Searching the globe for equity opportunities

While the US market remains an important source of alpha opportunities, there is an increasing appreciation among investors for the need to diversify return streams.

Which is why JPMorgan ASEAN Equity Fund seeks to integrate the best of Southeast Asia into a powerhouse portfolio that strives to capture long-term compounders and medium-term opportunities.

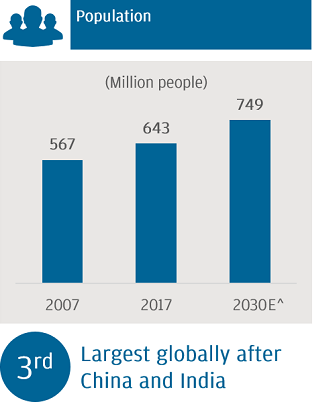

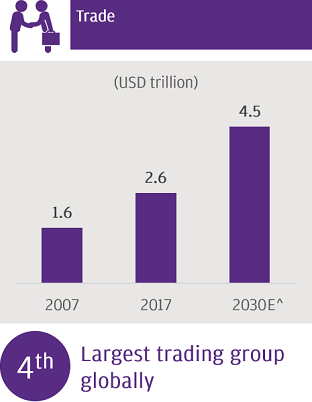

The Association of Southeast Asian Nations (ASEAN) comprises 10 member states and its economy is extensive, with youthful demographics and relatively low penetration rates for many goods and services. Rapid growth is underpinned by foreign direct investment, infrastructure investment and structural reforms.

Source: UOB Economic-Treasury Research, Macrobond, Visual Capitalist. GDP: gross domestic product. Opinions, estimates, forecasts, projections are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

^Forecasts / Estimates may or may not come to pass.

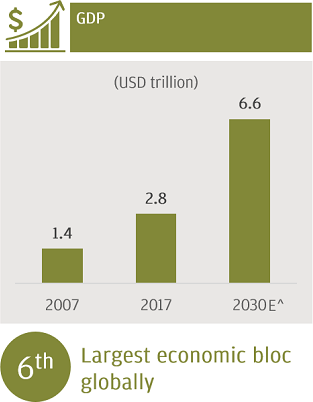

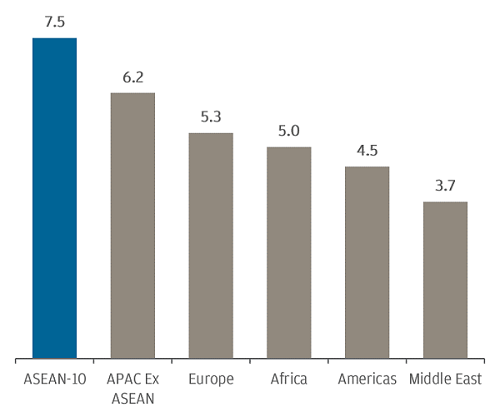

ASEAN captures 10%* of all international tourists and is one of the fastest-growing region in the world.

Tourist arrival 4-year CAGR^^ (%)

* Source: UBS, data as of 31.12.2018.

^^ Source: UBS, data as of 31.12.2018. Based on Compound Annual Growth Rate (CAGR).

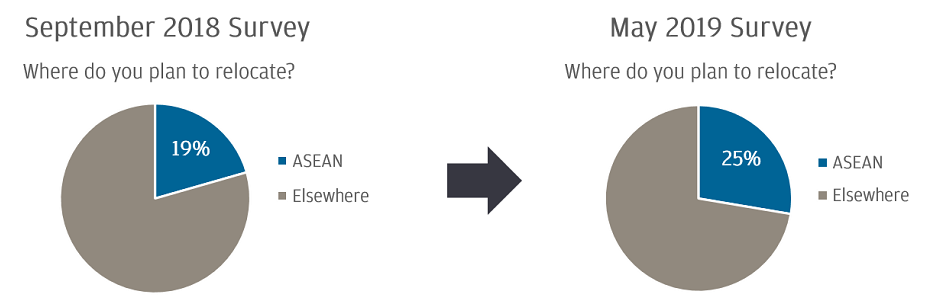

Despite the US–China trade row, ASEAN is potentially one of the largest beneficiaries as corporates are rethinking their supply chain strategies.

Source: “The 2019 AmCham Joint Survey on Tariffs”, AmCham China & AmCham Shanghai.

