Key takeaways:

- China is progressing with its return to economic normality and a focus on idiosyncratic, secular growth opportunities is key when investing in Chinese equities.

- Our Emerging Markets and Asia Pacific Equities team is constructive on sector leaders in technology, consumption and health care.

China offers a vast, liquid equity market with opportunities onshore and offshore. Building a global portfolio with an exposure to Chinese equities presents diversification benefits. It is also crucial to focus on quality and long-term growth potential.

Our Emerging Markets and Asia Pacific Equities team is constructive on long-term structural growth themes such as consumption upgrading, digital transformation and health care demand.

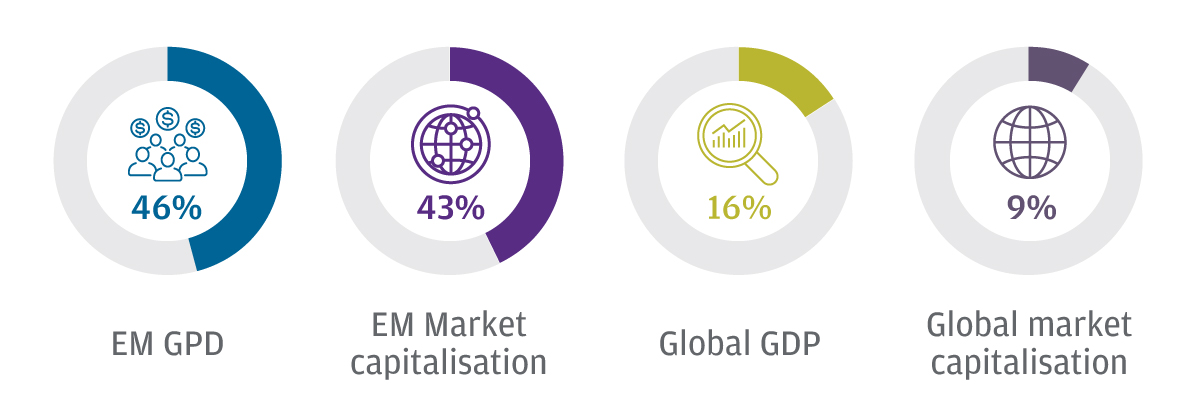

Source: J.P. Morgan Asset Management, Bloomberg, MSCI, World Bank. Share of emerging market (EM) gross domestic product (GDP) is for 2019 and is calculated as Chinese nominal GDP in US dollars as a percentage of all emerging markets within the MSCI EM index and as a percentage of the global GDP. Share of EM market cap is for 2019 and is calculated as China’s market capitalisation of listed domestic companies as a percentage of all emerging markets’ capitalisation of listed domestic companies within the MSCI EM index and as a percentage of global market capitalisation. Data as of 30.04.2021.