Signs of stress in some segments of the US banking sector, rising geopolitical risks and evidence of waning economic momentum have prompted concerns about the macro risks on the horizon. Yet decelerating inflation and the potential end to the Federal Reserve’s (Fed) rate hike cyle have stoked cautious optimism about the potential opportunities that may emerge in global financial markets.

This Q&A provides insights on how the JPMorgan Investment Funds – Global Income Fund is navigating the path ahead.

Q1: How do the recent concerns in some segments of the US banking sector affect the Fund’s outlook?

The strain in some segments of the US banking sector could lead to tighter bank lending standards and potentially affect access to credit for many small businesses. This would invariably tighten financial conditions and present headwinds to growth in developed economies. As a result, the odds of a moderate recession over the course of the year has increased.

Nevertheless, our base case remains for growth to stay resilient but distinctly subtrend with inflation staying relatively sticky. These views reflect the fact that there is still considerable uncertainty over the extent to which the recent banking turmoil will affect sentiment and economic activity, although the risks appear skewed to the downside. Against this uncertain backdrop, the Fund remains cautious and seeks to avoid extreme positioning between or within asset classes3.

From a global perspective, divergence in growth prospects are quite apparent. Growth risks appear greatest in the US, where the strain in regional banks and weakness in the real estate sector are clear headwinds. In Europe, lower energy prices and fiscal policy tailwinds suggest some resilience, while in China, pent-up demand and excess savings accumulated during the zero-COVID years could continue to support the uneven economic recovery as borders reopen. Absent a deep US recession, other economies could stay resilient despite growth concerns in developed markets.

Q2: How is the Fund positioned in fixed income following the significant repricing in bond markets?

Yields across a broad range of bond sectors have increased significantly since the repricing of fixed income markets last year. This has created more opportunities and sources of yield for income-oriented investors. The Fund has been able to harness these opportunities to increase its portfolio yield while effectively managing risks4.

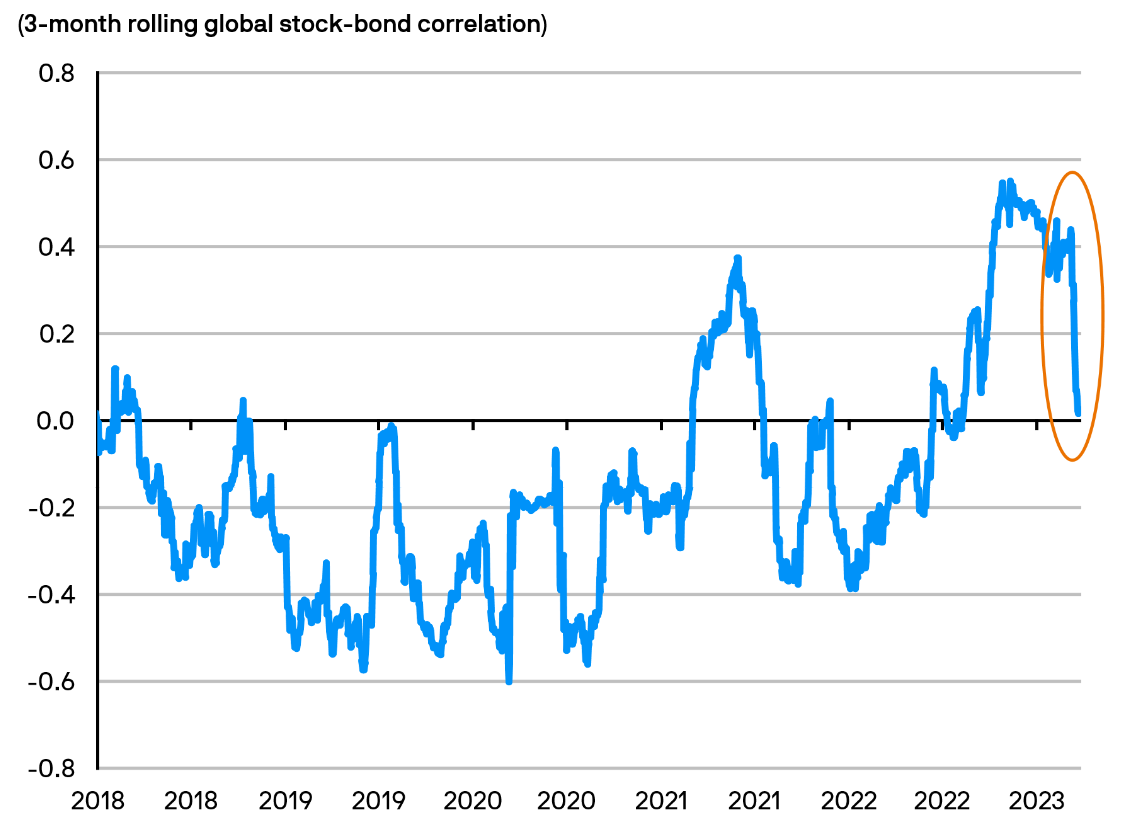

Furthermore, as illustrated below (LHS), stock-bond correlations have started to decline as focus shifts away from runaway inflation and policy tightening to slowing growth and recession risks5. Higher yields and normalising correlations suggest that bonds can, once again, help to cushion portfolio performance in the event of a market correction or an economic downturn.

