What if … things keep getting more expensive?

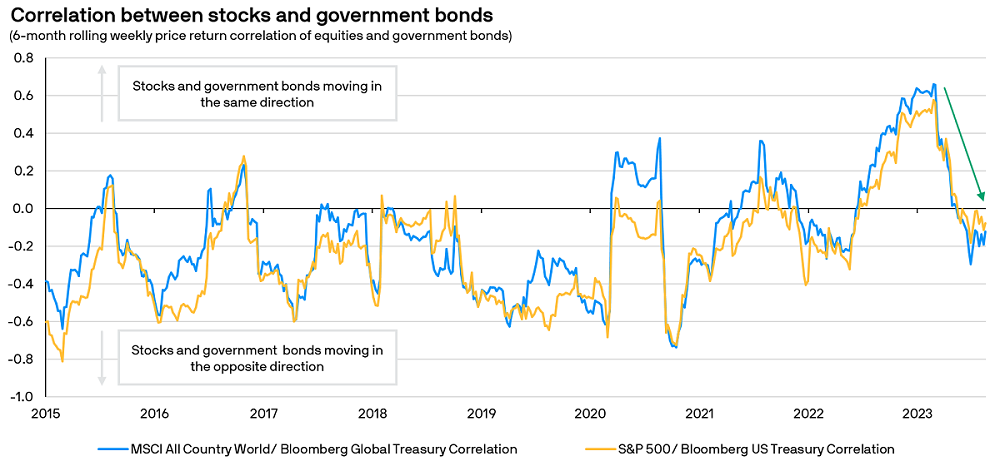

Inflation can diminish purchasing power. Exploring investment opportunities in various asset classes such as equities and bonds, subject to our individual risk appetite and financial goals, can help manage the impact of inflation over the long run.