![]()

Exploring low-risk alpha in a high-risk world

It has been a rocky year for investors so far, and the debate over active management versus passive management rages on as market volatility persists. Today, both approaches can play different roles in an overall portfolio. Still, not all active strategies are created equal.

Our approach for the global research enhanced index (REI) equity strategy is designed to balance simplicity with effectiveness – combining the quality of active investing with passive investing to present a core building block at competitive fees1.

By blending active stock selection with passive index exposure within a robust investment framework, our REI equity funds and exchange-traded funds (ETFs) seek positive alpha at low tracking error, providing a range of highly efficient tools that can be used to complement existing core portfolios, add diversification or to implement tactical views.

Striving to combine the advantages of active & passive

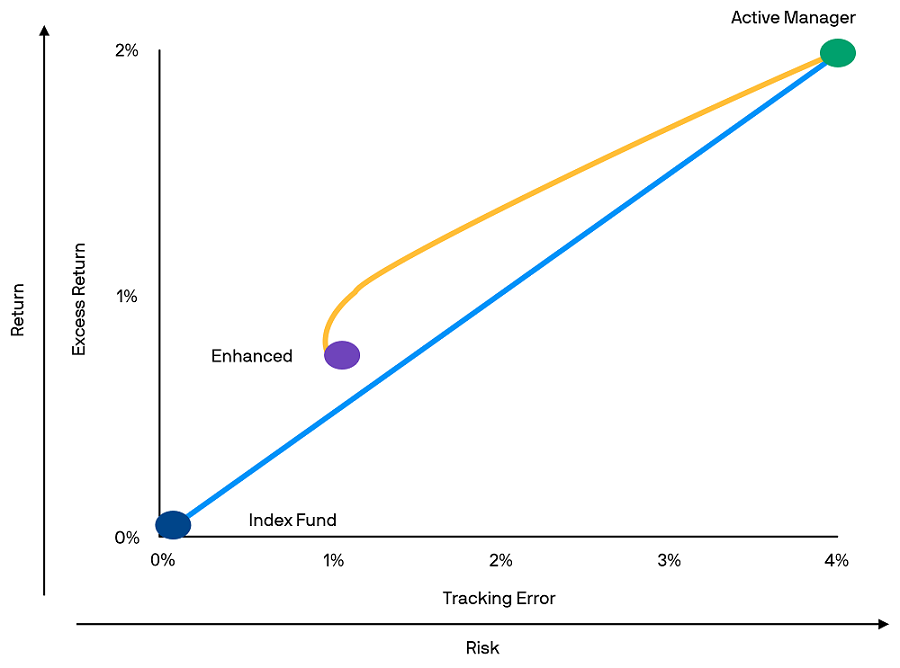

2. Source: J.P. Morgan Asset Management, 31.03.2023. Provided for information and illustrative purposes only not to be construed as offer, research or investment advice. Indicative ranges provided are for illustrative purpose only. Investments involve risks and are not similar or comparable to deposits. Not all investments are suitable for all investors. The manager seeks to achieve its objectives, there is no guarantee they will be met.

![]()

What sets us apart?

Indexed ETF strategies seek to provide consistent, cost-effective core solutions for investors looking to build efficient broad market exposure. However, with equity markets volatile and returns expected to be lower over the long term, growth-oriented investors may wish to explore opportunities to seek excess returns as part of a diversified portfolio.

Our REI approach takes small active positions in stocks based on our proprietary fundamental insights, while also keeping regional, sector and style exposures close to the index at all times to maintain a consistently low tracking error.

The goal is to maximise stock-specific alpha opportunities and to minimise uncompensated market, sector and style risks - all while maintaining a competitive fee1.

We achieve the ‘E’ in the strategy by applying the insights of our global team of 90+ research analysts (covering 2500+ stocks) and a disciplined valuation model. This is a process we have successfully used for 30+ years.

Additionally, the strategies are now available in an ETF wrapper - JPMorgan Global Research Enhanced Index Equity ETF (JREG) is a core building block that employs our proven investment process that goes beyond passive exposures and seeks to outperform the index.

Since inception in 2003, our REI strategy has continued to see both short- and long-term alpha generation3 against the benchmark across various market environments – whether it is value or growth orientated.

