Capturing fixed income opportunities in a changing rate environment

A more dynamic and flexible approach in managing fixed income portfolios can capitalise on numerous factors that impact bond prices and move markets.

Why JPMorgan Asian Total Return Bond Fund Now? | Investment Insights: Asian Bond | Fund Details

CAPTURING THE VAST POTENTIAL ACROSS ASIAN BONDS

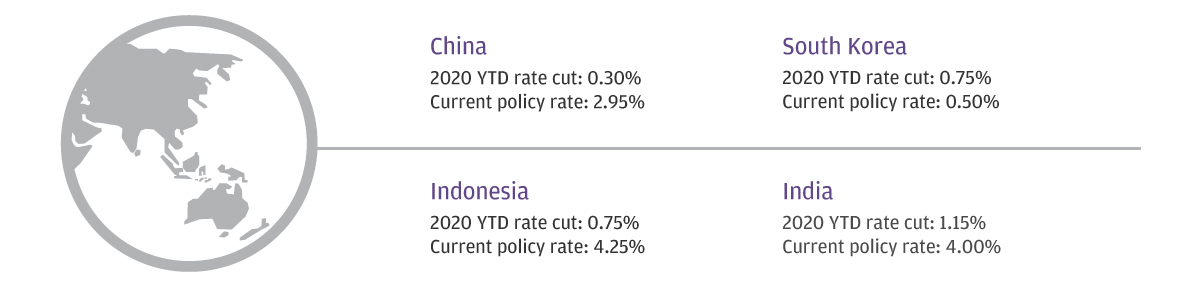

Supportive backdrop from accommodative policies

Over six months into 2020, geopolitical uncertainty and the public health crisis continue to dominate markets. Central banks and governments have responded with massive monetary and fiscal stimulus to support economies and help mitigate risks. Inflation is expected to remain benign in Asia, potentially giving policymakers more room for quantitative easing policies, which could be a boon for debt markets.

Source: Various central banks, J.P. Morgan Asset Management, as of end-June 2020. China’s policy rate is calculated based on the medium-term lending facility rates. YTD: year-to-date.

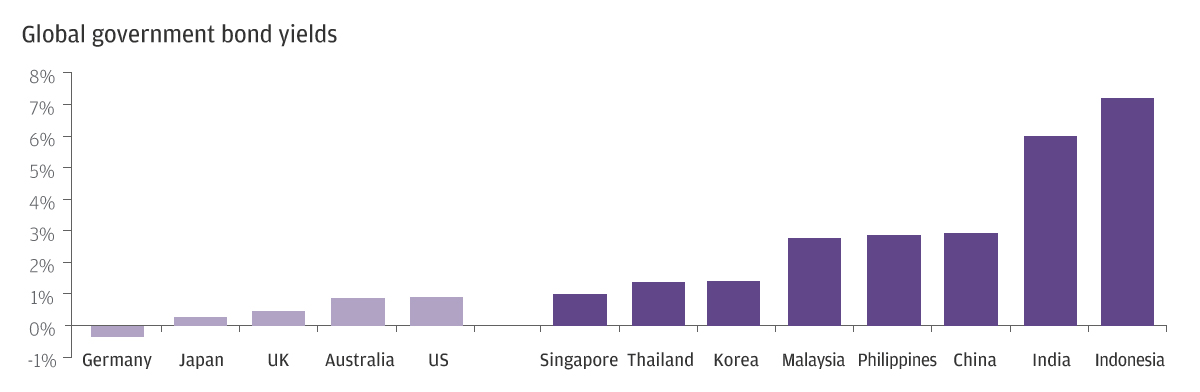

Better positioned to capture income potential

Investors’ search for yield has become tougher in the era of ultra-low, or zero interest rates. When compared with other regions around the globe, Asian bonds generally offer more attractive income potential. Meanwhile, investing in higher-yielding local currency debt may help enhance potential returns.

