Portfolio Chart: A menu of options as bond yields reset higher

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

More than just seeking for resilience

Given their higher credit rating, better liquidity and relatively low default risk, quality fixed income has moved into sharper focus of late as investors position against potential macro risks on the horizon, including the prospect of a well-telegraphed downturn.

Yet this is not the only reason why quality bonds are back in vogue. In fact, there are other reasons to polish up bond portfolios with higher quality fixed income.

Reason 1: Real yields look compelling

For one, after years of having to make the most of a relatively low-yielding environment, “income” is finally back in fixed income, including government bonds which are typically considered as higher quality bonds.

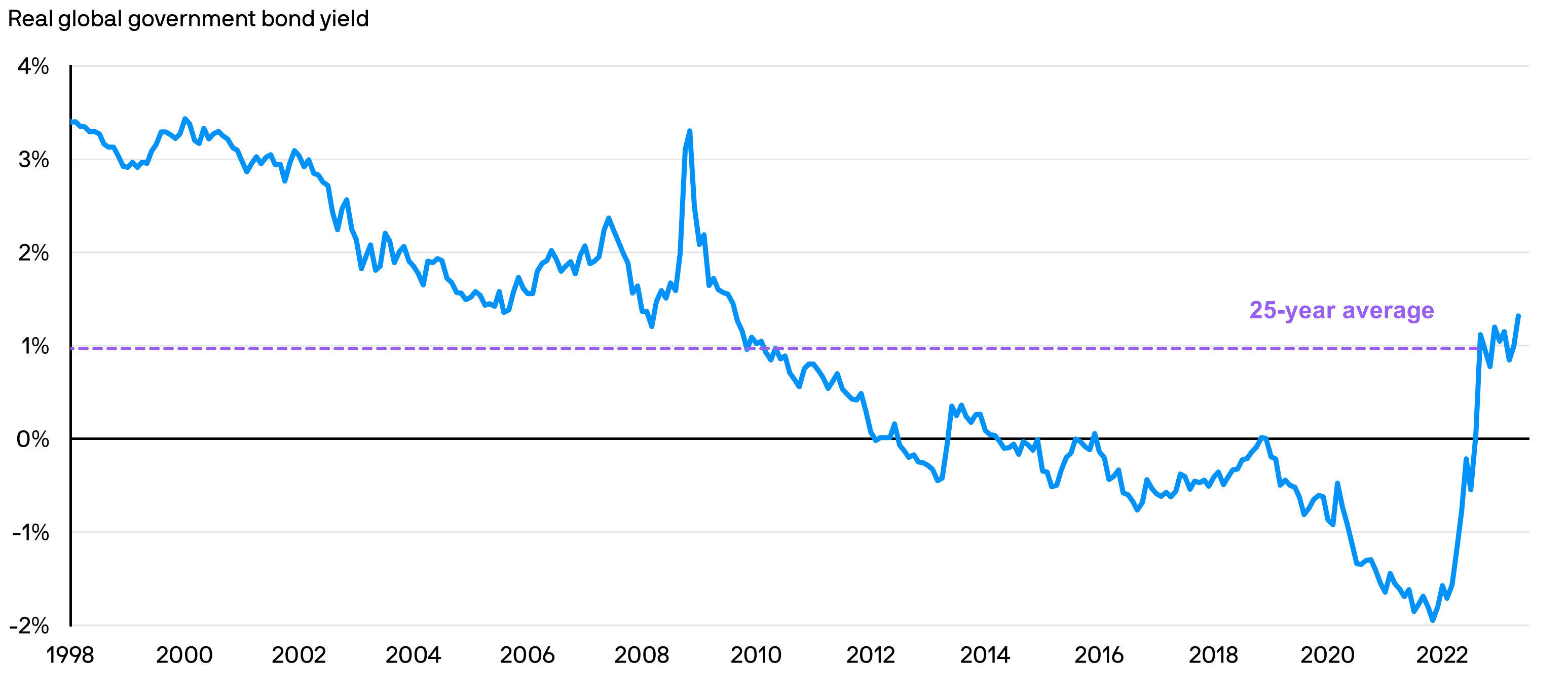

Real government bond yields* have turned positive and surged to the highest levels in over a decade as aggressive central bank tightening forced a major repricing in the bond markets1. As a result, investors are now able to tap opportunities for higher real yields with less of a concern forsacrificing quality in their fixed income portfolios.

