Portfolio Chart: A menu of options as bond yields reset higher

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

Big trends are helping to drive a sustainable future

As volatility continues to challenge markets, investors are looking further afield to generate returns, both geographically and beyond traditional balanced portfolios. As a result, liquid alternatives are becoming increasingly popular in the search for enhanced returns and portfolio diversification1.

Beyond returns, investors are also looking for investment solutions that reflect not only their financial goals but also their values.

We share how we employ our tried and tested macro process, sustainably, to help investors align their return goals with their values2.

The big picture

The war in Ukraine has further challenged risk assets in 2022 by triggering a commodity shock, which put further upward pressure on inflation. Inflation was already persistently high due to labour market strength and COVID-19-related supply chain issues, and has seen central banks turn increasingly hawkish this year, with a sharp re-pricing of interest rate expectations.

Central banks are now explicitly aiming to slow economic activity to reduce demand-side inflation pressures. This adds to the underlying slowing we were already tracking in our cyclical framework at the turn of the year and we estimate the chances of central banks engineering a ‘soft-landing’ where economic activity does not dip substantially below trend as low.

In recent weeks, strict COVID-19 control policies in China in response to an Omicron wave have hit activity markedly. Supply chain bottlenecks stemming from this may result in further inflationary pressures.

Against this backdrop, it is understandable for investors to focus on volatility management in the near term. Still, heightened market volatility has given rise to a shifting array of price dislocations and unexpected opportunities2.

Big trends drive opportunities

We believe that the cyclical macro economic backdrop, as well as long-term structural changes shaping the world, are significant drivers of asset prices. Organising these changes into a set of macro themes3 provides a framework to focus our research efforts in areas that we believe will have the most impact and offer attractive investment opportunities. Our themes are categorised as either secular (long term) or cyclical (medium to shorter term).

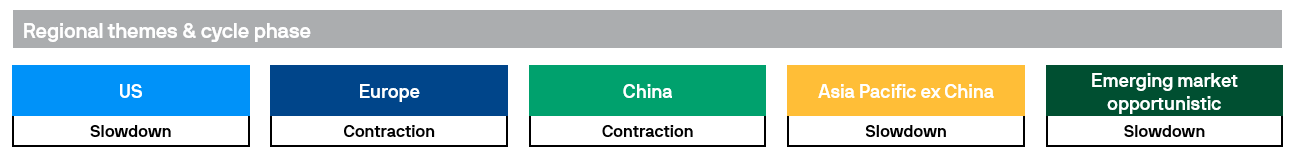

3. Source: J.P. Morgan Asset Management, as at 30.04.2022. US theme includes Canada. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

3. Source: J.P. Morgan Asset Management, as at 30.04.2022. US theme includes Canada. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

As illustrated above, we see the US, Asia Pacific ex-China and emerging markets as being a cyclical slowdown, driven by weaker growth, sentiment and liquidity. Meanwhile, Europe and China are in contraction due, respectively, to the commodity price shock and negative impact on confidence, and renewed COVID-19 restrictions.

3. Source: J.P. Morgan Asset Management, as at 30.04.2022. US theme includes Canada. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

3. Source: J.P. Morgan Asset Management, as at 30.04.2022. US theme includes Canada. Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

