Strike up a friendship with risk as you prepare for retirement

Explore the different possible outcomes of taking on risk as you invest for your retirement.

|

Most investors are intensifying their search for more attractive income prospects as they are likely to face another year of negative real cash returns in 2022, or possibly longer.

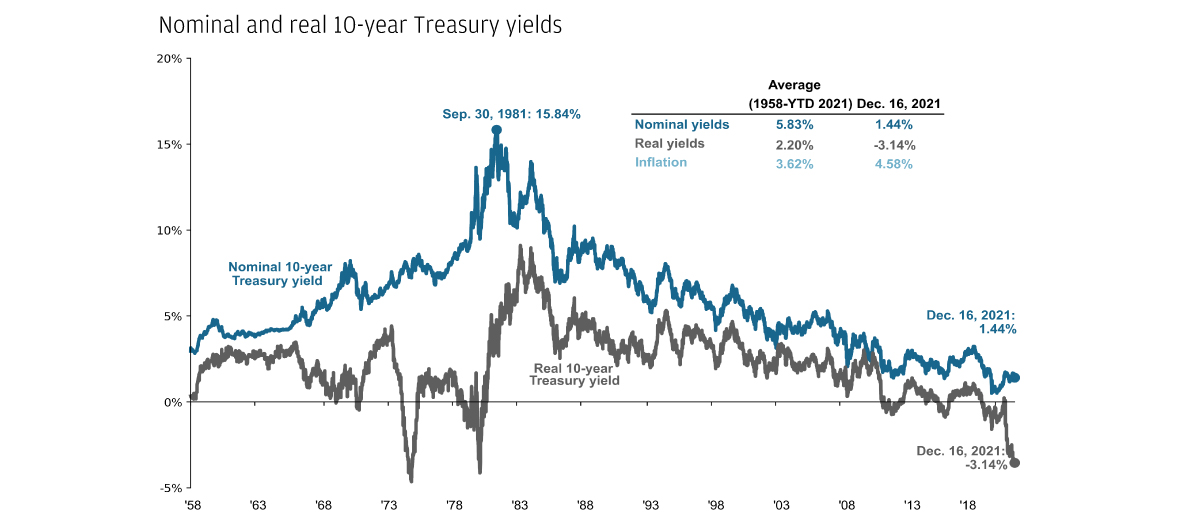

As illustrated in the chart, real yields stood at -3.14% while inflation was 4.58%, as of 16 December 2021. As inflationary pressure is building up in certain regions, some central banks are considering raising rates, albeit gradually.

Increasingly, investors are looking for a wider range of assets that can generate enough income so that their overall portfolio’s purchasing power is not eroded by inflation.

Interest rates and inflation

Source: U.S. Bureau of Labor Statistics, FactSet, Federal Reserve, J.P. Morgan Asset Management. Real 10-year Treasury yields are calculated as the daily Treasury yield less year-over-year core CPI inflation for that month except for December and November 2021 where real yields are calculated by subtracting out December 2021 year-over-year core inflation. Data are as of 16.12.2021.

![]()

Proven results: return and income

The Fund has delivered proven results since its inception:

USD (mth) Class1 has achieved

Cumulative return (since launch) of

59.3%2

Annualised yield of

5.63%3

Keeping the key objectives of yield, risk and return in mind, we seek to generate attractive risk-adjusted income for investors through different market cycles.

