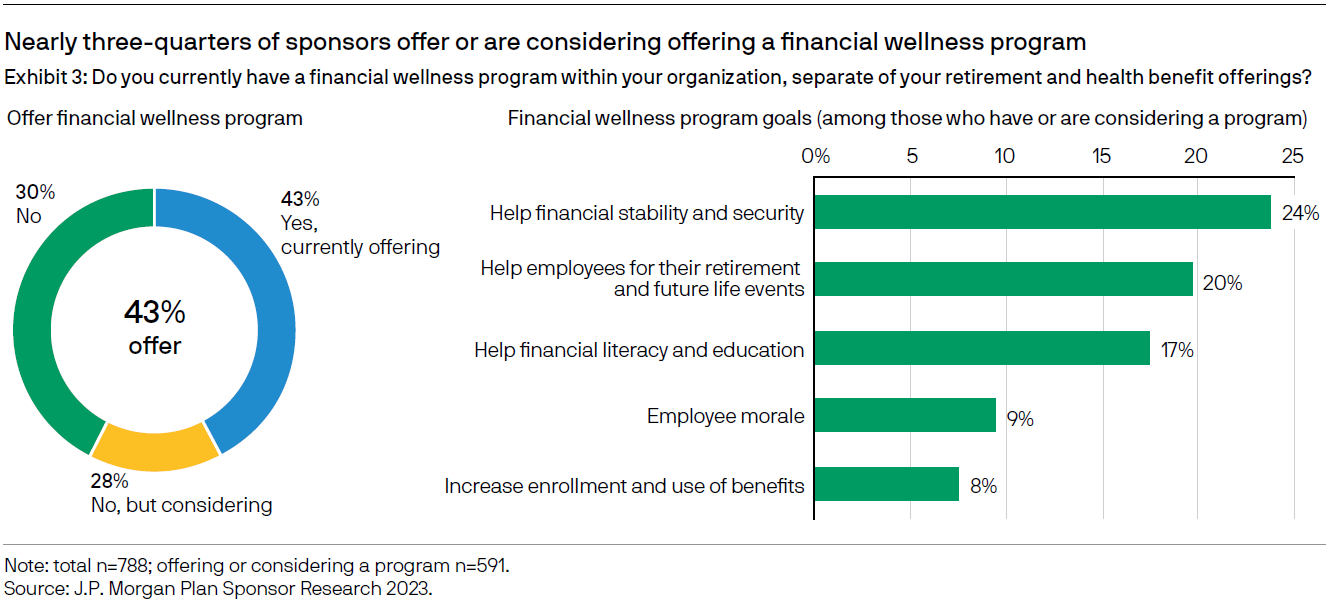

1. Increased sense of responsibility for financial wellness

2. Automation and customization continue to gain momentum

3. Target Date Fund (TDF) usage remains high as sponsors refine their investment menu

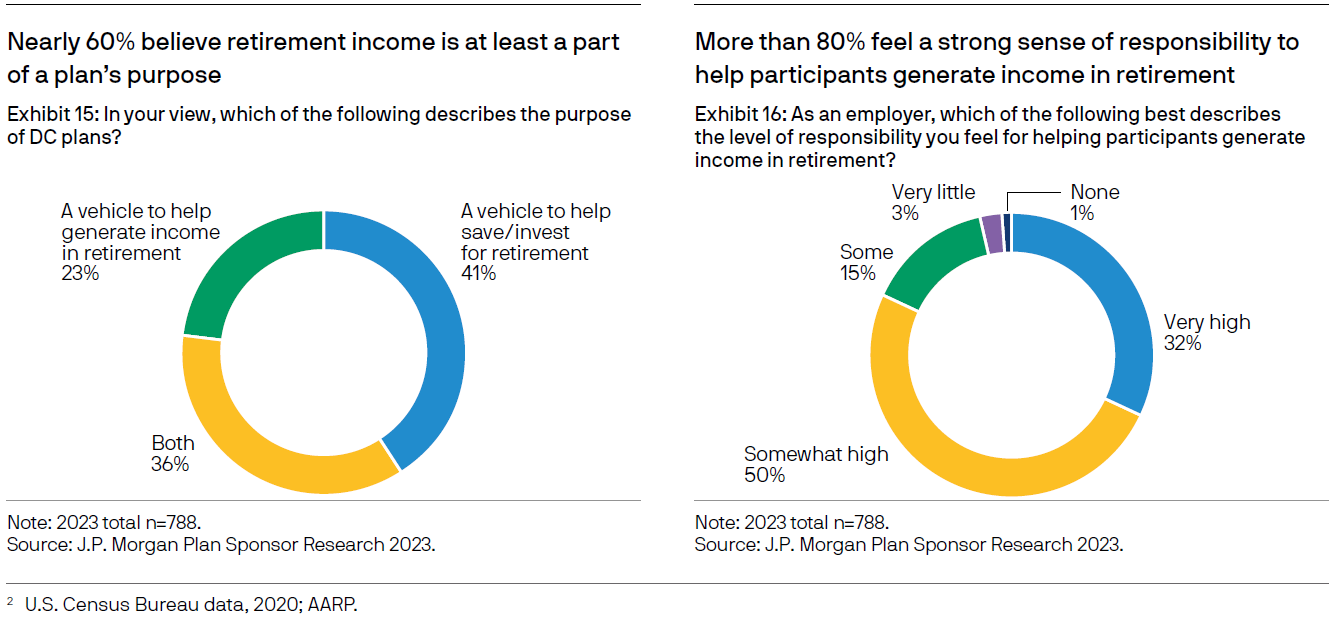

4. Retirement income has become a core purpose of DC plans

Key Implications for Plan Sponsors

“Our research shows that DC plans have become the primary retirement savings vehicle for most working Americans, and in many ways plan sponsors have risen to the occasion, however there is a clear need for plan sponsors to better understand their role as a fiduciary, with just under half aware of their responsibilities,” said Catherine Peterson, Global Head of Insights & Product Marketing, J.P. Morgan Asset & Wealth Management. “We expect to see a continued emphasis on incorporating retirement income solutions into DC plans going forward having been identified by plan sponsors as a core purpose of plans.”

Methodology

To stay in tune with the goals, motivations and progress of employers as they continue to shape the evolution of their defined contribution plans, J.P. Morgan Asset Management undertook its fifth plan sponsor survey on this topic.

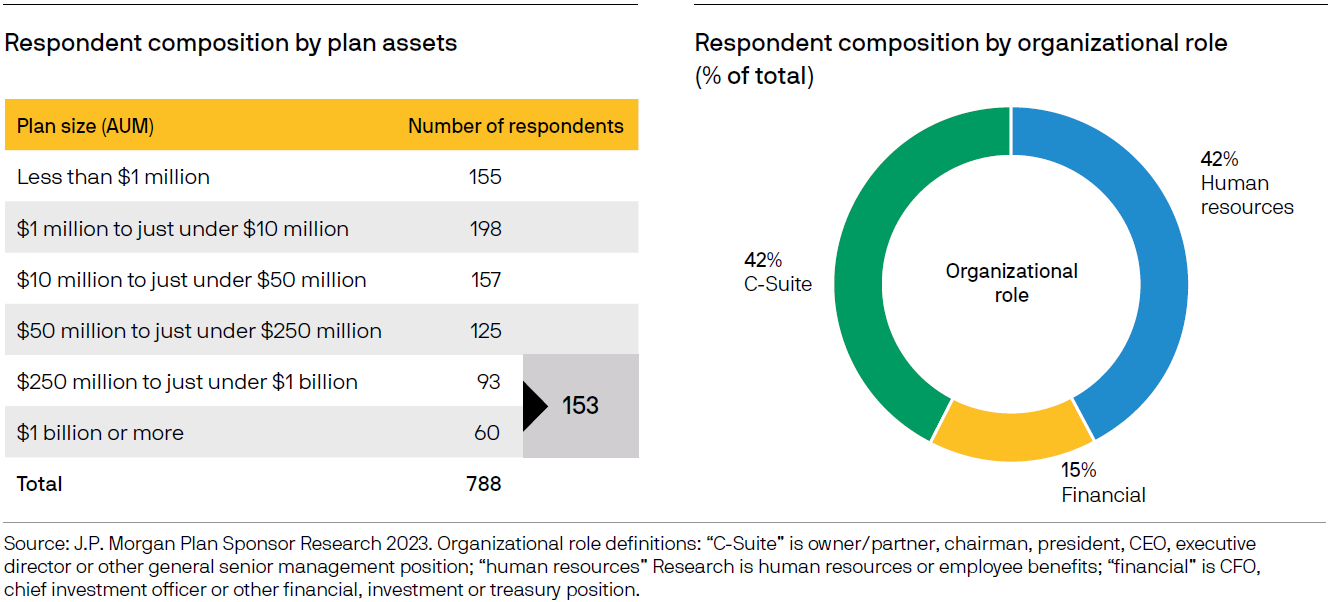

