Morgan Direct Demo

-

1. Payment Summary

-

2. Real Time Direct Debit (via J.P. Morgan DIRECT Investment Platform to set up)

-

2.1 HSBC

-

2.2 Hang Seng Bank

-

2.3 Standard Chartered

-

2.4 Bank of China

-

2.5 Citibank

-

3. Faster Payment System (FPS)

-

3.1 Standard Chartered

-

3.2 Bank of China

-

3.3 Citibank

-

4. HSBC Autopay Service

-

5. HSBC Bill Payment Service

-

6. Bank’s Money Transfer Service

Payment Summary

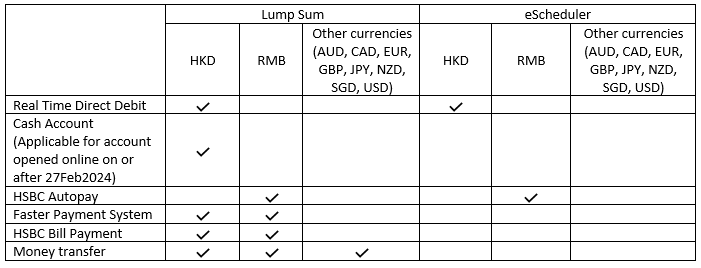

HOW TO MAKE ONLINE PAYMENT

Please note:

- RMB payment (except for JPMAM (China) Fund Range) can be made via HSBC’s Autopay, HSBC’s Bill Payment or Money Transfer, while payment for JPMAM (China) Fund Range can only be made via HSBC’s Autopay or Money Transfer. For eScheduler investments in JPMAM (China) Fund Range, payment must be made via HSBC’s Autopay.

- Payment in other currencies (AUD, CAD, EUR, GBP, NZD, SGD, JPY and USD) can only be made via Money Transfer.

- Switching from/to JPMAM (China) Fund Range is not allowed.

- Currently, Money Transfer only supports online lump sum transactions (excluding those made via eScheduler). Payment made via Money Transfer must be in the same currency as the one selected during order placement.

- Please be aware that severe weather conditions (such as an issuance of Typhoon Signal No.8 or above, or a Black Rainstorm Warning by the Hong Kong Observatory, or an announcement of "Extreme Conditions" by the Government of the Hong Kong Special Administrative Region) may impact payment via HSBC bill payment and may result in order rejection. Please consider using other payment methods on severe weather days.

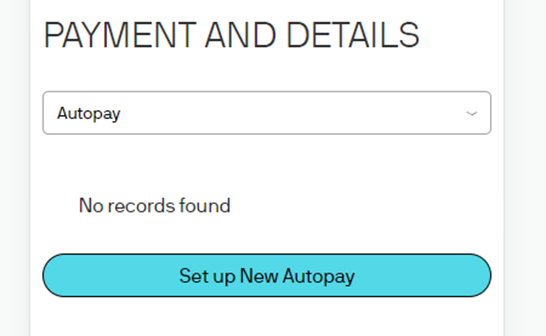

DIFFERENCES BETWEEN PAYMENT METHODS

The differences between payment methods are listed below:

HSBC Real Time Direct Debit

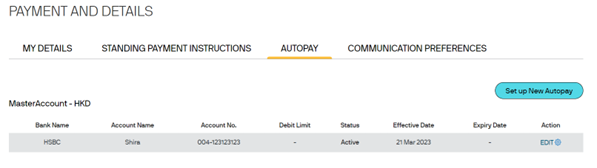

Introduction

To set up your Real Time Direct Debit (Autopay) and Standing Payment Instruction (SPI) instruction, you first need to logon to eTrading.

- Then go to the “My Account” and press “Payment and Details (SPI & Autopay)”.

- You may need to re-enter your login password.

- Under “Autopay” function, press “set up New Autopay”.

Desktop View

Mobile View

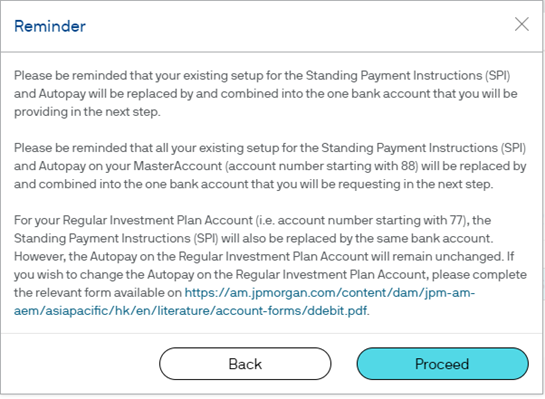

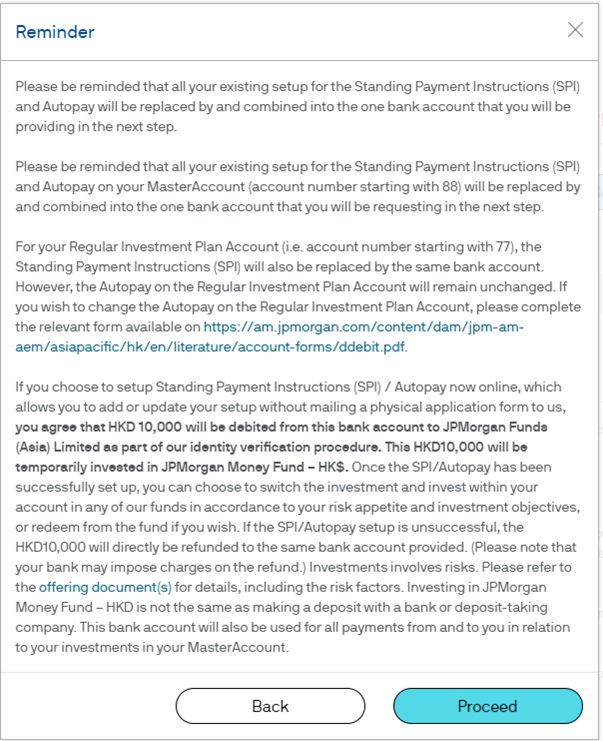

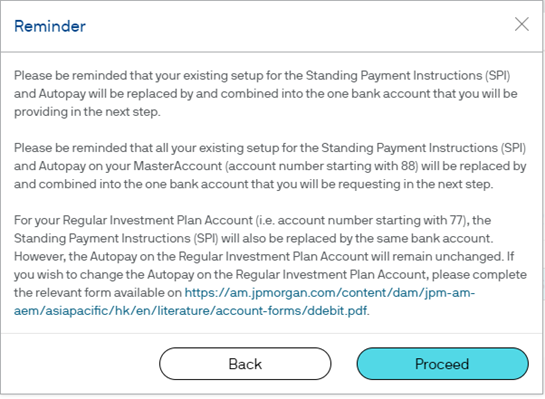

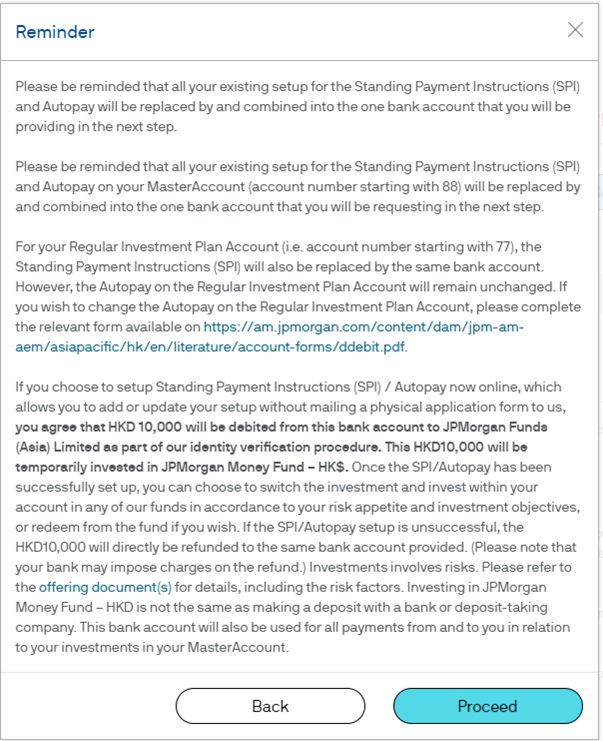

Client may carefully read the reminder (i.e., it may vary depending on your account setup) below and to click “Proceed” for the Reminder.

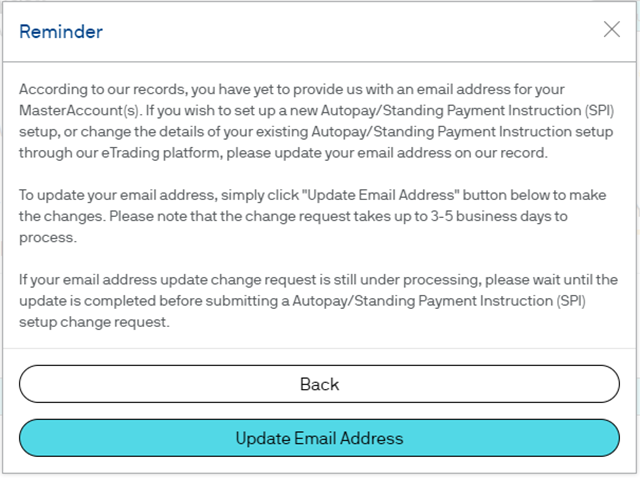

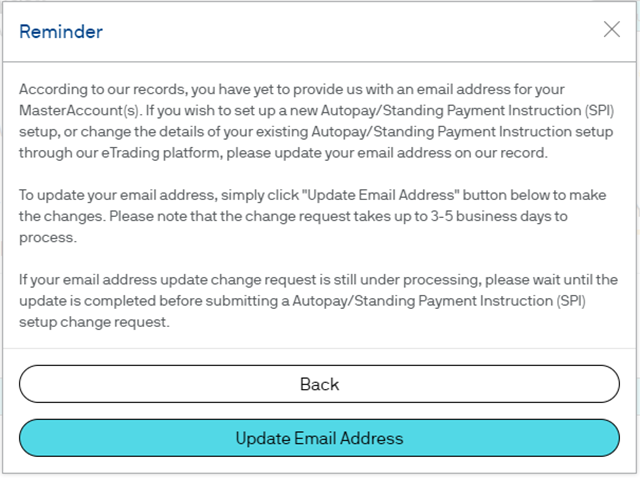

To update your email address (if it is not in existing record), before proceeding with the bank change request online.

STEP 1

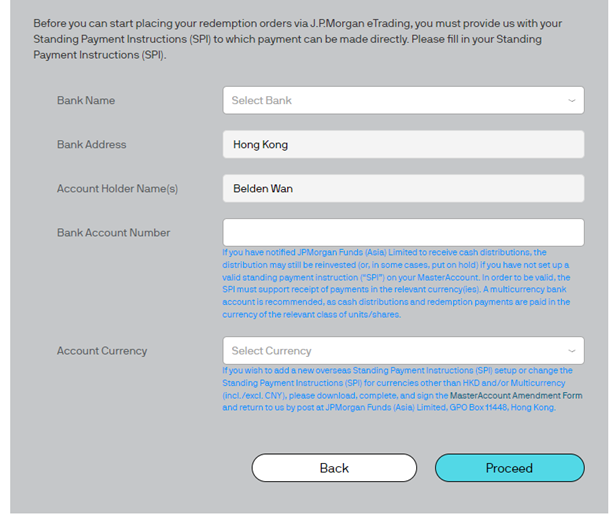

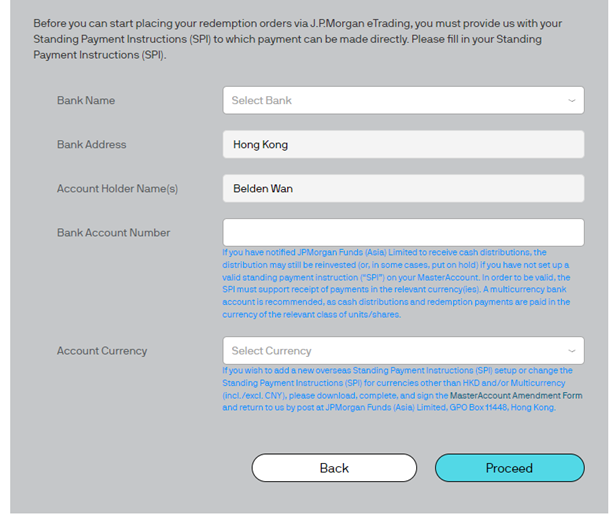

Check your details and enter the bank details for the Standing Payment Instructions update.

STEP 2

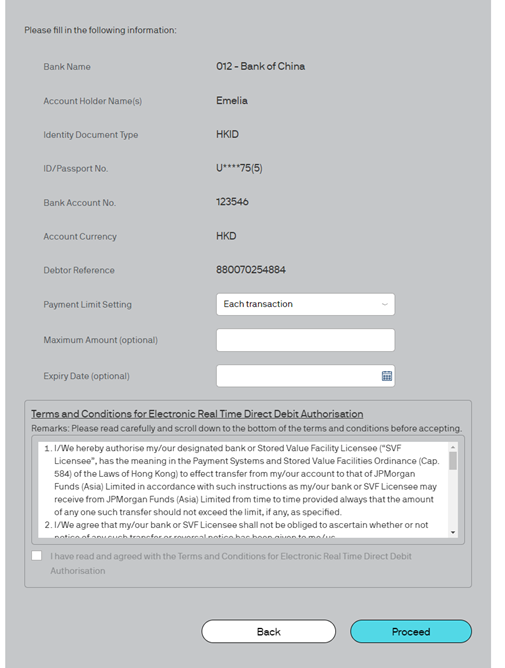

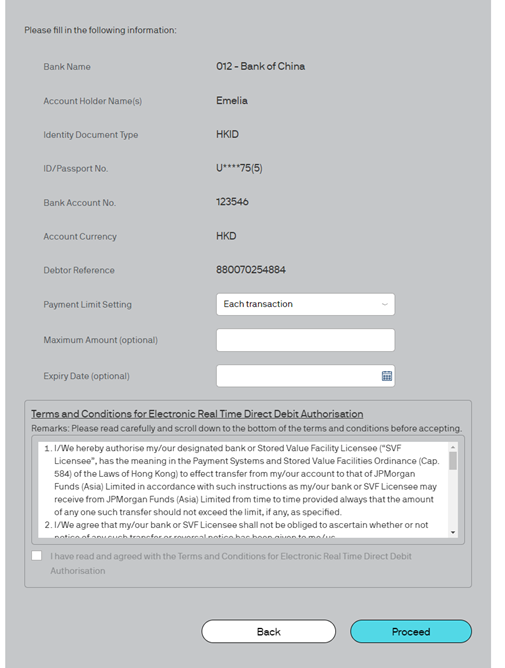

Check your details and enter the bank details for the Autopay update.

“Maximum Amount” & “Expiry Date” are the optional fields.

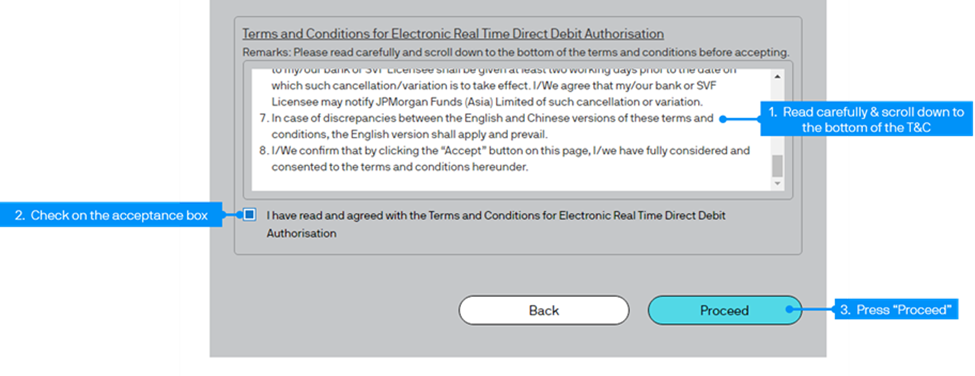

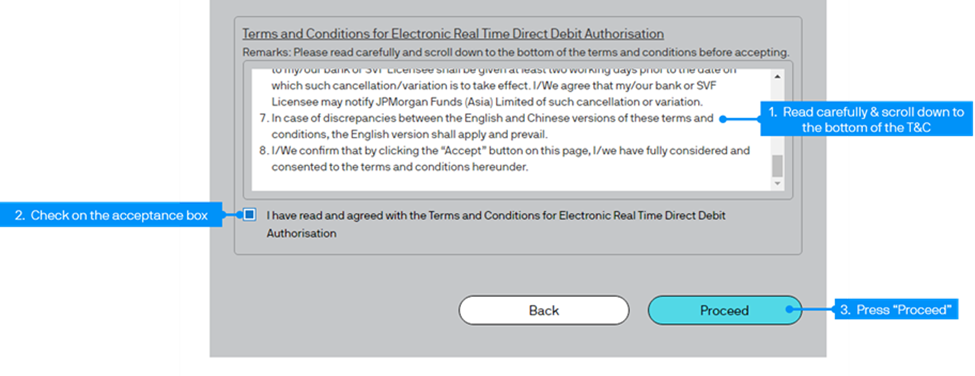

Then read carefully and scroll down to the bottom of the terms and conditions before check on the acceptance box. Press “Proceed”.