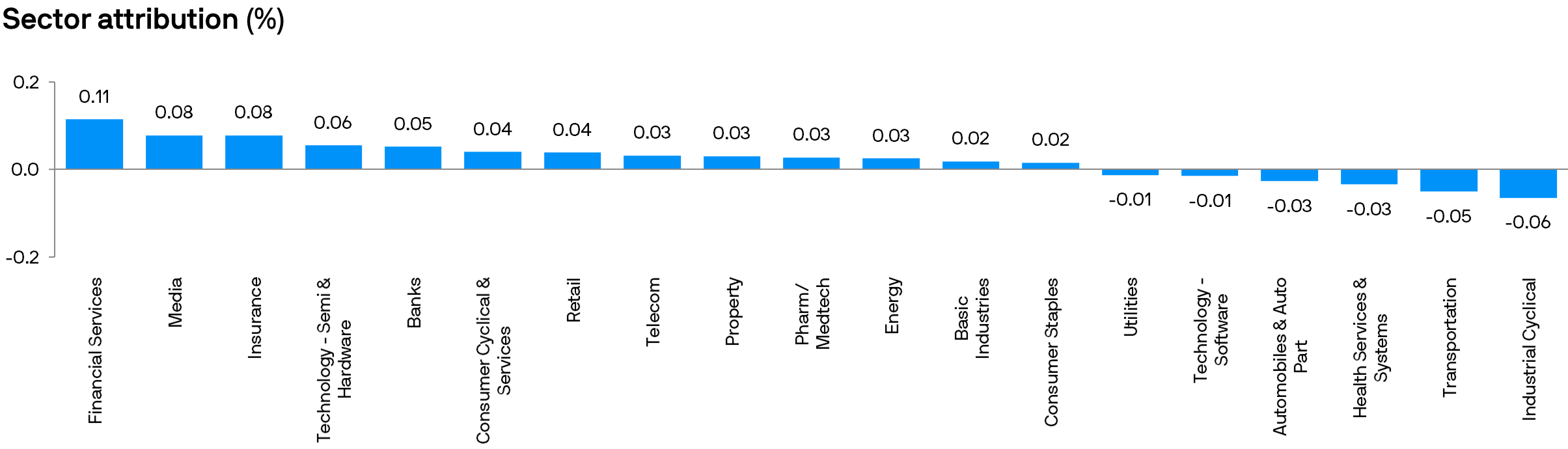

This is result-driven, specifically by the strength of our team of research analysts presenting a wide breadth of investment opportunities – which saw 13 out of 19 sectors under coverage contributing positively to the strategy’s performance4.

4. Source: Factset, J.P. Morgan Asset Management. For quarter ending 31.03.2023. Attribution results are for indicative purposes only. The fund is an actively managed portfolio. Holdings, sector weights, allocations and leverage, as applicable, are subject to change at the discretion of the Investment Manager without notice. Past performance is not a reliable indicator of current and future results.

![]()

What are the other key considerations to keep in mind?

Keeping tracking error low is important in the REI strategy. Tracking error helps us measure the risk we take versus the index – when markets are highly volatile, measuring tracking error helps to reduce the draw down. As of 31 March 2023, the realised since inception tracking error of the strategy stood at 0.68%6.

Even more important than tracking error, we have information ratio (IR). IR is the relationship between excess return and the tracking error. We seek to achieve consistent IR through the different market cycles – and IR measures how efficient the portfolio manager is in generating alpha.

From an academic point of view, a strong IR is 0.5. As of 31 March 2023, our since inception REI strategy’s IR was 1.286 – this implies that we are above what is considered a strong IR.

JPMorgan Global Research Enhanced Index Equity ETF (JREG) is the marketing name for JPMorgan Global Research Enhanced Index Equity Active ETF (Managed Fund).

Provided for information only based on market conditions as of date of publication, not to be construed as offer, research, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time, and are not to be construed as offer, research or investment advice. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

3. Source: J.P. Morgan Asset Management. Data as of 31.03.2023. J.P. Morgan Global REI Strategy in US dollar. Excess return, annnualised (%) stood at 1.67 (1 Year), 1.47 (2 Year), 1.38 (3 Year), 1.32 (4 Year), 1.09 (5 Year), 0.92 (6 Year), 0.92 (7 Year), 0.81 (8 Year), 0.86 (9 Year), 0.90 (10 Year), 0.86 (since inception). Benchmark changed from MSCI World (NDR) to MSCI All Country World Index ACWI (NDR) on 31.05.2010. Inception date 30.09.2003. The performance results are time-weighted rates of return net of commissions, transaction costs and non-reclaimable withholding taxes, where applicable. Gross returns do not reflect the deduction of management fees or any other expenses that may be incurred in the management of the account. Total return assumes the reinvestment of income. Excess returns are calculated on a geometric basis. Returns for periods greater than 1 year are annualised except since inception number. Actual performance will vary depending on security selection and the applicable fee schedule. Provided for information only to illustrate strategy characteristics, not to be construed as research, advice or investment recommendation. Past performance is not a reliable indicator of current and future results.

5. The rating issued on April 2023 for JPMorgan Global Research Enhanced Index Equity Active ETF (Managed Fund) is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Click here for important information about this rating: https://www.lonsec.com.au/logo-disclosure.

6. Source: J.P. Morgan Asset Management, data as of 31.03.2023. Based on the Global ACWI REI Composite. All data is since inception (30.09.2003) to 31.03.2023.

© 2023 All Rights Reserved – JPMorgan Asset Management (Australia) Limited ABN 55 143 832 080, AFSL No. 376919

Future performance and return of capital is not guaranteed. Information is considered correct at the time of issue but no liability for errors or omissions will be accepted by JPMorgan Asset Management (Australia) Limited or its affiliates. ETFs have fees that reduce their performance, indexes do not. Dividends or returns are not guaranteed. Please refer to offering documents for details on distribution policy.

No provider of information presented here, including index and ratings information, is liable for damages or losses of any type arising from use of their information. Information from communications with you will be recorded, monitored, collected, stored and processed consistent with our Australian Privacy Policy available at am.jpmorgan.com/au/en/asset-management/adv/privacy-policy/.

Fund information, including any performance calculations and other data, is provided by J.P. Morgan Asset Management (the marketing name for the asset management businesses of JPMorgan Chase & Co and its affiliates worldwide).

All investments contain risk and may lose value. The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs. Therefore, before you decide to buy any product or keep or cancel a similar product that you already hold, it is important that you read and consider the relevant JPMorgan fund Product Disclosure Statement (PDS) and Target Market Determination, which have been issued by Perpetual Trust Services Limited, ABN 48 000 142 049, AFSL 236648, as the responsible entity of the fund and are available to download on this website and make sure that the product is appropriate for you. Before making any decision, it is important for you to consider these matters and to seek appropriate legal, tax, and other professional advice..