Start eScheduler monthly fund investment from HK$1,000

Retirement is often viewed as life’s second innings. After decades of study, work and family, some people do long for a carefree retirement. To achieve a retirement of choice, it is important to anticipate the possible challenges that retirees could face and be better financially prepared.

![]() Challenge 1: We’re living longer than ever

Challenge 1: We’re living longer than ever

Hong Kong is leading the world in life expectancy1. The average expected life expectancies of newborn boys and girls were respectively 67.8 years and 75.3 years in the 1970s, and have climbed to 82.3 years and 88.1 years in 20192.

For most people, living a long life is considered a blessing. But with a standard retirement age at 65, people in Hong Kong could likely have 20 years or more of life in retirement. Without a regular work income, retirees would need to have other sources of income to help support their living expenses. Some examples include the Hong Kong government’s Old Age Living Allowance plan, accrued benefits from the Mandatory Provident Fund scheme and personal savings. Will the income be sufficient to cover the living costs of life in retirement? The answer to this question is most likely no.

Conclusion: It’s not advisable to start planning for retirement only when you approach the standard retirement age. Retirement planning is a long-term process that evolves over time. The earlier you start saving for retirement, the better you can benefit from the power of compounding.

![]() Challenge 2: Inflation erodes the value of money

Challenge 2: Inflation erodes the value of money

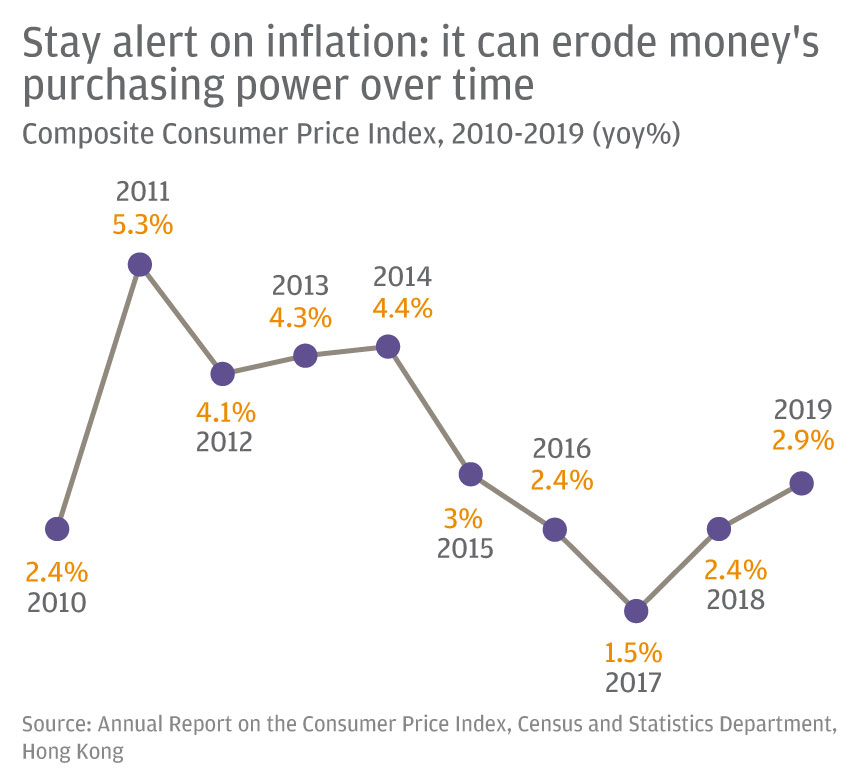

Consider the impact of inflation as you’re working out how much you would need to save for retirement. Previously, HK$10 or less could buy a full and hearty meal, but this is impossible today. Inflation has eroded the purchasing power of cash. Global interest rates have remain low since 2009, and most cash savings haven’t grown at the same rate as inflation. Cash isn't always king in the long run.

As the cost of living in Hong Kong continues to rise, cash savings continue to lag inflation. Among the top four daily living expenses for baby boomers – clothing, food, housing, and transportation – three have become at least 50% more expensive over the past decade, according to government statistics.

The accumulated growth of living costs in the past decade3

Assuming an annual inflation rate of 2.5% and interest rate for cash savings at 0.5% over the same period, cash savings still failed to keep up with inflation. Hong Kong’s average real saving rate stood at -1.7%4, as of 31 May 2020, indicating our savings may be depreciating year after year.

Conclusion: Your cash holdings are unlikely to keep up with inflation. Instead, investing in different asset classes could be a solution to keep your wealth from being eroded by inflation. It could also help increase your income streams at retirement.

A carefree retirement is achievable, despite the challenges. If you start saving early, alongside prudent financial management, you can also strive for higher returns through various investment vehicles, such as mutual funds to help build your retirement savings. With adequate financial preparation, anyone can strive for a comfortable retirement and live a fulfilling second life.

1. Source: Abridged Life Tables of 2019, Japan’s Ministry of Health, Labour and Welfare, as of 31.07.2020.

2. Source: Hong Kong Monthly Digest of Statistics, August 2020, 2019 data is tentative. Census and Statistics Department, Hong Kong.

3. Source: Annual Report on the Consumer Price Index, 2010 – 2019. Census and Statistics Department, Hong Kong.

4. Source: FactSet, Hong Kong Monetary Authority, J.P. Morgan Asset Management; as of 31.5.2020.

Don’t let short-term volatility derail your long-term retirement plan

Hiking and investing for retirement can be lifelong endeavours. The key to achieving your goal is taking the right level of risk for your age and staying committed till the end.

Equip yourself with the right tools on your retirement journey

Similar to how maps and GPS can help you plan and navigate your hiking trail, fund factsheets provide various key information, which can be a useful tool to help you make better informed investment decisions.