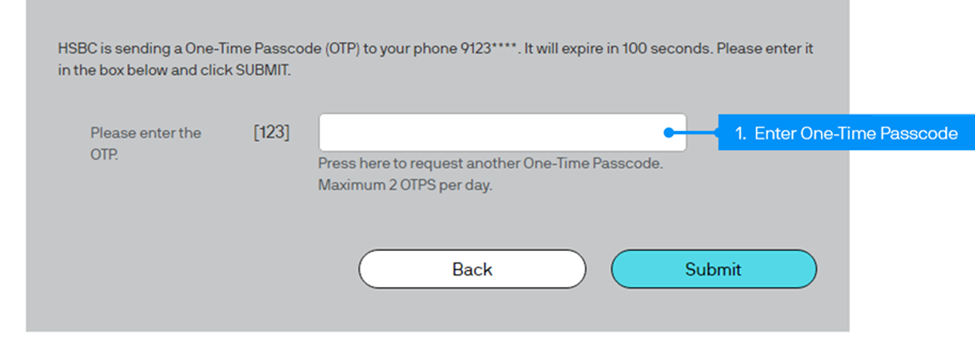

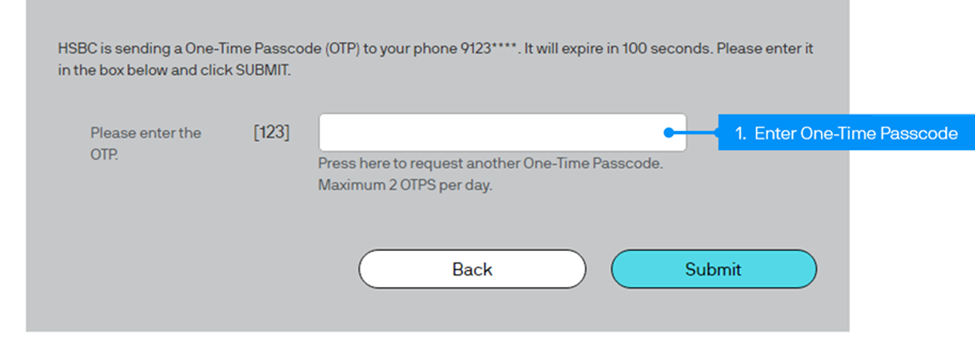

If client is using HSBC, you will receive a One-Time Passcode (OTP) from HSBC. Enter the OTP then press “Submit” to proceed. OTP will expire in 100 seconds. Each day could only retrieve 2 OTPs per day.

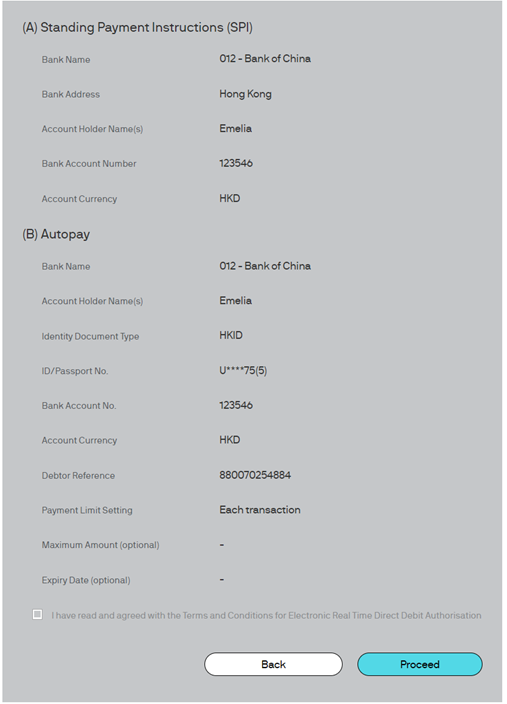

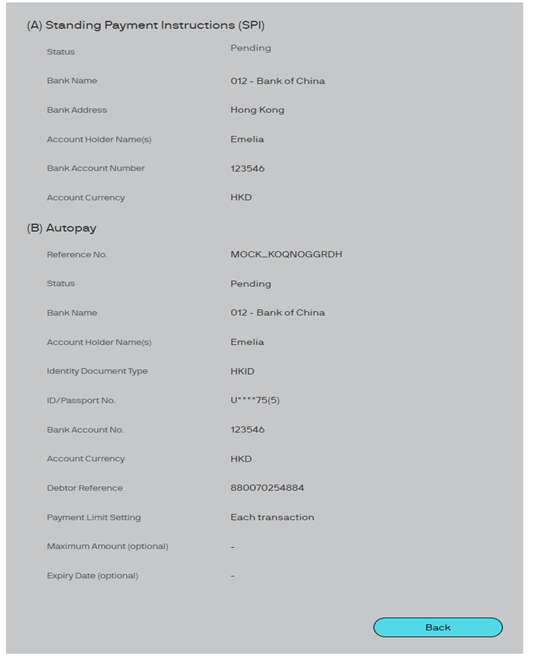

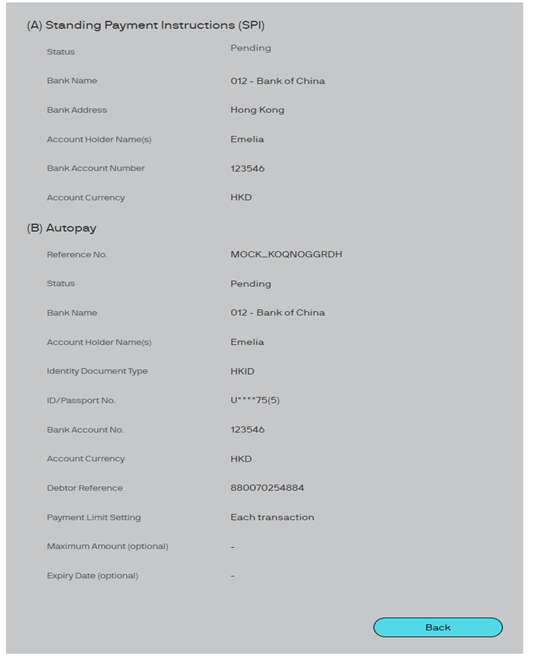

STEP 3

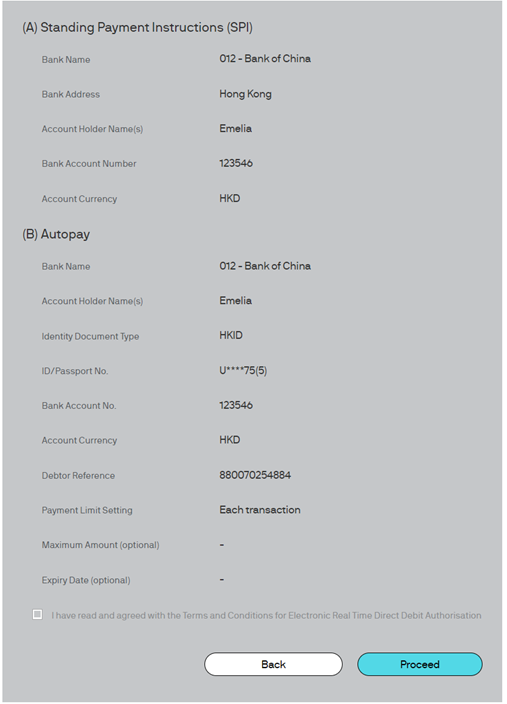

To check carefully your information in the “Confirmation” page. Then to click “Proceed”.

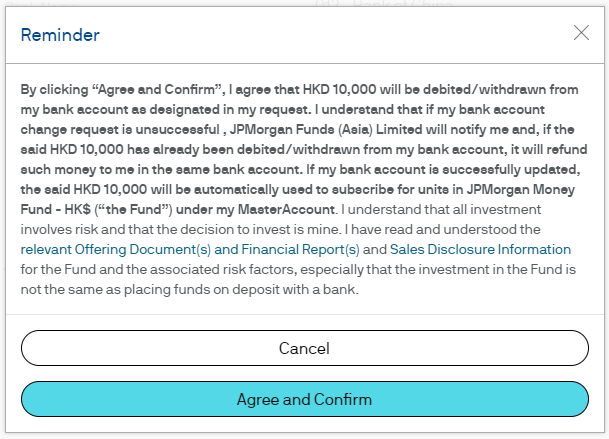

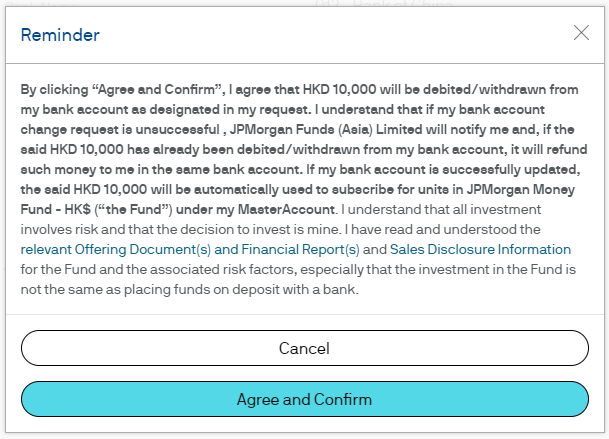

Client may carefully read the reminder (i.e., it may vary depending on your account setup) below and to click “Agree and Confirm” for the Reminder.

STEP 4

Successful submission will show the “Step 4 – Acknowledgement” page. Press “Back” button and move back to the “Payment and Details” page.

Client will receive emails for update request eAcknowledgement and when update is completed.

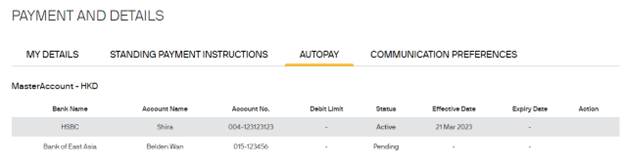

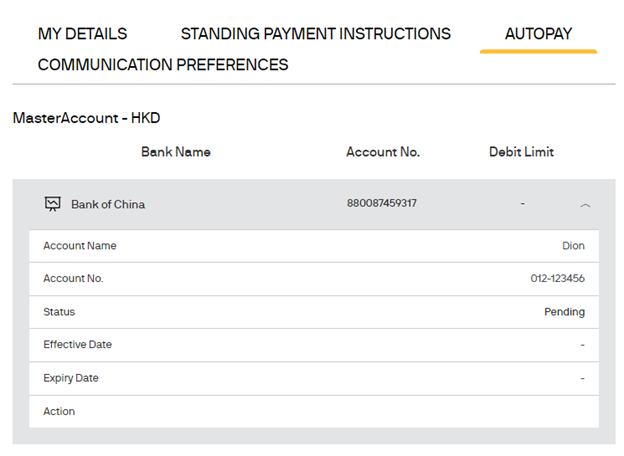

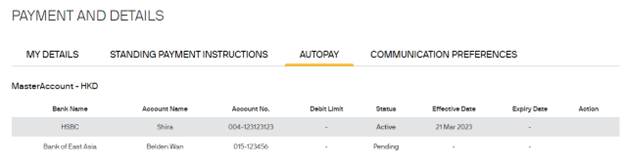

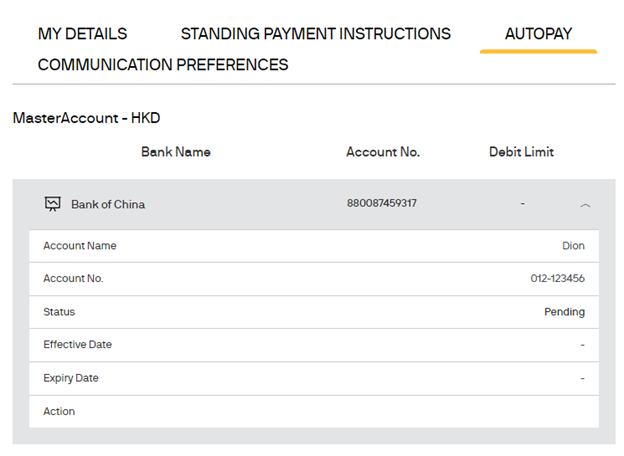

STEP 5

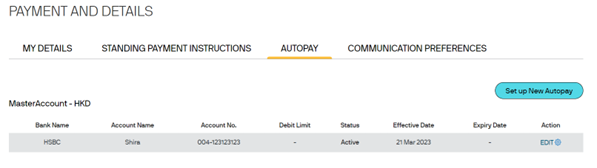

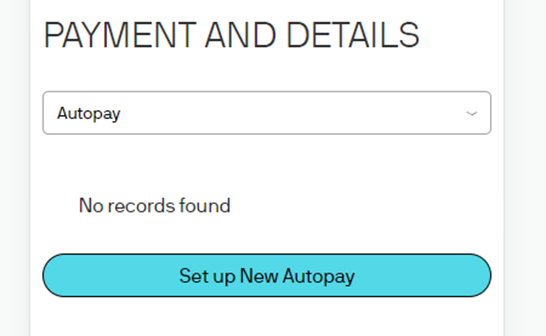

Your setup Standing Payment Instructions & Autopay are showing on “Payment and Details” page. You could edit the payment details when necessary.

Once the “Status” has turned to “Active”, the Standing Payment Instructions & Autopay will be ready for use.

Desktop View

Mobile View

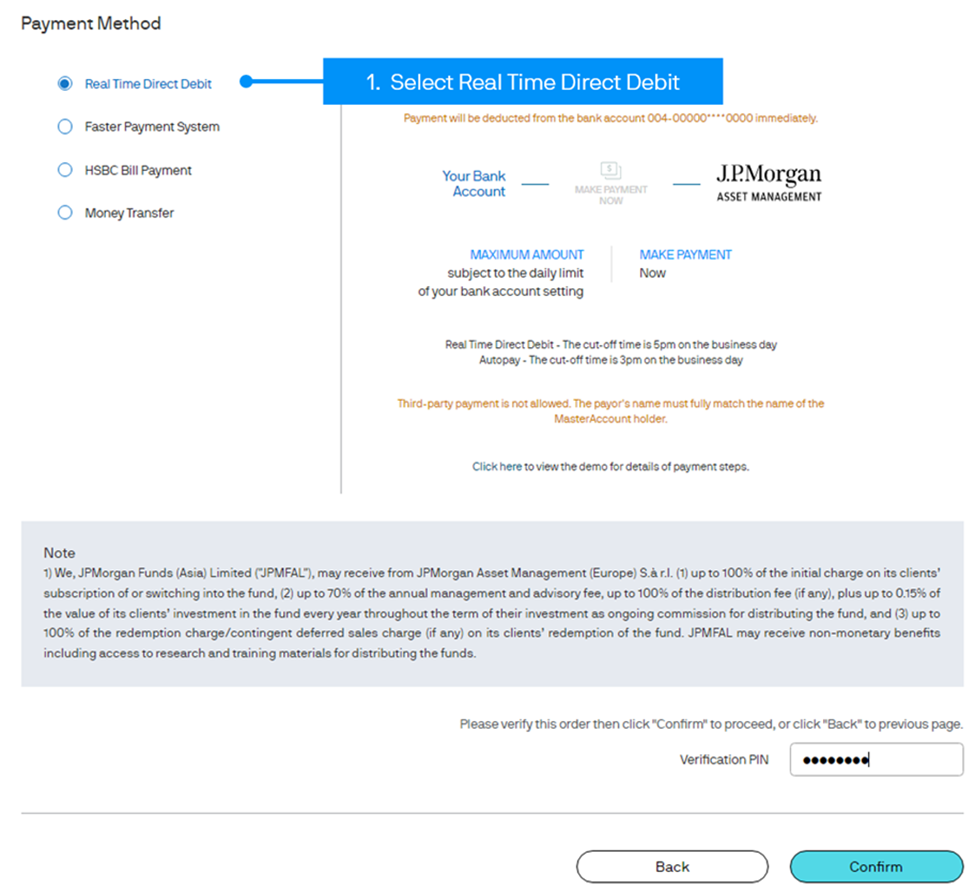

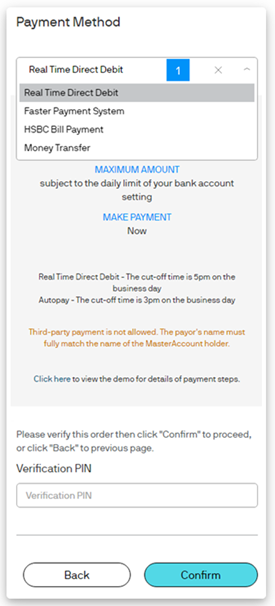

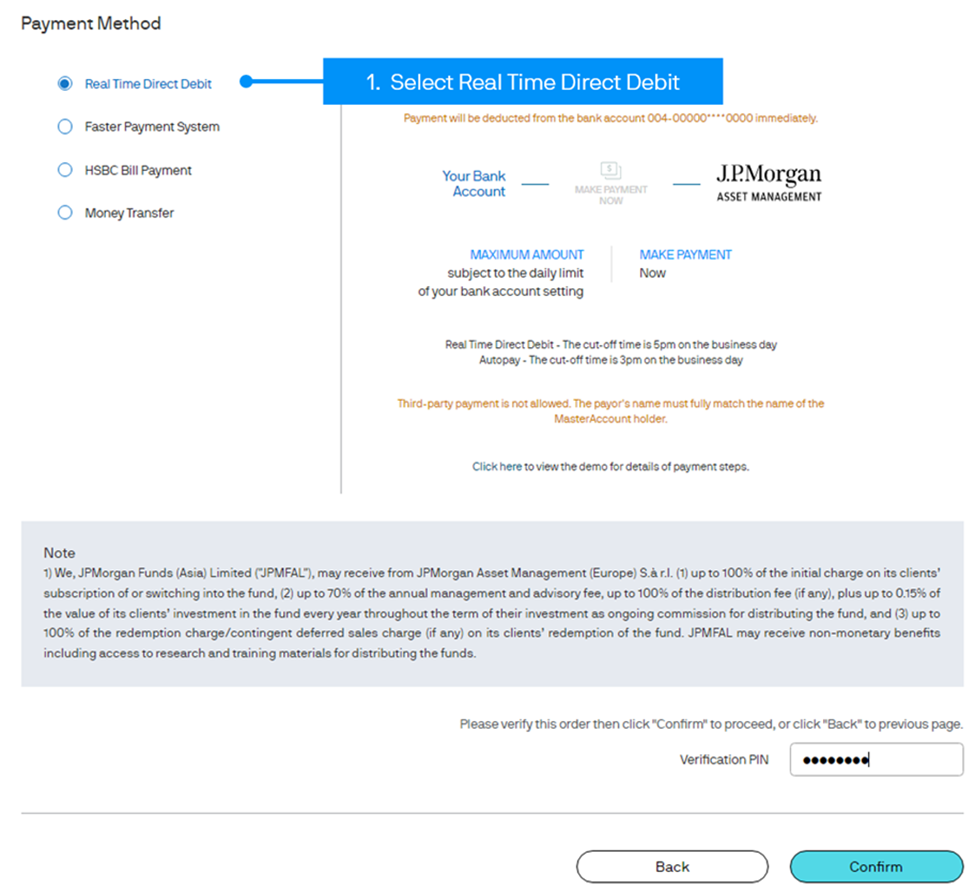

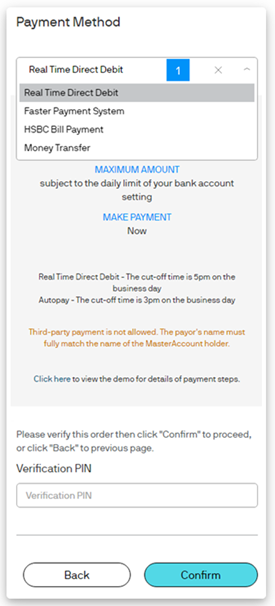

STEP 6

Follow the screen instructions to place your buy order and select “Real Time Direct Debit” as the payment method. Enter your Verification PIN and press “Confirm” to proceed.