Real global government bond yields* have surged to the highest levels in over a decade

1. Source: Bloomberg Finance L.P., ICE BofA, J.P. Morgan Asset Management. Data as of 31.05.2023. Real global government bond yield: Yield-to-Maturity (YTM) of the ICE BofA Global Inflation-Linked Government Index. *Real yields refer to the return to bond investors from interest payments after accounting for inflation. Yield is not guaranteed. Positive yield does not imply positive return. Past performance is not a reliable indicator of current and future results.

Reason 2: Attractive risk-return profile as we approach peak rates

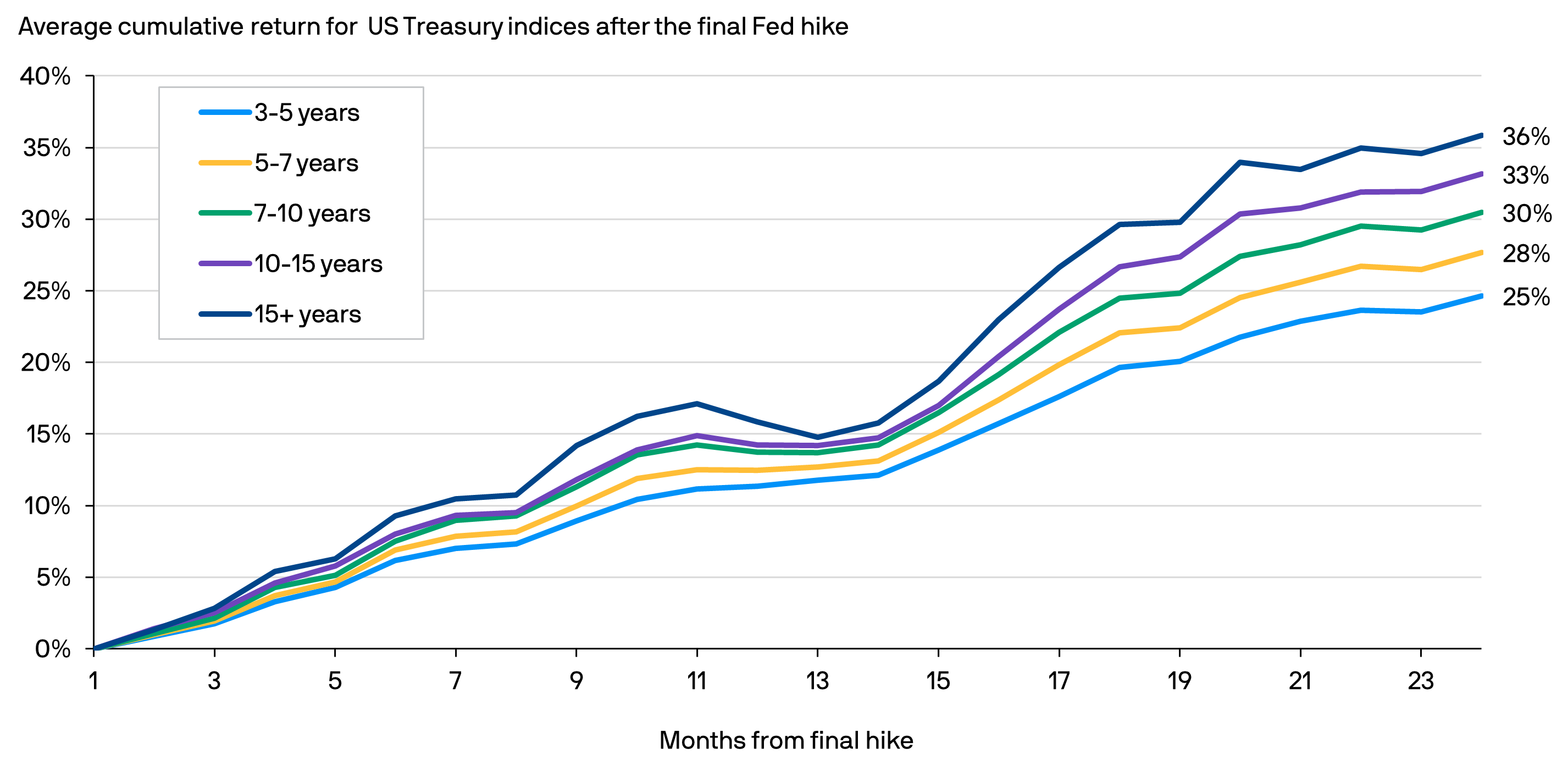

In addition, as we head closer to the end of the rate hike cycle, duration by way of US Treasuries can present opportunities for relatively attractive returns.

