Likewise, from a multi-asset portfolio perspective, income generated from a variety of instruments including stocks and bonds can act as a buffer during periods of elevated asset price volatility.

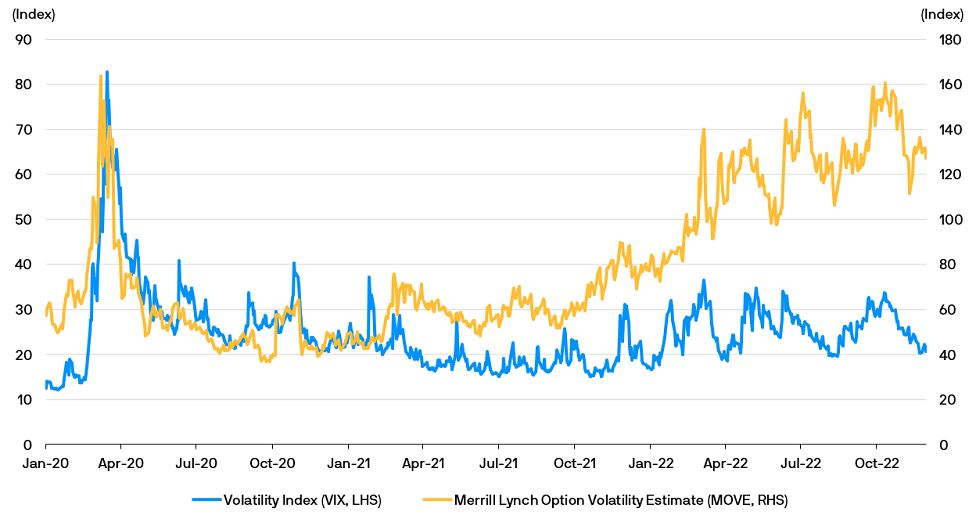

This may prove critical as market volatility remains high, as evidenced by the elevated Merrill Lynch Option Volatility Estimate (MOVE) index – a gauge of bond market volatility – and the Volatility Index – a gauge of the underlying volatility of the S&P 500. Even for a traditionally defensive asset class like fixed income, volatility has surged faster than equities. Volatility is still poised to stay elevated as markets work through a challenging macro setting, marked by stickier inflation, rising global interest rates, elevated geopolitical risks and rising recession fears.

Chart 2: Volatility remains elevated across both equity and bond markets

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 30.11.2022.

Provided for information only to illustrate macro trends, not to be construed as research or investment advice. Investments involve risks. Not all investments are suitable for all investors. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not indicative of current or future results.

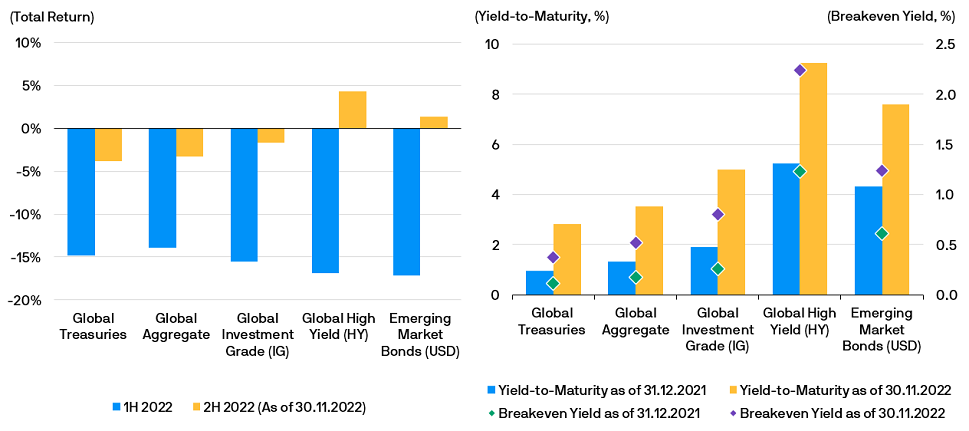

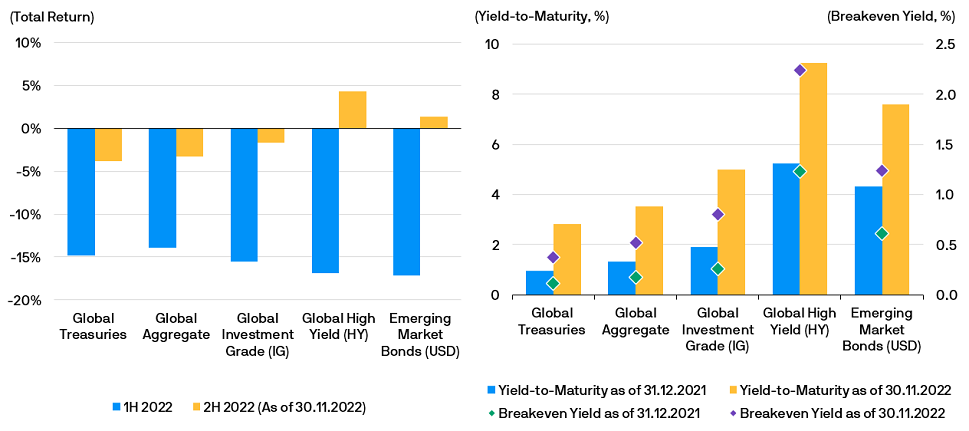

Yet through the trials and tribulations of a volatile 2022, there is a silver lining – the availability of income opportunities has meaningfully improved. A revaluation of both equity and bond markets has led to opportunities for higher dividend and bond yields.

Notably, the repricing in fixed income markets has been rather aggressive, leading to a rise in yields across a wide array of fixed income sectors year-to-date (as of 30 November 2022).

Chart 3: Yields have increased meaningfully across most fixed income sectors

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 30.11.2022. 1H 2022 time frame: 31.12.2021 – 30.06.2022. 2H 2022 time frame: 30.06.2022 - 30.11.2022.

Global Treasuries: Bloomberg Global Treasury Total Return Index; Global Investment Grade (IG): Bloomberg Global Aggregate – Corporate Total Return Index; Global Aggregate: Bloomberg Global Aggregate Total Return Index; Global High Yield: Bloomberg Global High Yield Total Return Index; Emerging Market (USD): Bloomberg Emerging Market USD Aggregate Total Return Index.

High-yield refers to corporate bonds which are given ratings below investment grade and are deemed to have a higher risk of default. Yields are not guaranteed. Positive yield does not imply positive return.

Breakeven yield is the magnitude of further rate rises required to produce a negative total return. Breakeven yield is calculated by dividing the Yield-to-Maturity by the duration; this does not take into account expected default. Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years.

Provided for information only to illustrate macro trends, not to be construed as research or investment advice. Investments involve risks. Not all investments are suitable for all investors. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not indicative of current or future results.

Nevertheless, these opportunities come with risks. Dividends are not guaranteed while higher yielding bonds tend to carry higher credit risks. With economic momentum slowing and financial conditions tightening, managing these risks will become increasingly important. Investors are once again faced with the perennial challenge of having to balance the potential rewards of significantly higher yielding assets with the risks of an uncertain macro environment.