We will collect the investment proceeds from your bank account instantly. Please make sure there are sufficient funds in your bank account.

Desktop View

Mobile View

HSBC Real Time Direct Debit

Introduction

To set up your Real Time Direct Debit (Autopay) and Standing Payment Instruction (SPI) instruction, you first need to logon to eTrading.

- Then go to the “My Account” and press “Payment and Details (SPI & Autopay)”.

- You may need to re-enter your login password.

- Under “Autopay” function, press “set up New Autopay”.

Desktop View

Mobile View

Client may carefully read the reminder (i.e., it may vary depending on your account setup) below and to click “Proceed” for the Reminder.

To update your email address (if it is not in existing record), before proceeding with the bank change request online.

STEP 1

Check your details and enter the bank details for the Standing Payment Instructions update.

STEP 2

Check your details and enter the bank details for the Autopay update.

“Maximum Amount” & “Expiry Date” are the optional fields.

Then read carefully and scroll down to the bottom of the terms and conditions before check on the acceptance box. Press “Proceed”.

If client is using HSBC, you will receive a One-Time Passcode (OTP) from HSBC. Enter the OTP then press “Submit” to proceed. OTP will expire in 100 seconds. Each day could only retrieve 2 OTPs per day.

STEP 3

To check carefully your information in the “Confirmation” page. Then to click “Proceed”.

Client may carefully read the reminder (i.e., it may vary depending on your account setup) below and to click “Agree and Confirm” for the Reminder.

STEP 4

Successful submission will show the “Step 4 – Acknowledgement” page. Press “Back” button and move back to the “Payment and Details” page.

Client will receive emails for update request eAcknowledgement and when update is completed.

STEP 5

Your setup Standing Payment Instructions & Autopay are showing on “Payment and Details” page. You could edit the payment details when necessary.

Once the “Status” has turned to “Active”, the Standing Payment Instructions & Autopay will be ready for use.

Desktop View

Mobile View

STEP 6

Follow the screen instructions to place your buy order and select “Real Time Direct Debit” as the payment method. Enter your Verification PIN and press “Confirm” to proceed.

We will collect the investment proceeds from your bank account instantly. Please make sure there are sufficient funds in your bank account.

Desktop View

Mobile View

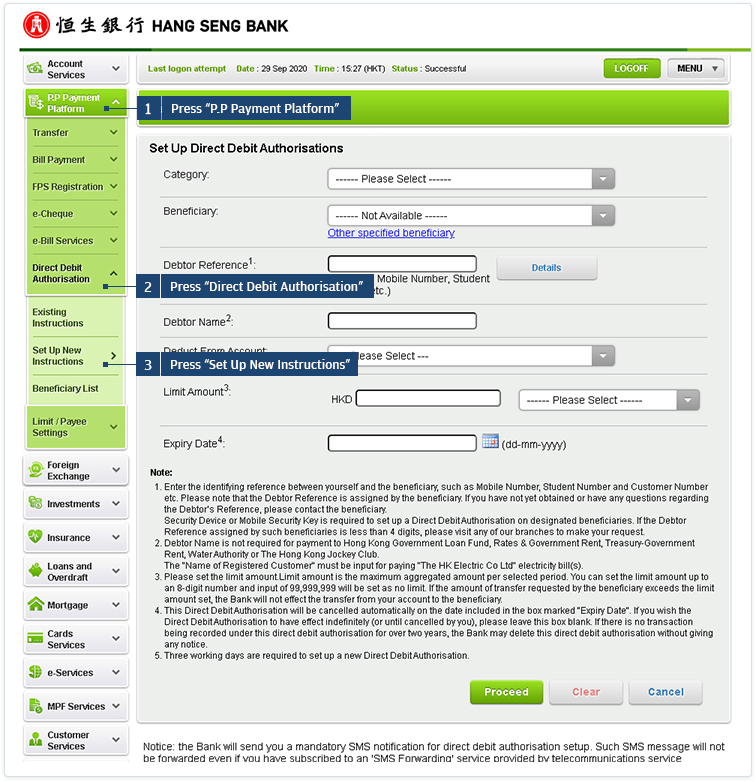

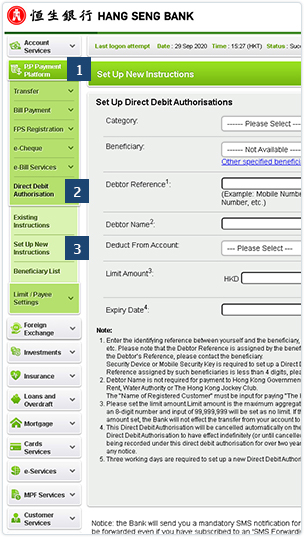

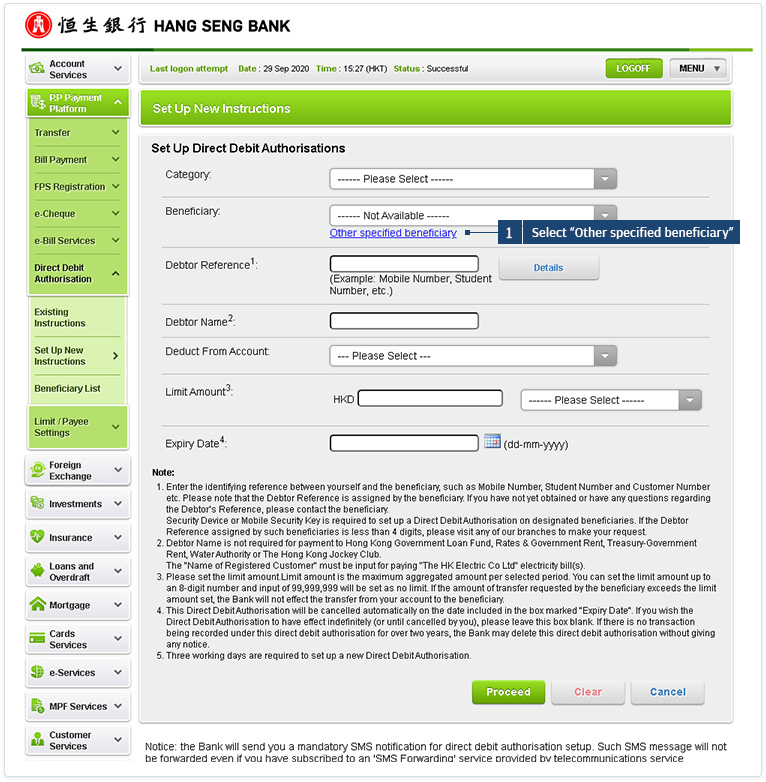

Hang Seng Bank

STEP 1

Log in to Hang Seng Personal eBanking. Go to the “P.P Payment Platform >> Direct Debit Authorisation” section, then press “Set Up New Instructions”.

- Press “P.P Payment Platform”

- Press “Direct Debit Authorisation”

- Press “Set Up New Instructions”

Desktop View

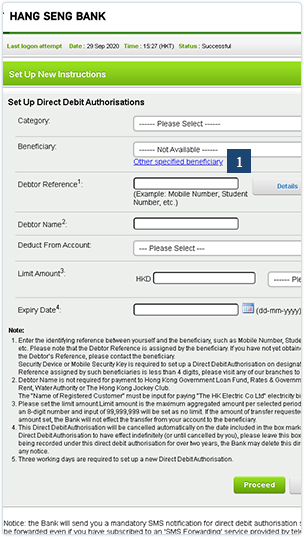

Mobile View

STEP 2

Select “Other specified beneficiary” under “Beneficiary”.

- Select “Other specified beneficiary”

Desktop View

Mobile View

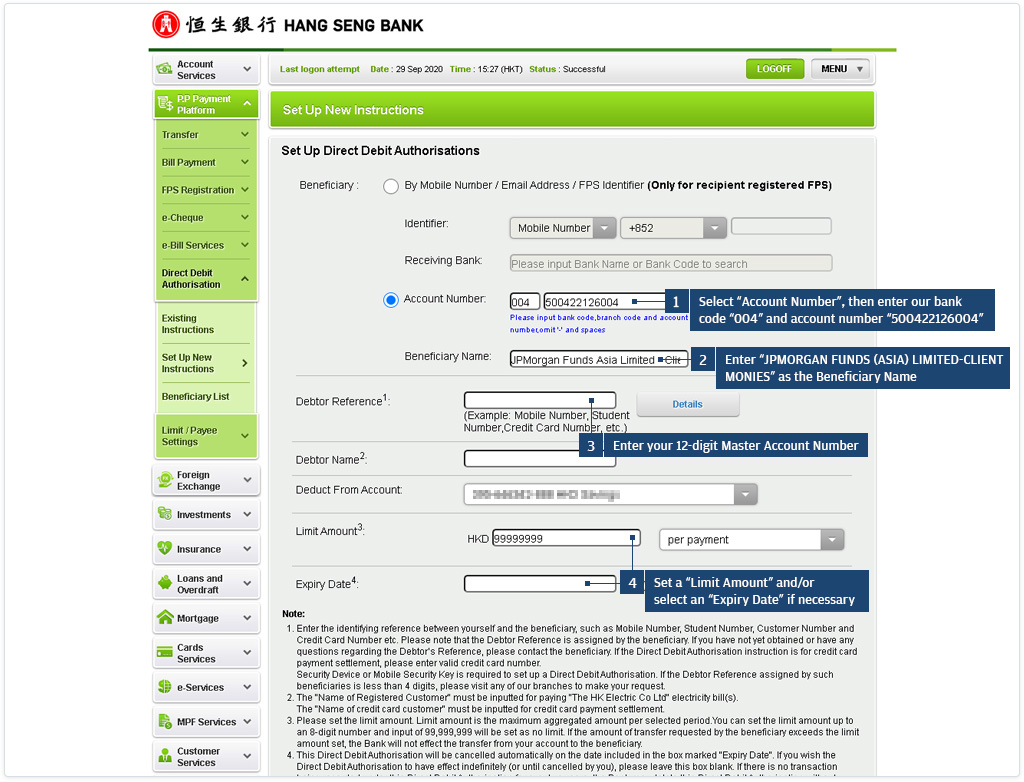

STEP 3

Select “Account Number” under “Beneficiary”. Then enter our bank code “004” and account number “500422126004”, and “JPMORGAN FUNDS (ASIA) LIMITED-CLIENT MONIES” as the Beneficiary Name.

Enter the relevant payment information, then press “Proceed”.

- Select “Account Number”, then enter our bank code “004” and account number “500422126004”

- Enter “JPMORGAN FUNDS (ASIA) LIMITED-CLIENT MONIES” as the Beneficiary Name

- Enter your 12-digit MasterAccount Number

- Set a “Limit Amount” and/or select an “Expiry Date” if necessary

Desktop View

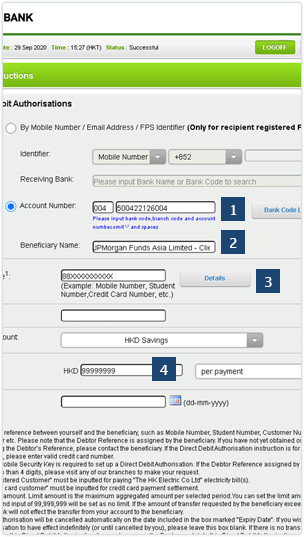

Mobile View

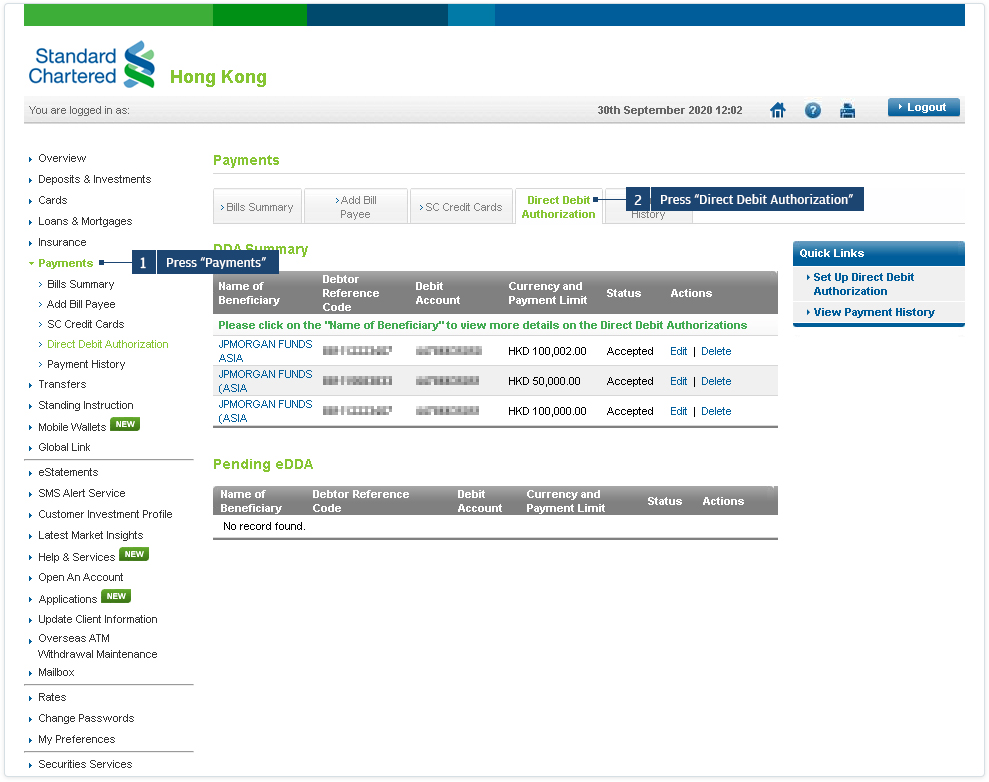

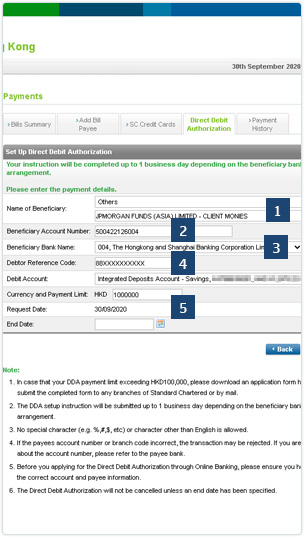

Standard Chartered

STEP 1

Log in to Standard Chartered Online Banking. Then go to the “Payments” section and press “Direct Debit Authorization”.

- Press “Payments”

- Press “Direct Debit Authorization”

Desktop View

Mobile View

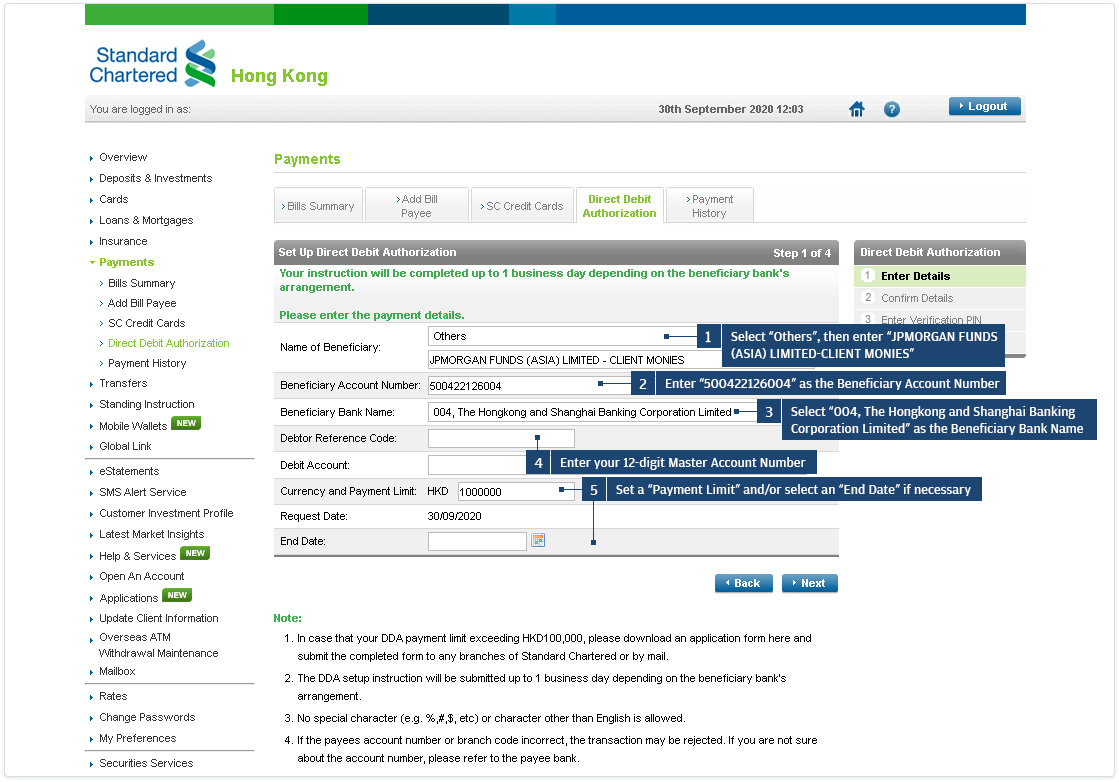

STEP 2

Under “Name of Beneficiary”, select “Others” from the dropdown list and enter “JPMORGAN FUNDS (ASIA) LIMITED-CLIENT MONIES”.