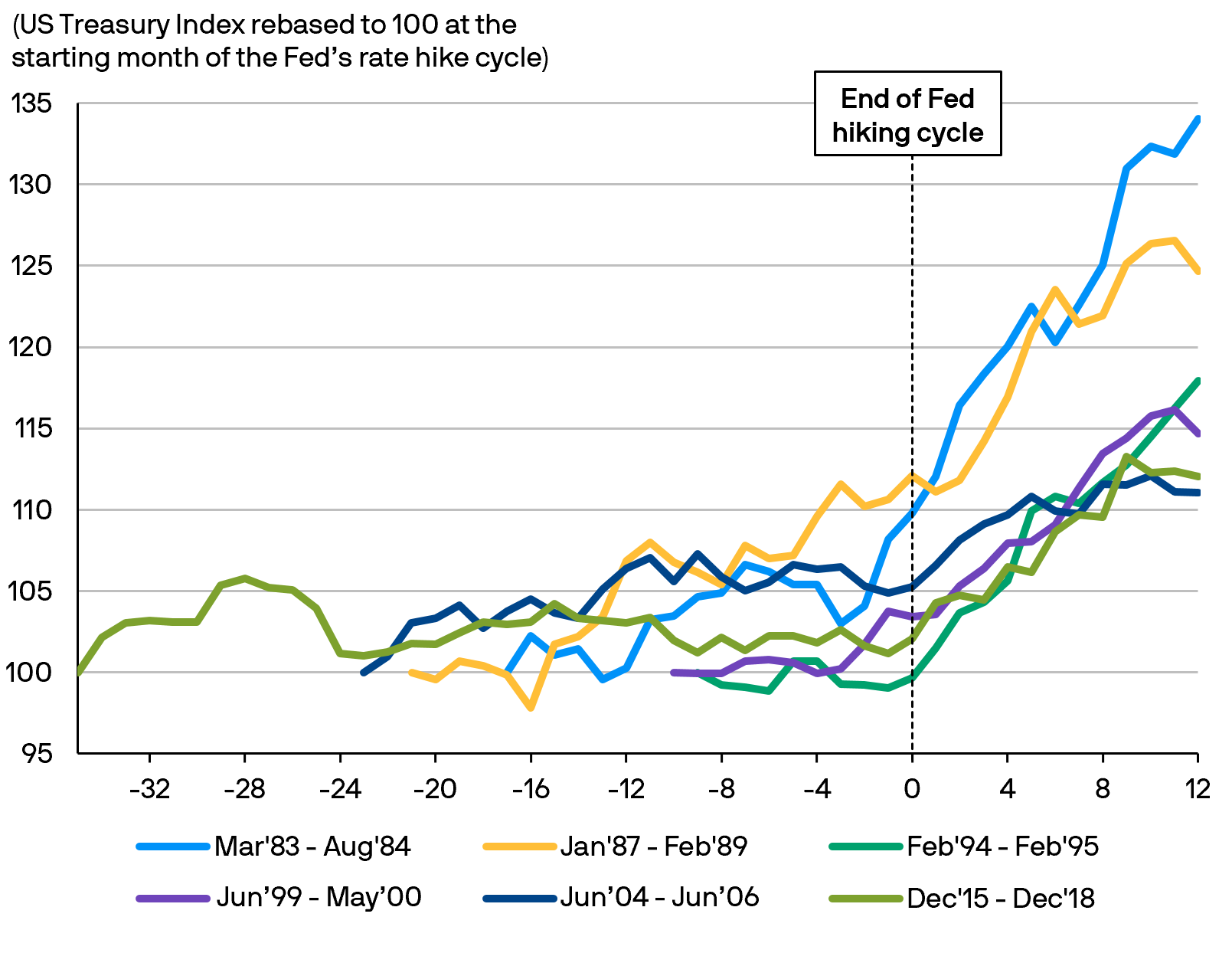

Meanwhile, the aggressive front-loading of interest rate hikes implies that we’re closer to the end of the rate hike cycle than the beginning. Decelerating inflation, tighter financial conditions and slowing growth momentum could point to a potential pause in the Fed’s interest rate hikes following May’s increase. Historically, the end of interest rate hikes has coincided with relatively decent returns for US Treasuries, as illustrated below5 (RHS). We believe this could augur well for bond returns.