Meeting the challenge of an ageing society

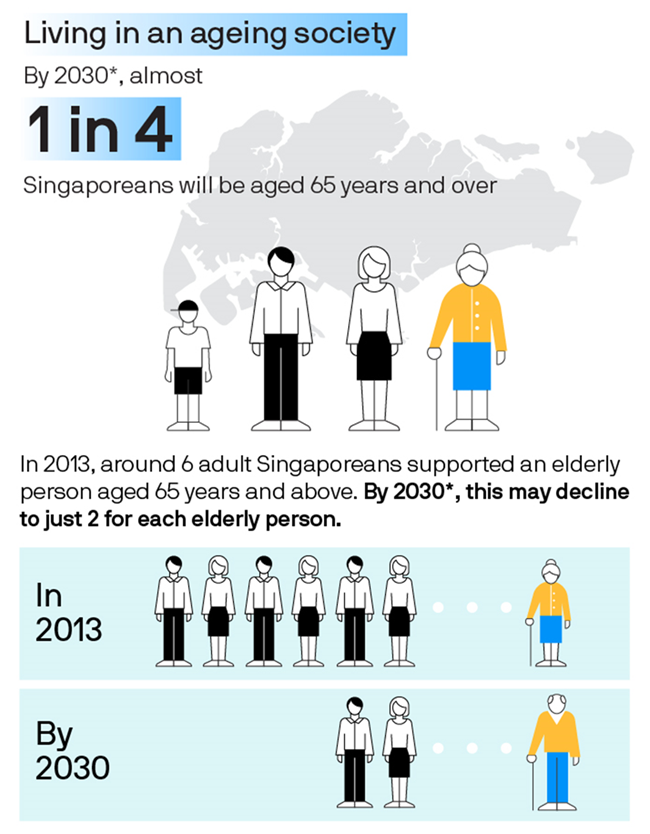

Singapore's population is ageing quickly. In 2013, about 1 in 10 Singaporeans were aged 65 years and older. This is projected to increase to 1 in 4 by 20301. In addition, with more Singaporeans entering their retirement years than working ages, the number of working people able to support a senior person is expected to shrink2.

This, coupled with longer life expectancies, declining average size of households and shifting societal norms that increasingly stress individual responsibility on the part of older Singaporeans3, underscore the importance of taking steps to stay independent in your silver years, both financially and physically.

Taking care of your health is an important part of that equation, but so is growing your wealth to ensure that your financial resources can last over a longer period of time. This can also help improve access to a wider array of medical and care services which many may require in their old age.

The reality is, to retire confidently tomorrow requires a serious effort to grow one’s assets today.

So, are you on track?

With the prices of food, from chicken rice to satay skewers, rising some 12% over the last two years (as of end-August 2023)4, many Singapore residents may be wondering if they have accumulated enough to meet the challenge of future inflation, especially those closer to retirement.

