Portfolio Chart: A menu of options as bond yields reset higher

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

Aug 2023 (2-minute read)

Back to regular programming

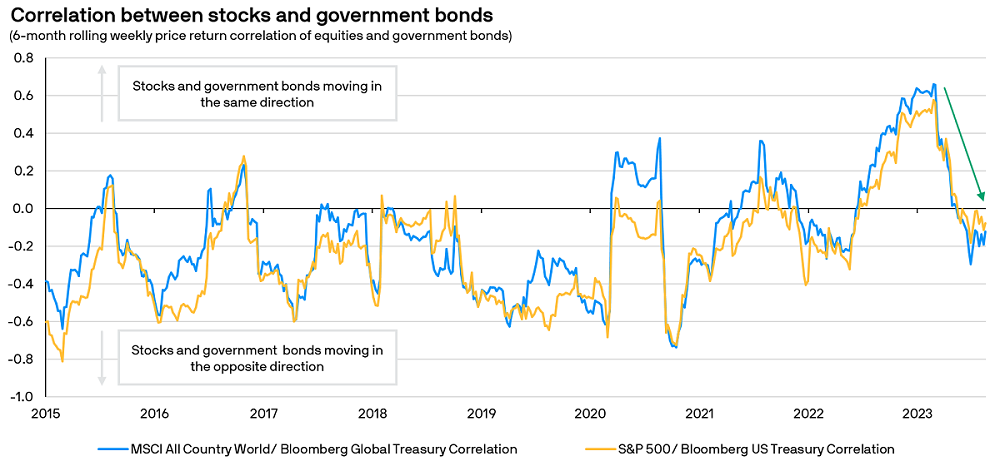

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 18.08.2023. Rolling six month pairwise correlations between weekly price returns of equity indices (S&P 500 and MSCI All Country World Index price indices) and bond indices (Bloomberg Global Treasury Index and Bloomberg US Treasury Index). Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not a reliable indicator of current and future results. This information is provided for illustrative purposes only to demonstrate general market trends. Information shown is based upon market conditions at the time of the analysis and is subject to change. Not to be construed as an offer, research or investment recommendation.

Doing what it says on the label

Actively pursuing stronger bond outcomes

Embrace the flexibility to make active decisions in fixed income

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years.

© 2023 All Rights Reserved – JPMorgan Asset Management (Australia) Limited ABN 55 143 832 080, AFSL No. 376919

Future performance and return of capital is not guaranteed. Information is considered correct at the time of issue but no liability for errors or omissions will be accepted by JPMorgan Asset Management (Australia) Limited or its affiliates. ETFs have fees that reduce their performance, indexes do not. Dividends or returns are not guaranteed. Please refer to offering documents for details on distribution policy.

No provider of information presented here, including index and ratings information, is liable for damages or losses of any type arising from use of their information. Information from communications with you will be recorded, monitored, collected, stored and processed consistent with our Australian Privacy Policy available at am.jpmorgan.com/au/en/asset-management/adv/privacy-policy/.

Fund information, including any performance calculations and other data, is provided by J.P. Morgan Asset Management (the marketing name for the asset management businesses of JPMorgan Chase & Co and its affiliates worldwide).

All investments contain risk and may lose value. The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs. Therefore, before you decide to buy any product or keep or cancel a similar product that you already hold, and for more detailed information relating to the risks of the Fund, the type of customer (target market) it has been designed for and any distribution conditions, it is important that you read and consider the relevant JPMorgan fund Product Disclosure Statement (PDS) and Target Market Determination, which have been issued by Perpetual Trust Services Limited, ABN 48 000 142 049, AFSL 236648, as the responsible entity of the fund and are available to download on this website and make sure that the product is appropriate for you. Before making any decision, it is important for you to consider these matters and to seek appropriate legal, tax, and other professional advice.

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

As the Fed’s rate hike cycle concludes, bonds can present an important source of income and diversification for portfolios.

We explain why investors should pay greater attention to quality bonds.

We share insights on how actively-managed fixed income ETFs can help build stronger portfolios.

Here is a chart indicating IG bond opportunities as US Treasury yields stay elevated.

Employing an equity premium income approach in an income-hungry world.

We share a flow chart to help explain ETF liquidity.

Seeking income as the outcome is the aim of our actively managed equity premium income ETF strategy.

Flexibility is at the heart of our approach to fixed income markets.

We share our insights on optimising call options in equity income ETFs.

We share the basics of call options in equity income ETFs.

We share the basics about thematic ETFs and how they are employed in portfolios.

Income investing can help tap investment opportunities while managing volatility through cash flows from a diversified portfolio of income generating assets.

We share our views on the fixed income themes and opportunities in current choppy markets.

Fixed income isn’t just government or corporate bonds, it also includes non-traditional debt securities.

The securitisation market has regained much ground in the past decade.

Harnessing an active equity ETF to seek out low-risk alpha in a high-risk world.

For more information, please call or email us. You can also contact your J.P. Morgan representative.

1800 576 100 (Application enquiries)