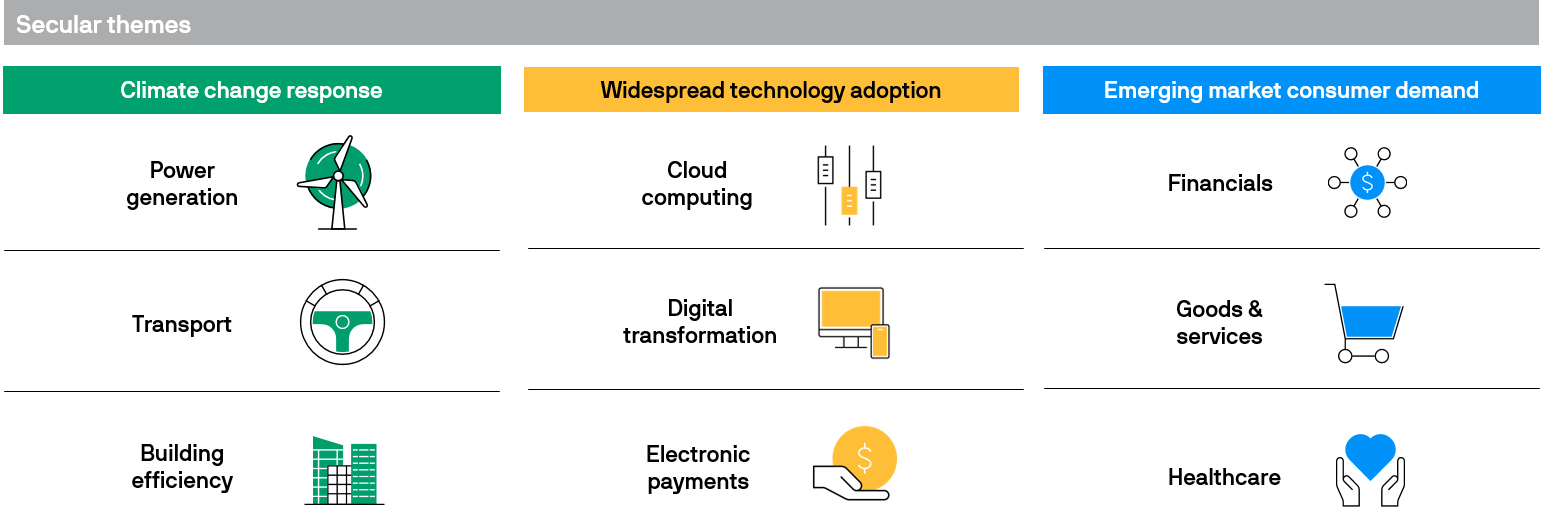

When it comes to secular themes, climate change response reflects the increased focus on sustainability from governments, companies and individuals, which presents multi-year opportunities across industries, such as power generation and construction, as efforts are made to transition to a lower carbon economy.

The widespread adoption of new technologies is another secular theme, in which our main focus is in cloud computing. We see a significant and underpriced shift in enterprise workloads moving from on-premises to cloud infrastructures, which supports the investment thesis for cloud computing providers1.

Another secular theme relates to consumer demand in emerging markets, where we are seeing the growth of the middle class leading to rising demand for financial services, and we hold select Indian banks which are high quality and well-placed to benefit from rising financial penetration in the market1.

The bigger picture is sustainable

JPMorgan Global Macro Sustainable Fund seeks to capitalise on global themes that help drive return opportunities within a sustainability framework.

Investing in liquid alternatives, sustainably

The experience of macro and market developments so far this year acts as a reminder of the importance of designing robust portfolios and this could reinforce the notion of allocating to alternatives.

We have seen episodes where correlations between traditional assets have broken down and bonds had their worst quarterly performance in 1Q 2022 since the 1980s, failing to provide much cushion to equity losses. This could continue to support demand for other assets and the use of alternative strategies.

The flexibility of our investing process, reflecting themes over multiple time horizons and the breadth of our investment universe enable us to seek to deliver our objective of generating positive returns in varying market environments over the long term.

In addition, we integrate the analysis of environmental, social and governance (ESG) topics into our overall assessment of a position and this influences decision making. We seek to manage negative risk scenarios stemming from ESG, and identify where there are opportunities linked to sustainability which might add conviction to our investment thesis.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

2. Provided for information only, not to be construed as investment recommendation. Investments involve risks, not all investment ideas are suitable for all investors.

© 2022 All Rights Reserved - JPMorgan Asset Management (Australia) Limited ABN 55 143 832 080, AFSL No. 376919

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs. Therefore, before you decide to buy any product or keep or cancel a similar product that you already hold, it is important that you read and consider the relevant JPMorgan fund Product Disclosure Statement (PDS) and Target Market Determination,which are available to download on this website and make sure that the product is appropriate for you. Before making any decision, it is important for you to consider these matters and to seek appropriate legal, tax, and other professional advice.

For wholesale clients only, not for retail clients use or distribution. Investment involves risk. Issued by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919).

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

After a difficult year for bonds, we explain why fixed income could once again prove to be a useful diversifier for portfolios.

As the Fed’s rate hike cycle concludes, bonds can present an important source of income and diversification for portfolios.

We explain why investors should pay greater attention to quality bonds.

We share insights on how actively-managed fixed income ETFs can help build stronger portfolios.

Here is a chart indicating IG bond opportunities as US Treasury yields stay elevated.

Employing an equity premium income approach in an income-hungry world.

We share a flow chart to help explain ETF liquidity.

Seeking income as the outcome is the aim of our actively managed equity premium income ETF strategy.

Flexibility is at the heart of our approach to fixed income markets.

We share our insights on optimising call options in equity income ETFs.

We share the basics of call options in equity income ETFs.

We share the basics about thematic ETFs and how they are employed in portfolios.

Income investing can help tap investment opportunities while managing volatility through cash flows from a diversified portfolio of income generating assets.

Income investing remains relevant in the current market environment, as volatility is poised to remain elevated.

We believe that quality and yield opportunities can still be found in bonds.

We share how we consider the risks and opportunities in climate change investing.

We discuss five megatrends related to climate change and the investment implications.

We share our views on the fixed income themes and opportunities in current choppy markets.

We share our perspectives of sustainable investing in an overall portfolio.

Fixed income isn’t just government or corporate bonds, it also includes non-traditional debt securities.

The securitisation market has regained much ground in the past decade.

Harnessing an active equity ETF to seek out low-risk alpha in a high-risk world.

For more information, please call or email us. You can also contact your J.P. Morgan representative.

1800 576 100 (Application enquiries)