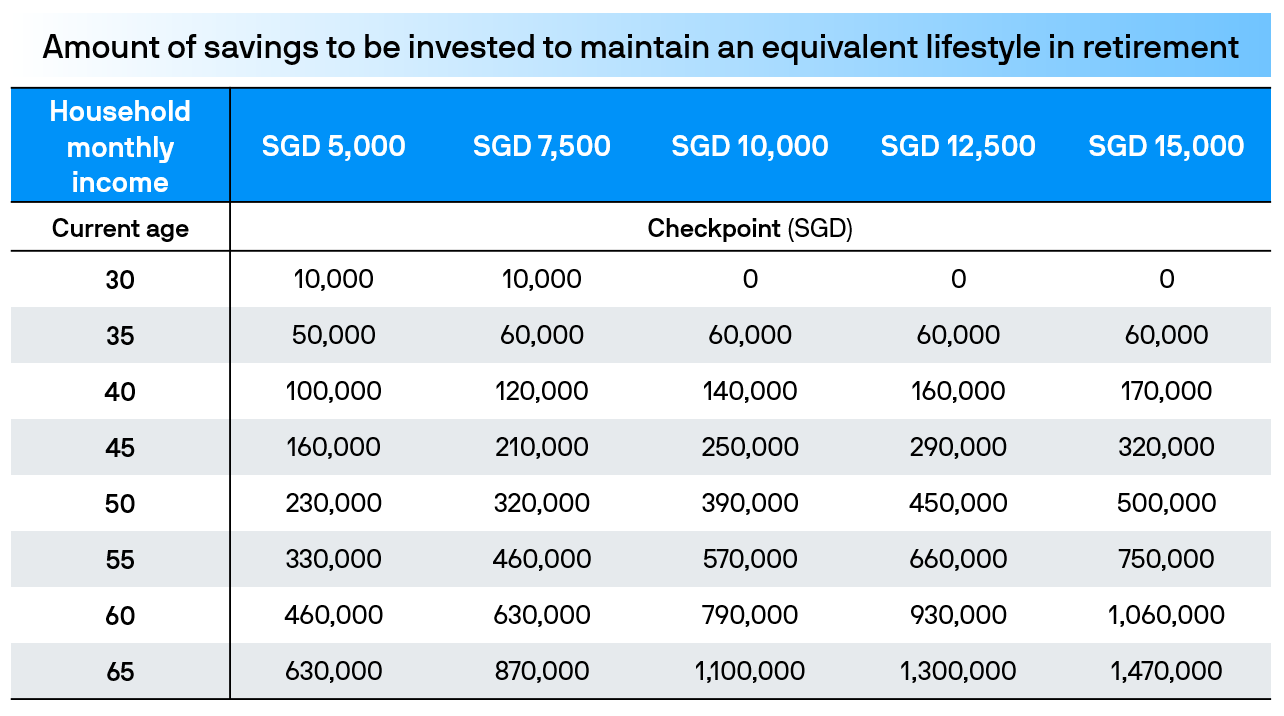

A retirement savings checkpoint or calculator can provide some useful insight into this question. The table below provides a rough gauge as to how much a household could already have invested to maintain their current lifestyle through 30 years of retirement.

How to use it? Go to the intersection of your current age and your closest current household gross monthly income. This is the amount an individual should have invested today, assuming he/she continues saving 10% for retirement going forward. For example, a 40-year-old with a household monthly income of S$10,000 should have S$140,000 invested for retirement today.

If you are below your checkpoint today, or you find that your personal circumstances have changed, work with an adviser to adjust your plan. After all, one’s retirement plan has to remain dynamic, to take into account evolving circumstances which include income, saving and spending habits, the number of years projected at work, the number of years expected in retirement, risk tolerance, the changing cost of a desired retirement lifestyle and so on. There are many variables to consider and these often change with time.

Ultimately, an optimal plan is one that is personalised and evolves as circumstances change.

Model assumptions: (1) Annual contribution rate: 10%^ (2) Pre-retirement investment return: 6.5% (3) Post-retirement investment return: 5% (4) Inflation rate: 1.3% (5) Retirement age: 65 (6) Years in retirement: 30.

^10% annual contribution rate assumed for all income levels.

Source: Central Provident Fund(CPF), Inland Revenue Authority of Singapore (IRAS), Singapore Department of Statistics, J.P. Morgan Asset Management (JPMAM) analysis as of September 2023. J.P. Morgan’s model is based on pre-retirement portfolio of 22% Asia ex-Japan equities, 43% MSCI All Country World, 35% US Aggregate bonds (SGD) and post-retirement portfolio of 12% Asia ex-Japan equities, 23% MSCI All Country World, 65% US Aggregate bonds (SGD). This portfolio is customised by J.P. Morgan Asset Management Multi-Asset Solutions. Lower forward-looking returns may require higher savings going forward. This chart is for illustrative purposes only and must not be used, or relied upon, to make investment decisions. Allocations, assumptions and expected returns are not meant to represent J.P. Morgan Asset Management performance. Given the complex risk/reward trade-offs involved, we advise clients to rely on judgment as well as quantitative optimisation approaches in setting strategic allocations. References to future returns for either asset allocation strategies or asset classes are not promises or even estimates of actual returns a client portfolio may achieve. Investments involve risks. Not all investments, strategies or ideas are suitable for all investors. Investors should make their own evaluation or seek independent advice prior to making any investment. Currency in SGD.