As an illustration of this macro trend, over the last seven rate hike cycles since 1981, US Treasuries have historically delivered relatively robust average cumulative returns in the succeeding 24 months after the Federal Reserve’s (Fed) final rate hike2. This applies across different maturities, although longer duration bonds have historically performed better.

As US Treasuries are typically regarded as risk-free assets, this highlights the return potential of high quality bonds should the US central bank pivot away from further policy tightening.

Average cumulative return of US Treasury indices in the months after the Fed’s final rate hike

2. Sources: J.P. Morgan Private Bank, Bloomberg Finance L.P. Data as of 31.05.2023. Cumulative returns for US Treasury Indices from 1981, 1984, 1989, 1995, 2000, 2006, 2018. Past performance is not a reliable indicator of current and future results.

Reason 3: Inflationary pressure is receding

While inflation has proven stickier than anticipated, it is important to note that inflationary pressure is abating, albeit gradually. Importantly, wage inflation is showing signs of easing as growth in average hourly earnings continues to moderate3.

Even if sticky inflation led to further rate hikes from the Fed, we believe deeper concerns about recession risks could limit the downside for longer duration government bonds. Interestingly, the yield on the 10-year US Treasury benchmark has stayed somewhat range-bound despite the Fed delivering four rate hikes since December 20224.

The case for quality

Decelerating growth, a relatively robust risk-return profile due to higher rates and fading inflation present a more favourable backdrop for quality bonds. Global government bonds can also provide ballast to investment portfolios during periods of heightened risk aversion, as flight-to-safety could lead to higher bond prices and potentially offset declines in other risk assets. Taken together, high quality fixed income can help mitigate downside risks.

An actively managed, quality-biased investment strategy with dynamic risk management5 can help shift exposure towards areas with stronger fundamental outlook while managing duration and currency risks.

Actively pursuing stronger bond outcomes

Embrace the flexibility to make active decisions in fixed income

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

3. Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.03.2023.

4. Source: Bloomberg, J.P. Morgan Asset Management. Data as of 15.06.2023

5. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

© All Rights Reserved - JPMorgan Asset Management (Australia) Limited ABN 55 143 832 080, AFSL No. 376919

All investments contain risk and may lose value. The information provided on this article is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information having regard to your objectives, financial situation and needs. Before making any decision, it is important for you to consider the appropriateness of the information and seek appropriate legal, tax, and other professional advice. Prior to making an investment decision, investors should read the relevant Product Disclosure Statement and Target Market Determination, which have been issued by Perpetual Trust Services Limited, ABN 48 000 142 049, AFSL 236648, as the responsible entity of the fund available on https://am.jpmorgan.com/au.

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

After a difficult year for bonds, we explain why fixed income could once again prove to be a useful diversifier for portfolios.

As the Fed’s rate hike cycle concludes, bonds can present an important source of income and diversification for portfolios.

We share insights on how actively-managed fixed income ETFs can help build stronger portfolios.

Here is a chart indicating IG bond opportunities as US Treasury yields stay elevated.

Employing an equity premium income approach in an income-hungry world.

We share a flow chart to help explain ETF liquidity.

Seeking income as the outcome is the aim of our actively managed equity premium income ETF strategy.

Flexibility is at the heart of our approach to fixed income markets.

We share our insights on optimising call options in equity income ETFs.

We share the basics of call options in equity income ETFs.

We share the basics about thematic ETFs and how they are employed in portfolios.

Income investing can help tap investment opportunities while managing volatility through cash flows from a diversified portfolio of income generating assets.

Income investing remains relevant in the current market environment, as volatility is poised to remain elevated.

We believe that quality and yield opportunities can still be found in bonds.

We share how we consider the risks and opportunities in climate change investing.

We discuss five megatrends related to climate change and the investment implications.

We share our views on the fixed income themes and opportunities in current choppy markets.

We share our perspectives of sustainable investing in an overall portfolio.

Fixed income isn’t just government or corporate bonds, it also includes non-traditional debt securities.

The securitisation market has regained much ground in the past decade.

Harnessing an active equity ETF to seek out low-risk alpha in a high-risk world.

Employing a macro process sustainably to help investors align their goals with their values.

For more information, please call or email us. You can also contact your J.P. Morgan representative.

1800 576 100 (Application enquiries)