Part Four: Working with advisors and consultants

Plan sponsors with proactive advisors/consultants are more secure about their decisions and are more often proactive themselves in plan design.

07/09/2019

Catherine Peterson

Our fourth biennial Defined Contribution (DC) Plan Sponsor Survey offers insights into the power of being proactive to help position more participants for greater retirement funding success. This year’s research highlights how proactive plans and proactive advisors and consultants are more likely to offer industry best practices and experience higher levels of overall satisfaction across a broad range of metrics. We present these findings in four parts covering plan sponsor goals, plan design, target date fund (TDF) usage and working with advisors and consultants.

View the DC Plan Sponsor Survey Findings overview >

TDF usage remains high …

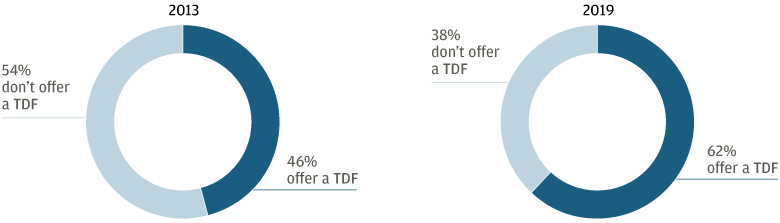

Providing participants with the easy-to-access, professionally managed asset allocation benefits of TDFs remains popular with many plan sponsors. This year, 62% indicated their plans offer TDF series—notably higher than in 2013, when only 46% did.

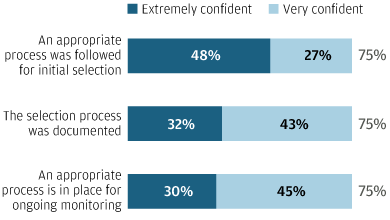

Three out of four plan sponsors (75%) are highly confident regarding their TDF selection and monitoring process. This is an encouraging finding, given today’s wide selection of more than 65 TDF suites available and their often significant differences in glide path design and portfolio construction—and by extension different risk-reward characteristics and potential impact on participant outcomes.1 The majority of these plans are also documenting their process, a critical part of demonstrating prudent due diligence from a fiduciary perspective.

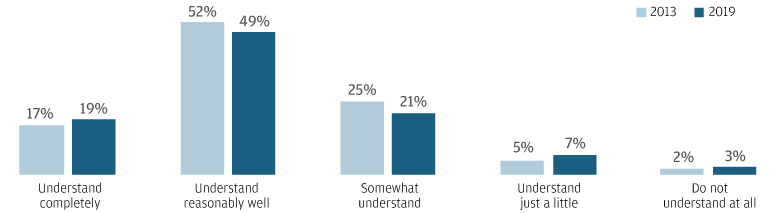

However, only 68% say they understand the methodology used to construct the TDFs they offer in their plans. That means almost one-third (31%) understand their TDF series’ methodologies only “somewhat,” “a little” or “not at all.” These responses are similar to those in 2013 and suggest that a meaningful number of plan sponsors continue to lack appropriate knowledge about TDF design, despite considerable education efforts by policy makers, TDF providers and the retirement planning industry overall.

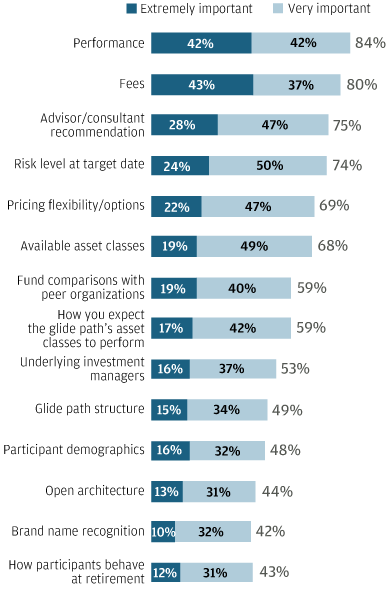

When asked about the criteria they use in TDF selection, plan sponsors most frequently rate performance and fees as “extremely important” or “very important,” in line with findings from past years. Other key factors, however, continue to be much less often cited. For example, fewer than 50% see glide path structure or participant demographics as highly important, despite both being identified as core evaluation considerations in the DOL’s February 2013 Target Date Retirement Funds—Tips for ERISA Plan Fiduciaries.

Plan sponsors naturally need to consider performance and fees when selecting a TDF strategy. From a fiduciary perspective, it is also crucial to understand how fundamental differences in glide path structure and other components of TDF design are likely to interact with participant characteristics and affect potential retirement outcomes. Further, 10 years of historically high equity returns may offer a somewhat distorted picture of how more aggressive TDF designs may perform in the future. As such, it will likely become increasingly important to dig deeper, beyond past returns, to understand how a TDF may perform across a fuller range of investment climates and whether that offers a strong fit with participant needs, given the current late-stage market cycle.

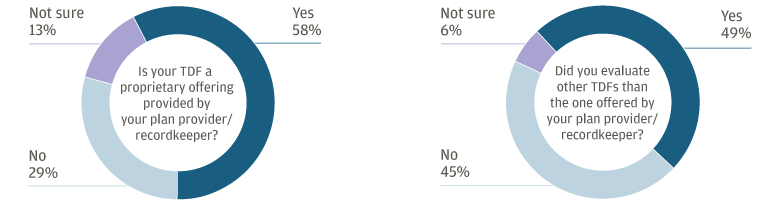

Another potential red flag in this year’s findings is that nearly three in five plan sponsors use a TDF that is a proprietary offering from their provider/recordkeeper. While this is not necessarily problematic on its own, almost half—45%—of these plan sponsors did not evaluate any other TDF options. Without shopping around, they may be omitting a crucial evaluation step and potentially missing a TDF strategy that could be a better choice for their plan.

Note: Have target date fund, n=584; have proprietary target date fund offered by plan provider/recordkeeper, n=352.

Source: J.P. Morgan Plan Sponsor Research 2019.

The broad adoption of TDFs has been a major positive development for plans and participants. Nevertheless, this year’s survey findings suggest that there is room for continuing education on the importance of clearly understanding and effectively evaluating the TDF strategies plan sponsors select for their plans, especially when they are used as a QDIA. Although most plan sponsors are confident in their strategy knowledge and selection process, a sizable number lack an acceptable level of basic awareness about how the TDFs they choose are constructed and the likely implications of what that might mean for potential retirement outcomes.

Many plan sponsors, especially for smaller plans, also appear to be discounting a range of key evaluation criteria and over-relying on performance or fees, or simply choosing the strategy offered by their plan provider/recordkeeper to select their TDFs. Offering the right TDF fit for a plan can be one of the most important decisions plan sponsors make in helping to place participants on a more secure retirement path. Given the different approaches to TDF design available today, it is crucial to look closely under the hood of these strategies to make sure any selected series is well aligned with a plan’s specific goals and participant needs.

This is an area where using a proactive advisor can be extremely useful. In “Part Four: Working with advisors and consultants,” we discuss how plan sponsors working with proactive advisors/consultants are much more likely to be confident in their TDF selection and monitoring.

1 Morningstar, March 31, 2019.

0903c02a826212c2

Plan sponsors with proactive advisors/consultants are more secure about their decisions and are more often proactive themselves in plan design.