Start eScheduler monthly fund investment from HK$1,000

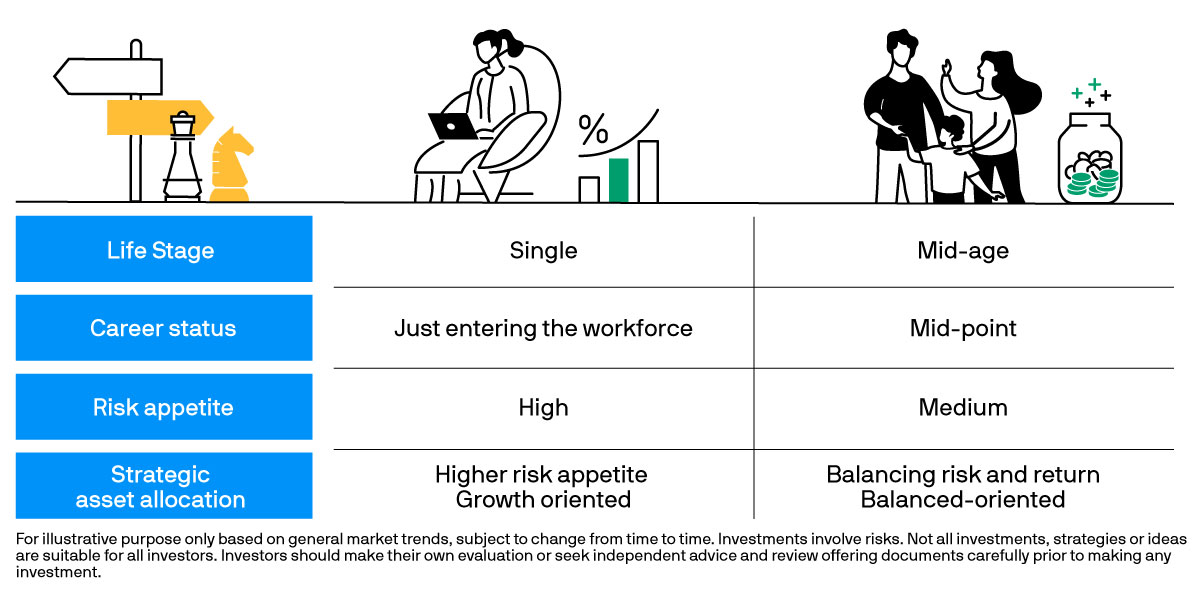

Investment strategies across life stages

Before starting on an investment journey, a key step is to define specific goals based on life’s different stages and needs, and craft a plan.

As young adults in their twenties and just entering the workforce, most tend to live paycheck to paycheck as they work towards covering various expenses with median wages. Thus, it is important for young investors to start saving and investing early. The advantage of being young is that they are far from retirement and so have the capacity to invest for growth. It is a time when they have the greater capacity to take on risk for higher return opportunities over a longer time horizon.

By the time most working adults are in their forties, many would have established their careers or started a family. With growing expenses alongside income, they may have to adjust their investment goals according to needs. As they set aside some savings for emergency expenses, they can adjust their portfolio to a more conservative strategy that can provide cushion for the wealth that has been accumulated, while still seeking growth.

Key investing principles

Whether investors are in their twenties or forties, it is optimal to keep in mind these investing principles on an investment journey.

Time can be an investor’s best friend. It is important for investors to start investing early in order to maximise the benefits of compounding. For example, if a young investor allocates HK$3,000 every month for long term investment, and assuming an annualised return rate of 5.5%, there is the potential to grow the investment to HK$1.307 million in 20 years1.

Some investors are often challenged by their emotions and natural biases, and can make ill-timed investment decisions after surrendering to their heightened emotions. Moreover, it can be tough to accurately time a market entry or exit, and frequent trading may risk losing out on opportunities and returns. Investing regularly can help investors take advantage of “dollar cost averaging” while navigating market volatility.

No single asset class can be an all-time winner. Investing all funds on a single or a small number of assets could increase concentration risk. Through active investing, investment professionals could employ different strategies to add equities, bonds or other types of assets in a mutual fund portfolio to capture potential opportunities and optimise the benefit of diversification.

While choosing whether or not to invest with an asset manager depends on your own circumstances, a trusted partner may help enrich your investment journey. Your plans may change when your life-stage changes. Fund managers that can provide a large variety of products and comprehensive services can provide you with different choices when fulfilling your changing needs. When choosing an investment partner, investment performance should not be the only consideration but a totality of level of services counts. Experience of investment teams, frequency of receiving recognitions are also some of the gauges that investors can make reference of.

Too Much Market Noise and No Clarity? Actionable Insights to Help You Stay Ahead.

Investment ideas to help you achieve your financial goals