Why sustainability matters

We have noticed the shift. Individuals are increasingly opting for more sustainable choices in their daily lives, and this can range from reusable shopping bags to plant-based meat substitutes1 and even electric vehicles.

Companies are factoring in sustainability, such as incorporating goals to achieve net-zero carbon emissions and reduce waste. Governments are also making policy decisions to help transit to a low-carbon economy. From consumers to policymakers, many economic actors are backing sustainability, and this is creating a powerful investment opportunity2.

These days, people are more mindful of environmental, social and governance (ESG) factors than ever before. That is especially evident among investors and the ESG criteria they use to build their portfolios1. Not only do sustainable investing funds incorporate ESG considerations in the investment decision-making decisions, they also allow investment managers to capture crucial investment opportunities and contribute to positive change1.

Sustainable growth opportunities

Sustainable investing is a forward-looking approach that seeks to deliver long-term returns in a fast-changing world.

Megatrends like climate change, demographic shifts and urbanisation are driving business changes and sustainable investing opportunities.

Investing to drive climate action

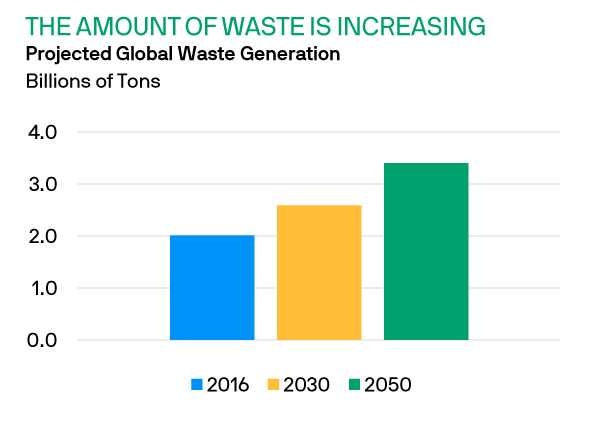

Recycling & re-use

Investing in companies developing technologies to reduce waste, including equipment and materials recycling.

![]()

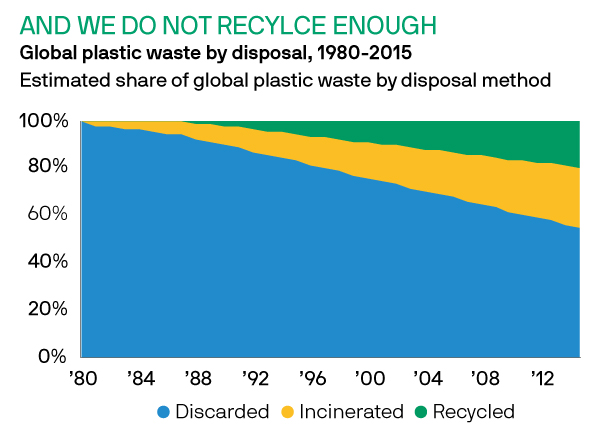

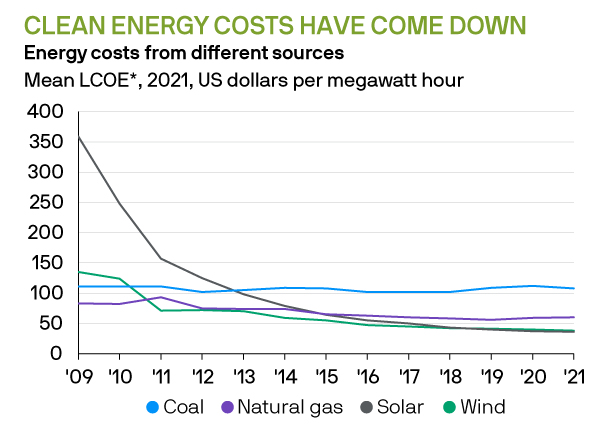

Renewables & electrification

Investing in companies developing clean energy such as wind or solar, across the full production chain, and enabling electrification across the economy.

Investing to build a better world

![]()

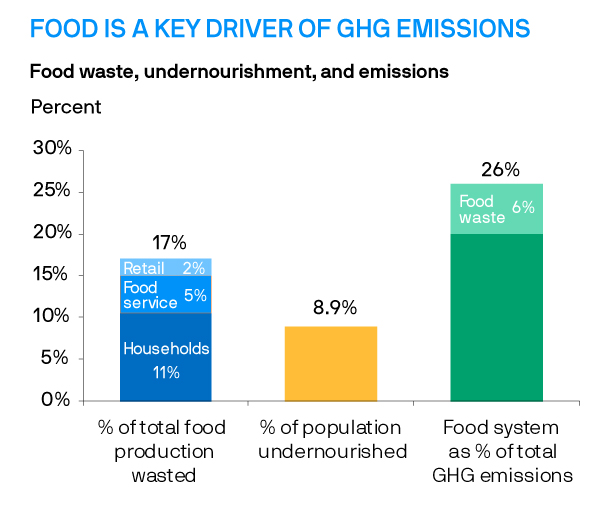

Sustainable food & water

Investing in companies developing less carbon-intense forms of agriculture, sustainable food, or clean water.

