What are ETFs?

- Like mutual funds, ETFs pool investor’s money into broadly diversified, professionally managed “baskets” of stocks and bonds.

- ETFs are bought and sold on an exchange, like a stock, giving investors access to markets and their money throughout the trading day.

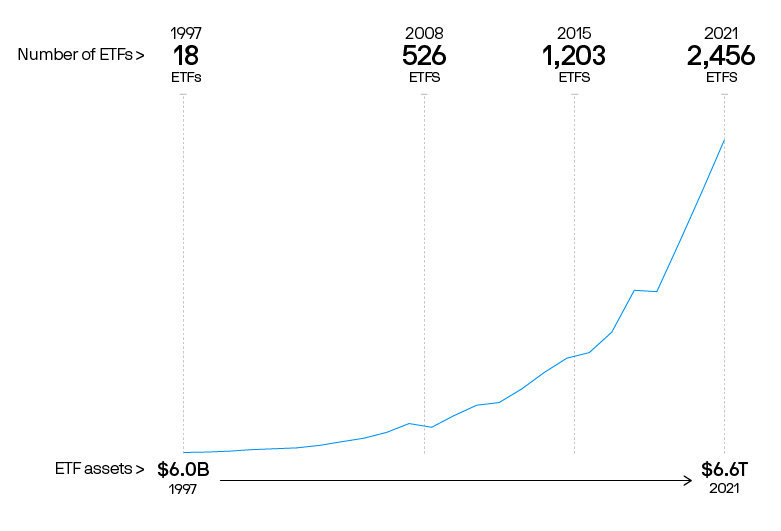

Number of ETFs and total ETF assets

Source: ETF assets, Morningstar. Data from 12/31/97 to 09/30/21. Shown for illustrative purposes only.

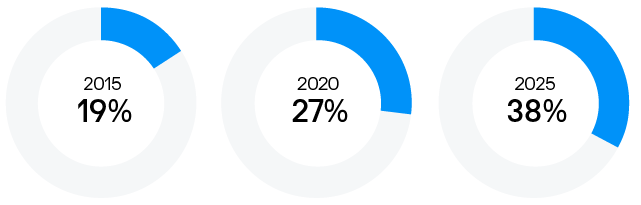

Percentage of portfolios invested in ETFs

Source: Charles Schwab, 2021 ETF Investor Study. Shown for illustrative purpose only.

Why are ETFs growing so fast?

- Efficient: ETFs are cost-effective and tax-friendly, allowing investors to keep more of what they earn.

- Tradable: ETFs can be easily traded throughout the day and turned into cash as needed.

- Flexible: ETFs offer access to virtually every market worldwide – with the flexibility to quickly move in and out of them as conditions change.

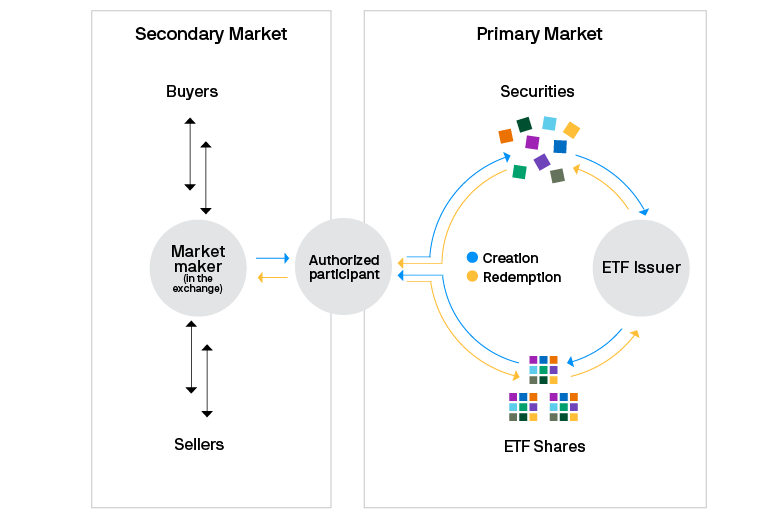

How does an ETF work?

The supply of an ETF’s shares can be increased or decreased to help keep its price in line with the value of its underlying portfolio holdings. For example, if many investors want to sell an ETF, its share price might fall below its basket’s value. Here’s how the process would work to reduce shares in those instances (green lines in chart):

- Market maker buys ETF shares, usually at a discount to basket value.

- Shares are redeemed by sending them through an Authorized Participant (AP) to the ETF issuer, in exchange for the underlying securities.

- Market maker sells those securities, usually for more than they paid for ETF shares.

As ETF shares are bought and removed from the market, it helps drive prices back toward the basket’s value. The process happens in reverse when more shares are needed to meet buyers’ demands (blue lines).

Creating and redeeming shares helps ETFs trade at prices close to the market value of their portfolio holdings

Source: J.P. Morgan Asset Management. Shown for illustrative purposes only.