Enter the relevant payment information and click “Next”.

- Select “Others”, then enter “JPMORGAN FUNDS (ASIA) LIMITED-CLIENT MONIES”

- Enter “500422126004” as the Beneficiary Account Number

- Select “004, The Hongkong and Shanghai Banking Corporation Limited” as the Beneficiary Bank Name

- Enter your 12-digit MasterAccount Number

- Set a “Payment Limit” and/or select an “End Date” if necessary

Desktop View

Mobile View

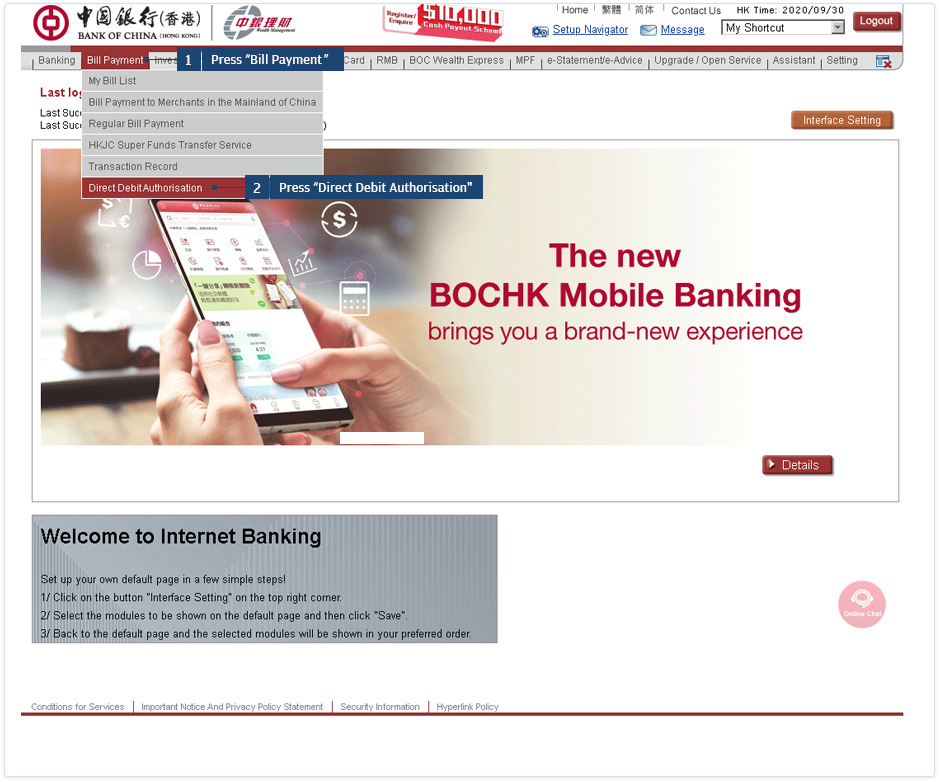

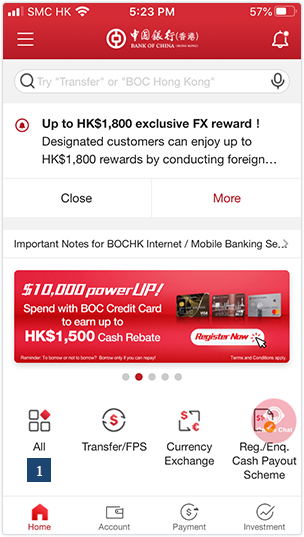

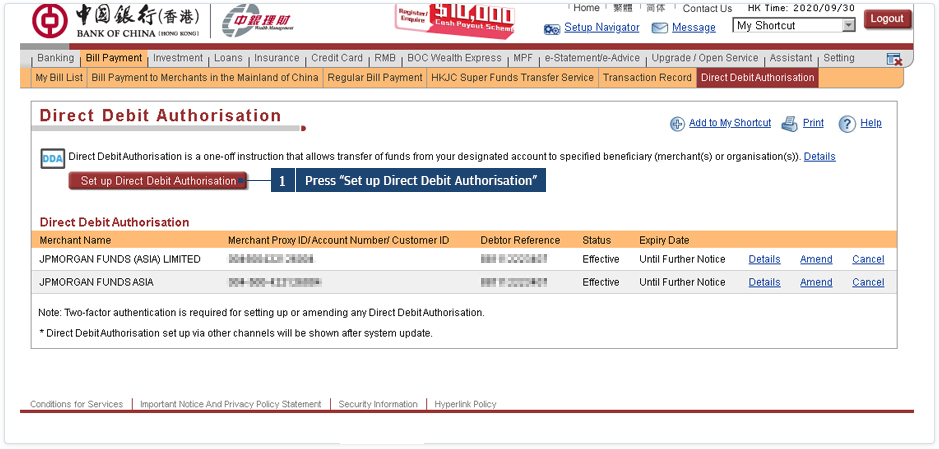

Bank of China Real Time Direct Debit

STEP 1

Log in to BOCHK Personal Internet Banking. Select “Direct Debit Authorisation” under the “Bill Payment” section.

Open the BOCHK Mobile Banking application. Tap “All” and then select “Pay Bills” under “Transfer & Bill Payment”.

- Tap “All”

- Tap “Pay Bills”

Desktop View

Mobile View

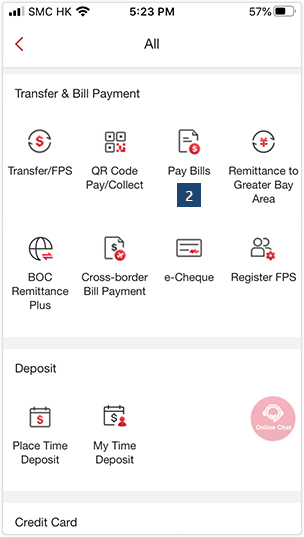

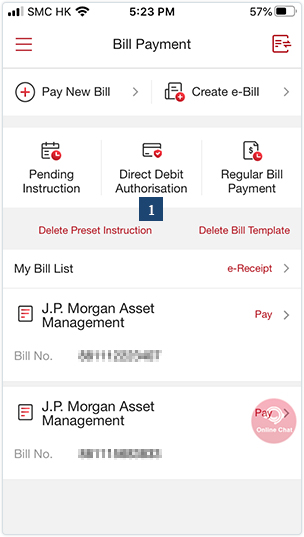

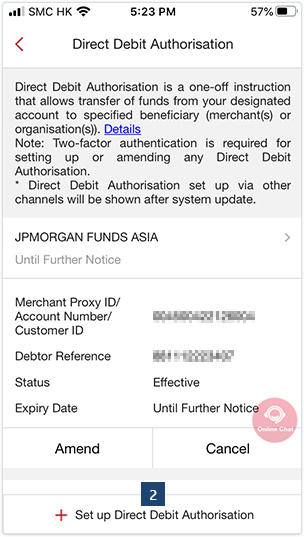

STEP 2

Press “Set up Direct Debit Authorisation”.

After logging in to your account, select “Direct Debit Authorisation” and then tap “Set up Direct Debit Authorisation”.

- Tap “Direct Debit Authorisation”

- Tap “Set up Direct Debit Authorisation”

Desktop View

Mobile View

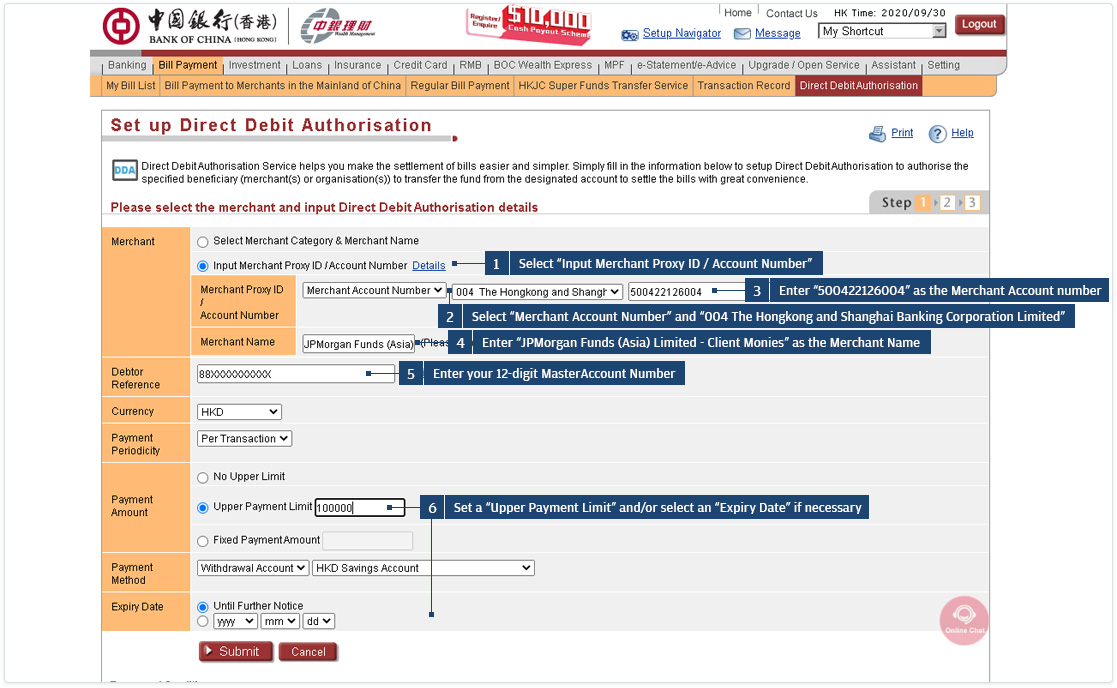

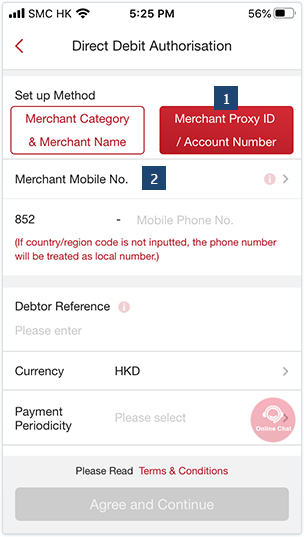

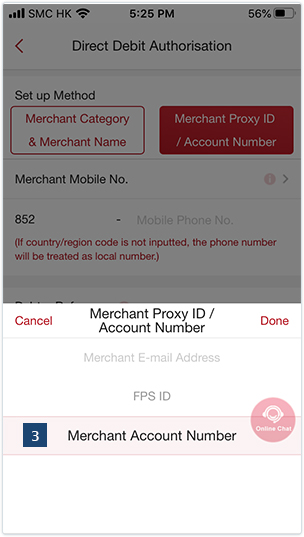

STEP 3

Select “Input Merchant Proxy ID / Account Number” under “Merchant”.

Enter the relevant payment information, then press “Submit”.

Select “Merchant Proxy ID / Account Number”. Then tap “Merchant Mobile No.” and select “Merchant Account Number”.

- Tap “Merchant Proxy ID / Account Number”

- Tap “Merchant Mobile No.”

- Select “Merchant Account Number”

Desktop View

Mobile View

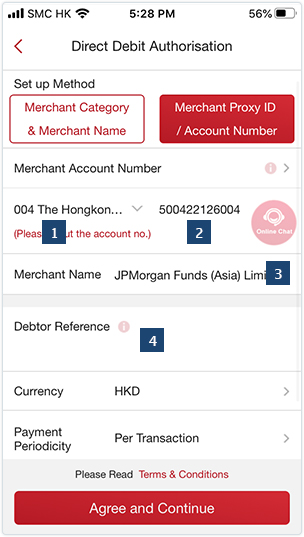

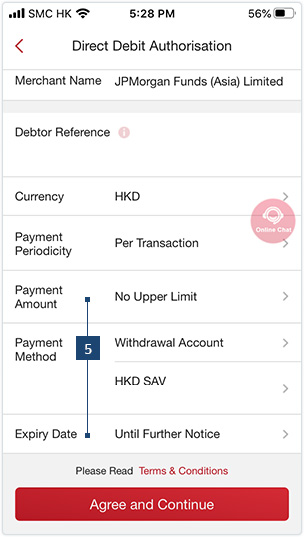

STEP 4

Enter the relevant payment information, then tap “Agree and Continue”.

Select “004 The Hongkong and Shanghai Banking Corporation Limited“ as the “Merchant Account Number“

- Enter “500422126004“ as the Merchant Account Number

- Enter “JPMorgan Funds (Asia) Limited - Client Monies“ as the Merchant Name

- Enter your 12-digit MasterAccount Number

- Set a “Payment Amount“ and/or “Expiry Date“ if necessary

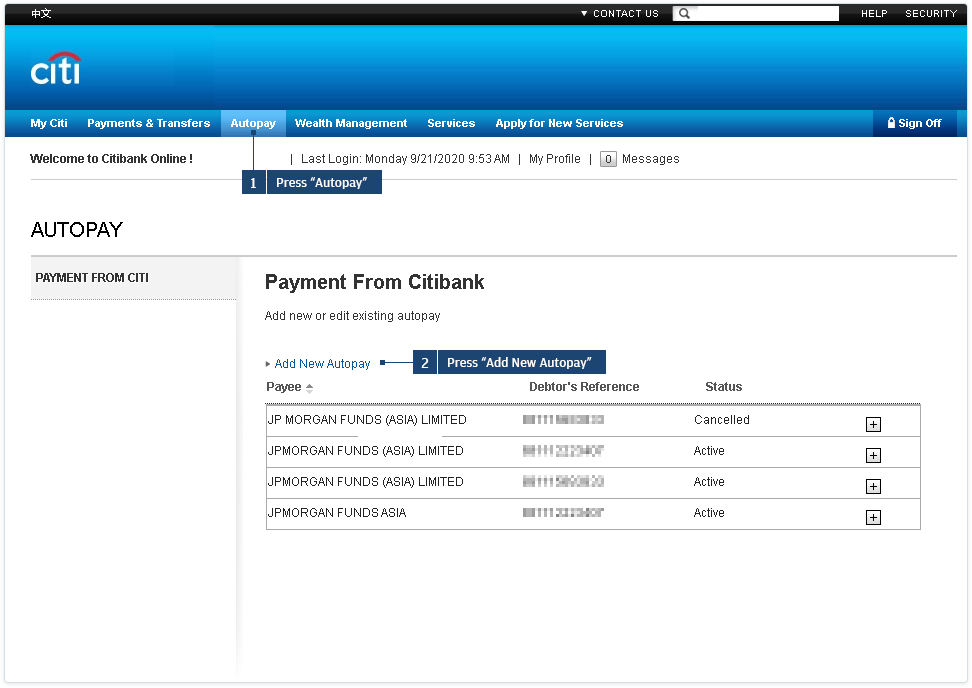

Citibank

STEP 1

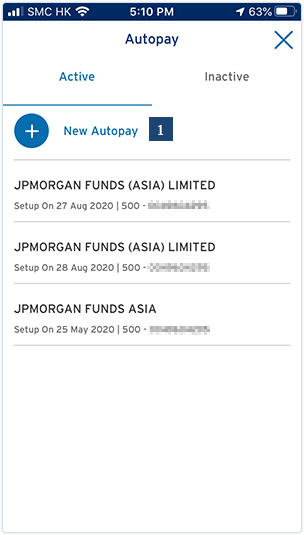

Log in to Citibank Online Banking. Press “Autopay” and select “Add New Autopay”.

Desktop View

Mobile View

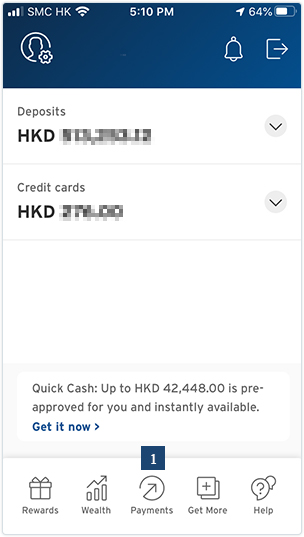

Log in to the Citi Mobile® App, then tap “Payments”.

- Tap “Payments”

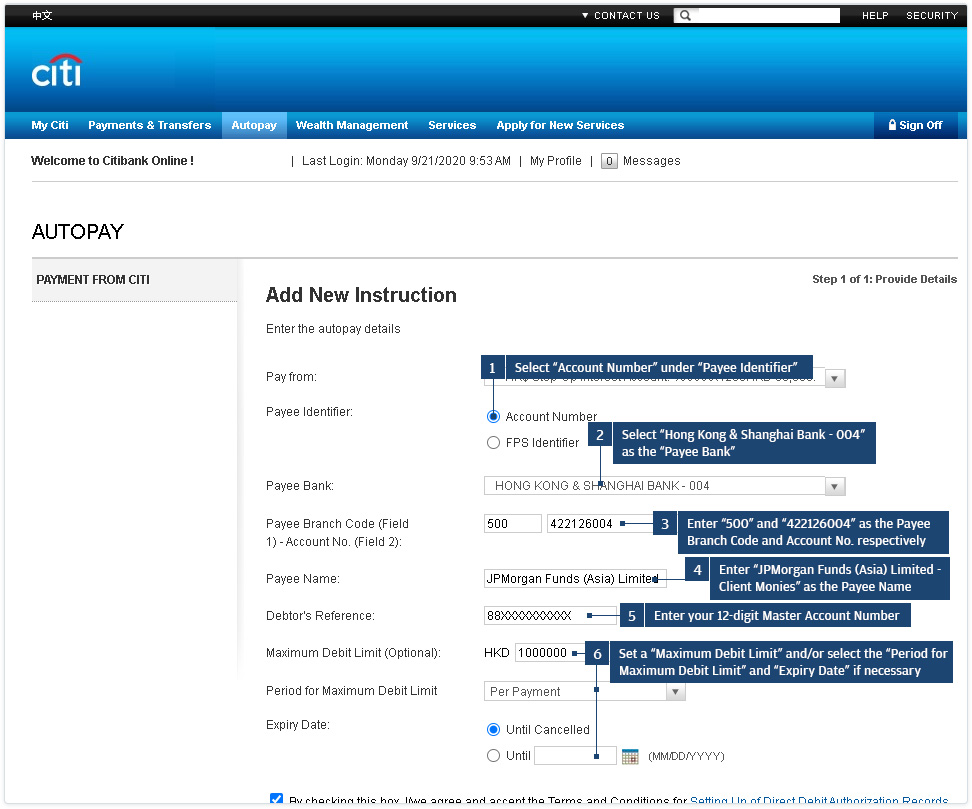

STEP 2

Enter the relevant payment information, then press “Next”.