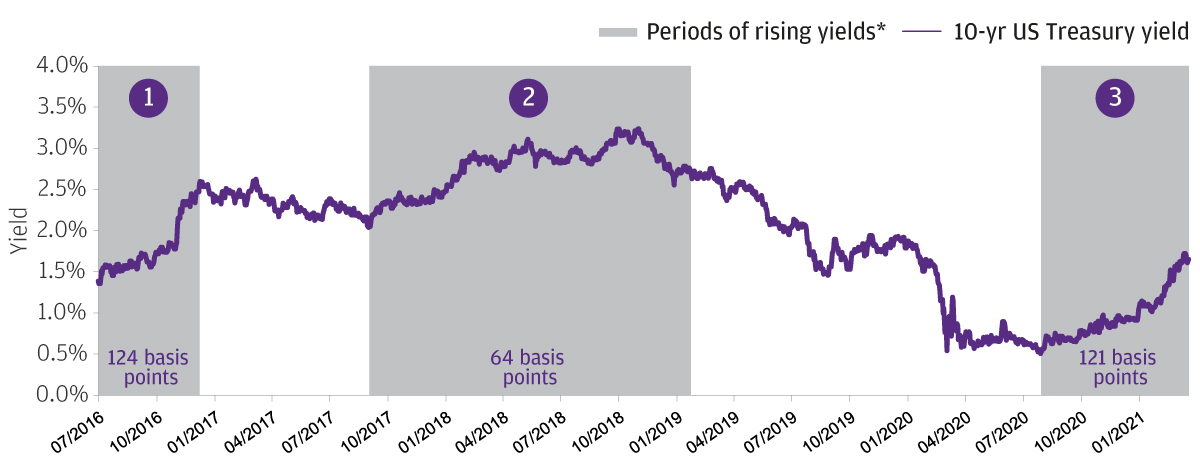

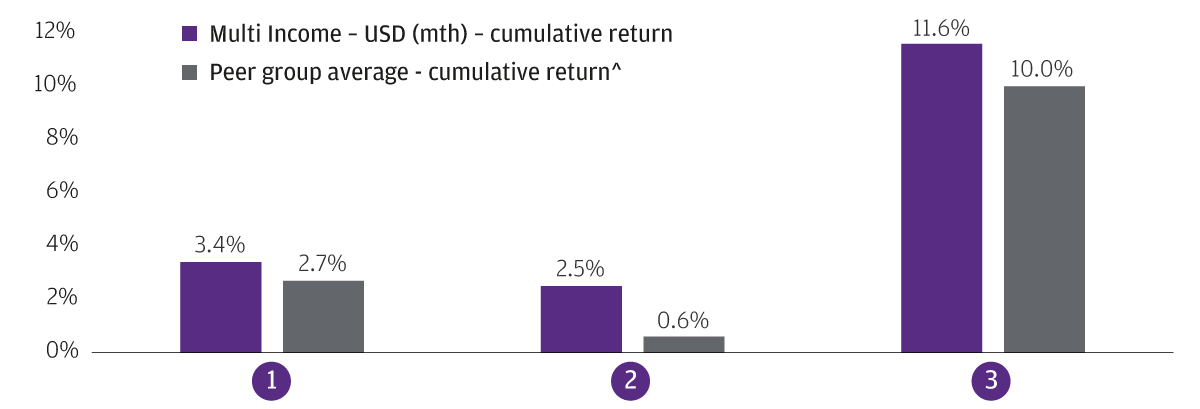

The portfolio has demonstrated the benefits of diversification through flexible asset allocation, outperforming peers in the various rising rate periods in the past five years, as illustrated in the chart below.

Our Fund's performance during rising rate periods

Source: J.P. Morgan Asset Management, Bloomberg. *Methodology is based on daily data. A ‘rate rise’ is defined as a 50 basis points (bps) increase in the US Treasury 10-year yield. Periods of rising rates: (1) 08.07.2016 to 15.12.2016; (2) 07.09.2017 to 30.01.2019; (3) 04.08.2020 to 21.03.2021. Fund return refers to USD (mth) class return, NAV to NAV in USD with income reinvested. Calendar year return: 2016 +7.4%; 2017 +10.6%; 2018 -5.0%; 2019 +14.8%; 2020 +4.7%; 2021 YTD as of 31.12.2021 +9.1%. Past performance is not a reliable indicator of current and future results.

^ Source: Morningstar, Inc, USD Moderate Allocation Category of HK SFC authorised funds (as of 21.03.2021, NAV to NAV in USD with income reinvested). SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors.