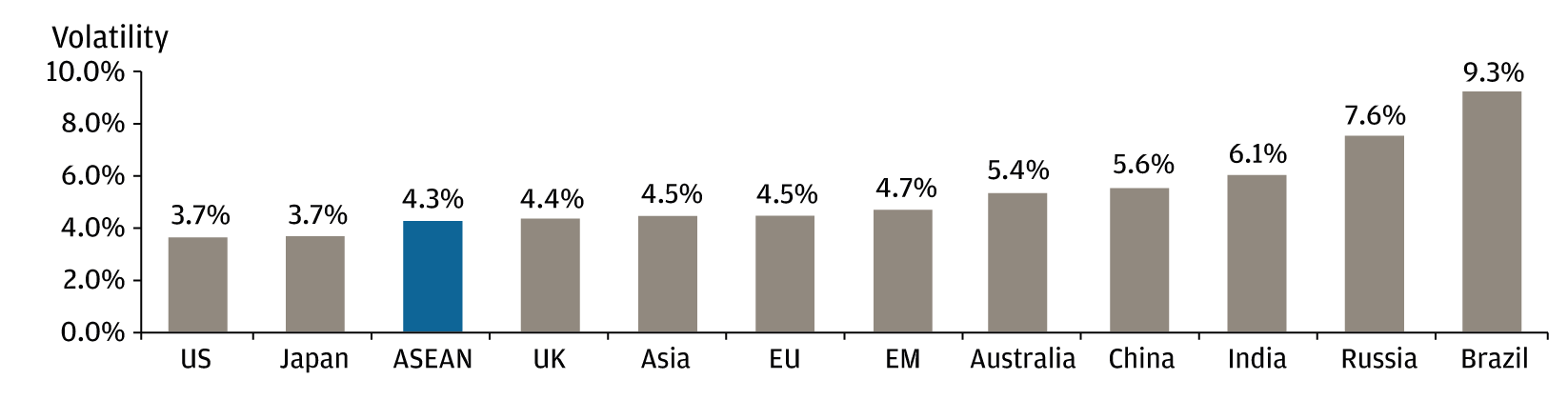

ASEAN continues to offer opportunities for sustainable growth and diversification*. Underpinned by its youthful demographics and infrastructure investment alongside various policy reforms, we believe the region remains relatively resilient.

Equity index volatility over the last 10 years

Source: J.P. Morgan Asset Management, MSCI, DataStream, data as of 23.06.2021. Equity indices shown are MSCI Country indices. EU: Europe; EM: Emerging Markets. Volatility = 6 month rolling standard deviation of monthly returns (in US dollars).

*Diversification does not guarantee positive return or eliminate risk of loss.

![]()

Award-winning

The Fund was awarded a Morningstar Silver Medalist Rating, alongside a 4-star rating1.

![]()

High conviction ideas

The Fund leverages a comprehensive research platform through a bottom-up approach with top-down considerations, seeking the long-term compounders and domestic champions of tomorrow.

![]()

Strong local presence

J.P. Morgan Asset Management has been managing dedicated ASEAN portfolios since 1983. We have a dedicated team of 5 ASEAN investment professionals on the ground with an average 19 years of industry experience2.

1. Source of medalist rating: Morningstar, Inc., awarded to A (acc) - USD Class, A (acc) - SGD Class and A (dist) - USD Class. Source of star rating: Morningstar, Inc., awarded to A (acc) - SGD Class and A (acc) - USD Class. Data as of 31.03.2024.

2. Source: J.P. Morgan Asset Management. Data as at 31.03.2024.

![]()

![]()

![]()

1. Source: J.P. Morgan Asset Management, as of 31.03.2024.

2. Source: J.P. Morgan Asset Management. Data as of 31.03.2024. Data includes internal Fund of Funds and joint ventures.

While the US market remains an important source of alpha opportunities, there is an increasing appreciation among investors for the need to diversify return streams.

Wider valuation and performance dispersion, elevated market concentration and potentially higher-for-longer interest rates underscore the importance of an active approach when engaging opportunities in the US stock market.

Inflation can diminish purchasing power. Exploring investment opportunities in various asset classes such as equities and bonds, subject to our individual risk appetite and financial goals, can help manage the impact of inflation over the long run.

You may need to plan for the possibility of living much longer – perhaps 30+ years – in retirement. This underscores the importance of saving adequately and investing a portion of your portfolio for growth to maintain your purchasing power over time.

A soft landing outcome coupled with the potential for monetary easing later this year, could present significant tailwinds for US stocks.

With starting yields across many fixed income sectors hovering near decade highs, it could be opportune to lock in elevated yields as central banks approach the end of their rate hike cycles.

Approaching income investing without borders, bias and benchmarks.

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

After a difficult year for bonds, we explain why fixed income could once again prove to be a useful diversifier for portfolios.