Desktop View

Mobile View

Select “Autopay”.

- Tap “Autopay”

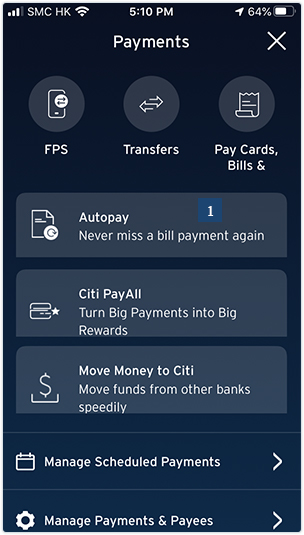

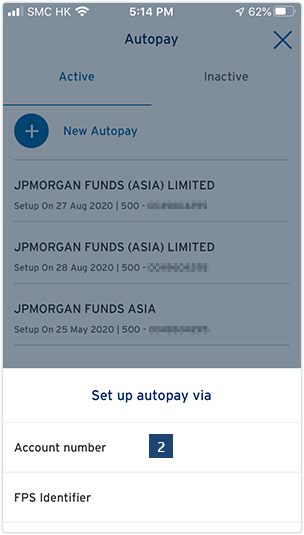

STEP 3

Mobile View

After entering a Citi Mobile® Token Unlock Code, select “New Autopay” and choose to set up autopay via “Account number”.

- Select “New Autopay”

- Choose “Account number”

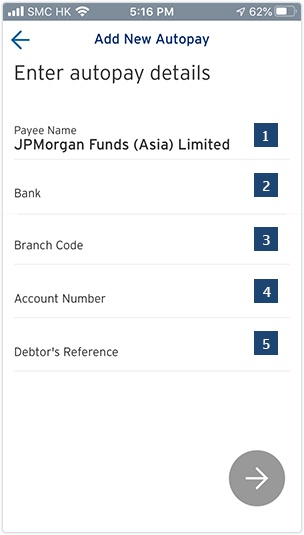

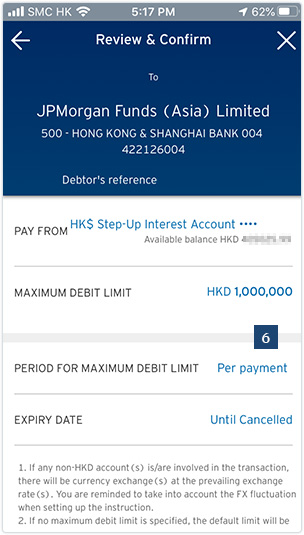

STEP 4

Mobile View

Enter the relevant payment information, then tap “Confirm”.

- Enter “JPMorgan Funds (Asia) Limited - Client Monies“ as the Payee Name

- Select “Hongkong and Shanghai Bank 004“ as the Bank

- Enter “500“ as the Branch Code

- Enter “422126004“ as the Account Number

- Enter your 12-digit MasterAccount Number

- Set a “Maximum Debit Limit“, and/or select the “Period for Maximum Debit Limit“ and “Expiry Date“ if necessary

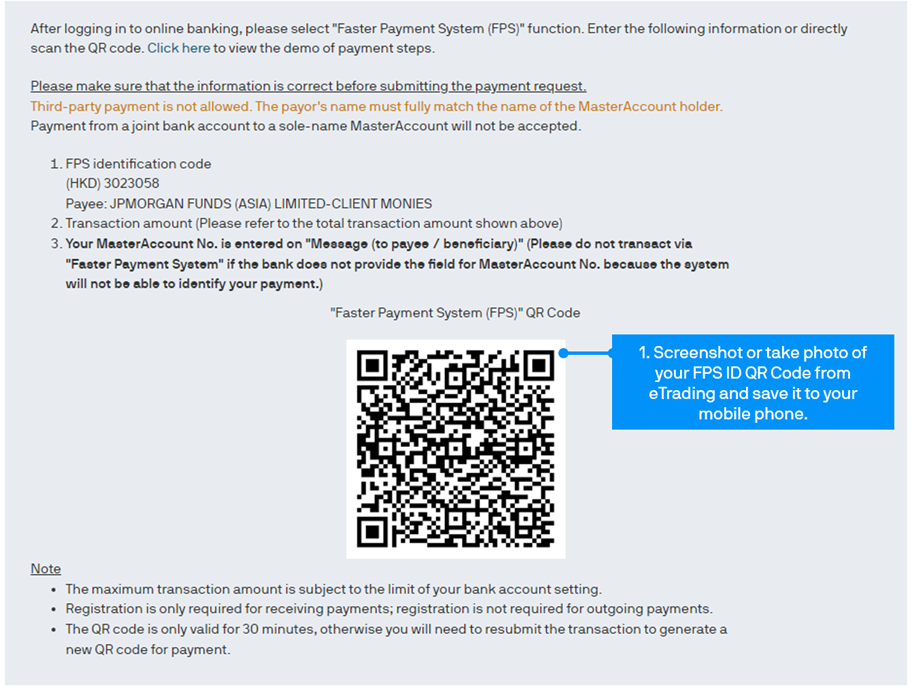

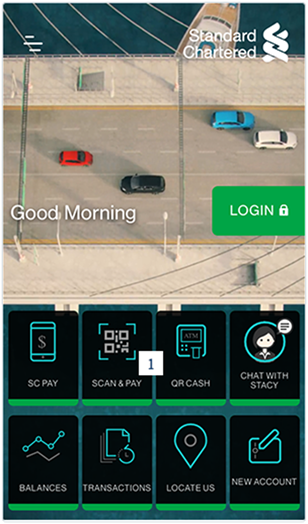

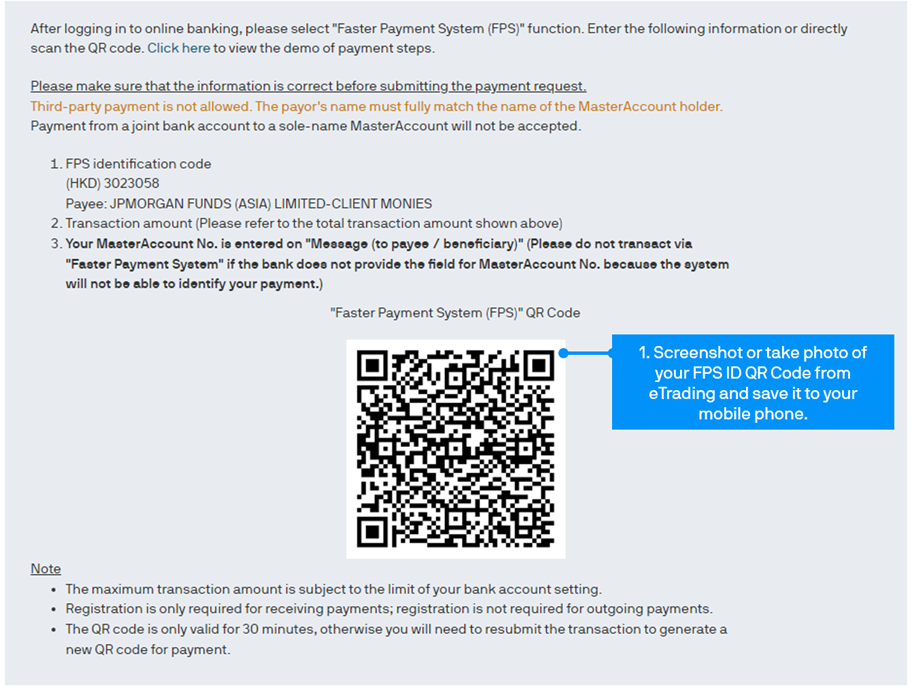

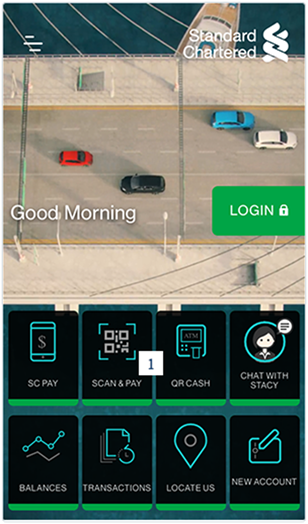

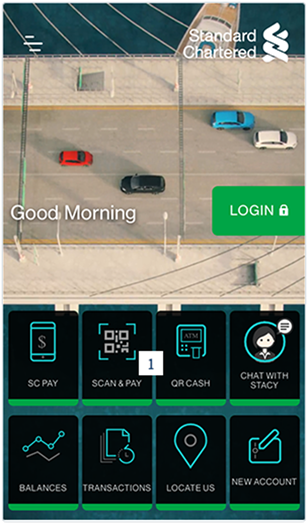

Standard Chartered Faster Payment System

PLEASE NOTE

- Standard Chartered Bank only supports Faster Payment on Mobile App.

- Third party payment is not allowed.

- The maximum transaction amount is subject to the limit of your bank account setting.

- Registration is only required for receiving payments; registration is not required for outgoing payments.

- The QR code is only required for 30 minutes, otherwise you will need to resubmit the transaction to generate a new QR code for payment.

Scanning QR Code in Mobile App

STEP 1

- Screenshot or take photo of your FPS ID QR Code from eTrading and save it to your mobile phone.

Desktop View

Mobile View

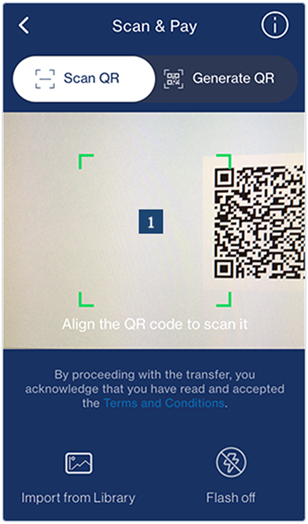

STEP 2

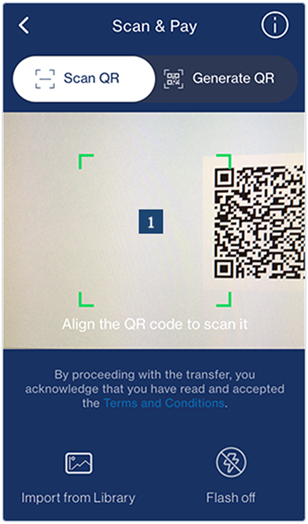

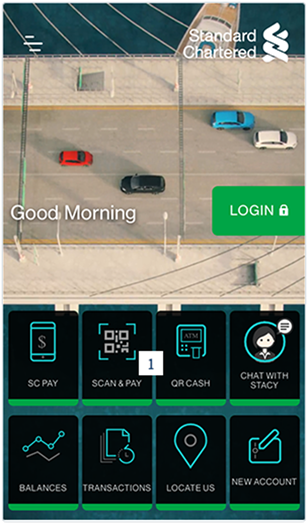

- Open your Standard Chartered Mobile App and select “Scan & Pay”.

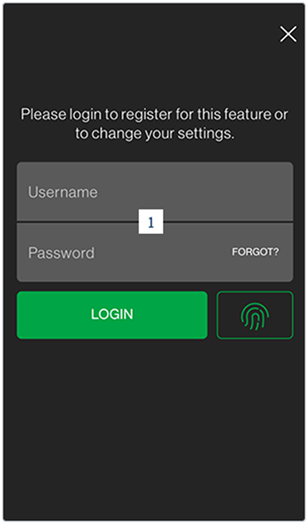

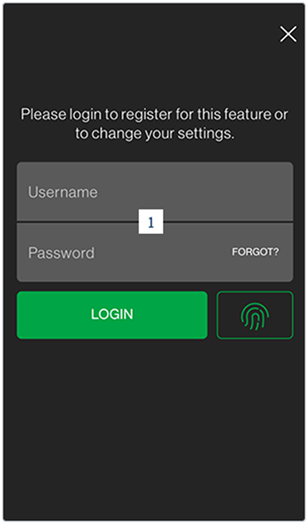

STEP 3

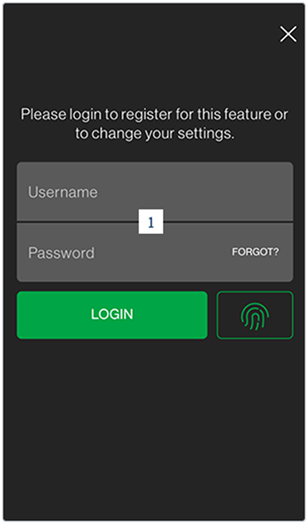

- Login to your account.

STEP 4

- You could either scan the QR code from eTrading or import the QR Code from your phone’s Library.

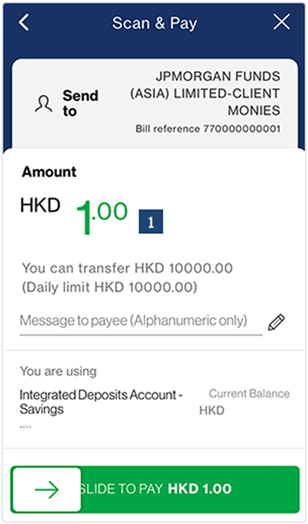

STEP 5

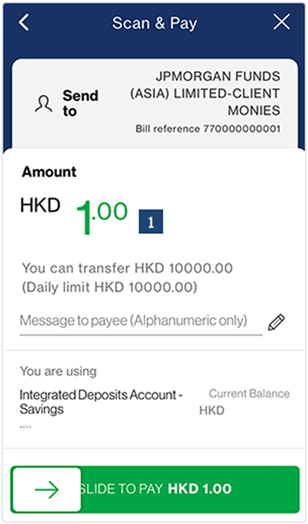

- Please ensure correct Beneficiary Name and Transaction Amount before you submit the payment. At “Message to payee”, your MasterAccount number should be included.

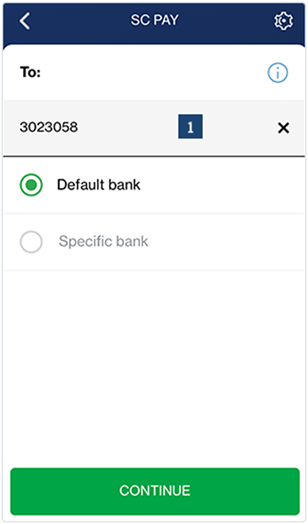

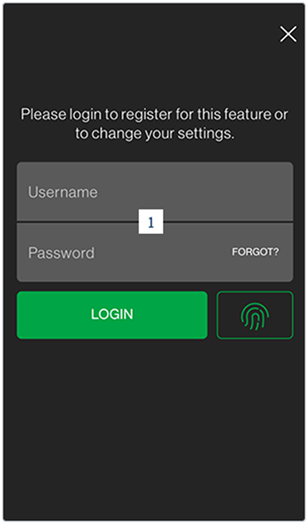

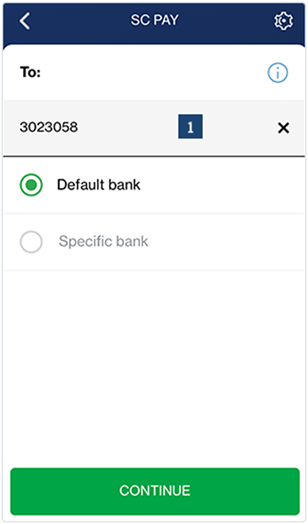

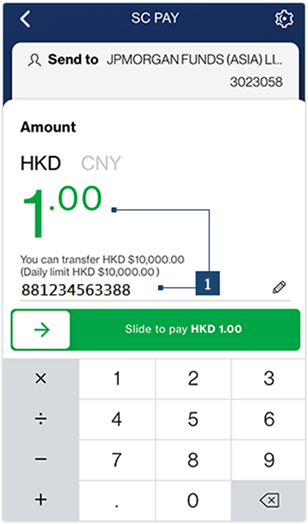

Manual input in Mobile App

STEP 1

- Open you Standard Chartered Mobile App and select “SC Pay”.

STEP 2

- Login to your account.

STEP 3

- Input FPS ID (HKD – 3023058) (RMB – 3522752), then press “Continue”.

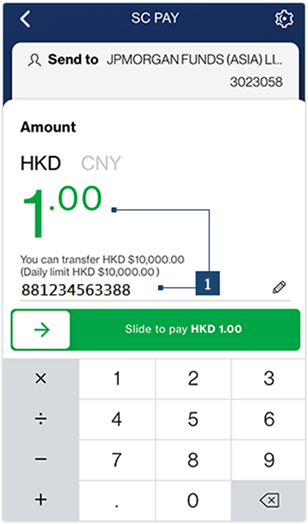

STEP 4

- Enter the Transaction Amount and your MasterAccount number on “Message to payee” before you submit the payment.

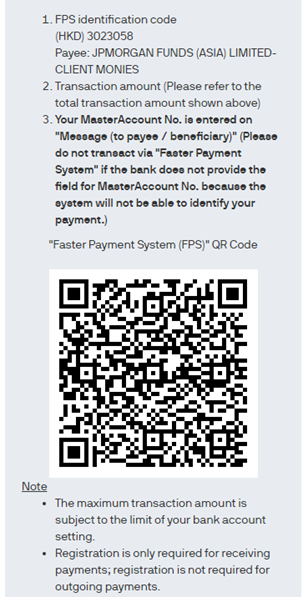

Standard Chartered Faster Payment System

PLEASE NOTE

- Standard Chartered Bank only supports Faster Payment on Mobile App.

- Third party payment is not allowed.

- The maximum transaction amount is subject to the limit of your bank account setting.

- Registration is only required for receiving payments; registration is not required for outgoing payments.

- The QR code is only required for 30 minutes, otherwise you will need to resubmit the transaction to generate a new QR code for payment.

