Searching the globe for equity opportunities

While the US market remains an important source of alpha opportunities, there is an increasing appreciation among investors for the need to diversify return streams.

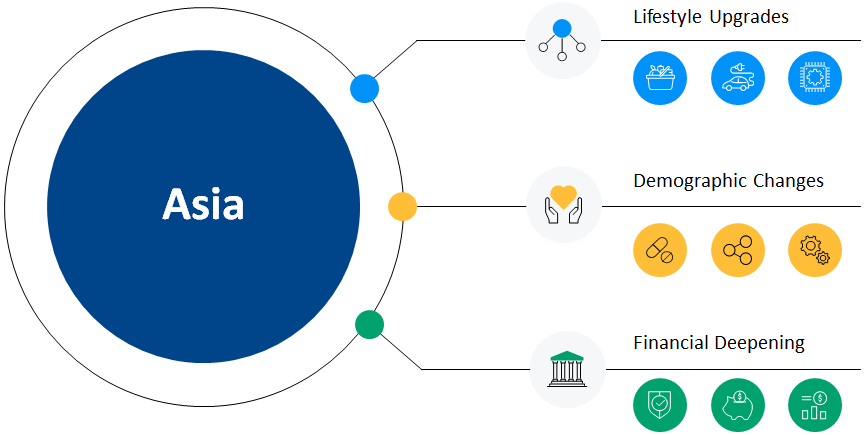

Trends shaping Asia today

The continuing evolution of Asia’s economies presents opportunities for diversification and structural growth. Factors such as the rise of the middle class and lifestyle changes could play increasingly significant roles in Asia’s markets.

For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Provided to illustrate broad market trends, not to be construed as research or investment advice.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

The digital wave

Rising demand for technological products and services, alongside the adoption of technology such as cloud computing, artificial intelligence, autonomous cars and 5G, is benefitting market leaders in Asia.

Asia’s rising consumption

Generally, an increase in income could drive consumers to pursue higher quality lifestyles, unleashing demand for upgrades in consumption.

Path to decarbonisation

Carbon neutrality is gaining ground among companies across the region, presenting new investment opportunities.

Giants and champions

Although Asia’s multiple economies are in varying stages of development, the region is also home to some of the world’s leading companies in their sectors, particularly in consumer, internet and technology.

A diverse pool

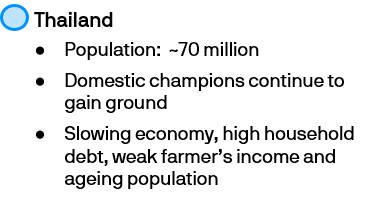

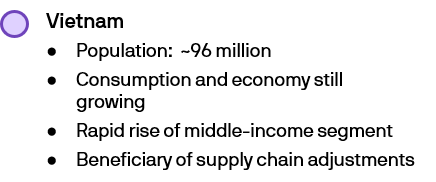

Economies in the Association of Southeast Asian Nations (ASEAN) have developed a vibrant yet diverse pool of businesses. The region is well-placed for many long-term structural positives such as favorable demographics, further supply chain diversification and increasing digital adoption.

ASEAN in a snapshot – middle class is estimated to double to 344 million by 2030E

Source: Bloomberg, J.P. Morgan Asset Management, ASEAN Secretariat. As of June 2020. Middle class population estimates from uaasean.org. The opinions and views expressed here are those of the investment team at the date of publication which are subject to change and are not to be taken as or construed as investment advice. FDI: foreign direct investment. Estimates and forecasts are indicative, may or may not come to pass. Provided to illustrate macro-economic trends, not to be construed as offer, research or investment advice.

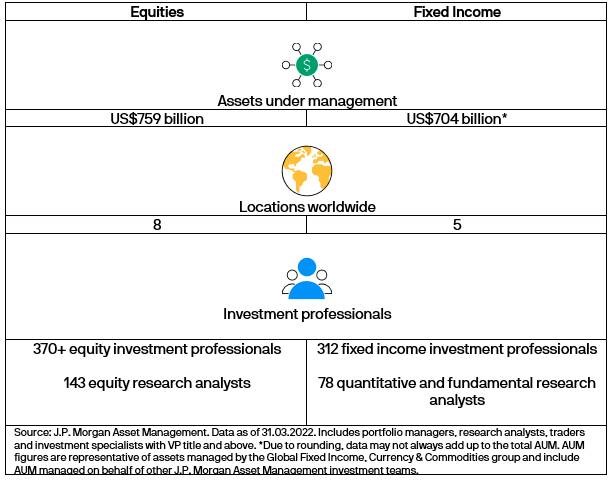

Our powerhouse of Equities and Fixed Income capabilities

JPMorgan China A-Share Opportunities Fund is the marketing name of JPMorgan Funds - China A-Share Opportunities Fund. JPMorgan Asia Growth Fund is the marketing name of JPMorgan Funds - Asia Growth Fund. JPMorgan ASEAN Equity Fund is the marketing name of JPMorgan Funds - ASEAN Equity Fund. JPMorgan Asia Pacific Income Fund is the marketing name of JPMorgan Funds - Asia Pacific Income Fund.

By using this information, you confirm that you are a Singapore resident and you accept the Terms of Use as set out in https://www.jpmorgan.com/sg/am/per/.

This website is meant for informational purposes only and is intended solely for the person to whom it is delivered. Except as indicated on this website or otherwise with express consent from JPMorgan Asset Management (Singapore) Limited, it may not be reproduced or distributed, in whole or in part, to any third parties and in any jurisdiction.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It does not constitute investment advice and it should not be treated as an offer to sell or a solicitation of an offer to buy any fund, security, investment product or service. The information contained herein does not constitute J.P. Morgan research and should not be treated as such.

Investment involves risks. Dividend distributions if any are not guaranteed and are made at the manager’s discretion. Funds which are invested in emerging markets, smaller companies and financial derivative instruments may also involve higher risks and are usually more sensitive to price movements. Any applicable currency hedging process may not give a precise hedge and there is no guarantee that any hedging will be successful. Investors in a currency hedged fund or share class may have exposure to currencies other than the currency of their fund or share class.

Not all investment ideas referenced are suitable for all investors. Investors should make their own investigation or evaluation or seek independent advice prior to making any investment. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. The information provided herein should not be assumed to be accurate or complete and you should conduct your own verification. References to specific securities, asset classes and financial markets and any forecast contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. J.P. Morgan accepts no legal responsibility or liability for any matter or opinion expressed in this material.

The fund(s) mentioned in this document has/have been approved as recognised scheme(s) under the Securities and Futures Act, Chapter 289 of Singapore. Any offer or sale, or invitation for subscription or purchase of the Fund(s) must be accompanied with the relevant valid Singapore Offering Documents (which incorporates and is not valid without the relevant Luxembourg prospectus). Please refer to the Singapore Offering Documents including the risk factors set out therein and the relevant Product Highlights Sheet for details before any investment. The Singapore Offering Documents including the Product Highlights Sheet can be found at https://www.jpmorgan.com/sg/am/per/.

The funds seek to achieve the investment objectives stated in the offering documents, there can be no guarantee the objective will be met. Investments in the Fund are not deposits and are not considered as being comparable to deposits. Fund’s net asset value may likely have high volatility due to its investment policies, exposure to emerging markets, financial derivatives instruments or portfolio management techniques. The value of the units in the scheme and the income accruing to the units, if any, may fall or rise. Past Performance is not indicative of current or future results and investors may not get back the full or any part of the amount invested.

This material is issued by JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K). All rights reserved.