Portfolio Pulse: Future Transition Multi-Asset Fund

Eyes on the future with an innovative asset allocation strategy

Positioning for peak rates with bonds

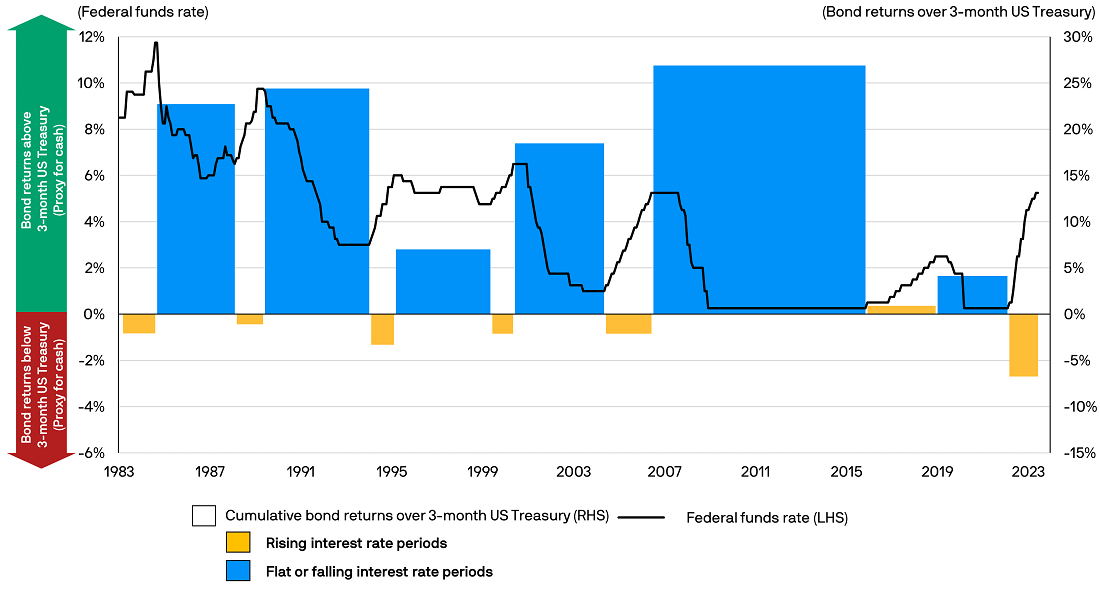

As we head towards the end of the Federal Reserve’s (Fed) rate-hike cycle, history provides two useful lessons.

Historically, bonds typically outperform 3-month US Treasury Bills1 in flat and falling interest rate environments. 3-month US Treasury Bills are often used as a proxy for cash, due to its very short duration and low default risk by the US government.

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 30.06.2023. Bond returns are cumulative and represented by the Bloomberg 1-5 Year Government/Credit Total Return Index. Returns of 3-month US Treasury are cumulative and represented by the Bloomberg 3-Month US Treasury Bellwether index. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not a reliable indicator of current and future results. This information is provided for illustrative purposes only to demonstrate general market trends. Information shown is based upon market conditions at the time of the analysis and is subject to change. Not to be construed as an offer, research or investment recommendation.

Lesson 1: Be mindful of reinvestment risk as interest rates peak

Lesson 2: Duration2 shines as interest rates peak and growth stalls

Review, revise and reoptimise

Staying short on duration may have worked well amid the fastest rate hike cycle in 40 years. Yet, in the face of its looming conclusion and potentially higher reinvestment risk, this strategy could prove less useful. As we enter the next phase of the policy cycle, duration could present opportunities not just for income, but capital appreciation should rates fall.

As we arrive at the end of the rate hike cycle, it is important for investors, based on their investment objectives and risk appetite, to review and revise their fixed income exposure to reoptimise portfolios to make the most of evolving economic conditions.

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. Treasury bills (or T-bills) are short-term financial instruments that is issued by the US Treasury with maturity periods ranging from a few days up to 52 weeks (one year).

2. Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years. The higher the duration of a bond, the more sensitive is its price to changes in interest rates. As a rule of thumb, every 1% increase in interest rates leads to a 1% decline in a bond’s price for every year of duration. The reverse also applies.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.