A business owner’s dashboard for navigating the COVID-19 crisis

Why cash is king and communication is critical.

03/31/2020

Steve Faulkner

Head of Private Business Advisory, J.P. Morgan Private Bank

Ken DiCairano

Private Business Advisory, J.P. Morgan Private Bank

As COVID-19 continues to disrupt our lives and economy, private business owners are at the forefront of tough decisions and prolonged uncertainty. In this environment, owners need to continuously adapt their playbooks and focus on what they can control in order to weather the storm and be positioned to thrive once the virus and economic volatility have subsided.

At JPMorgan Chase, we pride ourselves on advising owners through business transitions both planned and unexpected. It’s axiomatic: You get what you measure. Therefore, our team has put together a dashboard to help you, as business owners, establish and manage priorities through the turbulence.

Two common themes are represented throughout our dashboard: the importance of communication and the reign of cash as king.

Financial management

As we learned during the Great Recession, in times of crisis, liquidity is of the utmost importance for businesses. COVID-19 has placed an extreme burden on businesses by creating an even more pronounced mismatch between reduced revenue streams and ongoing operating expenses. With that in mind, never has the saying “cash is king” been more relevant. The two important considerations for extending your company’s available liquidity are: accelerating the receipt of receivables (such as focusing on collections, and offering quick pay discounts or other incentives) and prioritizing the timing of cash disbursements.

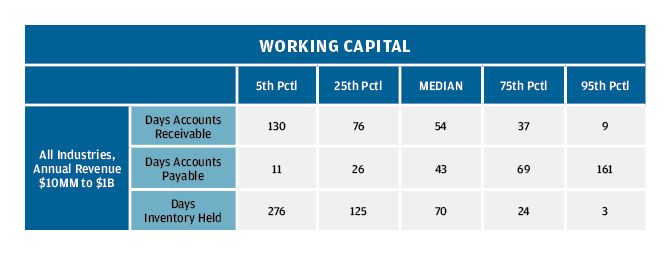

During this crisis, owners need to identify and monitor the key performance indicators (KPIs) that will be mission-critical for their businesses. KPIs that could be relevant to your business include: quick and current ratios, customer orders, receivables, workforce callout, operating expenses and equipment utilization, to name a few. Additionally, we suggest continuously monitoring cash buffer days1 and working capital to ensure business solvency. According to the J.P. Morgan Institute, the median small business has just 27 cash buffer days in reserve, which means many businesses will likely need additional capital to get through this downturn. (See “Working capital performance” chart.)

Working capital management performance

Source: Working Capital Management: How Much Cash Is Your Business Tying Up?, National Center for the Middle Market.

Credit management

With an eye toward liquidity, your relationship with your primary lender is an asset and should not be overlooked. Maintaining a continuous, active dialogue with lenders will allow you to discuss potential challenges and develop mutually acceptable solutions. In addition, your JPMorgan Chase advisor is working with many clients facing similar struggles, and should be considered a resource.

In advance of conversations with lenders, you and your professional advisors (such as tax, legal and accounting) should review your business’s loan documents to develop a better understanding of financial covenants, definitions and calculations. Additionally, consider performing multiple scenario analyses to assess various macro timing scenarios (outside of your control; e.g., loss of revenue due to continued economic shutdown) and corresponding business plan strategies (within your control; e.g., reducing operating expenses). The goal is to estimate a cash flow runway and identify potential liquidity gaps that could be filled with bank financing and/or an injection of equity.

In light of the recently passed Coronavirus Aid, Relief, and Economic Security (CARES) Act, small business owners should assess their eligibility for government loan programs and tax relief at the federal level (as well as at state and local levels), and for any private sector programs. These can help bridge a liquidity gap, but you should carefully review which ones will provide the greatest benefit, since certain programs and tax provisions may be mutually exclusive.

Operational and risk oversight

As an owner, nobody knows your business better than you do. Your employees will look to your leadership during this time of hardship as an indicator of things to come. Robust leadership will be two-pronged: intensely focused with decisive business action, as well as genuinely empathetic regarding the health and safety of the workforce. Being in constant communication with your management and employees will help confirm that everyone is in this together, and will inspire much-needed confidence.

Depending on how integrally involved you are in the business’s day-to-day operations or how extensive your management team is, there may be a number of considerations that need to be addressed in order to maintain business continuity should a crisis or a catastrophic event affect you directly. As a first step, you should review your corporate governance provisions, which may be part of your operating agreement and/or separate business resiliency plans. Having a well-structured and communicated plan will ensure continuity in your absence. For example, determine if appropriate parties have signatory authority (for expenses such as payroll), and assess if a power of attorney is appropriate for your situation.

Additionally, as the workforce moves increasingly from an in-office to a more technology-based/work-from-home environment, evaluate security options to guard against fraud, including cyber fraud, as these types of scams always increase during times of high anxiety.

Customer and supplier connectivity

While there tends to be a natural reflection on internal mechanisms during a crisis, external stakeholders need to be top-of-mind as well. Maintaining connectivity with customers and suppliers during this time, potentially through video-conferencing, will help strengthen relationships. Remember that these partners are facing similar hardships in this environment, and opening the lines of communication may help identify potential issues (such as slow pay or supply-chain logistics) in their early stages and thus help set expectations for all parties.

While there are innumerable considerations that vary across industries, geographies, products and services, we hope this dashboard will better arm you, your management team and your professional advisors. JPMorgan Chase is committed to providing thoughtful advice as we continue to navigate through this pandemic together.

As a final takeaway, keep in mind that there is opportunity in adversity for every business. Owners have an obligation to maintain a strategic vision for the future. Anticipate how the impact of this disruption will transform your business strategy, create different customer demands, and offer new growth prospects in order to best position your enterprise for continued success.

1Cash buffer days are the number of days of cash outflows a business could pay out of its cash balance were inflows to stop.

0903c02a82868ee6