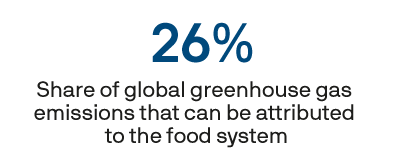

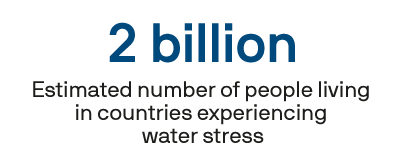

Sustainable food and water by the numbers

Investing to help shape the next generation of cities

![]()

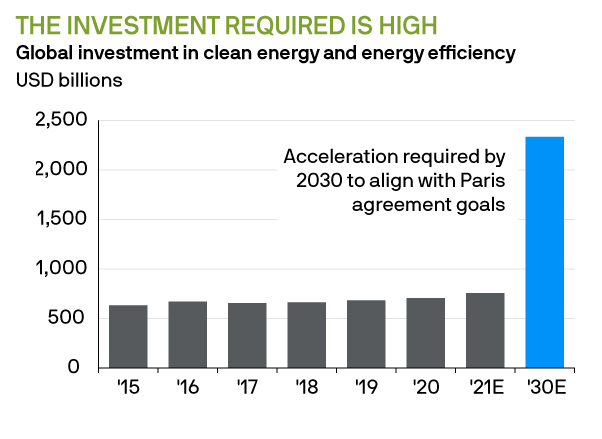

Sustainable construction

Investing in companies developing less carbon-intense forms of construction, including energy efficiency of buildings.

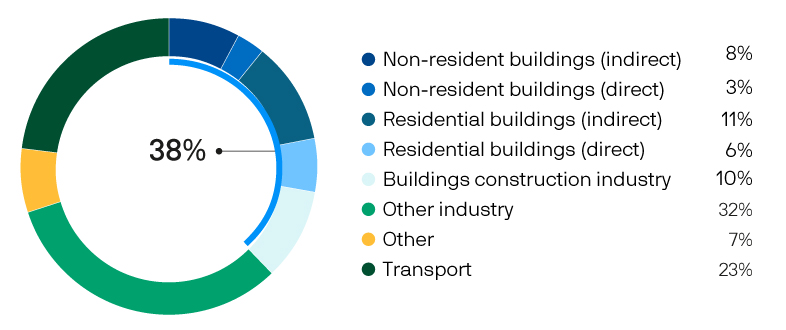

THE BUILDINGS WE LIVE AND WORK IN ARE KEY DRIVERS OF GREENHOUSE GAS EMSISSIONSGlobal share of buildings and construction emissions, 20191

![]()

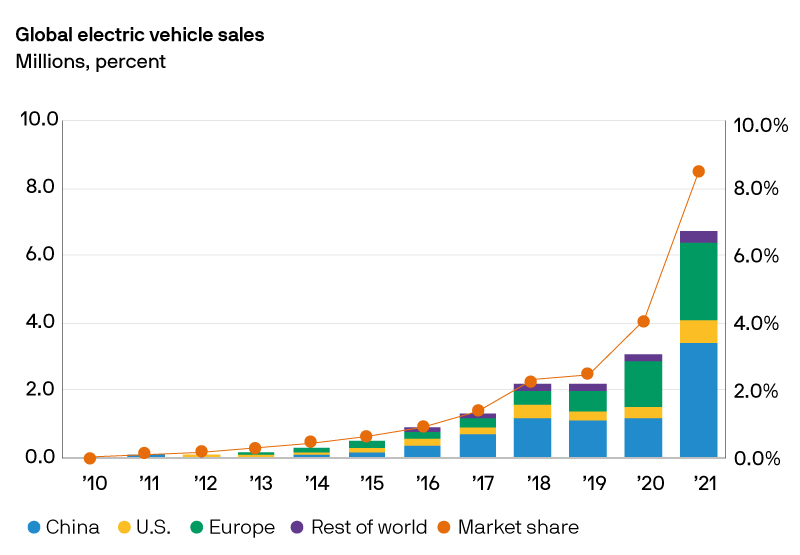

Sustainable transport

Investing in companies that are investing in sustainable forms of transportation across automobiles, trains, and planes.

Source: IEA, Global electric car sales by key markets, 2010-2020e, IEA, Paris . 2020 data is preliminary. Includes passenger and commercial light-duty vehicles. Provided to illustrate macro themes, not to be construed as offer, research or investment advice. Forecasts/ estimates may or may not come to pass.

Sustainable income opportunities

Interest in sustainable investing is growing globally, driven by investors trying to increase risk-adjusted returns (“doing well”) and support sustainable outcomes (“doing good”).