Scanning QR Code in Mobile App

STEP 1

- Screenshot or take photo of your FPS ID QR Code from eTrading and save it to your mobile phone.

Desktop View

Mobile View

STEP 2

- Open your Standard Chartered Mobile App and select “Scan & Pay”.

STEP 3

- Login to your account.

STEP 4

- You could either scan the QR code from eTrading or import the QR Code from your phone’s Library.

STEP 5

- Please ensure correct Beneficiary Name and Transaction Amount before you submit the payment. At “Message to payee”, your MasterAccount number should be included.

Manual input in Mobile App

STEP 1

- Open you Standard Chartered Mobile App and select “SC Pay”.

STEP 2

- Login to your account.

STEP 3

- Input FPS ID (HKD – 3023058) (RMB – 3522752), then press “Continue”.

STEP 4

- Enter the Transaction Amount and your MasterAccount number on “Message to payee” before you submit the payment.

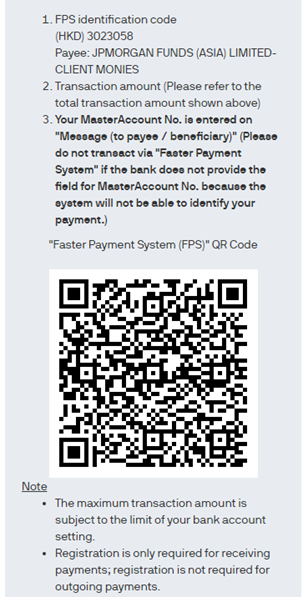

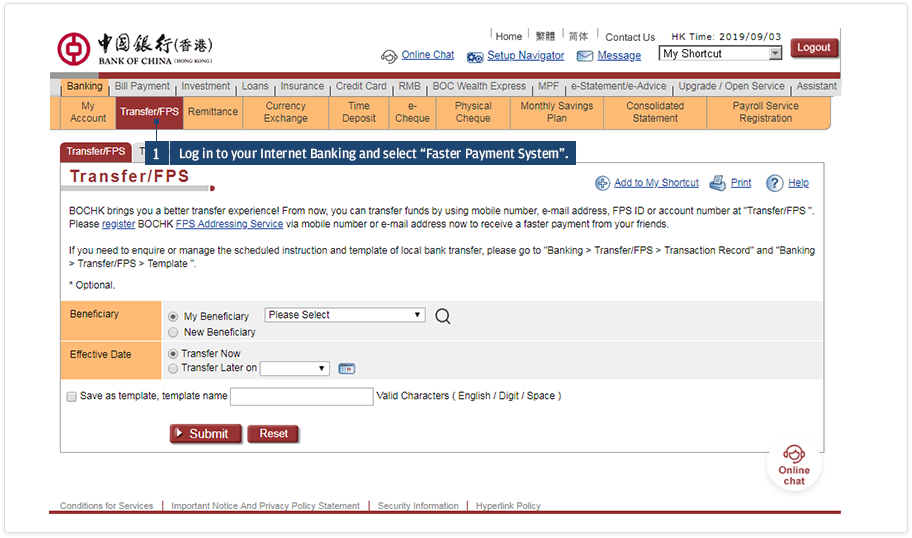

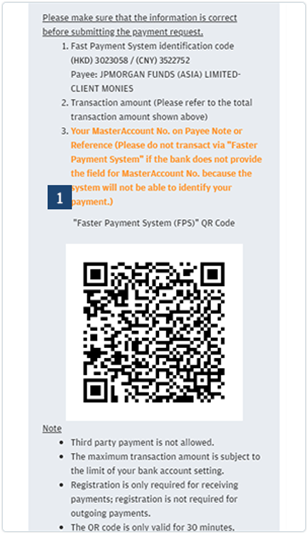

Bank of China Faster Payment System

PLEASE NOTE

- Third party payment is not allowed.

- The maximum transaction amount is subject to the limit of your bank account setting.

- Registration is only required for receiving payments; registration is not required for outgoing payments.

- The QR code is only required for 30 minutes, otherwise you will need to resubmit the transaction to generate a new QR code for payment.

Scanning QR Code in Mobile App

STEP 1

- Screenshot or take photo of your FPS ID QR Code from eTrading and save it to your mobile phone

Desktop View

Mobile View

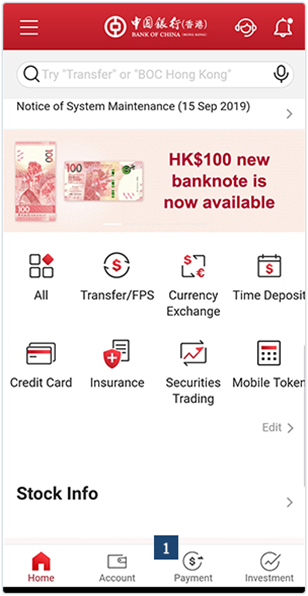

STEP 2

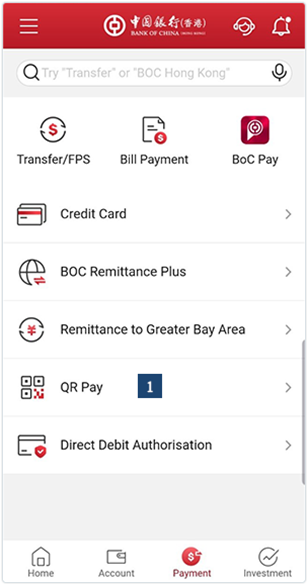

- Open you BOCHK Mobile App and select “Payment” at the bottom.

Desktop View

Mobile View

STEP 3

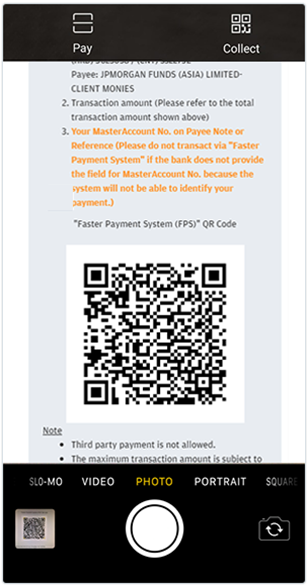

Mobile View

- Select QR Pay.

STEP 4

Mobile View

- You could either scan the QR code from eTrading or import the QR Code from your phone’s Library.

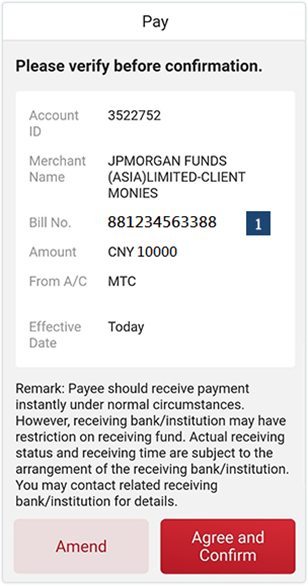

STEP 5

Mobile View

- Please ensure correct Beneficiary Name and Transaction Amount before you submit the payment. At “Message to Beneficiary Message to payee”, your MasterAccount number should be included.

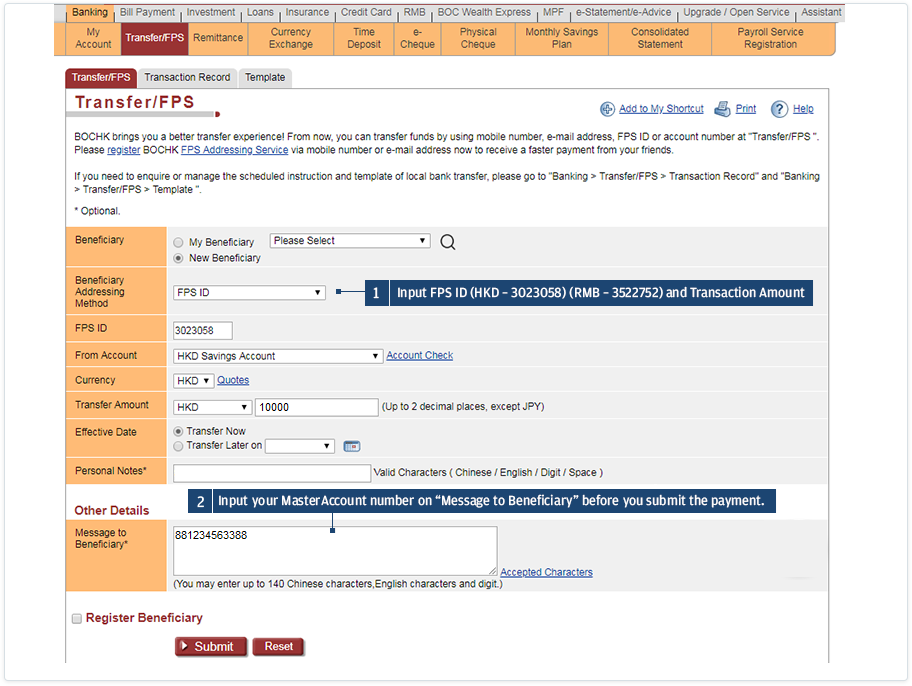

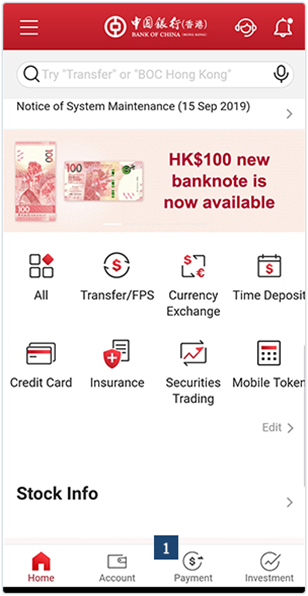

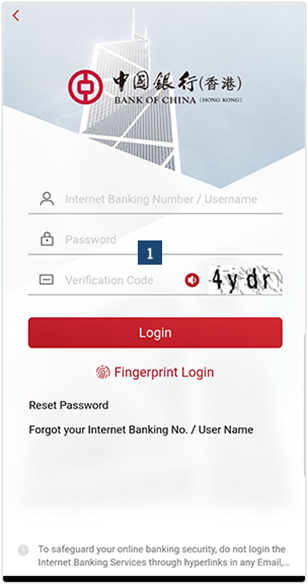

Manual input in Mobile App

STEP 1

Mobile View

- Open you BOCHK Mobile App and select “Transfer/FPS”.

STEP 2

Mobile View

- Login to your account.

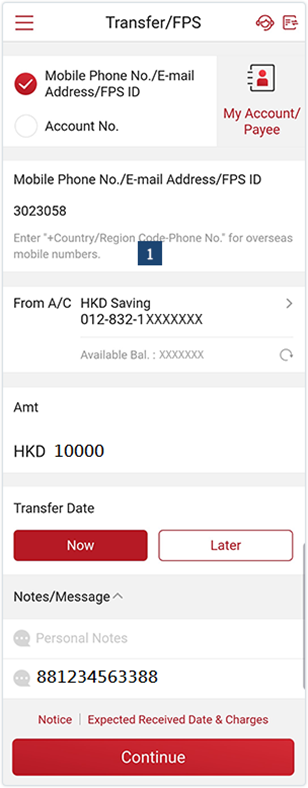

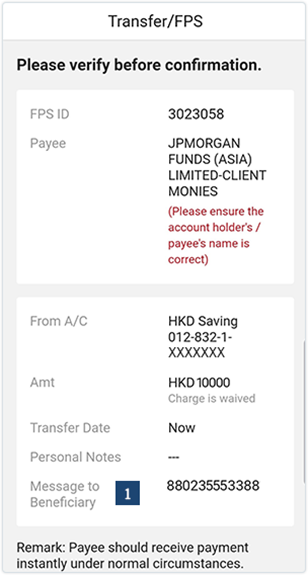

STEP 3

Mobile View

- Input FPS ID (HKD – 3023058) (RMB – 3522752), then press “Continue”.

STEP 4

Mobile View

- Enter the Transaction Amount and your MasterAccount number on “Message to Beneficiary” before you submit the payment.

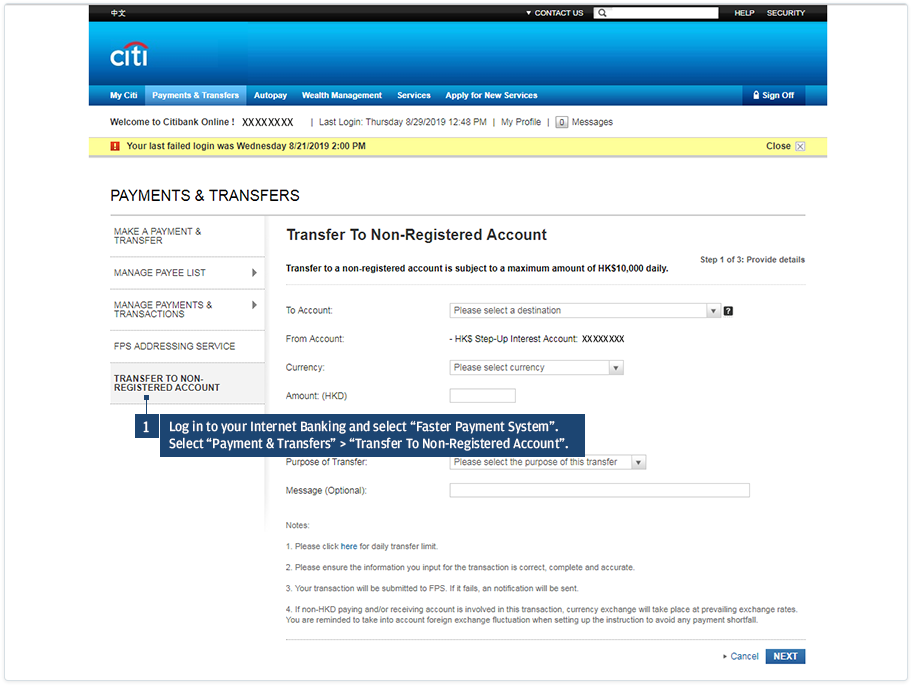

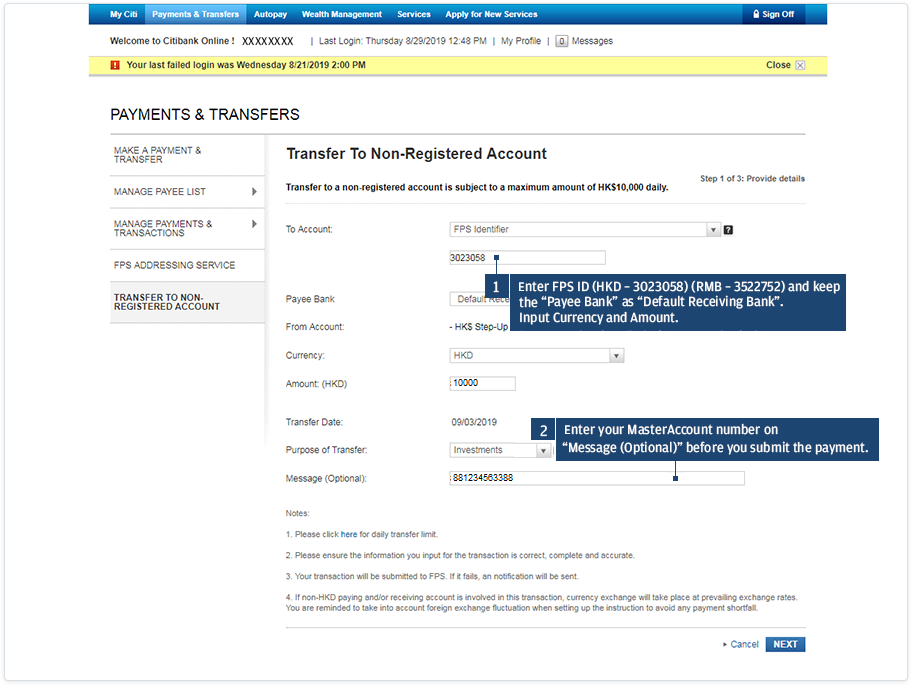

Citibank

PLEASE NOTE

- Third party payment is not allowed.

- The maximum transaction amount is subject to the limit of your bank account setting.

- Registration is only required for receiving payments; registration is not required for outgoing payments.

STEP 1

Desktop View

STEP 2

Desktop View

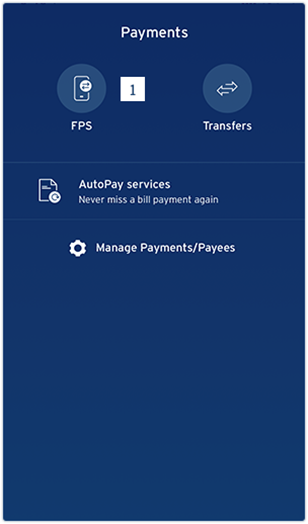

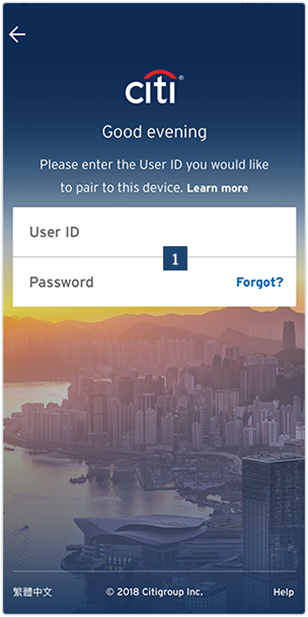

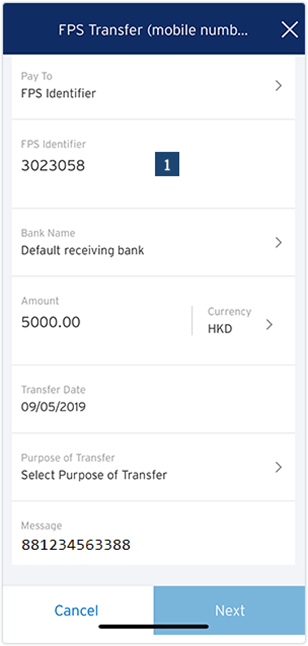

Manual input in Mobile App

STEP 1

Mobile View

- Open you Citi Mobile App and select “FPS”.

