More than just a portfolio diversifier

Given their higher credit rating, better liquidity and relatively low default risk, quality fixed income has moved into sharper focus of late as investors position against potential macro risks on the horizon, including the prospect of a well-telegraphed downturn.

Yet this is not the only reason why quality bonds are back in vogue. In fact, there are other reasons to polish up bond portfolios with higher quality fixed income.

Reason 1: Real yields look compelling

For one, after years of having to make the most of a relatively low-yielding environment, “income” is finally back in fixed income, including government bonds which are typically considered as higher quality bonds.

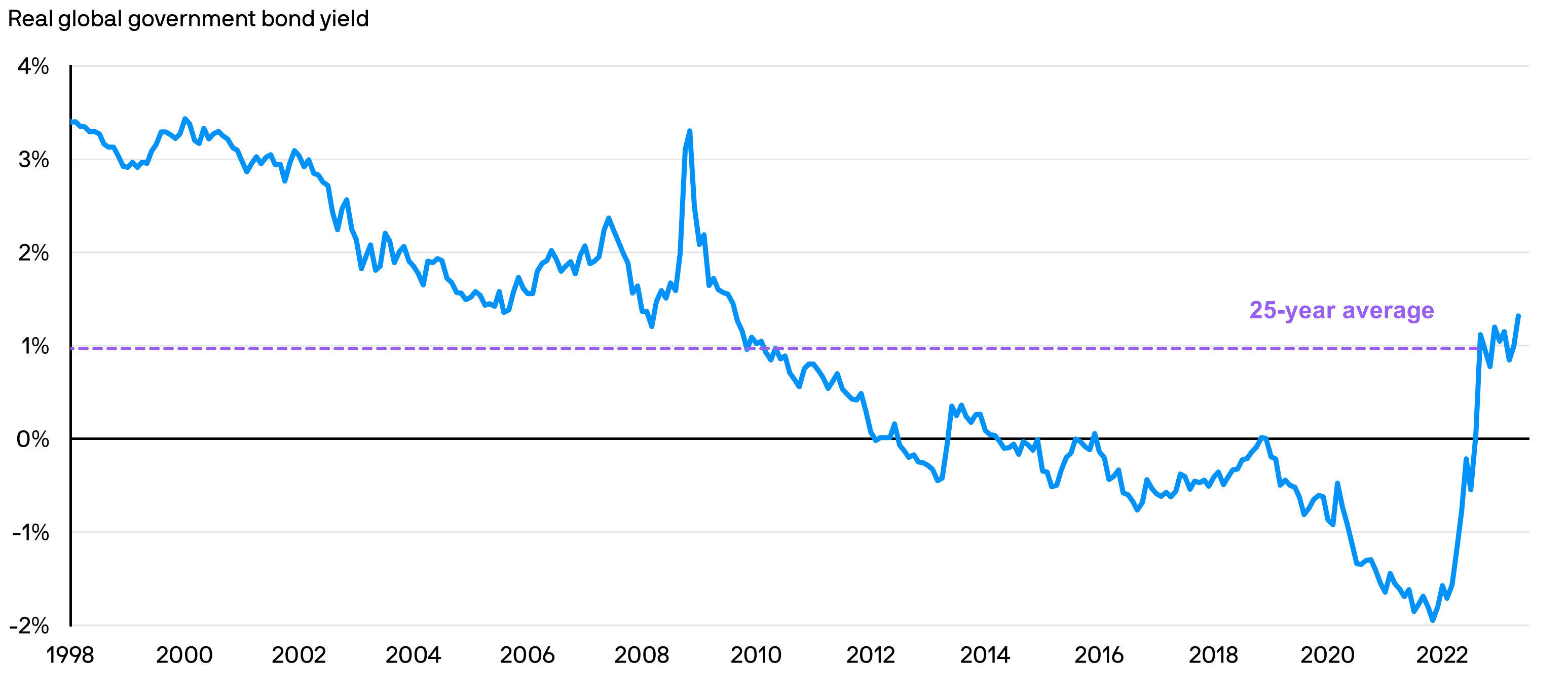

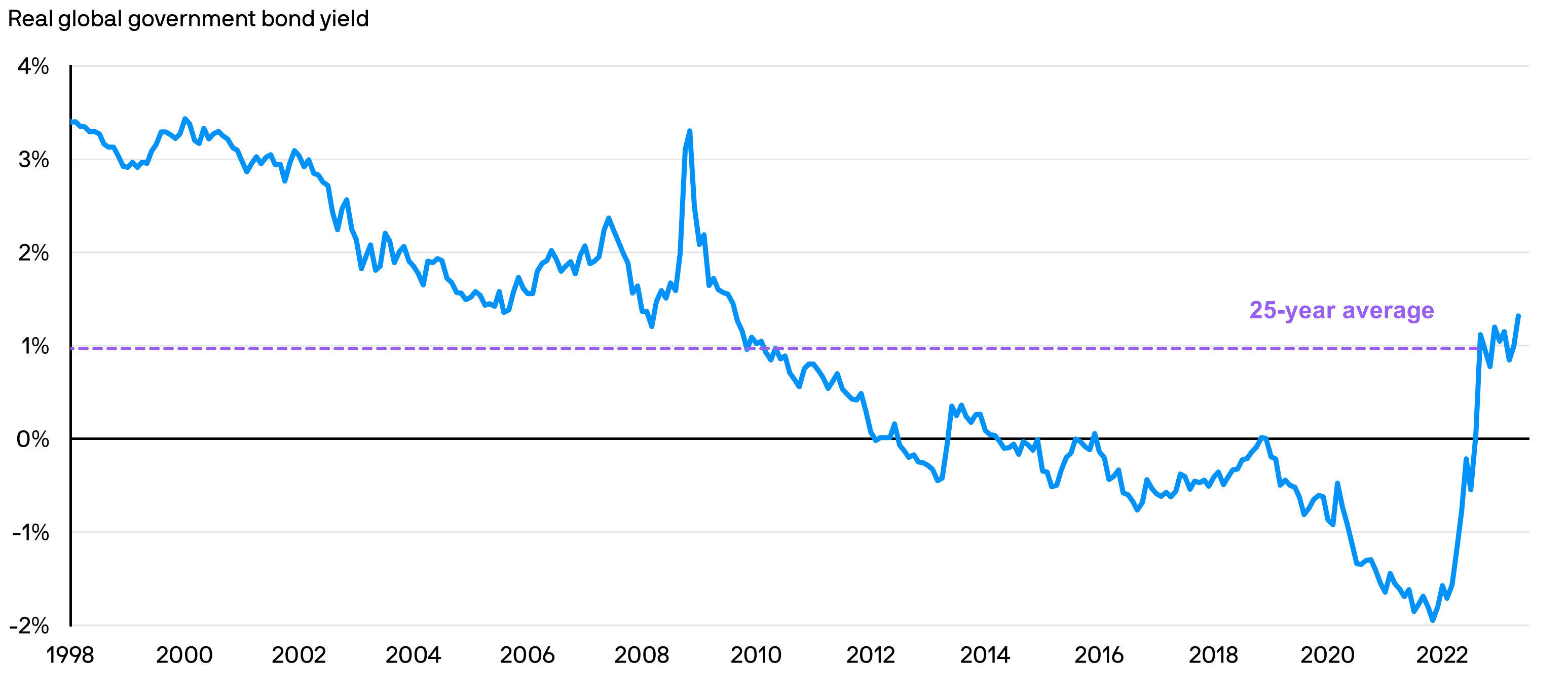

Real government bond yields* have turned positive and surged to the highest levels in over a decade as aggressive central bank tightening forced a major repricing in the bond markets1. As a result, investors are now able to tap opportunities for higher real yields with less of a concern for sacrificing quality in their fixed income portfolios.

Real global government bond yields* have surged to the highest levels in over a decade

1. Source: Bloomberg Finance L.P., ICE BofA, J.P. Morgan Asset Management. Data as of 31.05.2023. Real global government bond yield: Yield-to-Maturity (YTM) of the ICE BofA Global Inflation-Linked Government Index. *Real yields refer to the return to bond investors from interest payments after accounting for inflation. Yield is not guaranteed. Positive yield does not imply positive return. Past performance is not a reliable indicator of current and future results.

Reason 2: Attractive risk-return profile as we approach peak rates

In addition, as we head closer to the end of the rate hike cycle, duration by way of US Treasuries can present opportunities for relatively attractive returns.