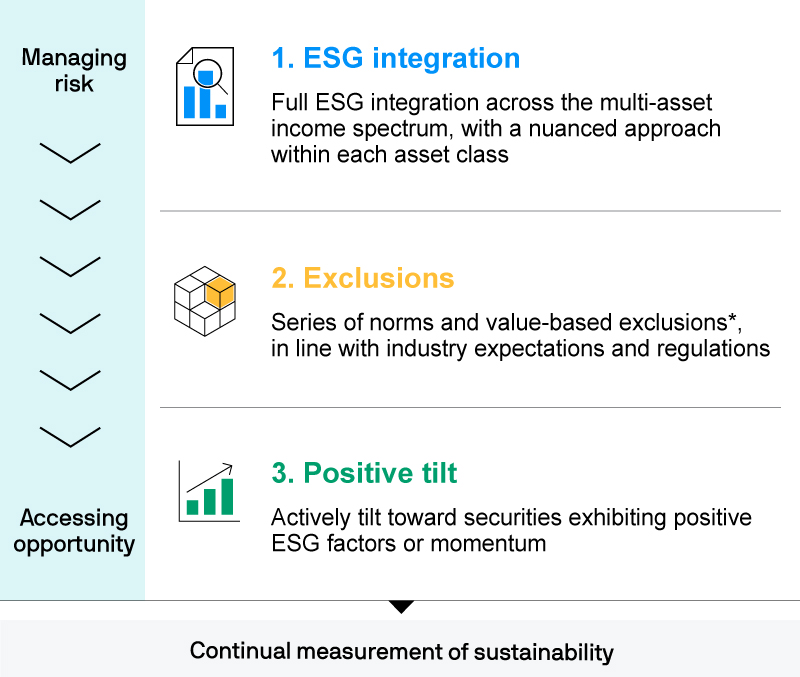

In our multi-asset investment process, we believe that explicit incorporation of material ESG information in the investment process can help us seek enhanced risk-adjusted returns over the long-run while also serving as a foundation to align portfolios with client sustainability values.

Our JPMorgan Investment Funds - Global Income Sustainable Fund3 seeks a consistent and attractive level of sustainable income, with a traditional balanced risk profile, by investing globally across a variety of income-generating sustainable asset classes. It is a multi-asset income fund built on three pillars of sustainability.

Source: J.P. Morgan Asset Management, as of February 2022. *Exclusion does not necessarily mean zero exposure. Company revenue thresholds may apply instead.

3. The Fund is an actively managed portfolio, holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk. The fund seeks to achieve its investment objectives as stated in the offering documents, there is no guarantee they will be met.

The JPMorgan Funds – Global Bond Opportunities Sustainable Fund3 is an example of ESG in action within our fixed income range of strategies.

The Fund seeks to help investors achieve the twin goals by providing flexible, high-conviction exposure across the global fixed income market, with a specific focus on sustainability. The shared values of our clients are reflected through robust ESG research, systematic exclusions of unsustainable industries, and tilts towards more sustainable issuers.

3. The Fund is an actively managed portfolio, holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk. The fund seeks to achieve its investment objectives as stated in the offering documents, there is no guarantee they will be met.

How we invest sustainably

We have been taking action to address climate change through various industry advocacy efforts such as being an active member of the Climate Action 100+ and the Institutional Investors Group on Climate Change’s Net Zero Working Group and through activities such as proxy voting and corporate engagement. In 2021, we became a signatory to the Net Zero Asset Managers Initiative and United Nations-convened Glasgow Financial Alliance for Net Zero, through which we have committed to support investing aligned with the goal of net zero greenhouse gas emissions by 2050 or sooner.

Sustainability resources

JPMorgan Climate Change Solutions Fund is the marketing name of JPMorgan Funds – Climate Change Solutions Fund.

JPMorgan Global Income Sustainable Fund is the marketing name of JPMorgan Investment Funds – Global Income Sustainable Fund

JPMorgan Global Bond Opportunities Sustainable Fund is the marketing name of JPMorgan Funds - Global Bond Opportunities Sustainable Fund

JPMorgan Emerging Markets Sustainable Equity Fund is the marketing name of JPMorgan Funds - Emerging Markets Sustainable Equity Fund.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Investments involve risks. This includes illustrations of macro trends which may or may not come to pass. Investors should seek professional advice before investing. The manager seeks to integrate environmental, social and governance ("ESG") factors in the investment process. ESG integration is the systematic integration of material ESG factors in company/issuer selection through research and risk management. It involves proprietary research on financial materiality of the ESG factors in relation to the relevant company/issuer and discretion to invest regardless of whether the company/issuer may be positively or negatively impacted by the ESG factors. Integration of ESG factors in does not imply ESG factors as the sole investment focus. Please refer to the offering documents for more details on the ESG approach.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. Source: J.P. Morgan Asset Management, “Selecting stocks for an environmentally sustainable future”, December 2021.

2. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.