From January 9 through February 28, 2023, we partnered with Greenwald Research, a market research firm based in Washington, D.C., to conduct an online survey of 788 plan sponsors. All respondents are key decision-makers for their organizations’ DC plans. All organizations represented have been in business for at least three years and offer a 401(k) or 403(b) plan to their domestic U.S. employees.

Below are breakdowns of our sample of plan sponsors, both by plan assets and by their organizational role. Results aggregated across plan size categories were weighted to reflect the size distribution of plans in the U.S. DC universe.

About J.P. Morgan Asset Management

J.P. Morgan Asset Management, with assets under management of $2.8 trillion (as of 6/30/2023), is a global leader in investment management. J.P. Morgan Asset Management's clients include institutions, retail investors and high net worth individuals in every major market throughout the world. J.P. Morgan Asset Management offers global investment management in equities, fixed income, real estate, hedge funds, private equity and liquidity. For more information: www.jpmorganassetmanagement.com. J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co., and its affiliates worldwide.

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America (“U.S.”), with operations worldwide. JPMorgan Chase had $3.9 trillion in assets and $313 billion in stockholders’ equity as of June 30, 2023. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.

J.P. Morgan Distribution Services, Inc., member of FINRA

Copyright 2023 JPMorgan Chase & Co. All rights reserved.

SOURCE J.P. Morgan Asset Management

09kg230708144032