INCOME FROM DIVIDENDS

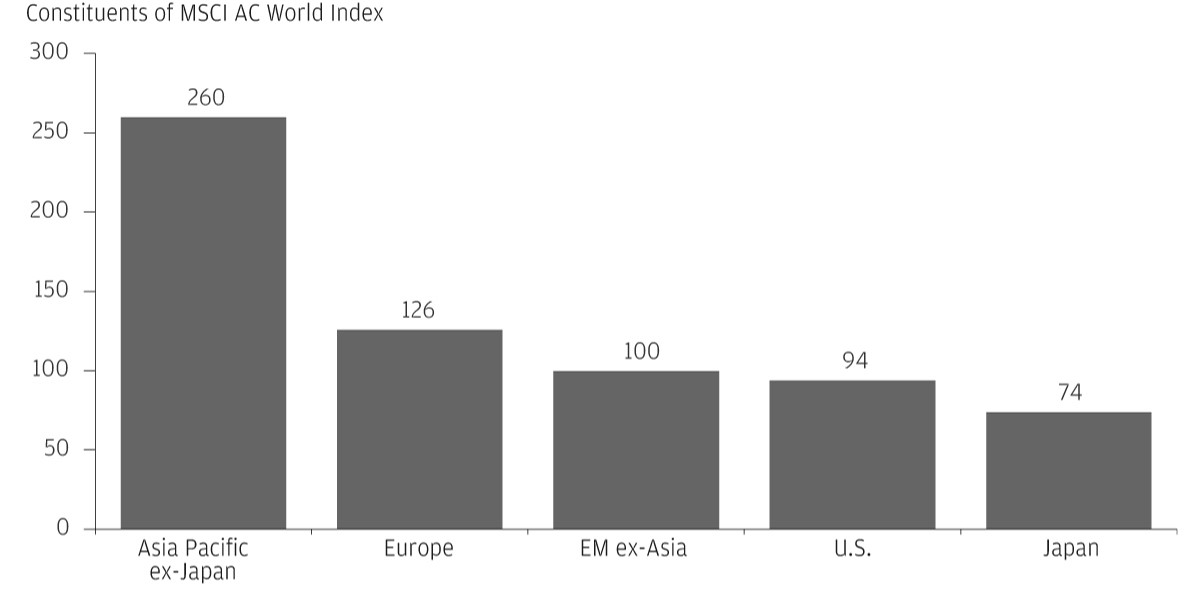

The global economic recovery continues and the fundamental picture for global dividends look cyclically attractive as economies around the world reopen and pent-up consumer demand is materialising, supporting corporate earnings.

Quality equities could offer attractive opportunities of dividend income, as illustrated in the chart below.

Number of companies yielding greater than 3% by region

Source: FactSet, MSCI, J.P. Morgan Asset Management. EM refers to emerging markets. Past performance is not a reliable indicator of current and future results. Yield is not guaranteed. Positive yield does not imply positive return. Provided for information only to illustrate macro trends, not to be construed as research or investment advice. Investments involve risks. Not all investments are suitable for all investors. Data reflect most recently available as of 30.09.2021.

