Part Three: Selecting the right target date fund

Performance and fees continue to dominate how plans evaluate TDFs, while important factors such as demographics and glide path structure still lag.

07/09/2019

Catherine Peterson

Our fourth biennial Defined Contribution (DC) Plan Sponsor Survey offers insights into the power of being proactive to help position more participants for greater retirement funding success. This year’s research highlights how proactive plans and proactive advisors and consultants are more likely to offer industry best practices and experience higher levels of overall satisfaction across a broad range of metrics. We present these findings in four parts covering plan sponsor goals, plan design, target date fund (TDF) usage and working with advisors and consultants.

View the DC Plan Sponsor Survey Findings overview >

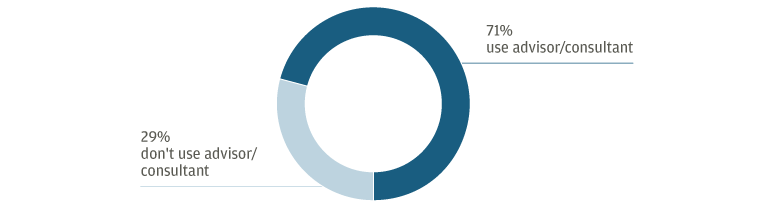

Most plan sponsors—71%—use advisor/consultant, and 67% are satisfied with their relationships. However, fewer than one in four (24%) express extreme satisfaction.

Note: Has an advisor/consultant, n=615. All numbers are rounded to the nearest full percentage.

Source: J.P. Morgan Plan Sponsor Research 2019.

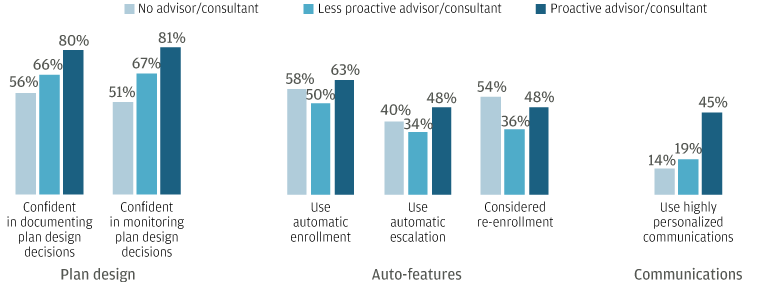

Plan sponsors who work with advisors/consultants that proactively suggest new ideas and share best practices to evolve the plan are more likely to be extremely satisfied with the relationship—41% vs. 17% of plan sponsors with advisors/consultants who do not offer these types of insights.

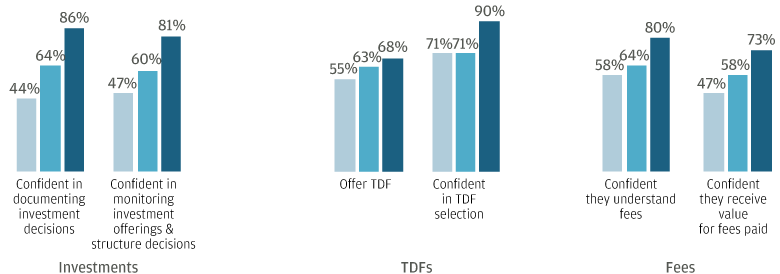

Plan sponsors with proactive advisors/consultants also tend to be much more confident in plan decisions and understanding of fees, as well as more apt to offer proactive plan features. Furthermore, 73% are confident they receive value for the fees they are paying, compared with 58% for plan sponsors with less proactive advisors/consultants and 47% for plan sponsors without.

Note: Does not have an advisor/consultant, n=233; has less proactive advisor/consultant, n=400; has proactive advisor/consultant, n=215.

Source: J.P. Morgan Plan Sponsor Research 2019.

Our research from this year’s survey shows that advisors and consultants have a real opportunity to differentiate their services by being proactive. Plan sponsors report they get tremendous value from working with partners they consider proactive, both in terms of how satisfied they are with the relationship and with their overall plan decisions and plan design. Yet only 27% say their advisors and consultants proactively suggest new ideas and share best practices to advance the plan. This relatively limited number offers a real chance for advisors and consultants who do consistently bring new insights to the table. Taking a more proactive approach can add meaningful value to their client relationships and potentially tap into new ways to expand their businesses.

0903c02a826212c2

Performance and fees continue to dominate how plans evaluate TDFs, while important factors such as demographics and glide path structure still lag.