STEP 2

Mobile View

- Login to your account.

STEP 3

Mobile View

- Input FPS ID (HKD – 3023058) (RMB – 3522752) and enter the Transaction Amount and you MasterAccount number on Message before you submit the payment.

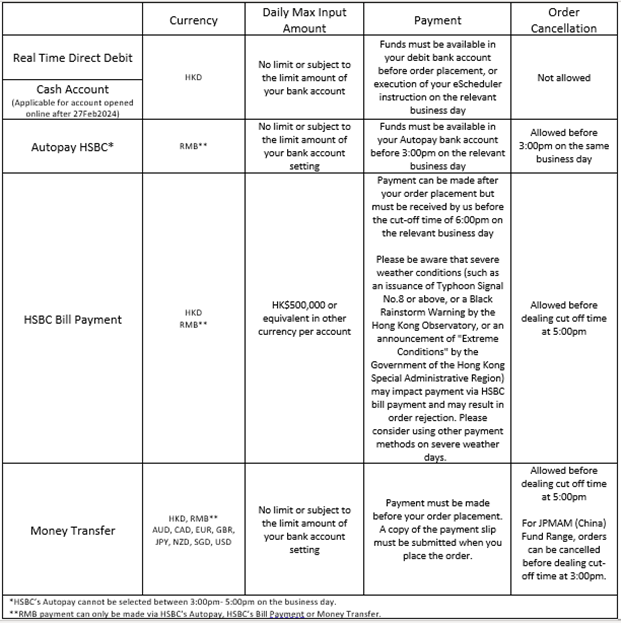

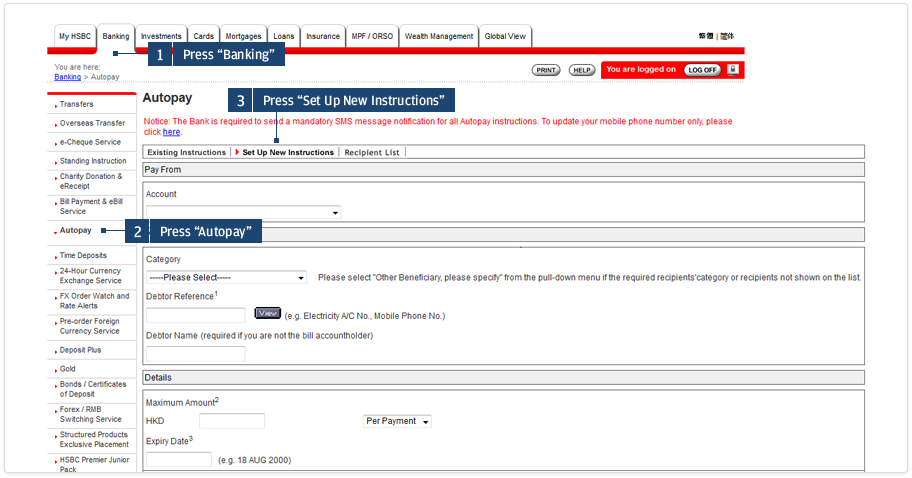

HSBC Autopay

Set up RMB Autopay

Please fill in the setup form and return to HSBC

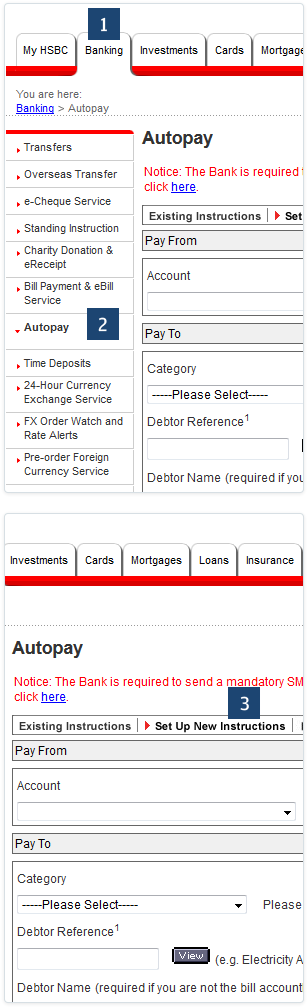

STEP 1

To set up your Autopay instruction, you first need to logon to HSBC Personal Internet Banking. Then go to the “My Banking” section and press “Autopay”.

- Press “My Banking”

- 2Press “Autopay”

Desktop View

Mobile View

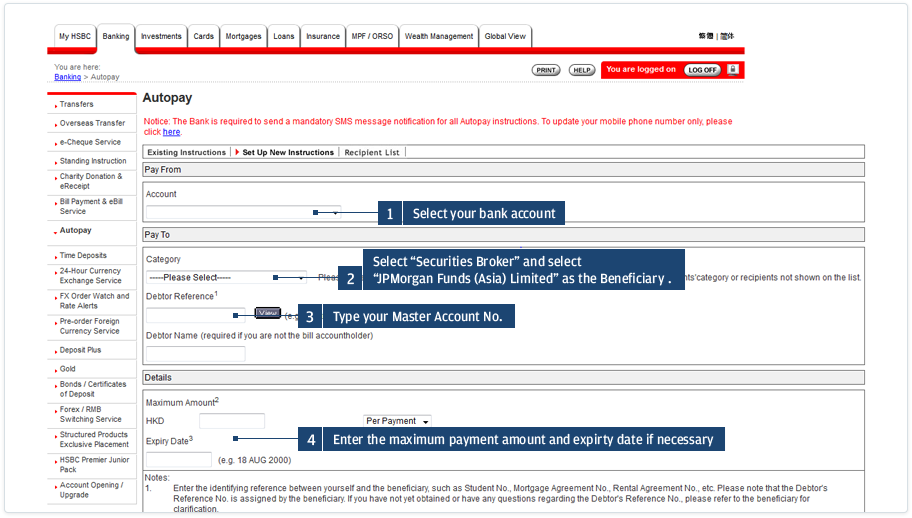

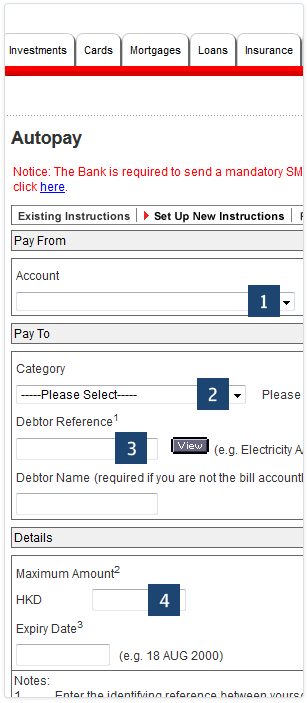

STEP 2

Select the bank account from which you wish to pay. Select “JPMorgan Funds (Asia) Limited”, then enter your 12-digit MasterAccount Number as the Debtor Reference.

If necessary, you may set a maximum payment amount and an expiry date here. Then press “Go” and follow the instructions on the screen to complete the setup. It normally takes 3-5 days to process your instruction.

- Select your bank account

- Select “JPMorgan Funds (Asia) Limited” as the Payee.

- Enter your MasterAccount Number

- Enter the maximum payment amount and expiry date if necessary

Desktop View

Mobile View

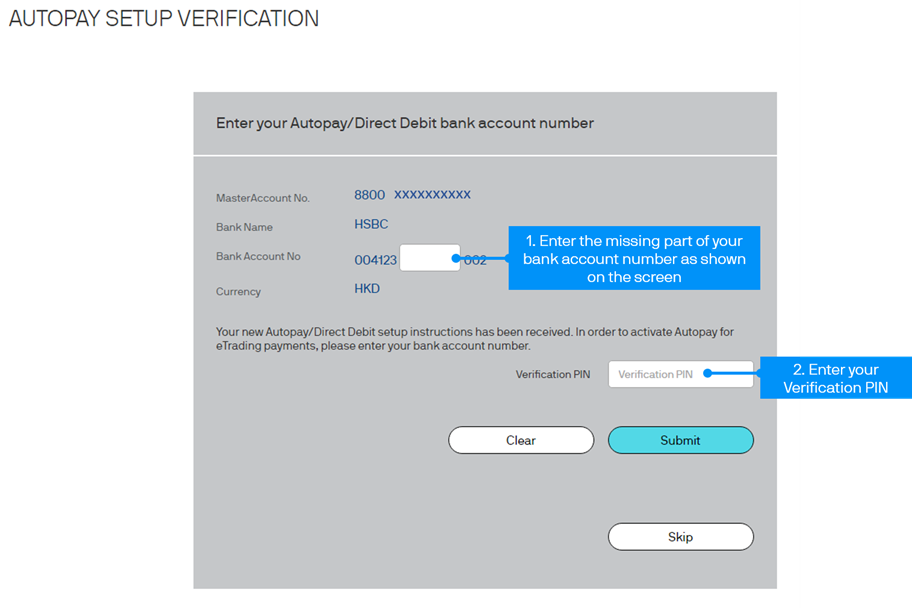

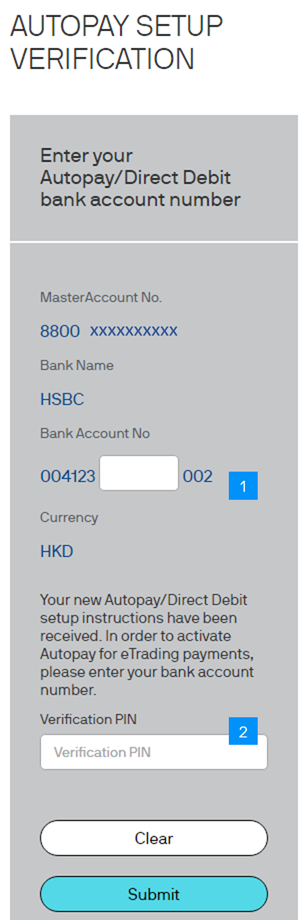

STEP 3

Once your Autopay instruction is effective, login to J.P. Morgan eTrading site to activate your instruction. Enter your bank account number and Verification PIN. Then press “Confirm” to proceed.

- Enter the missing part of your bank account number as shown on the screen

- Enter your Verification PIN

Desktop View

Mobile View

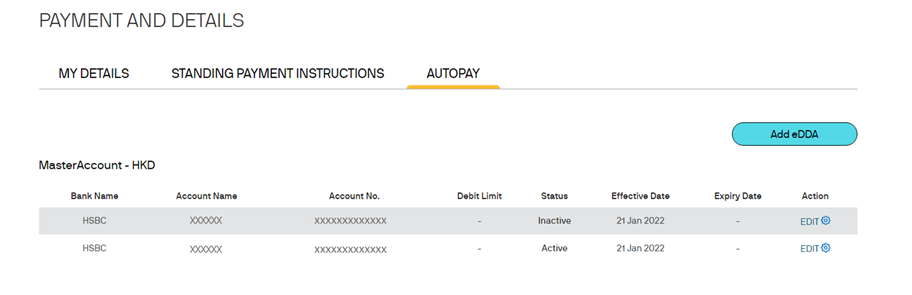

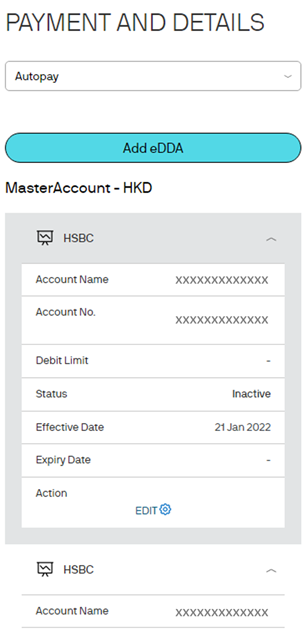

STEP 4

You can now view your Autopay details by clicking “My Account”, “Payment Details (SPI & Autopay)” and then “Autopay”.

Desktop View

Mobile View

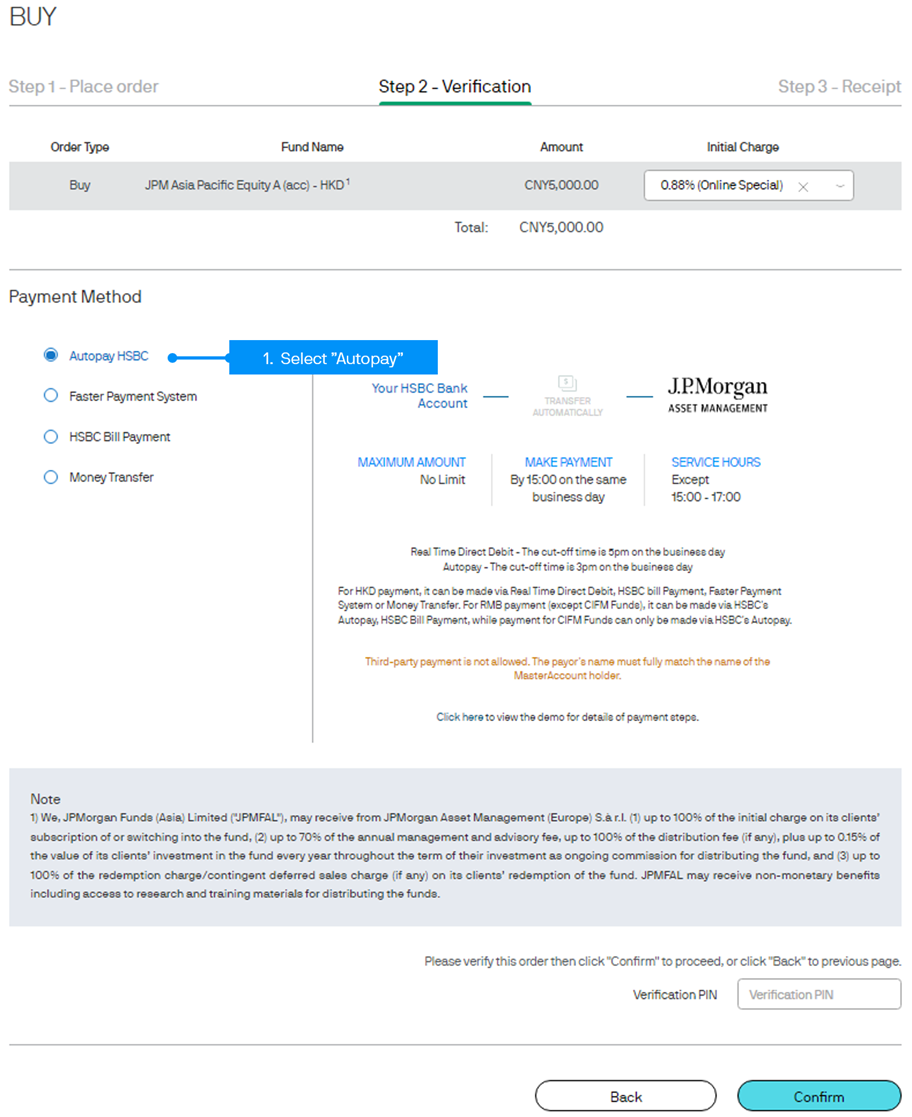

STEP 5

Follow the screen instructions to place your buy order and select “Autopay” as the payment method. Enter your Verification PIN and press “Confirm” to proceed.

We will collect the investment proceeds from your bank account accordingly. Please make sure there are sufficient funds in your bank account.

- Select “Autopay”

Desktop View

Mobile View

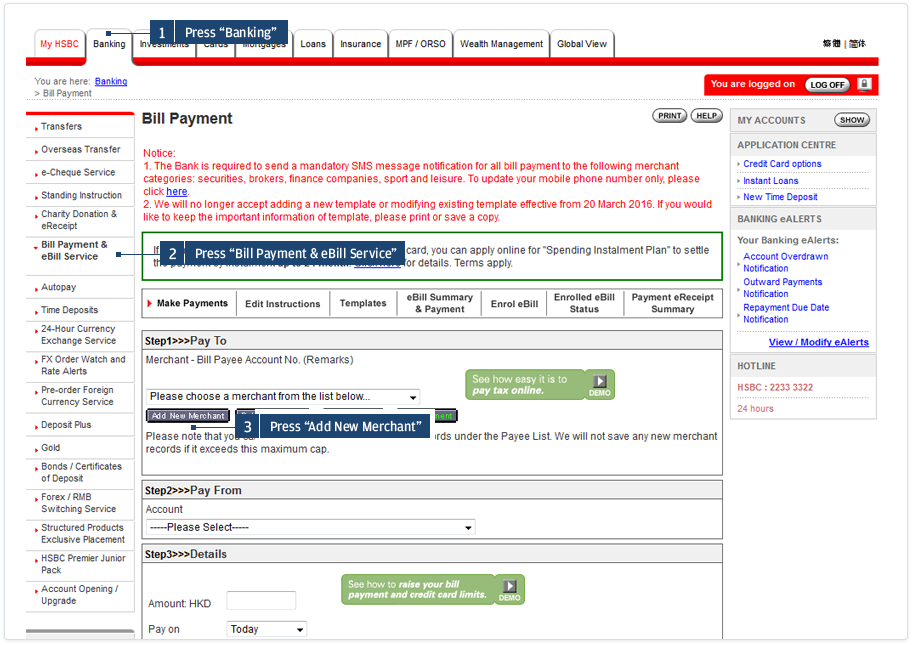

HSBC Bill Payment

STEP 0

Please skip this step if you are already a user of HSBC HK Internet Banking services.

- Open an HSBC bank account (credit card / loan account is not applicable) with ATM service if you do not already have one.

- Visit HSBC’s website and follow the registration procedure to register HSBC Internet Banking.

- Increase the maximum daily limit for payment made to “Security Brokers” by completing the Internet Banking / Phone Banking / ATM Transaction Limit Revision request form provided by HSBC.

- Please be aware that severe weather conditions (such as an issuance of Typhoon Signal No.8 or above, or a Black Rainstorm Warning by the Hong Kong Observatory, or an announcement of "Extreme Conditions" by the Government of the Hong Kong Special Administrative Region) may impact payment via HSBC bill payment and may result in order rejection. Please consider using other payment methods on severe weather days.