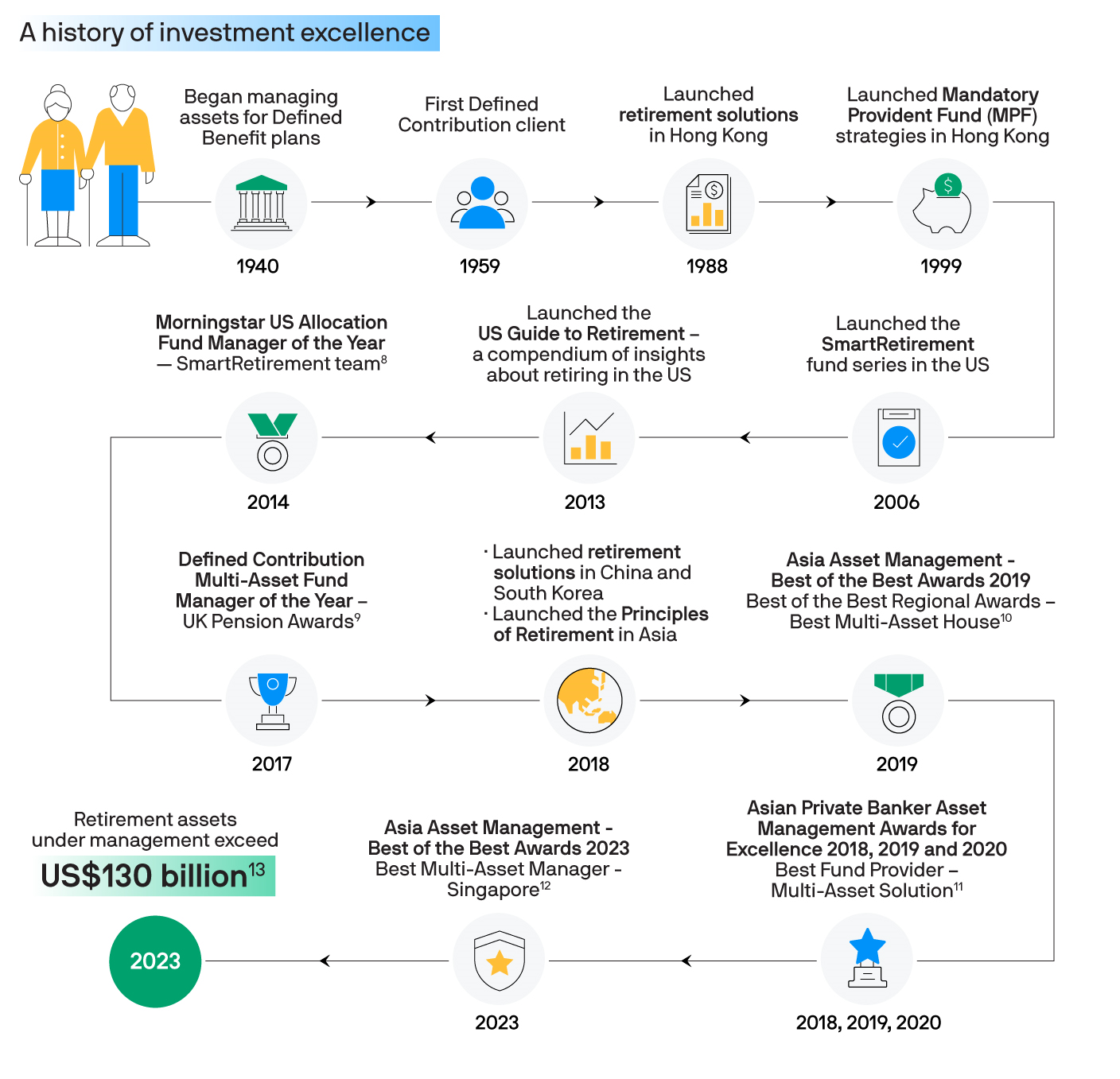

Retirement capabilities honed over the decades

J.P. Morgan Asset Management has a long and proud history of helping clients achieve stronger outcomes for retirement through various investment strategies and comprehensive retirement insights.

Led by our award-winning and well-resourced Multi Asset Investment team, our firm has over half a century of experience managing retirement assets on behalf of our clients, in the US, UK and Asia.

An award-winning multi-asset investment house…

…with 50+ years of managing retirement portfolios.

Is it possible to glide your way to retirement?

Our life stage and personal circumstances tend to influence our ability to take risks. A portfolio solution that automatically de-risks and rebalances its asset allocation towards less risky assets as an investor approaches his or her preferred retirement age may be one way to ensure that retirement portfolios adjust to changing circumstances. Download the PDF to gain insights from a journalist’s exploration of retirement planning.

Key principles to grow your retirement nest egg

Here are six key principles to help you take positive steps towards a successful retirement.

Read our “Principles for Successful Long-term Investing” for important lessons in investing.

What if...

The rate of inflation, the mix of goods and services, the social safety net and life expectancy can vary widely across geographies. So, while certain principles of retirement planning are universal, the way we think about retirement is often highly local.

In the articles below, we delve deeper into a series of “what ifs” when thinking about retirement in Singapore.

Our growth solutions with CPF share classes

The following strategies have been included under the CPF Investment Scheme (for CPFIS List A category). These share classes are available on select investment platforms.

Our market insights

JPMorgan ASEAN Equity Fund is the marketing name of the JPMorgan Funds - ASEAN Equity Fund.

JPMorgan China Fund is the marketing name of the JPMorgan Funds – China Fund.

