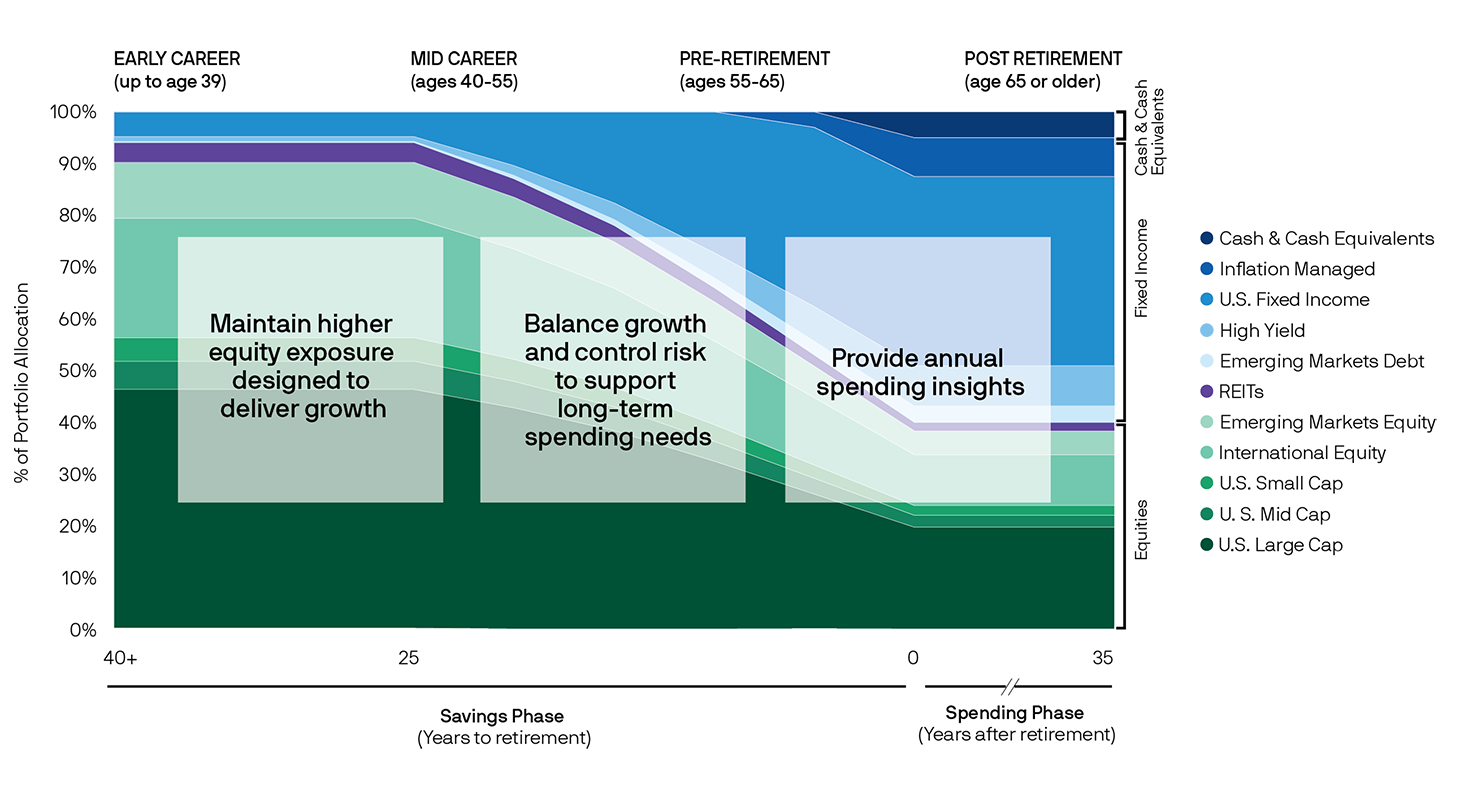

SmartRetirement Blend is an all-in-one target date fund solution for any point of a participant’s retirement journey - from maximizing savings during working years to making those assets last throughout retirement.

![]()

People Insights

Designing target date strategies around real-life saving and spending behavior

![]()

Investment Expertise

Using participant and market insights to build people-centered portfolios

![]()

Better retirement experience

Helping participants build and make the most of their retirement savings

Building participant savings during their working years

Our target date funds help more participants reach a comfortable level of retirement income versus industry peers.*

Source: J.P. Morgan retirement research, 2018–19.

*When compared with S&P TD Index.

Helping participants make the most of their savings once they retire

Our target date funds help support actual spending behavior in retirement while minimizing the risk of outliving assets

Morningstar Medalist RatingTM

SILVER1(as of 11/22/23)

AWARDED TO ENTIRE SERIESAnalyst-Driven %: 100

Data Driven %: 100

Category: US Fund Target Date

Source: Morningstar, US Fund Target Date categories. Medalist rating as of 11/22/23; applies to SmartRetirement Blend R6 mutual funds only. The Morningstar Medalist RatingTM is a summary expression of Morningstar’s forward-looking analysis of investment strategies using a rating scale of Gold, Silver, Bronze, Neutral and Negative. Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with fees, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating assigned. Products are sorted by expected performance into rating groups defined by their Morningstar Category and their active or passive status. Analyst-covered products are assigned the three pillar ratings based on the analyst’s qualitative assessment, subject to the Analyst Rating Committee’s oversight, monitored and reevaluated at least every 14 months. Ratings are assigned monthly for vehicles covered either indirectly by analysts or by algorithm. For more detailed information including methodology, please go to global.morningstar.com/managerdisclosures.

Ratings and rankings should not be used as the sole basis in evaluating an investment product and should not be considered an offer or solicitation to buy or sell the investment product.

©2023 Morningstar Inc. All rights reserved. Morningstar information is proprietary to Morningstar and/or its content providers, may not be copied or distributed and is not warranted to be accurate, complete or timely.

The target asset allocation depicts the Fund’s targeted weights based on J.P. Morgan’s internal analysis. The Fund’s actual allocations may differ due to changes to these allocations. Diversification and asset allocation do not guarantee investment returns and do not eliminate the risk of loss. Past performance does not guarantee future results.

Emerging markets equities are represented by the MSCI EAFE Index.

Inflation Managed is allocated to TIPS (Treasury Inflation-Protected Securities): Treasury bonds adjusted to eliminate the inflation effects on interest and principal payments, as measured by the Consumer Price Index (CPI). REITs (Real Estate Investment Trusts): Companies that own or finance income-producing real estate, providing investors of all types regular income streams, diversification and long-term capital appreciation.

Risk Summary: this investment is not a complete retirement program and may not provide sufficient retirement income. There may be additional fees or expenses associated with investing in a Fund of Funds strategy. Asset allocation does not guarantee investment returns and does not eliminate the risk of loss.

Target Date Funds: The JPMorgan SmartRetirement Funds are target date funds with the target date being the approximate date when investors plan to retire. Generally, the asset allocation of each Fund will change on an annual basis with the asset allocation becoming more conservative as the Fund nears the target retirement date. The principal value of the Fund(s) is not guaranteed at any time, including at the target date.y

Indexes: Mutual funds have fees that reduce their performance: indexes do not. You cannot invest directly in an index. The S&P Target Date Index Series reflects exposure to various asset classes included in target date funds driven by a survey of such funds for each particular target date. These asset class exposures are represented by indices of securities in the index calculation. Prior to May 31, 2017 the asset class exposures were represented by ETFs net of fees. The Index returns are calculated on a daily basis.