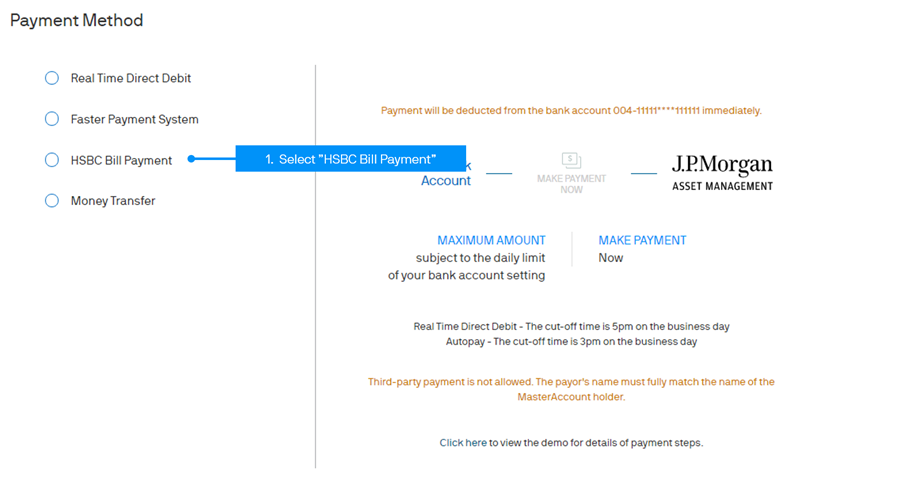

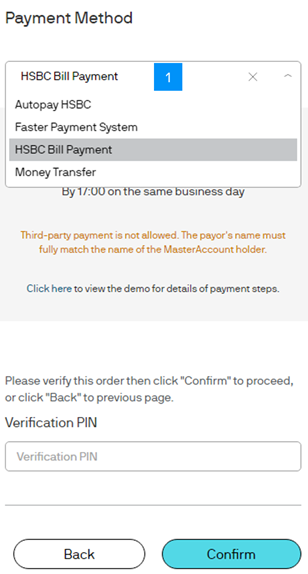

STEP 1

Follow the screen instruction to place your buy order and select “HSBC Bill Payment” as the payment method. Please refer to the section Buy Funds for details.

- Select “HSBC Bill Payment”

Desktop View

Mobile View

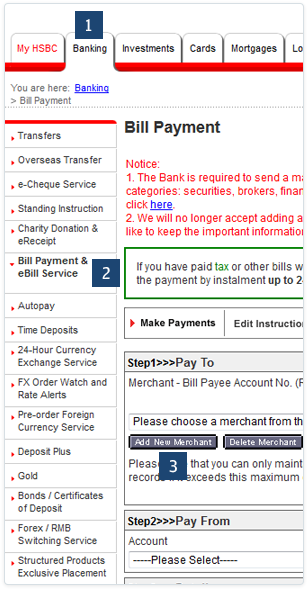

STEP 2

To make your payment, you need to logon to HSBC Personal Internet Banking. Press “Bill Payment” under the “My Banking” section and then select your bank account to proceed.

- Press “My Banking”

- Press “Bill Payment”

Desktop View

Mobile View

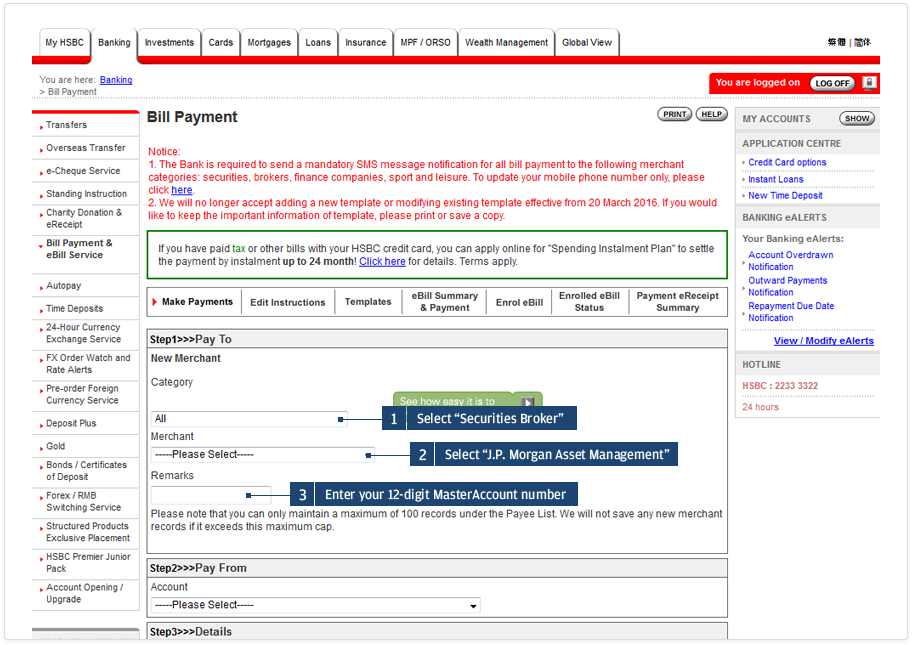

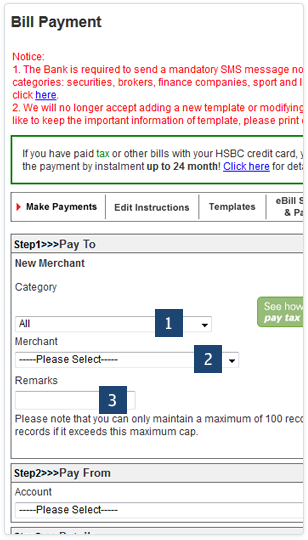

STEP 3

Select the Payee “J.P. Morgan Asset Management”. Enter your 12-digit MasterAccount Number as the Bill Payee Account Number.

Note: You may need to increase the maximum daily limit for payment made to “Security Brokers” by completing the Internet Banking / Phone Banking / ATM Transaction Limit Revision request form in order to select the category “Security Brokers”. The transaction limit would be reset to zero if it has been inactive for 6 months since established or if has been inactive for 13 months since last transaction.

- Select Your Bank Account

- Select “J.P. Morgan Asset Management”

- Enter your 12-digit MasterAccount Number

Desktop View

Mobile View

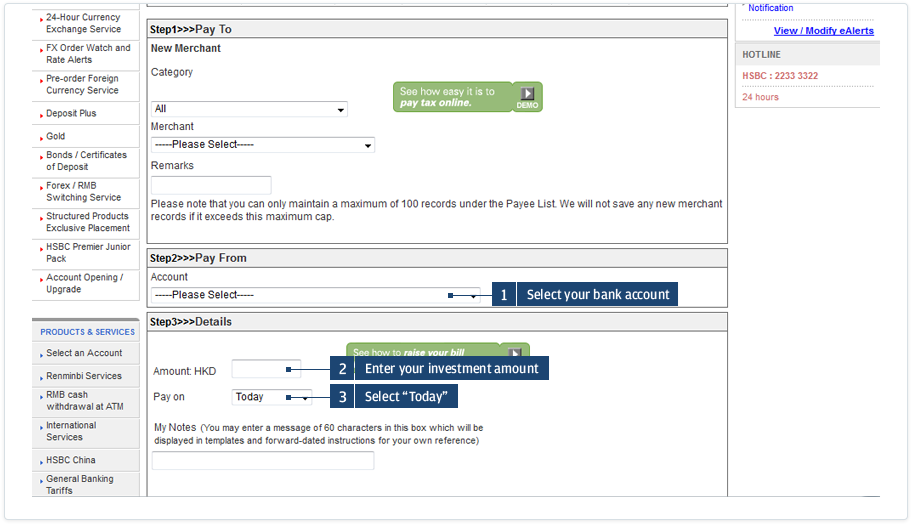

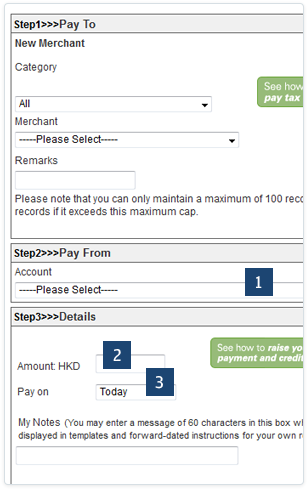

STEP 4

Scroll down the screen and input the EXACT investment amount and choose to pay on today. Then press “Go” to complete the payment.

- Enter your investment amount

- Select “Today”

Desktop View

Mobile View

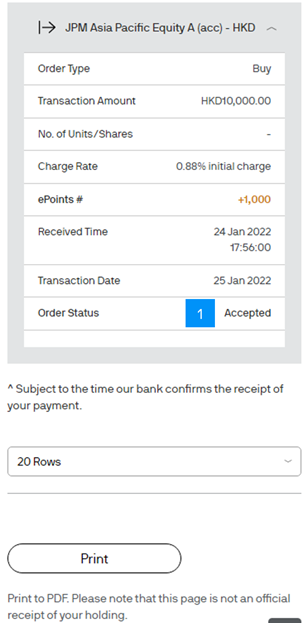

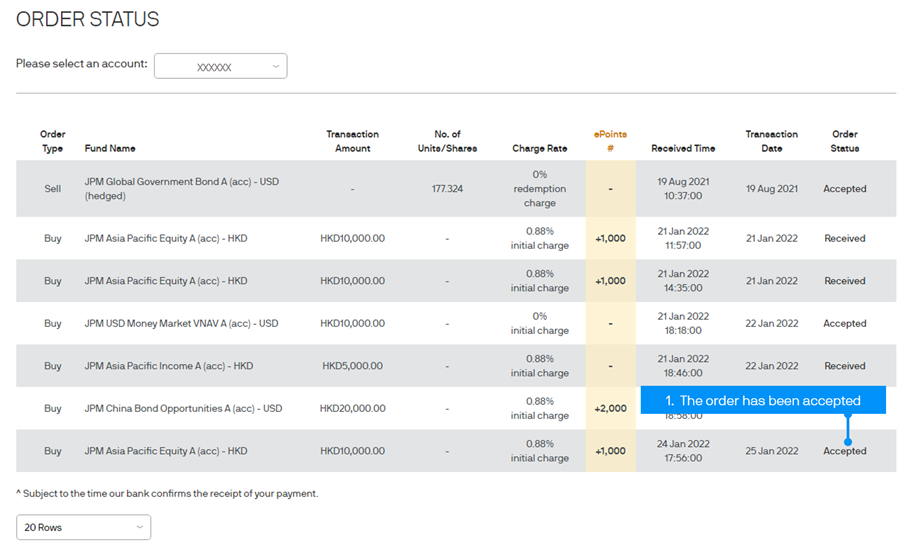

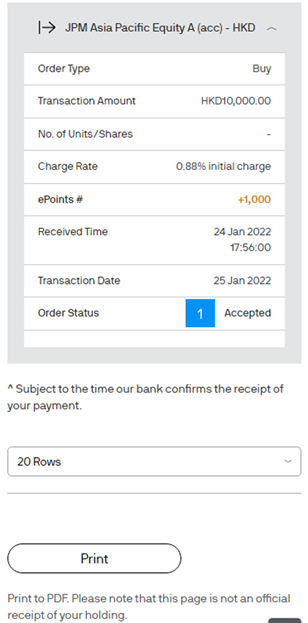

STEP 5

After 10:00pm, come back to the Order Status in J.P. Morgan eTrading. If your payment has been successfully received, the status of your order will read “Accepted”.

- The order has been accepted

Desktop View

Mobile View

Money Transfer

You can use Money Transfer to pay for your online lump sum investments (excluding those made via eScheduler). Simply transfer the investment amount to us from your bank – at a branch or via online banking – before placing the order.

For more details about the transfer procedures, please refer to your bank for the use of their money transfer service.

STEP 1

Please follow your bank’s instructions to transfer to us the investment amount for the buy order you are going to place. Remember to keep the payment slip after scanning or taking a clear photo of it.

To avoid rejection of your order, make sure that you transfer the exact investment amount. Do not split your payment for a single order into multiple transfers, nor pay for multiple orders in one single transfer. Please note that the time we receive the payment depends on the banking practices of the country(ies) concerned and our bank’s processing time for your transfer. Any charge(s) levied by the remitting bank should be excluded from the transfer amount. Our bank does not charge for the remittance.

STEP 2

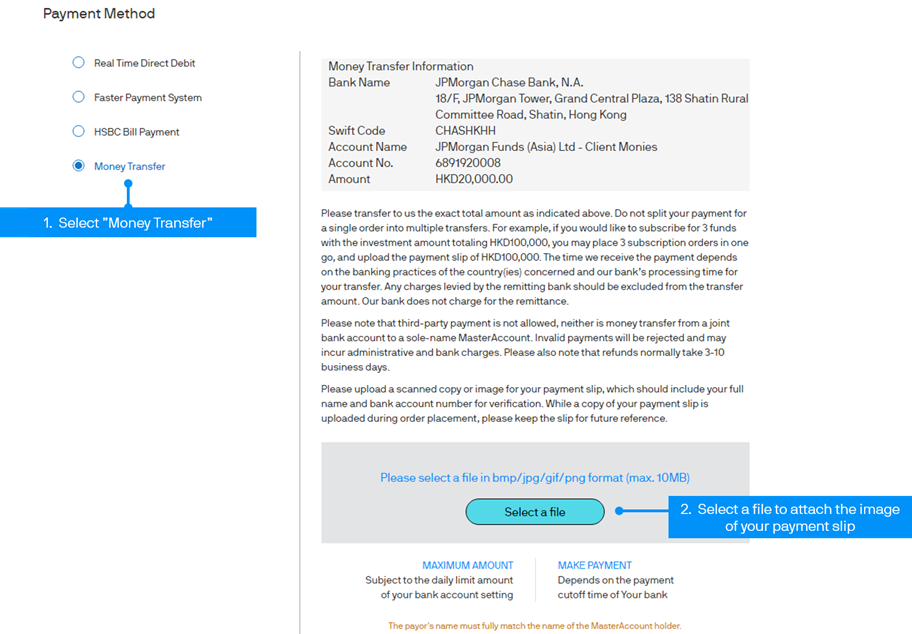

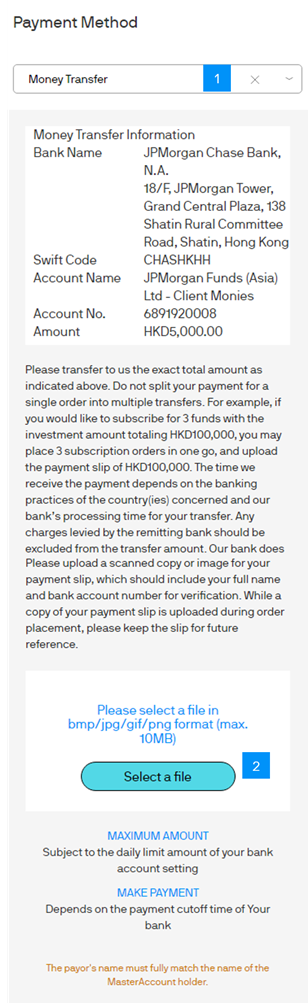

Follow the screen instructions to place your buy order and select “Money Transfer” as the payment method. Then attach the scanned copy or image of the payment slip. To learn more about how to buy funds, please refer to the “Buy Funds” section in our online trading demo.

Please note:

There will be an error message if your file exceeds the file size limit (maximum 5MB) or is not in one of supported formats (bmp/jpg/gif/png ). Please re-upload/attach an image of smaller size or in a supported format.

You must attach a copy of the payment slip to proceed to the final step.

- Select “Money Transfer”

- Select the file to attach the image of your payment slip

Desktop View

Mobile View

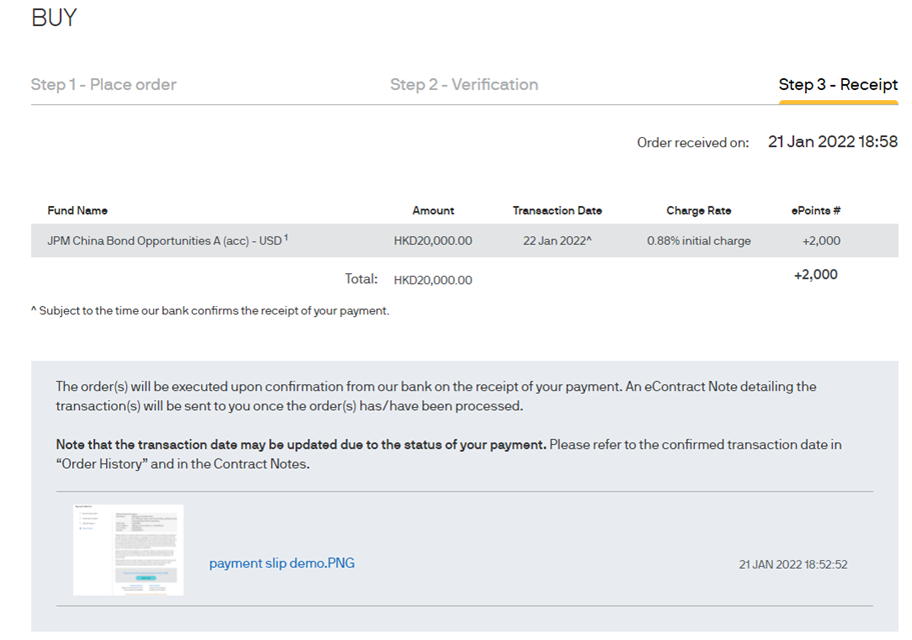

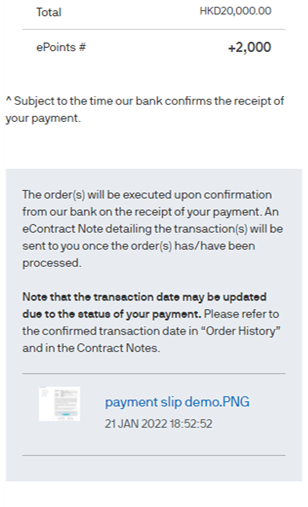

STEP 3

Order and payment details will be shown in Step 3. The order(s) will be executed upon confirmation from our bank on the receipt of your payment. An eContract Note detailing the transaction(s) will be sent to you once the order(s) has/have been processed.

Desktop View

Mobile View

Bank Transfer Information