INCOME FROM YIELDS

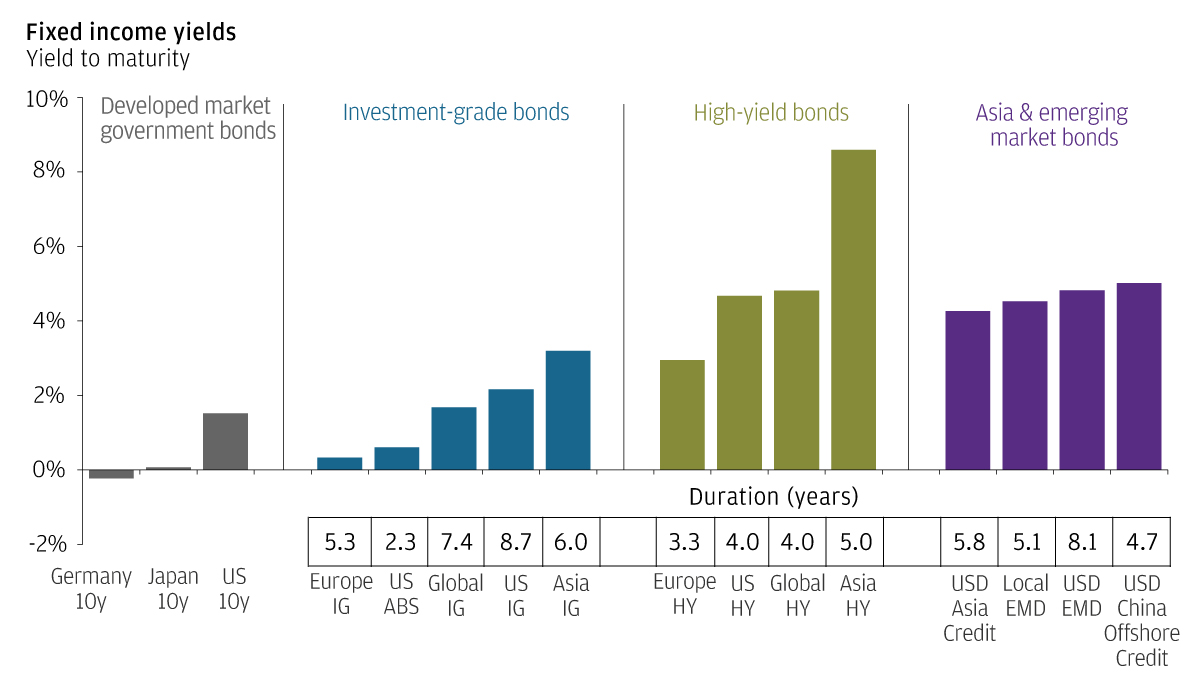

Additionally, fixed income assets with high-yielding potential like high-yield bonds continue to be a relatively attractive source of income, as illustrated in the chart below. For example, Europe high-yield bonds can present potential diversification benefits and they also have shorter duration.

In fixed income investing, duration is a gauge of interest rate risk, showing how bond prices will likely change when interest rates move. As the movement of interest rates can have a significant impact on an income portfolio, managing duration is crucial for both alpha generation and risk management4.

Global fixed income yields and duration

Source: Barclays, Bloomberg Finance L.P., FactSet, ICE BofA Merrill Lynch, J.P. Morgan Economic Research, J.P. Morgan Asset Management. Based on Bloomberg Barclays US Aggregate Credit – Corporate Investment Grade Index (US IG), Bloomberg Barclays Euro Aggregate Credit – Corporate (Europe IG), J.P. Morgan Asia Credit Investment Grade Index (Asia IG), Bloomberg Barclays Global Aggregate – Corporate (Global IG), Bloomberg Barclays US Aggregate Credit – Corporate High Yield Index (US HY), Bloomberg Barclays US Aggregate Securitized – Asset Backed Securities (US ABS), Bloomberg Barclays Pan European High Yield (Europe HY), J.P. Morgan Asia Credit High Yield Index (Asia HY), ICE BofA Global High Yield (Global HY), J.P. Morgan GBI-EM (Local EMD), J.P. Morgan EMBI Global (USD EMD), J.P. Morgan Asia Credit Index (JACI) (USD Asia Credit), J.P. Morgan Asia Credit China Index (USD China Offshore Credit). Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years. Yields are not guaranteed, positive yield does not imply positive return. Past performance is not a reliable indicator of current and future results. Data reflect most recently available as of 30.09.2021.

INCOME FROM HYBRID ASSETS

Other hybrid assets such as preferred equities are also generally higher in the capital structure compared with common stocks. Such assets are also generally supported by the strong fundamentals in financials and robust capitalisation of banks5, which comprise the majority of preferred equities.

