Giving it time. Letting it grow.

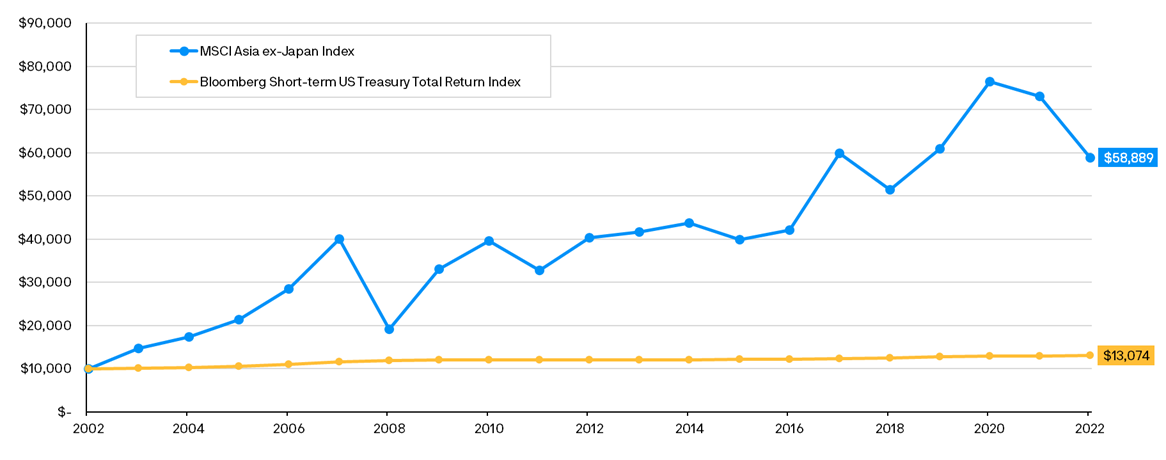

Harnessing Asia’s growth potential requires a long-term perspective as these enduring, multi-year secular themes take time to bear fruit. As illustrated below, investing in Asia ex-Japan equities invariably entails some volatility, but the longer-term outcome could be worthwhile2.

Investing for the long run

As an illustration of long-term investing, the chart below tracks the historical cumulative growth of US$10,000 invested in Asia ex-Japan equities versus short-term US Treasuries over a 20-year time horizon2.

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.05.2023. For illustrative purposes only. Asia ex-Japan equities is based on the MSCI Asia ex-Japan Index. Short-term US Treasuries is based on the Bloomberg Short-term US Treasury Total Return Index. Both indices are in US dollar terms. Results may vary. Past performance is not indicative of current or future results. Provided for information only to illustrate macro trends, not to be construed as offer, research or investment advice. Indices do not include fees or operating expenses and are not available for actual investment. Typically, actual investment also includes fees and charges.

From this perspective, an allocation to Asian equities, in the context of a well-diversified portfolio, can be useful for longer-term goals such as retirement, where investment horizons tend to stretch decades rather than months or years2.

In addition, in instances where Asian assets are underrepresented in a portfolio, we believe Asian equities can present an important source of regional diversification2.