As the Fed’s rate hike cycle concludes, bonds can present an important source of income and diversification for portfolios.

We explain why investors should pay greater attention to quality bonds.

We share insights on the Japanese equity strategy while riding on cyclical and structural tailwinds.

ASEAN, China and the broader Asia ex-Japan region present ample opportunities for long-term growth.

A quick look at how the Fund is positioned as recession risks loom and financial conditions tighten.

A quick take on our strategy in investing Asian income assets amid global economic slowdown and China’s reopening.

Flexibility is at the heart of our approach to fixed income markets.

Income investing can help tap investment opportunities while managing volatility through cash flows from a diversified portfolio of income generating assets.

We share the key themes driving equities as China reopens.

We share the key themes that are driving equity investment opportunities in ASEAN.

Income investing remains relevant in the current market environment, as volatility is poised to remain elevated.

We believe that quality and yield opportunities can still be found in bonds.

We share how we consider the risks and opportunities in climate change investing.

Sustainable investing is a forward-looking approach that aims to deliver long-term sustainable financial return in a fast-changing world.

The securitisation market has regained much ground in the past decade.

Sustainable Investing Solutions

To achieve our desired retirement, it is important to anticipate the possible challenges that retirees could face and be better financially prepared.

Insights and products to help you cut through the noise and keep your portfolio on track.

Our wide range of income solutions that seek multiple yield opportunities across asset classes, regions and sectors for stronger outcomes.

Sitting on excess liquidity for long-term goals like retirement may not be optimal given the diminishing effects of inflation on the purchasing power of money over the long run.

Let’s look at what the Fund has achieved over the last 10 years.

Dividend equities may play an important role in portfolios as investors navigate a more challenging market environment marked by slowing growth, higher interest rates, and elevated geopolitical risks.

For Fund or Institutional enquiries, please call or email us. You can also contact your financial advisor or your J.P.Morgan Representative.

JPMorgan ASEAN Equity Fund is the marketing name of the JPMorgan Funds – ASEAN Equity Fund.

By using this information, you confirm that you are a Singapore resident and you accept the Terms of Use as set out in https://www.jpmorgan.com/sg/am/per/.

This is meant for informational purposes only and is intended solely for the person to whom it is delivered. Except as indicated on this website or otherwise with express consent from JPMorgan Asset Management (Singapore) Limited, it may not be reproduced or distributed, in whole or in part, to any third parties and in any jurisdiction.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It does not constitute investment advice and it should not be treated as an offer to sell or a solicitation of an offer to buy any fund, security, investment product or service. The information contained herein does not constitute J.P. Morgan research and should not be treated as such.

Investment involves risks. Dividend distributions if any are not guaranteed and are made at the manager’s discretion. Funds which are invested in emerging markets, smaller companies and financial derivative instruments may also involve higher risks and are usually more sensitive to price movements. Any applicable currency hedging process may not give a precise hedge and there is no guarantee that any hedging will be successful. Investors in a currency hedged fund or share class may have exposure to currencies other than the currency of their fund or share class.

Not all investment ideas referenced are suitable for all investors. Investors should make their own investigation or evaluation or seek independent advice prior to making any investment. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. The information provided herein should not be assumed to be accurate or complete and you should conduct your own verification. References to specific securities, asset classes and financial markets and any forecast contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. J.P. Morgan accepts no legal responsibility or liability for any matter or opinion expressed in this material.

The fund(s) mentioned in this document has/have been approved as recognised scheme(s) under the Securities and Futures Act, Chapter 289 of Singapore. Any offer or sale, or invitation for subscription or purchase of the Fund(s) must be accompanied with the relevant valid Singapore Offering Documents (which incorporates and is not valid without the relevant Luxembourg prospectus). Please refer to the Singapore Offering Documents including the risk factors set out therein and the relevant Product Highlights Sheet for details before any investment. The Singapore Offering Documents including the Product Highlights Sheet can be found at https://www.jpmorgan.com/sg/am/per/.

The funds seek to achieve the investment objectives stated in the offering documents, there can be no guarantee the objective will be met. Investments in the Fund are not deposits and are not considered as being comparable to deposits. Fund’s net asset value may likely have high volatility due to its investment policies, exposure to emerging markets, financial derivatives instruments or portfolio management techniques. The value of the units in the scheme and the income accruing to the units, if any, may fall or rise. Past Performance is not indicative of current or future results and investors may not get back the full or any part of the amount invested.

© 2023 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Source of star and analyst rating: Morningstar, Inc.

This material is issued by JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K). All rights reserved.