Source: Bloomberg, as of end-June 2020. Yield is not guaranteed. Positive yield does not imply positive return.

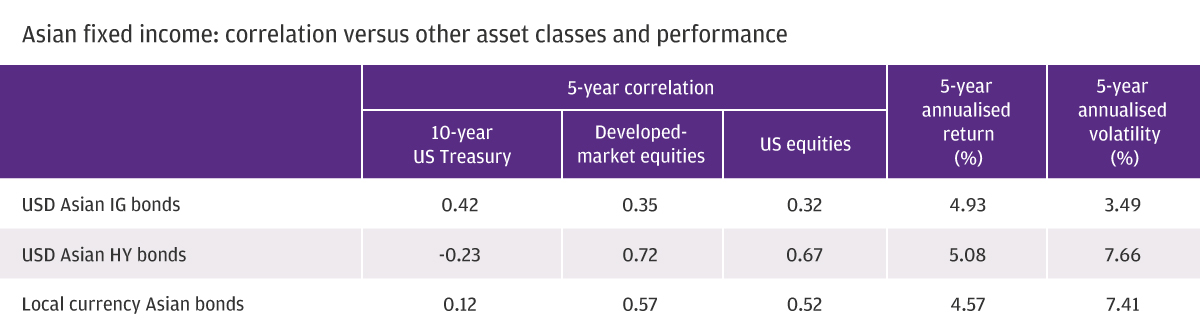

Risk diversification potential

Various Asian bonds exhibit lower, or negative correlation to US Treasuries while offering compelling returns. Similarly, USD Asian IG bonds and local currency Asian bonds also show lower correlation to equities. Taking a diversified approach across Asian bond sectors could offer diversification^ benefits to the overall portfolio.

^ Diversification does not guarantee investment return and does not eliminate the risk of loss.

IG: investment grade. HY: high yield. Source: Bloomberg, J.P. Morgan, as of end-June 2020, calculated using monthly returns in USD. Indices used: J.P. Morgan Asia Credit Investment Grade Index (USD Asian IG bonds), J.P. Morgan Asia Credit High Yield Index (USD Asian HY bonds), J.P. Morgan Asia Diversified Index (Local currency Asian bonds), ICE BofA US Treasury Index (10-year US Treasury), MSCI World Index (Developed-market equities), S&P 500 Index (US equities). Past performance is not indicative of future performance. Indices do not include any fees or operating expenses and are not available for actual investment.

J.P. MORGAN ASSET MANAGEMENT'S ASIAN FIXED INCOME TEAM

Source: J.P. Morgan Asset Management, as of end-June 2020. There can be no assurance that the professionals currently employed by J.P. Morgan Asset Management (JPMAM) will continue to be employed by JPMAM or that the past performance or success of any such professional serves as an indicator of such professional's future performance or success.

![]()

A flexible Asian bond strategy

A robust Asian bond strategy would require the flexibility to exploit investment ideas across a wide range of opportunities available in the region. Without benchmark constraints, the Fund invests flexibly in fixed income sectors such as USD Asian credit, local currency bonds and convertibles, striving for competitive total returns.

![]()

Actively managed portfolio

The Fund taps into a diverse set of sectors available in the region, seeking to optimise the unique benefits of each sector. The investment team actively manages currency positions and duration to navigate changing market conditions. The tactical foreign exchange hedging also allows for flexible adjustment in our Asian currency exposure, covering RMB and other higher-yielding currencies such as IDR, with a view to managing risks while seizing opportunities.

![]()

Attractive income opportunities

The Fund offers monthly distributing share classes*, providing attractive income opportunities. In addition, the Fund is available in USD and HKD Classes, alongside AUD Hedged, CAD Hedged, NZD Hedged, RMB Hedged and GBP Hedged Classes, to help meet investors’ need for different currencies.

(* Aim at monthly distribution. Dividend rate is not guaranteed. Distributions may be paid from capital. Refer to important information 3)