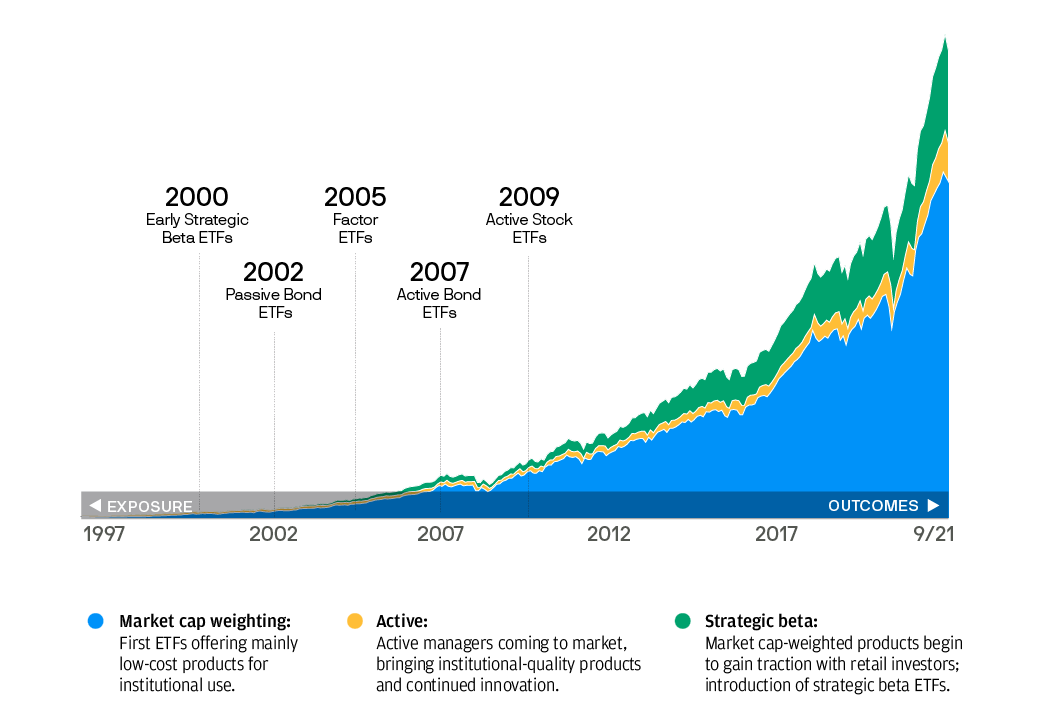

Total assets by type

Source: Morningstar. U.S. data from 12/31/97 to 9/30/21. Shown for illustrative purposes only.

What types of ETFs are available?

- On one end of the spectrum are purely passive ETFs tracking broad market indexes. Passive Investing, or “indexing,” seeks to match the portfolio holdings and performance of a market benchmark, such as the S&P 500 Index.

- In the middle are Strategic Beta ETFs that combine elements of both passive and active investing.

- On the other end of the spectrum are active ETFs in which managers decided what securities to buy and sell. Active Investing seeks to achieve a specific outcome by picking only those securities considered most attractive.

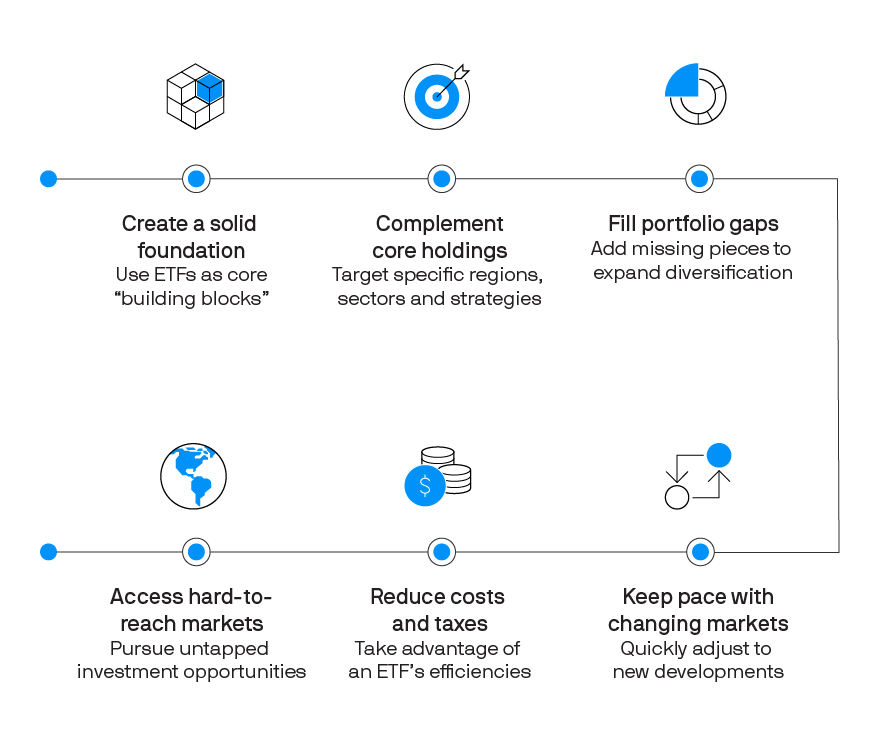

How are investors using ETFs?

Nearly everyone can find a use for ETFs. The wide variety and versatility of ETFs allow them to play a number of different roles in an investor’s portfolio.

- Their ability to mirror broad stock and bond indexes make them good “building blocks” for a core portfolio.

- ETFs targeting specific regions, sectors and strategies can be used in several ways to enhance diversification. For example, they can complement core holdings, fill gaps, realign an unbalanced portfolio or provide access to otherwise hard-to-reach markets.

- Investors are also using ETFs to reduce costs and taxes. And because ETFs can be traded quickly and easily throughout the day, they’re effective vehicles for moving in and out of markets as new opportunities and risks arise.

Shown for illustrative purposes only.

DISCLOSURES

This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice

Investing involves risk, including possible loss of principal. Shares are bought and sold throughout the day on an exchange at market price (not NAV) through a brokerage account and are not individually redeemed from the fund.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and decreased trading volume.

There is no guarantee the funds will meet their investment objective. Diversification may not protect against market loss. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve.

0903c02a82445c56