Drawing on 50+ years of experience in multi-asset investing as a team, we dynamically allocate across geographies, asset classes, market capitalisation and capital structures, striving to provide investors with a consistent and attractive income stream and the opportunity for capital growth in a truly diversified portfolio.

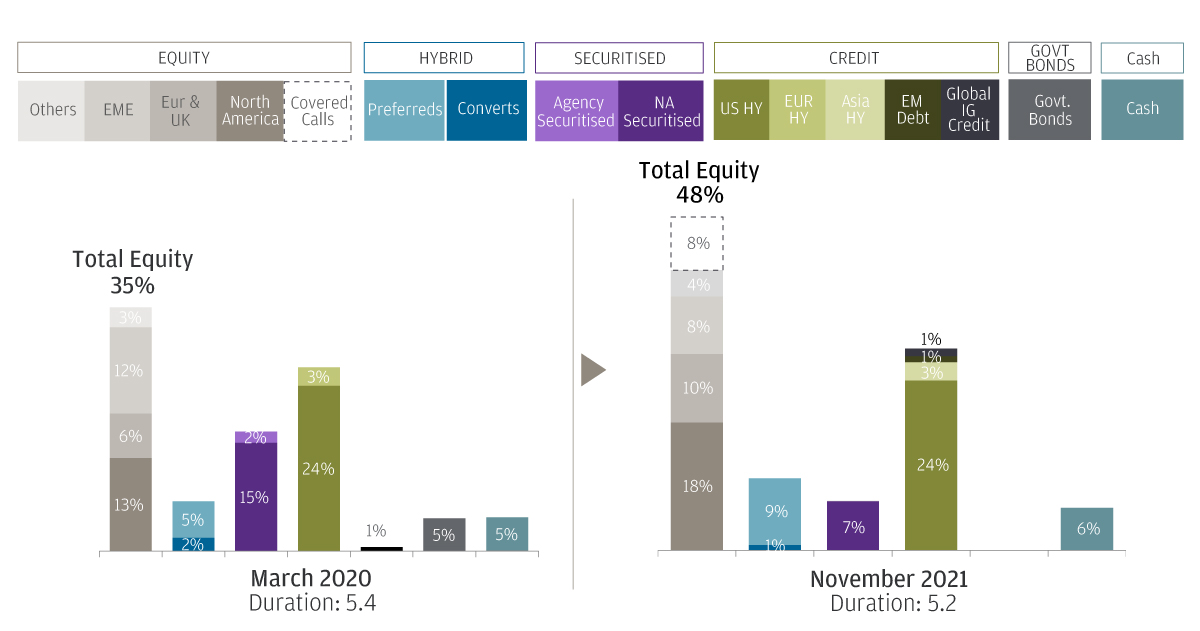

A dynamic multi-asset approach allows investors to seek the high-conviction income opportunities in the prevailing market conditions. The portfolio6 has maintained a risk-on tilt since the COVID-19 drawdown in March 2020, favouring equity exposures that are geared to continued recovery, as well as adding covered call positions which provided attractive income and upside participation opportunities. Within fixed income, we have preferred low-duration, high-carry credit such as high yield where we continue to see strong fundamentals.

By shifting tactically across asset classes and regions, JPMorgan Multi Income Fund is able to exploit market dislocations, seeking to deliver a sustainable yield6* in this fast-changing market environment, as illustrated in the chart below. (*The Fund’s mth – USD share class aims at monthly distribution. Dividend rate is not guaranteed. Distributions maybe paid from capital Refer to important information 3.)

A flexible and dynamic approach6

6. Source: J.P. Morgan Asset Management. Allocation data as at 31.03.2020 and 30.11.2021. The Fund is an actively managed portfolio, holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. Cash exposure represents both physical cash and derivative cash offset.

Indices do not include fees or operating expenses and are not available for actual investment. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstances and market conditions.

High-yield credit refers to corporate bonds which are given ratings below investment grade and are deemed to have a higher risk of default. Yield is not guaranteed. Positive yield does not imply positive return. Diversification does not guarantee investment return and does not eliminate the risk of loss.