JPMorgan Asia Growth Fund is the marketing name of the JPMorgan Funds – Asia Growth Fund.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

*2030 numbers are Singapore Department of Statistics forecasts. The 2030 numbers illustrate the possible change in the population that could occur if certain demographic assumptions prevail over the stated period. These assumptions may or may not be realised. Projections have been updated from Population in Brief 2022.

1, 2. Source: “Population in Brief 2023”, National Population and Talent Division; Strategy Group, Prime Minister’s Office; Singapore Department of Statistics; Ministry of Home Affairs; Immigration & Checkpoints Authority; Ministry of Manpower, September 2023. Forecasts, projections and other forward-looking statements are based upon current beliefs and expectations, they may or may not come to pass.

3. Source:“How is filial piety changing in Singapore? Here’s the younger generation’s take on it”, Channel News Asia, 19.08.2023.

4. Source:“Singapore’s vanishing S$3 chicken rice stokes inflation angst”, The Business Times, 29.09.2023.

5, 12. Issued by Asia Asset Management in the year specified, reflecting performance as at end-November 2022.

6. Source: J.P. Morgan Asset Management. Data as of 30.09.2023.

7. Source: J.P. Morgan Asset Management. Data as of 30.09.2023.

8. Source: Morningstar® Awards 2014. Morningstar, Inc. All rights reserved. The 2014 US Allocation Fund Manager of the Year was awarded to the SmartRetirement team for the management of the JPMorgan SmartRetirement Target Date Series (Institutional shares).

9. Source: Professional Pensions, UK Pension Awards 2017.

10. The Asia Asset Management Best of the Best Awards are issued by Asia Asset Management, reflecting performance as at end-November of previous year for awards in the year specified; the stated calendar year end for 2015 award or before.

11. Asian Private Banker Asset Management Awards for Excellence are issued by Asian Private Banker in the year specified, reflecting product performance, business performance, service competency, branding and marketing as at the previous calendar year end.

13 Source: J.P. Morgan Asset Management. Data as of 30.06.2023.

By using this information, you confirm that you are a Singapore resident and you accept the Terms of Use as set out in https://www.jpmorgan.com/sg/am/per/.

This website is meant for informational purposes only and is intended solely for the person to whom it is delivered. Except as indicated on this website or otherwise with express consent from JPMorgan Asset Management (Singapore) Limited, it may not be reproduced or distributed, in whole or in part, to any third parties and in any jurisdiction.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It does not constitute investment advice and it should not be treated as an offer to sell or a solicitation of an offer to buy any fund, security, investment product or service. The information contained herein does not constitute J.P. Morgan research and should not be treated as such.

Investments involve risks. Investments in funds are not deposits and are not considered comparable to deposits. Past performance is not a guarantee or necessarily indicative of future results and investors may not get back the full or any part of the amount invested. Dividend distributions if any are not guaranteed and are made at the manager’s discretion. Fund’s net asset value may likely have high volatility due to its investment policies or portfolio management techniques. Funds which are invested in emerging markets, smaller companies and financial derivative instruments may also involve higher risks and are usually more sensitive to price movements. Any applicable currency hedging process may not give a precise hedge and there is no guarantee that any hedging will be successful. Investors in a currency hedged fund or share class may have exposure to currencies other than the currency of their fund or share class.

Not all investment ideas referenced are suitable for all investors. Investors should make their own evaluation or seek independent advice prior to making any investment. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. The information provided herein should not be assumed to be accurate or complete and you should conduct your own verification. References to specific securities, asset classes and financial markets and any forecast contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. J.P. Morgan accepts no legal responsibility or liability for any matter or opinion expressed in this material.

The funds mentioned in this document have been approved as recognised scheme(s) under the Securities and Futures Act, Chapter 289 of Singapore. Any offer or sale, or invitation for subscription or purchase of the Fund(s) must be accompanied with the relevant valid Singapore Offering Documents (which incorporates and is not valid without the relevant Luxembourg prospectus). Please refer to the Singapore Offering Documents (including the risk factors set out therein) and the relevant Product Highlights Sheet for details before any investment at https://www.jpmorgan.com/sg/am/per/

The funds seek to achieve the investment objectives stated in the offering documents, there can be no guarantee the objective will be met. Investments in the Fund are not deposits and are not considered as being comparable to deposits. Fund’s net asset value may likely have high volatility due to its investment policies, exposure to emerging markets, financial derivatives instruments or portfolio management techniques. The value of the units in the scheme and the income accruing to the units, if any, may fall or rise. Past performance is not indicative of current or future results and investors may not get back the full or any part of the amount invested.

This material is issued by JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K). All rights reserved.