Bonds are no longer a supporting character in portfolios

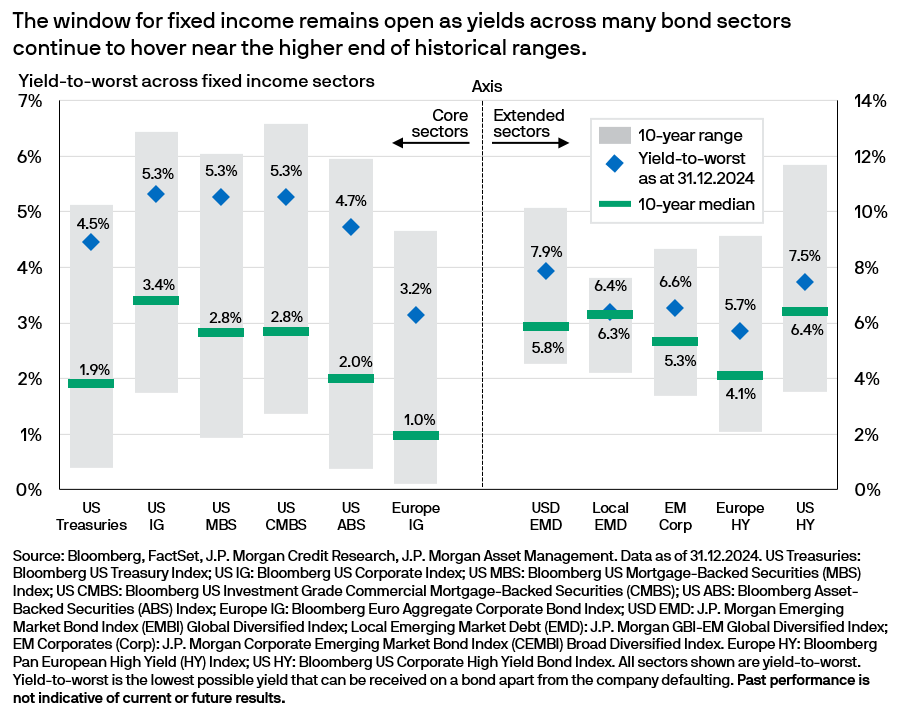

The days of the zero lower bound and negative yields have become a distant memory, allowing bonds to once again regain their rightful place in portfolios as both an attractive source of income and portfolio diversifier.

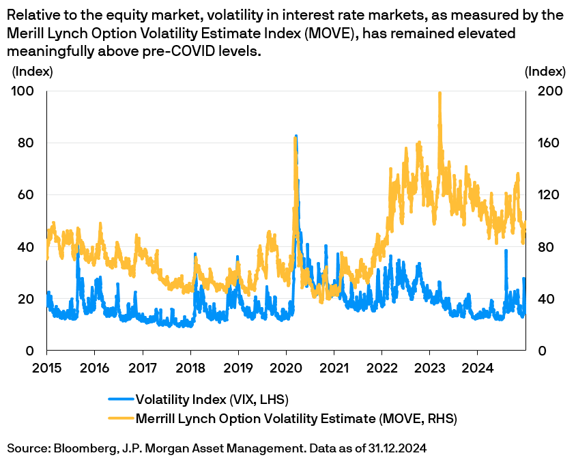

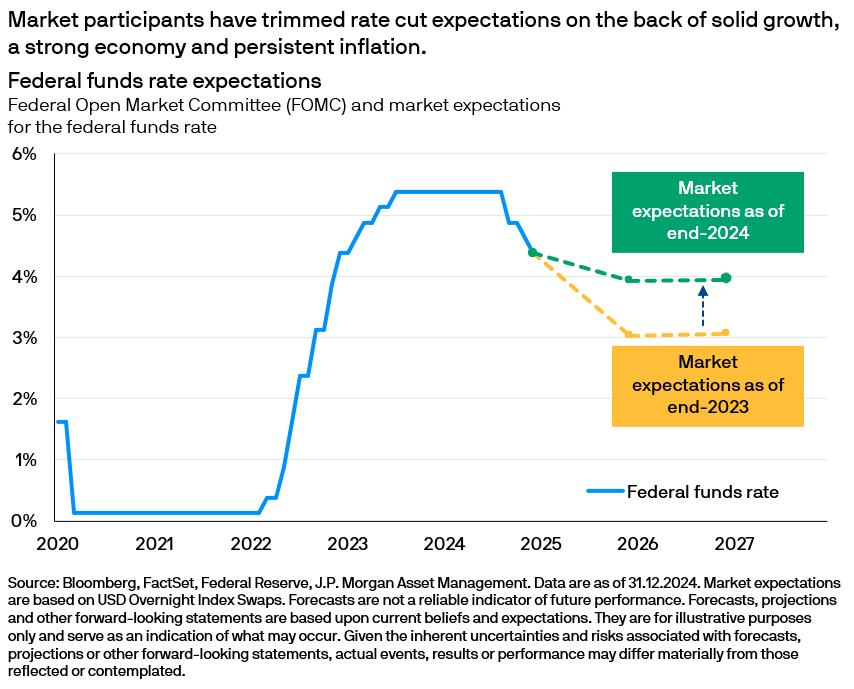

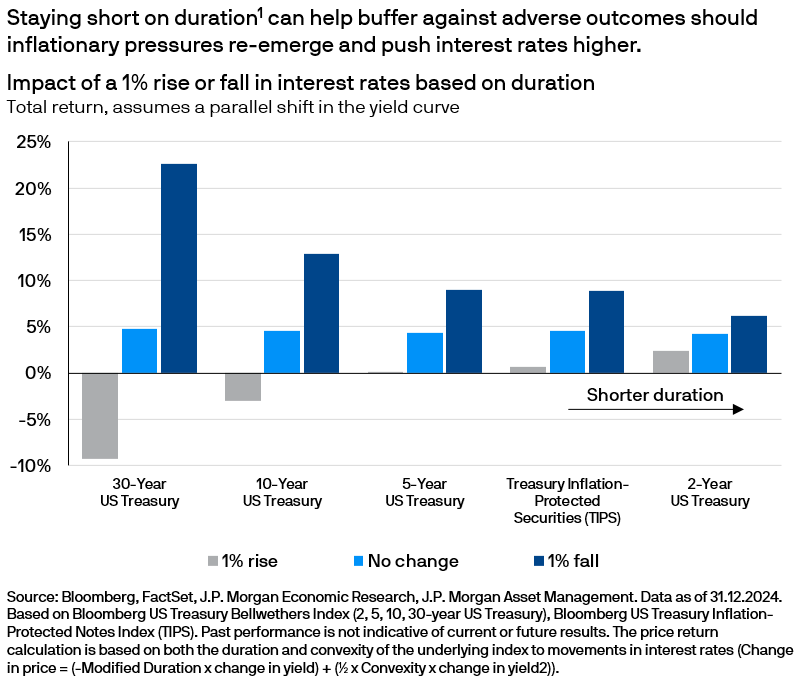

While the fixed income market is rich with opportunities, policy uncertainty, higher valuations and elevated volatility underscore the importance of actively managing duration1 and credit risks. In addition, bottom-up sector and security selection will prove critical in gaining exposure to quality assets that can withstand the vagaries of fast-changing market cycles.

For more than a decade, the JPMorgan Funds – Income Fund has steered through a complex and fast-changing macro environment, all while recording competitive returns, attractive income and lower volatility. This time-tested strategy could prove useful to navigate a constructive yet volatile market backdrop.

This could be the case with a new US administration in control, one whose policies could impact the outlook for growth, employment and monetary policy significantly and unpredictably.