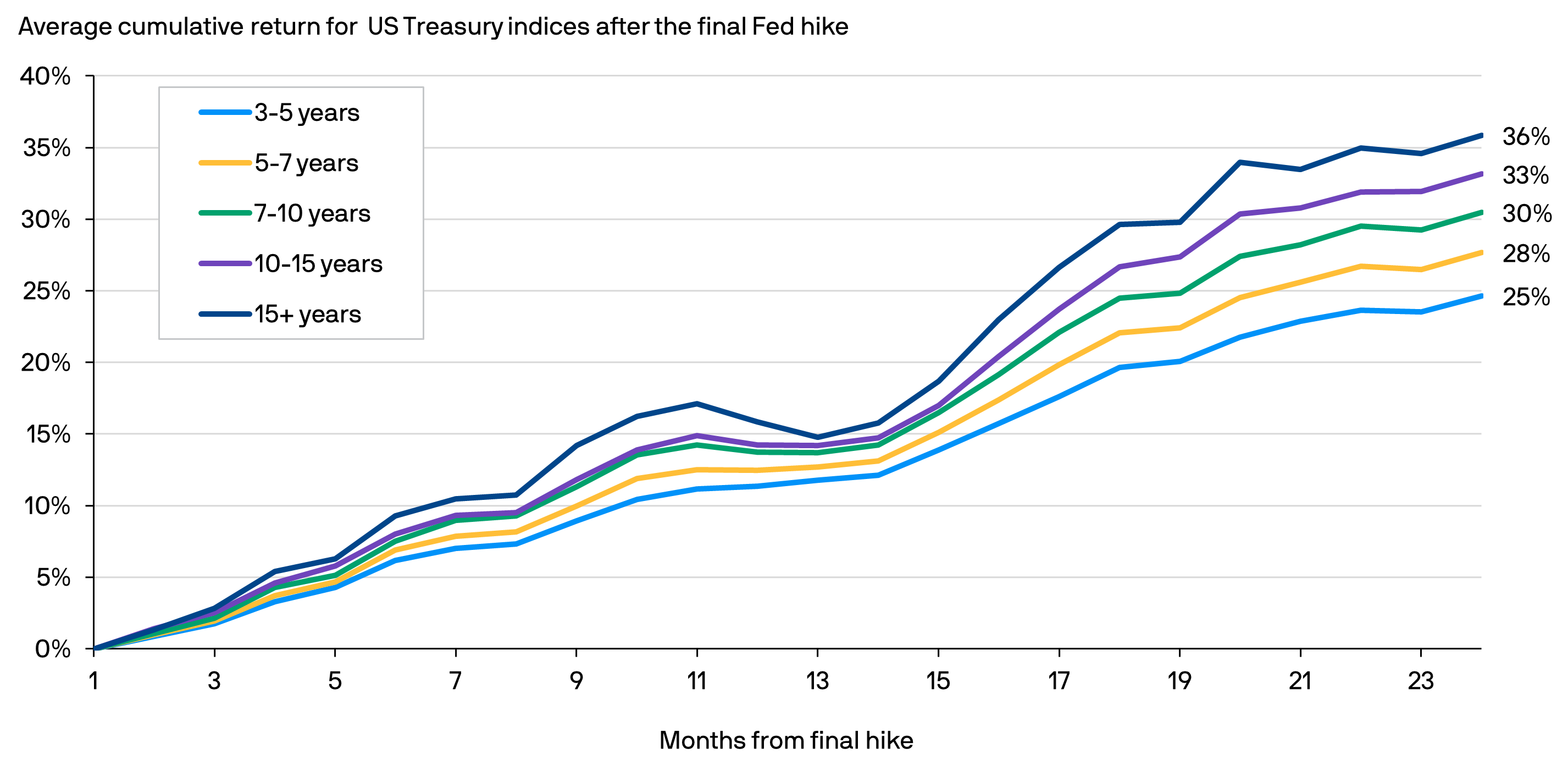

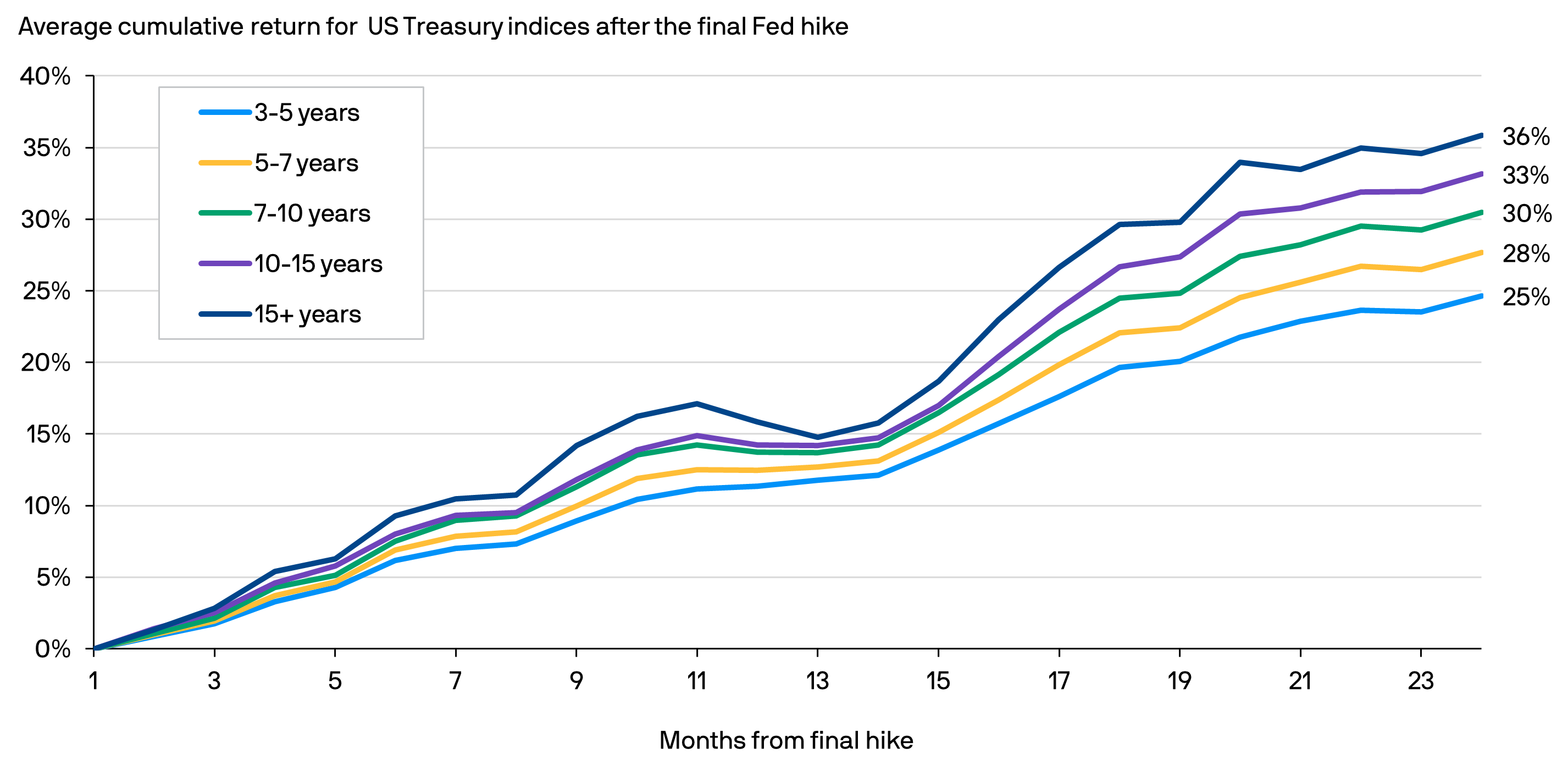

As an illustration of this macro trend, over the last seven rate hike cycles since 1981, US Treasuries have historically delivered relatively robust average cumulative returns in the succeeding 24 months after the Federal Reserve’s (Fed) final rate hike2. This applies across different maturities, although longer duration bonds have historically performed better.

As US Treasuries are typically regarded as risk-free assets, this highlights the return potential of high quality bonds should the US central bank pivot away from further policy tightening.

Average cumulative return of US Treasury indices in the months after the Fed’s final rate hike

2. Sources: J.P. Morgan Private Bank, Bloomberg Finance L.P. Data as of 31.05.2023. Cumulative returns for US Treasury Indices from 1981, 1984, 1989, 1995, 2000, 2006, 2018. Past performance is not a reliable indicator of current and future results.

Reason 3: Inflationary pressure is receding

While inflation has proven stickier than anticipated, it is important to note that inflationary pressure is abating, albeit gradually. Importantly, wage inflation is showing signs of easing as growth in average hourly earnings continues to moderate3.

Even if sticky inflation led to further rate hikes from the Fed, we believe deeper concerns about recession risks could limit the downside for longer duration government bonds. Interestingly, the yield on the 10-year US Treasury benchmark has stayed somewhat range-bound despite the Fed delivering four rate hikes since December 20224.

The case for quality

Decelerating growth, a relatively robust risk-return profile due to higher rates and fading inflation present a more favourable backdrop for quality bonds. Global government bonds can also provide ballast to investment portfolios during periods of heightened risk aversion, as flight-to-safety could lead to higher bond prices and potentially offset declines in other risk assets. Taken together, high quality fixed income can help mitigate downside risks.

An actively managed, quality-biased investment strategy with dynamic risk management5 can help shift exposure towards areas with stronger fundamental outlook while managing duration and currency risks.