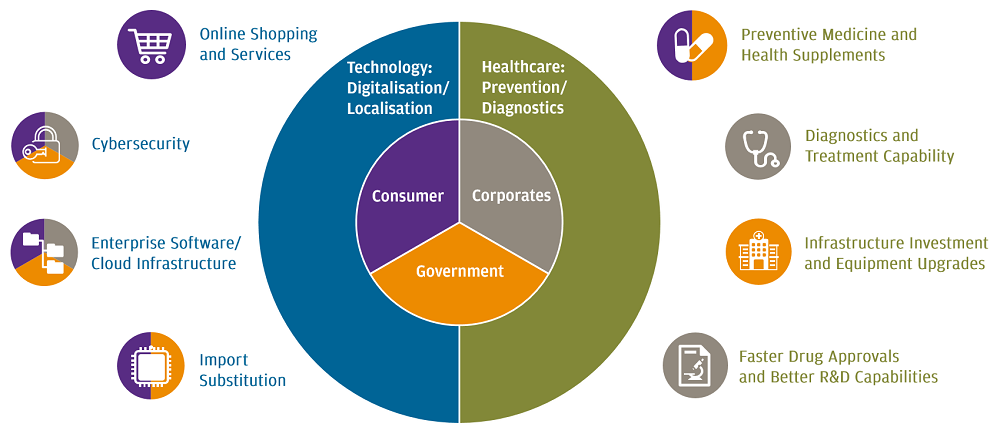

WHAT DRIVES GROWTH?

Long-term structural trendsUncertain times are accelerating structural trends in economies. Whether it’s consumer, corporate or government, the trend for spending on technology and healthcare has accelerated.

The pandemic has accelerated demand and magnified structural trends

Source: J.P. Morgan Asset Management. Data as of 31.05.2020. For illustrative purposes only.

The opinions and views expressed here are those held by the investment team at the date of publication which are subject to change and are not to be taken as or construed as investment advice.

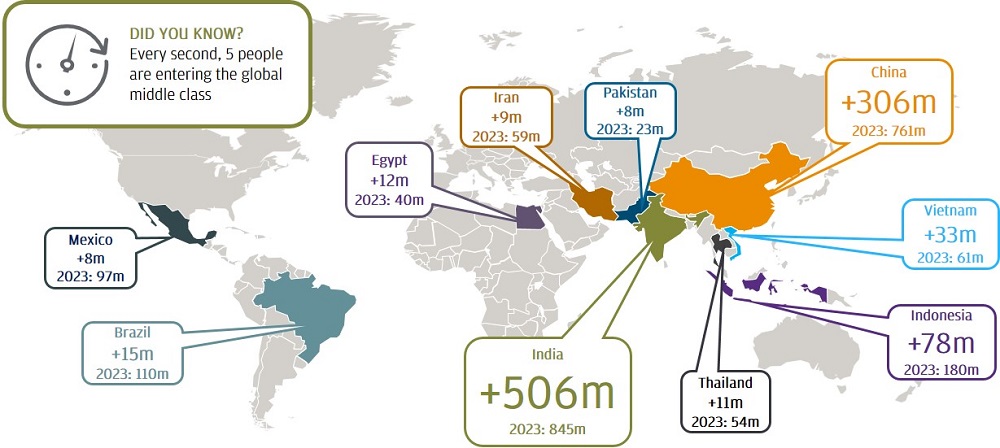

Asia’s rapidly rising middle class is a powerful engine for growth. A billion people joined the global middle class over the past 10 years. The next billion will arrive by 2023, of which 90% will be in Asia Pacific.

The middle class is growing around the world

Source: Brookings Institute, HSBC estimate as of 2018.

First row numbers = estimated increment by 2023.

Second row numbers = estimated middle class population in 2023.

Provided for information only to illustrate structural trend. Estimates and forecasts are indicative, may or may not come to pass.

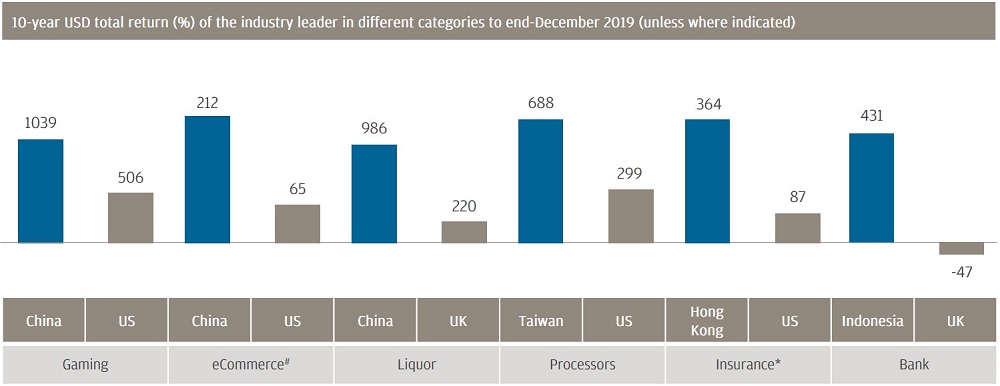

In the past decade, Asia’s leading companies have outpaced their developed market peers. We believe the future will continue to ride the wave of success.

More opportunities in the next decade

Source: Bloomberg, J.P. Morgan Asset Management, data as of 31.12.2019.

# Since September 2014. * Since October 2010.

The companies as described above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell. J.P. Morgan Asset Management may or may not hold positions on behalf of its clients in any or all of the aforementioned securities. Past performance is not indicative of current or future results. Provided for information only to illustrate general market trends.

Returns, income or yields are not guaranteed. Value of investments or income accruing from them may rise or fall.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

This information is generic, not tailored to any specific individual circumstances and should not be construed as investment advice. Risk management does not imply elimination of risks. Investments involve risks and are not similar or comparable to deposits, not all investments are suitable for all investors. Please seek financial advice and make independent evaluation before investing.